Global Digital Payment Market is segmented By Component (Solution, Service), By Mode of Payment (Point of Sales, Digital Wallet, Bank Cards, Digital Currencies, Net Banking, Others), By Deployment (Cloud, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By End-User (Banking, Financial Service, and Insurance, Healthcare, Retail and Ecommerce, Transportation, Travel and Hospitality, Media and Entertainment, Transportation and Logistics, Others), By Region (North America, Europe, South America, Asia-Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Digital Payment Market Size

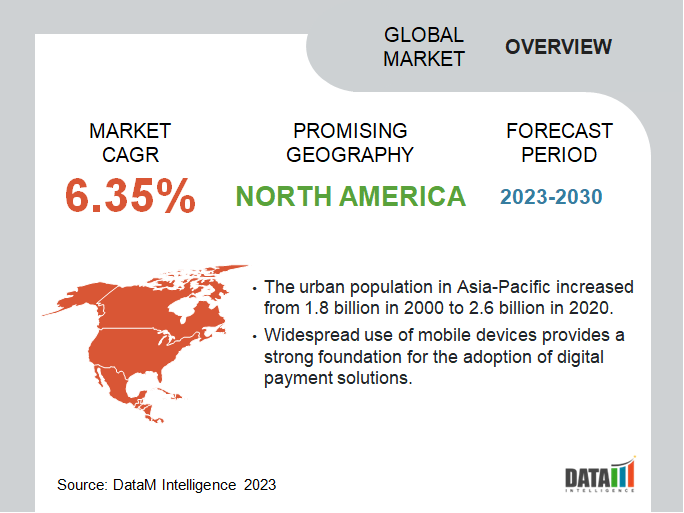

Global Digital Payments Market reached USD 10.1 Billion in 2022 and is expected to reach USD 15.6 Billion in 2030, growing with a CAGR of 5.6% during the forecast period 2024-2031. Digital payment provides feasible solutions because of the rapid development of technology, especially in the fields of electronic devices and internet access.

Consumers can easily make payments online due to the increasing use of smartphones and the accessibility of high-speed internet.

North America witnessed the highest smartphone adoption rate, with a large portion of the population owning smartphones. This widespread use of mobile devices provides a strong foundation for the adoption of digital payment solutions leading the region to contribute nearly 28.3% globally. Big players in the region are investing heavily in the region to boost technology.

For instance, On 15 July 2023, Car IQ Inc. partnered with Visa to enable vehicles to make payments directly through the Car IQ Pay vehicle wallet. This collaboration allows vehicles to transact with Visa's global ecosystem of merchants and banks, which enables purchases of fuel, tolls, parking, insurance, service and repairs without the need for physical cards. The integration of Car IQ Pay with Visa expands its reach and taps into the growing connected vehicle payment market, which is projected to reach D 600 billion by 2030 according to Ptolemus.

Market Scope

|

Metrics |

Details |

|

CAGR |

5.6% |

|

Size Available for Years |

2022-2031 |

|

Forecast Period |

2024-2031 |

|

Data Availability |

Value (USD ) |

|

Segments Covered |

Component, Mode of Payment, Deployment, Organization Size, End-User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Equipment Type Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report – Request for Sample

Market Dynamics

Worldwide Initiatives for the Promotion of Digital Payments

Governments and organizations globally promoting and launching digital payments as a means to enhance financial inclusion that improves efficiency and economic growth. For instance, On 3 Oct 2022, news launched by the National Payments Corporation of India, UPI enables instant and seamless transactions between different banks through mobile devices. It has gained significant popularity and has been instrumental in driving digital payment adoption in the country.

Furthermore, On 3 Sept 2022, Prime Minister Narendra Modi highlighted the significant growth of digital payments in India, emphasizing the country's innovations in this digital payment field, such as the BHIM-UPI. He mentioned that digital payments have reached historic levels and are gathering attention globally.

During an official event in Mangaluru, where he inaugurated various development projects, Modi emphasized the importance of fast and affordable internet connectivity, particularly in connecting gram panchayats through extensive network expansion. The government’s focus on digital payments reflects its commitment to promoting a cashless economy and fostering financial inclusion.

E-commerce Platform Boost the Growth of Digital Payment

The digital payment gateway offers a cashless and user-friendly platform that allows consumers to have payments in just one click. These factors made online shopping more convenient and more accessible. The digital payment system has incorporated robust security features such as encryption, tokenization and multiple authentication factors.

