Overview

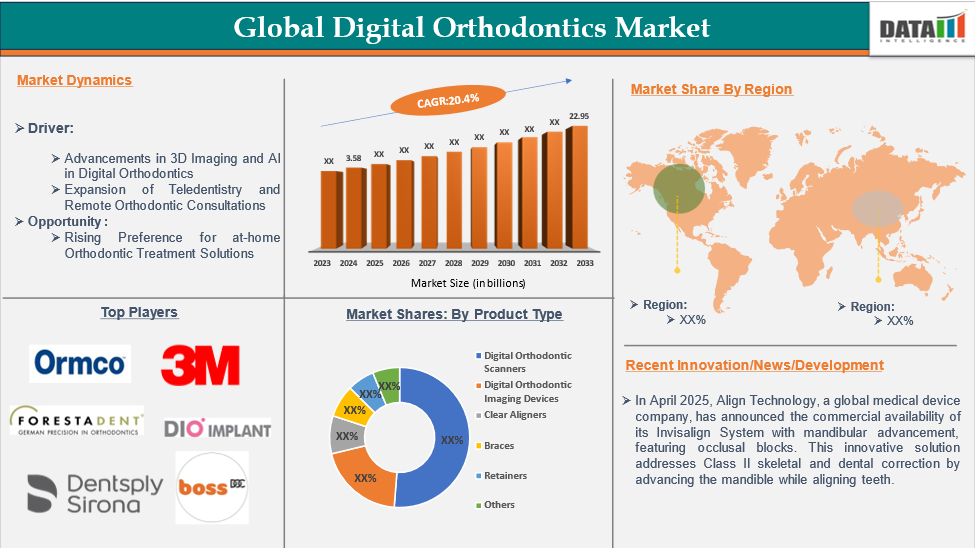

The global digital orthodontics market reached US$ 3.58 billion in 2024 and is expected to reach US$ 22.95 billion by 2033, growing at a CAGR of 20.4% during the forecast period 2025-2033.

Digital orthodontics uses advanced digital technologies like 3D imaging, intraoral scanning, CAD, CAM, and AI to diagnose, plan, and manage orthodontic cases. This technology enhances precision, efficiency, and patient outcomes by enabling customized treatments like clear aligners and 3D-printed braces. It reduces the need for traditional impressions and manual adjustments, improving workflow, patient comfort, and ensuring predictable treatment outcomes.

Executive Summary

Market Dynamics: Drivers & Restraints

Advancements in 3D Imaging and AI in Digital Orthodontics

Advancements in 3D imaging and AI are driving the adoption of digital orthodontics, improving diagnosis, treatment planning, and patient monitoring. These technologies enable precise tooth movement predictions and treatment customization.

The demand for clear aligners and digitally designed braces accelerates the shift towards digital workflows, reducing chair time and improving patient satisfaction. For instance, in November 2024, Dror Ortho-Design, an AI-based orthodontic platform company, developed ZSmile, an innovative solution that corrects smiles by straightening teeth using pulsating air delivered through a custom-made smart aligner. This technology generates up to 20 times less plastic waste compared to traditional aligners.

Moreover, in April 2024, OrthoSelect, a leading orthodontics software company, released DIBS AI 8.0, a powerful tool that enhances treatment times and case outcomes by utilizing digital indirect bonding, a technology already pioneered in the field.

Need for Specialized Training and Adaptation

Digital orthodontics requires specialized training for orthodontists and dental professionals to use advanced technologies like AI-driven treatment planning, 3D imaging, and CAD/CAM systems. Traditional practitioners may find the learning curve steep, leading to hesitation. The time-consuming and challenging integration of new software into practice management systems also slows the widespread implementation of digital orthodontic solutions, especially in regions with limited training resources.

Segment Analysis

The global digital orthodontics market is segmented based on product type, technology, end user, and region.

Product Type:

The digital orthodontic scanners from product type segment is expected to dominate the digital orthodontics market with the highest market share

Digital orthodontic scanners are advanced imaging devices used in orthodontics to capture 3D images of a patient's teeth, gums, and bite, eliminating the need for traditional physical impressions. They use optical or laser technology to create precise models, aiding in treatment planning, aligner design, and orthodontic appliance fabrication, enhancing patient comfort and treatment accuracy.

The rise in digital orthodontic scanners is attributed to the need for accurate treatment planning, enhanced scanning precision, and the popularity of clear aligners and personalized treatments.

Advancements in 3D imaging technology, AI, and CAD/CAM integration have made digital workflows more reliable. For instance, in October 2024, Align Technology, a global medical device company, announced the introduction of iTero intraoral scanners, a versatile solution for general practitioner dentists, in addition to the Invisalign System of clear aligners. Digital scanners also eliminate discomfort from traditional impression materials, improve patient experience, reduce chair time, and enhance communication between orthodontists and dental labs.

Geographical Analysis

North America is expected to hold a significant position in the digital orthodontics market with the highest market share

North America is driving the global digital orthodontics market growth due to its advanced healthcare infrastructure, high adoption of dental technologies, and key market players. The demand for clear aligners and customized treatments is driving the need for digital workflows like 3D imaging and AI-driven treatment planning. The region's high disposable income and awareness of aesthetic dentistry encourage patients to opt for advanced solutions. Favorable reimbursement policies, technological innovations, and established dental clinics further boost market expansion.

For instance, in April 2024, ClearCorrect launched a suite of products and features to enhance clinicians' orthodontic care and practice efficiency. These include improvements to the digital workflow, Virtuo Vivo scanning workflow, and ClearCorrect Sync mobile app, which improve efficiency in record collection, case submission, and management. Additionally, a new version of the ClearPilot treatment planning tool has been released, offering enhanced features and improved setup control.

Competitive Landscape

The major global players in the digital orthodontics market include 3M, Ormco Corporation, FORESTADENT Bernhard Förster GmbH, DIO IMPLANT CO., LTD, Dentsply Sirona, Boss Orthodontics, Institut Straumann AG, Planmeca Oy, Carestream Dental, and Stratasys Ltd, among others.

Key Developments

- In April 2025, Align Technology, a global medical device company, announced the commercial availability of its Invisalign System with mandibular advancement, featuring occlusal blocks. This innovative solution addresses Class II skeletal and dental correction by advancing the mandible while aligning teeth.

Scope

| Metrics | Details | |

| CAGR | 20.4% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | Digital Orthodontic Scanners, Digital Orthodontic Imaging Devices, Clear Aligners, Braces, Retainers, Others |

| Technology | 3D Imaging, CAD/CAM Systems, 3D Printing, Artificial Intelligence (AI) Tools | |

| End User | Dental Clinics, Hospitals, Dental Laboratories, Research Institutes | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

Why Purchase the Report?

- Technological Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global digital orthodontics market report delivers a detailed analysis with 70 key tables, more than 74 visually impactful figures and 165 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Application & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.