Digital Health Market – Industry Trends & Outlook

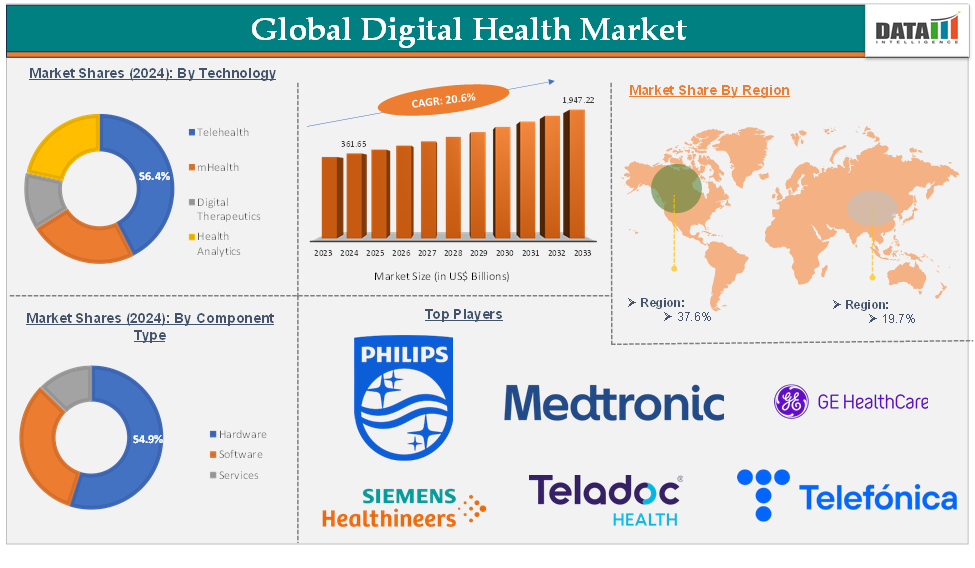

Digital Health Market reached US$ 361.65 Billion in 2024 and is expected to reach US$ 1,907.21 Billion by 2033, growing at a CAGR of 20.6% during the forecast period of 2025-2033.

Digital health is the integration of digital technologies into healthcare systems and services, aimed at enhancing health outcomes, improving patient care, and optimizing healthcare delivery. These applications enable users to manage their health through smartphones and tablets, providing features like health tracking, medication reminders, and access to telehealth services.

The increasing adoption of digital healthcare, rapid technological innovations, including wearable devices, mobile health applications, and artificial intelligence (AI) enabled diagnostics, and telemedicine platforms, are significantly enhancing healthcare delivery and patient engagement. These advancements facilitate real-time monitoring and data collection, improving overall health management.

North America holds a major portion of the market share owing to the advanced treatment options, the rise in the prevalence of ocular diseases, and increasing research and development of efficient drugs and innovative products for digital health treatment.

Executive Summary

For more details on this report, Request for Sample

Digital Health Market Dynamics: Drivers

Increasing adoption of digital healthcare

The global digital health market is driven by multiple factors. One of the key factors is that the increasing adoption of digital healthcare is expected to drive the market. Digital healthcare includes the need for improved patient care, enhanced access to services, and the demand for more efficient healthcare systems.

Digital health technologies allow providers to gather and analyze patient data more effectively. EHRs enable the integration of comprehensive patient histories, including previous treatments, medications, and outcomes. This information helps healthcare providers create personalized treatment plans that cater to individual patient needs, improving the relevance and effectiveness of care.

Furthermore, key players’ strategies such as partnerships & collaborations, and product launches would drive this market growth. For instance, in October 2024, sehatUP, a health tech startup, launched a digital health clinic to bring a holistic approach to healthcare. Using technology, it provides tailored treatment plans that integrate modern medicine, ayurveda, and homeopathy to address individual health needs.

Global Digital Health Market Dynamics: Restraints

Privacy and data security concerns

Privacy and data security concerns are significant restraints in the global digital health market due to the sensitive nature and sheer volume of personal health information (PHI) being collected, stored, and transmitted by digital health platforms.

As healthcare systems increasingly adopt technologies like telemedicine, mobile health apps, and the Internet of Medical Things (IoMT), the risk of cyberattacks and unauthorized data access has surged dramatically, with healthcare organizations experiencing a notable rise in cyberattacks in recent years. Medical data is highly valuable on the black market, making it a prime target for criminals seeking to commit identity theft, insurance fraud, or illicitly obtain medical equipment.

Digital Health Market - Segment Analysis

The global digital health market is segmented based on component type, technology, delivery mode, application, end-user, and region.

Technology:

The telehealth technology segment is expected to hold 56.4% of the global digital health market in 2024

Telehealth segment of the Digital Health Market experienced substantial growth, increasing from an estimated $128.05 billion in 2023 to $148.28 billion in 2024.

Telehealth technology includes video consultations, remote patient monitoring (RPM), long-term care monitoring, and others. Continuous improvements in telehealth technologies, such as mobile applications and wearable devices, enhance patient engagement and streamline healthcare delivery. For instance, the integration of artificial intelligence (AI) and data analytics into telehealth platforms allows for personalized patient care and better health monitoring.

Telehealth technology plays a transformative role in the global digital health market, enhancing access to healthcare while addressing challenges related to chronic disease management and provider shortages. The combination of increasing smartphone penetration and robust government support for digital health initiatives is transforming telehealth into a vital component of modern healthcare. The convenience afforded by these technologies not only empowers patients to monitor their health but also facilitates timely consultations with healthcare providers.

This widespread availability allows patients to easily access telemedicine services, health applications, and wearable health technologies, fostering a proactive approach to healthcare management.

Furthermore, key players in the industry product launches and platforms help to propel this segment’s growth in the market. For instance, in September 2024, Iris Telehealth launched a new Virtual Clinic that incorporates AI insights specifically designed for behavioral health. This initiative aims to enhance the delivery of mental health services by leveraging artificial intelligence to improve patient care and treatment outcomes.

Similarly, in January 2024, Eli Lilly and Company introduced LillyDirect, a new digital healthcare experience designed specifically for patients in the U.S. living with obesity, migraine, and diabetes. This innovative platform aims to streamline disease management by providing a comprehensive suite of resources and services tailored to individual health needs. These factors have solidified the segment's position in the global digital health market.

Digital Health Market Geographical Analysis

North America is expected to hold 37.7% of the global digital health market in 2024

Digital Health Market in North America experienced substantial expansion, increasing from an estimated $116.70B in 2023 to $134.86B in 2024.

The rising prevalence of chronic diseases in the United States is driving the market, with approximately 6 in 10 Americans living with at least one chronic condition. This trend is significant as it drives the demand for digital health solutions that facilitate continuous monitoring and management of these conditions, ultimately improving patient outcomes and reducing hospital visits.

The growing acceptance of telehealth services among consumers has significantly influenced healthcare providers' willingness to adopt digital health solutions. This trend is evident across various dimensions, including convenience, satisfaction, and evolving consumer expectations.

Innovations in technology, including mobile applications, wearable devices, and advanced data analytics, are enhancing the functionality and appeal of digital health solutions. These advancements improve patient engagement and enable more personalized care approaches.

Moreover, in this region, a majority of key players’ presence, well-advanced healthcare infrastructure, government initiatives & regulatory support, product launches & approvals, and partnerships & collaborations would propel this market growth. For instance, in August 2024, Pfizer launched PfizerForAll, a digital platform designed to simplify access to healthcare for millions of Americans. This initiative aims to provide an integrated experience for managing health and wellness, particularly for individuals affected by common illnesses such as migraines and the flu, as well as those seeking adult vaccinations.

Also, in February 2024, the Digital Health Collaborative is a newly formed organization that brings together 14 prominent healthcare and consumer organizations, including the American Telemedicine Association (ATA), AARP, and the American Medical Association (AMA). This collaboration aims to advance evidence-based digital health research and technology adoption, addressing the growing need for effective digital health solutions in the healthcare landscape. Thus, the above factors are consolidating the region's position as a dominant force in the global digital health market.

Digital Health Market Major Players

The major global players in the digital health market include Koninklijke Philips N.V., Medtronic plc, GE HealthCare, Siemens Healthineers AG, Apple Inc., Teladoc Health, Inc., Telefónica S.A., AT&T, Veradigm LLC (Allscripts Healthcare Solutions Inc.), and AirStrip Technologies, Inc., among others.

Key Developments

In June 2024, Wheel launched Horizon, an AI-powered telehealth platform designed to enhance the delivery of virtual care for health plans, retailers, digital health providers, and life sciences companies across the United States. This innovative platform aims to simplify and scale virtual care programs while improving patient experiences and health outcomes.

Market Scope

Metrics | Details | |

CAGR | 20.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Component Type | Hardware, Software, Services |

Technology | Telehealth, mHealth, Digital Therapeutics, Health Analytics | |

Delivery Mode | On-Premise Solutions, Cloud-Based Solutions | |

Application | Chronic Disease Management, Diabetes Management, Cardiovascular Health, Behavioral Health, Health & Fitness, Oncology, Sleep Apnea Management, Others | |

End-User | Healthcare Providers, Healthcare Payers, Patients & Consumers, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |