Digital X-ray Market Size

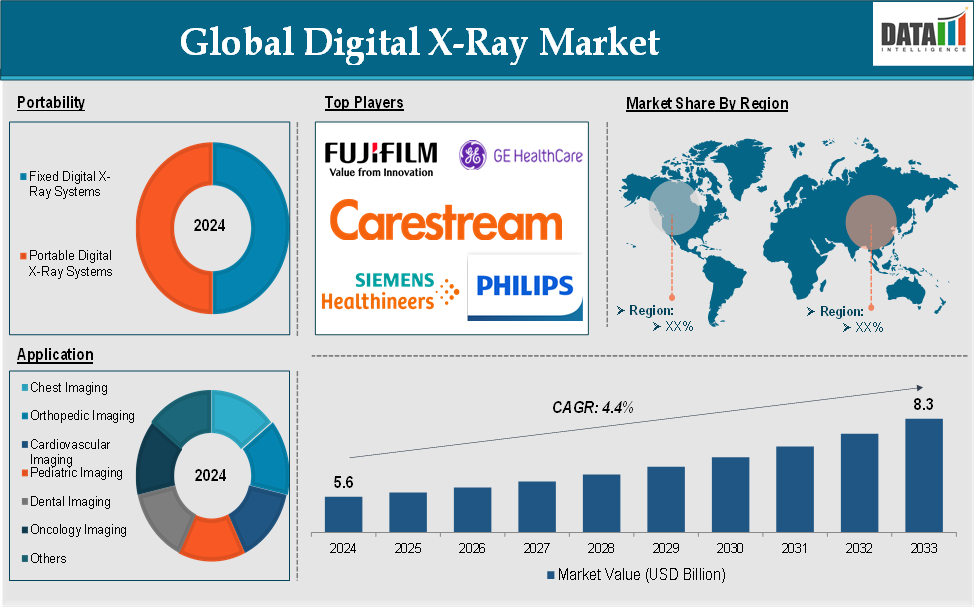

The Global Digital X-ray Market reached US$ 5.6 billion in 2024 and is expected to reach US$ 8.3 billion by 2033, growing at a CAGR of 4.4% during the forecast period of 2025-2033.

Digital X-ray refers to a type of X-ray imaging technology that uses digital detectors instead of traditional photographic film to capture and create inside images of the body. Unlike conventional X-ray systems, which require film development for image production, digital X-rays generate images electronically and store them in digital form. These images can then be viewed on a computer screen, analyzed by radiologists, and shared easily across healthcare systems for further consultation or review.

The demand for digital X-ray technology has been rapidly increasing across the globe due to several factors, such as advancements in technology, growing healthcare needs, and an increasing emphasis on patient safety, convenience, and healthcare efficiency. The speed and efficiency of digital image processing are major drivers in fields such as emergency care and orthopedics, where timely diagnosis is critical. Direct Radiography (DR) systems, which offer immediate image results, are particularly in demand.

Executive Summary

For more details on this report – Request for Sample

Digital X-ray Market Dynamics: Drivers & Restraints

Rising Technological Advancements in Imaging

The rising technological advancements in imaging are significantly driving the growth of the digital X-ray market and are expected to continuously drive the market over the forecast period. Advancements in detector technology, such as flat-panel detectors (FPDs) and others, offer superior image resolution and clarity compared to traditional film X-rays. This allows for more accurate diagnostics and better detection of conditions like cancer, fractures, and infections.

Moreover, advances in image processing algorithms allow Digital X-ray systems to produce high-quality images with lower radiation doses, improving patient safety, especially in sensitive populations like children and pregnant women. The shift to lower radiation exposure has encouraged the adoption of Digital X-ray systems in both routine and specialized diagnostics. Hospitals and diagnostic centers are increasingly investing in digital solutions to meet regulatory standards for radiation safety, further boosting market growth.

In addition, key market players across the globe are launching these technologically advanced digital X-ray systems. This can significantly change the practice of radiology in the future, which is anticipated to be a key driver for the overall market growth.

For instance, at the 2024 Radiological Society of North America (RSNA) conference in the U.S., Samsung unveiled its new floor-mounted digital X-ray, called the GF 85. This advanced digital X-ray is bolstered to be cost-effective as compared to the ceiling-mounted type. The device is featured with AI diagnostic assistance features and can produce high-quality images even at low radiation doses.

Moreover, in July 2023, Canon Medical Systems launched the Zexira i9 digital X-ray RF system, a multi-purpose fluoroscopic table equipped with many new functions, along with a compact design providing high-quality images with low radiation exposure. Zexira i9 is a new digital X-ray RF system equipped with essential features to meet clinical demands. Equipped with Canon’s flat panel detector (FPD) and a newly developed image processing technology, the system has been developed in consultation with medical staff, referring physicians, and engineers.

High Cost of Digital X-Ray Systems

Digital X-ray systems are complex and require regular maintenance to ensure their optimal functioning. The cost of servicing, repairing, and upgrading components like detectors, software, and other technical parts can add significant operational expenses over time. For instance, a major component such as a flat-panel detector for a DR system could cost between $10,000 and $30,000 for replacement. These ongoing costs add financial strain, especially for smaller clinics with limited budgets.

Additionally, according to Healthcare Imaging Solutions, the maintenance costs for a digital X-ray system can range between $10,000 to $20,000 per year, depending on the type of system and service contract. The high cost of digital X-ray systems, including the initial investment, maintenance, and upgrade expenses, presents a significant barrier to adoption, particularly for smaller healthcare facilities and in developing regions. This financial constraint limits the ability of many institutions to upgrade from traditional X-ray systems or purchase cutting-edge models, hindering overall market growth.

Digital X-ray Market Segment Analysis

The global digital X-ray market is segmented based on portability, system type, application, end-user, and region.

By Portability:

The portable digital X-ray systems in the portability segment are expected to dominate in the digital X-ray market.

The demand for portable digital X-ray systems has surged due to the increasing need for point-of-care imaging in emergency rooms, intensive care units (ICUs), and rural or remote areas. These systems enable healthcare providers to assess patients at the bedside, improving diagnostic efficiency and reducing the need for patient transportation.

For instance, the COVID-19 pandemic significantly boosted the demand for portable imaging systems. Portable digital X-ray machines were crucial in assessing patients in ICUs and emergency settings where transporting critically ill patients to imaging rooms was not feasible. Philips’ MobileDiagnost wDR and GE Healthcare's Logiq e Mobile X-ray System became highly in demand during the pandemic for rapid chest X-rays to monitor lung conditions, particularly in patients with severe COVID-19 symptoms.

Portable digital X-ray systems provide rapid imaging, reducing the time needed for diagnosis. This is particularly critical in emergencies where timely decision-making is essential for patient outcomes. For instance, the Carestream DRX- Revolution is a mobile X-ray system that allows healthcare providers to obtain high-quality digital images at the patient’s bedside. This flexibility in diagnosis speeds up clinical decisions and is invaluable in emergency departments and trauma centers where every second counts.

While the initial cost of portable X-ray systems can still be high, they are often seen as more cost-effective in the long run compared to traditional X-ray systems. Portable systems eliminate the need for additional staff, transportation of patients, and the use of fixed imaging rooms, lowering operational costs. For instance, Siemens Healthineers’ Mobile X-ray systems, such as the Ysio X-ray system, offer wireless capabilities that enable healthcare professionals to capture images quickly without needing to move patients, saving time and costs associated with traditional imaging rooms.

Digital X-ray Market Geographical Share

North America is expected to hold a significant position in the digital X-ray market share

North America, especially the United States, is home to many prominent players in the digital X-ray market, including GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, and Carestream Health. These companies are leaders in the development, manufacturing, and distribution of digital X-ray systems, contributing to the region's dominance in the global market.

For instance, Siemens Healthineers launched the Y.Sio X-ray system, a high-quality portable Digital X-ray solution that has gained widespread adoption in North American hospitals due to its advanced features, ease of use, and flexibility. Similarly, Philips Healthcare's MobileDiagnost wDR and U-Arm system have been widely deployed in U.S. and Canadian healthcare facilities, expanding the region's market share.

North America, particularly the United States, is known for its substantial healthcare funding, both in terms of government and private sector investments. The healthcare system’s willingness to invest in the latest medical technologies directly supports the growth of the digital X-ray market.

For instance, in November 2024, Silveray, a company pioneering Digital X-ray Film (DXF) technology, raised £4M in a seed extension funding round led by Northern Gritstone, an investment firm focused on science and technology ventures in the North of England. The funding will support Silveray’s efforts to finalize the development of its first DXF product, which is set to launch in 2025. This innovative solution aims to transform industrial radiography by digitizing traditional processes, offering enhanced efficiency, flexibility, and cost-effectiveness.

Asia-Pacific is growing at the fastest pace in the digital X-ray market

Major global players like GE Healthcare, Siemens Healthineers, Fujifilm, Canon Medical Systems, and Philips Healthcare have established a strong presence in APAC to tap into this rapidly growing region. The presence of these global leaders ensures that cutting-edge imaging technology is rapidly introduced and adopted in the APAC region, fueling market growth.

For instance, in July 2024, Siemens Healthineers announced that the Multix Impact E digital radiography X-ray machine would be manufactured in India, marking a significant milestone in the company's commitment to providing better access to care for patients in the country. The Multix Impact E is a floor-mounted system featuring all the necessary tools for easy, intuitive system operation and allows for the detection of anatomical details at low doses radiation, ensuring patient safety and quality healthcare.

Several APAC countries are introducing initiatives to modernize healthcare systems, improving access to advanced diagnostic imaging. Governments are also offering financial support, subsidies, and incentives to healthcare providers to adopt digital imaging technologies, including digital X-ray systems. For instance, in China, the Healthy China 2030 initiative focuses on providing better healthcare access and improving the quality of healthcare services, especially in rural and underserved areas. This program is driving the demand for cost-effective and portable imaging solutions like digital X-ray systems.

Digital X-ray Market Major Players

The major global players in the digital X-ray market include GE HealthCare, Siemens Healthineers, Koninklijke Philips N.V., FUJIFILM Holdings Corporation, Carestream Health, CANON MEDICAL SYSTEMS CORPORATION, Shimadzu Corporation, SAMSUNG, Konica Minolta, Inc., MinXray, Inc., and others.

Market Scope

| Metrics | Details | |

| CAGR | 4.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Portability | Fixed Digital X-Ray Systems and Portable Digital X-Ray Systems |

| System Type | Retrofit Digital X-Ray Systems and New Digital X-Ray Systems | |

| Application | Chest Imaging, Orthopedic Imaging, Cardiovascular Imaging, Pediatric Imaging, Dental Imaging, Oncology Imaging, and Others | |

| End-User | Hospitals, Diagnostic Imaging Centers, Specialty Clinics, and Others | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyze product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: This covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyze competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global digital X-ray market report delivers a detailed analysis with 70 key tables, more than 65 visually impactful figures, and 179 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.