For instance, NPCI international partners with PPRO for enabling e-commerce payment globally, on 27 April 2023, This collaboration aims to empower global payment service providers, banks and enterprises with payment platforms to expand their reach and offer international e-commerce merchants access to Indian consumers. The integration of UPI into PPRO's digital payments infrastructure simplifies cross-border transactions in India, providing operational ease and enabling consumers to make purchases in Indian rupees using any payment method. NPCI's UPI has gained significant traction in India, with over 325 million active users and supporting numerous banks and third-party apps.

Limited Connectivity and Cybersecurity Threats

Digital payment relies on the availability of internet connectivity and technological infrastructure. In the area where the limited resource is there, then there is limited access to internet services and conducting digital transactions is very challenging in that situation. Digital payments are vulnerable to security risks.

Cyberthreat is one of the major concerns in the digital payment market. As cyber crimes are constantly increasing and exploiting vulnerabilities and gaining unauthorized access to sensitive financial and personal data. Phishing is one of the common tactics used by cybercriminals that trick users and access their data such as login credentials or payment card details.

Market Segment Analysis

The global digital payment market is segmented based on component, mode of payment, deployment, organization size, end-user and region.

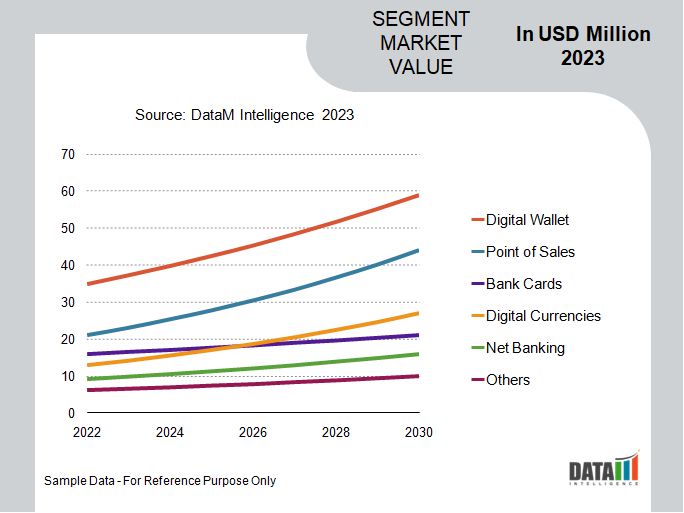

Consumer Adoption of Digital Wallets

The digital payment industry witnessed tremendous growth in digital wallets making it cover more than 1/3rd share globally. Consumers increasingly adopting digital transactions and searching for comfort, safety and ease of use, digital wallets have emerged as a popular preference for making payments. These mobile-based applications allow users to keep their payment records, together with credit or debit card information and make transactions in just a few seconds on their smartphones.

For instance, On 13 Jul 2023, Digital wallets are not limiting money as these wallets provide users to store their transactions history on their mobile devices in digital form. The popularity of digital wallets increased the need for sustainable monetization. Consumers switch from cash to digital and these digital wallets played a major role, as these digital modes are steadily being adopted.

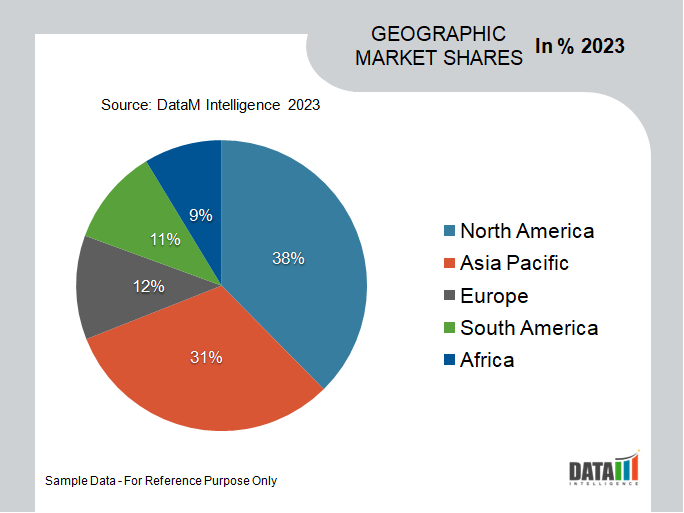

Market Geographical Share

Government Support and the Rise of Real-Time Payments in North America

Governments in North America are supporting the use of digital payments, implementing various regulations and frameworks that encourage the growth of the digital payment market. They have also focused on promoting financial inclusion and consumer protection in the digital payment space. Countries like U.S., Canada and Mexico are the fastest growing in the region covering more than 77.3% share in the region.

Government initiatives played a major role in driving the adoption of real-time payments in various countries. U.S. federal reserve is set to launch FedNow service and the government aims to modernize the payment system in the nation. For instance, on 20 July 2023, the service enables citizens of America to send and receive funds in real time. This move will bring U.S. in line with other countries that already offer real-time payment systems. The FedNow service has been in development since 2019 and is expected to significantly improve the speed and efficiency of transactions for everyday Americans.

Digital Payment Market Companies

The major global players include MasterCard, Google, Amazon, Alipay, Visa, PayPal, ACI Worldwide, Aurus, Apple Pay and Paysafe.

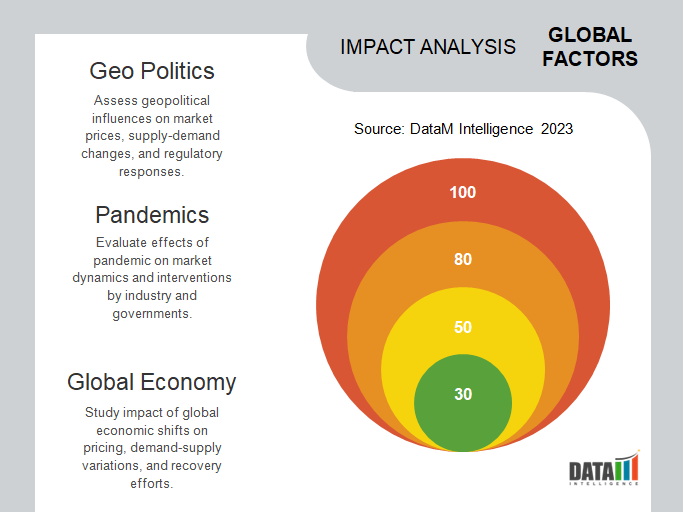

COVID-19 Impact on Market

To minimize physical contact and reduce the risk of virus transmission, consumers have increasingly started adopting contactless payment options that include mobile wallets (Google Pay, Paytm, phone pay) and contactless cards. Due to its hygienic and convenient nature, contactless transactions have increased significantly during the COVID-19 outbreak.

The government imposed lockdowns and restrictions on purchasing retail items physically, there has been a significant shift towards online shopping. This surge in e-commerce has necessitated the use of digital payments for online purchases, resulting in increased adoption and usage of digital payment platforms leading to an uplift in the market predominantly during the pandemic phase.

AI Impact

AI-driven payment platforms can gather and analyze user data, that enables personalized recommendations and offers tailored to individual preferences. This enhances user satisfaction and fosters customer loyalty by providing seamless and relevant payment experiences. These factors boost the growth of the market.

Generative AI, by GPT-3, is revolutionizing the digital payments industry by offering innovative solutions in various applications. For instance, on 19 Jan 2023, it can provide decision support by quickly presenting relevant information to decision-makers and updating dashboards in real time for faster reactions to fraud attacks. Generative AI's ability to search and summarize vast knowledge bases aids researchers in retrieving critical information efficiently.

Russia-Ukraine War Impact

During conflict, there is a risk of disruption to financial infrastructure that includes banking systems and payment networks. Infrastructure damage or service disruptions hinders the smooth functioning of digital payment services. This can result in difficulties in conducting online transactions and accessing funds, these factors further impact the functioning of digital payment services.

Cyberattacks and hacking attempts may increase during periods of conflict. Both state-sponsored and independent hackers may target digital payment systems to disrupt financial operations, gather intelligence, or carry out financial crimes. Hackers target financial infrastructure that poses risks and integrity in digital payment operations.

Key Developments

- On 6 March 2023, RBI Governor Shaktikanta Das launched a mission called "Har Payment Digital" during the Digital Payments Awareness Week (DPAW) in 2023. The objective of this initiative is to make every citizen in the country a user of digital payments. The aim is to limit the gap and increase awareness and adoption of digital payment methods among the population.

- On 2 Aug 2021, Narendra Modi launches India’s new digital payment system e-RUPI and this payment system was developed by the national payment corporation of India in the collaboration with Department of financial services.

- On 21 Feb 2023, Collaboration between India and Singapore launched a digital payment mechanism that enables residents of both countries to make cross-border transactions easily and quickly. The tie-up between India's Unified Payments Interface (UPI) and Singapore's PayNow was officially launched by Reserve Bank of India Governor Shaktikanta Das and Monetary Authority of Singapore Managing Director Ravi Menon.

Why Purchase the Report?

- To visualize the global digital payment market segmentation based on component, mode of payment, deployment, organization size, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of bioplastics market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global digital payment market report would provide approximately 77 tables, 83 figures and 181 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies