Dialysis Market Size

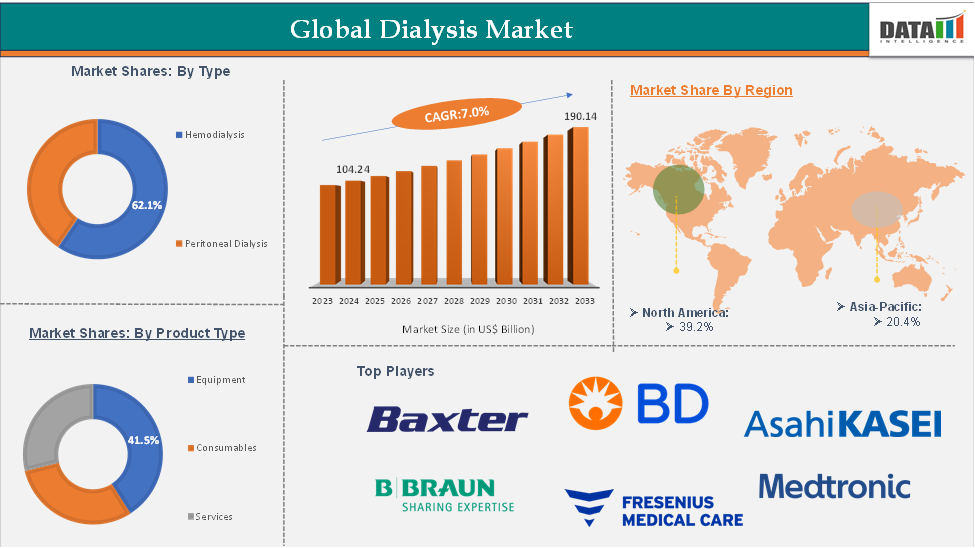

In 2023, the global dialysis market was valued at US$ 98.05 Billion. The global dialysis market size reached US$ 104.26 Billion in 2024 and is expected to reach US$ 190.14 Billion by 2033, growing at a CAGR of 7.0% during the forecast period 2025-2033.

Dialysis Market Overview

The dialysis market is on a rapid expansion trajectory, primarily driven by the rising incidence of End-Stage Renal Disease (ESRD), continuous technological advancements, and growing awareness and education about kidney health. As the global burden of ESRD increases, the demand for effective renal replacement therapies like dialysis is surging.

Simultaneously, innovations in dialysis technology, including portable and home-based devices, are making treatment more accessible and efficient. Additionally, increased public health initiatives and educational efforts are enhancing early detection and encouraging timely intervention, further fueling the growth of the dialysis market. With the rising development of advanced homecare dialysis solutions and cost-effective solutions, the market is expected to experience lucrative opportunities in the future.

Dialysis Market Executive Summary

Dialysis Market Dynamics: Drivers & Restraints

Drivers:

The rising incidence of end-stage renal disease (ESRD) is significantly driving the dialysis market growth

The rising incidence of end-stage renal disease (ESRD) is a major driver of growth in the dialysis market. As more individuals progress to stage 5 chronic kidney disease, the need for life-sustaining treatments like dialysis significantly increases.

According to a report published by the National Institutes of Health, between 2002 and 2022, the number of newly registered ESRD patients rose from 99,956 to 131,194, reflecting a 31.3% increase. In 2022, 82.4% of new ESRD patients (107,735 individuals) began hemodialysis (HD), while 13.7% (17,939 individuals) started peritoneal dialysis (PD). The increasing share of patients opting for PD since its low point in 2008 further expands treatment options, contributing to sustained growth in the dialysis market.

Factors such as increasing rates of diabetes, hypertension, and aging populations are contributing to a higher prevalence of ESRD globally. This growing patient pool is leading to greater demand for both hemodialysis and peritoneal dialysis services, encouraging healthcare providers and manufacturers to expand capacity, improve technology, and invest in more accessible treatment options.

Increasing technological advancements are expected to boost the dialysis market growth

Increasing technological advancements are significantly boosting the dialysis market, particularly through innovations that enhance treatment precision, patient comfort, and home-based care. In 2024 and 2025, the shift toward portable and wearable dialysis devices has accelerated, offering more flexibility and improving the quality of life for patients with end-stage renal disease (ESRD).

The integration of artificial intelligence (AI) and remote monitoring systems into dialysis machines has enabled real-time tracking of treatment parameters, early detection of complications, and personalized therapy adjustments.

For instance, in June 2025, Renalyx Health Systems Pvt. Ltd. launched RENALYX – RxT 21, India’s first fully indigenous, AI- and cloud-enabled smart hemodialysis machine with real-time remote monitoring. This device aims to improve affordability and dialysis access, particularly in semi-urban and rural areas.

Restraint:

Risks and complications associated with dialysis are hampering the growth of the dialysis market

The dialysis market faces significant challenges due to the risks and complications associated with dialysis treatments, which can deter patient adoption and strain healthcare systems. Common complications include infections at vascular access sites, hypotension, muscle cramps, and electrolyte imbalances. Hemodialysis patients with catheters experience higher rates of sepsis and hospitalization compared to those with grafts or fistulas, among other complications.

Depression is a significant concern among dialysis patients, with approximately one in five affected. For instance, according to the National Institute of Health in 2022, it was reported that a large-scale meta-analysis of 198 studies involving over 46,000 dialysis patients across multiple countries found depression prevalence rates of 22.8% based on clinical interviews and 39.3% based on self-reported symptoms.

This high psychological burden not only impacts patient quality of life but may also lead to reduced treatment adherence, posing an additional challenge to the growth and sustainability of the dialysis market. Additionally, cardiovascular issues such as atrial fibrillation are prevalent among dialysis patients, leading to increased morbidity and mortality.

Opportunity:

Adoption of wearable and portable dialysis devices is expected to create a lucrative opportunity for the growth of the dialysis market

The adoption of wearable and portable dialysis devices is expected to create a lucrative opportunity for the dialysis market by addressing key limitations of conventional in-clinic dialysis. These compact, patient-friendly devices offer greater mobility, enabling more frequent and flexible treatments, which can lead to better health outcomes and improved quality of life for individuals with end-stage renal disease (ESRD).

Additionally, growing investments, supportive regulatory pathways, and rising demand for home-based care are accelerating the commercialization of these innovations. This shift not only empowers patients but also creates new revenue streams for device manufacturers and healthcare providers, positioning the segment as a high-growth driver within the broader dialysis market.

For instance, in September 2023, AWAK Technologies, a medical technology company specializing in regenerative dialysis solutions for end-stage renal disease, announced the successful closure of its Series B funding round, raising over USD 20 million. This marks the largest MedTech fundraising event in Singapore for 2023 and one of the biggest in Southeast Asia for the year.

For more details on this report – Request for Sample

Dialysis Market, Segment Analysis

The global dialysis market is segmented based on type, product type, end-user, and region.

The equipment from the product type segment is expected to hold 62.1% of the market share in 2024 in the dialysis market

The equipment segment is expected to hold a dominant position in the dialysis market due to its critical role in delivering effective treatment to patients with end-stage renal disease.

Advances in dialysis machines, including improvements in technology, portability, and user-friendliness, are driving strong demand. Additionally, the rising adoption of home dialysis therapies, which require reliable and easy-to-use equipment, further boosts this segment’s growth. For instance, according to a study published by the University of Pennsylvania in 2024, 13.7% of Americans who use dialysis services do so at home. The number is expected to increase with the initiatives that are being taken by the government and with the rising development of advanced solutions.

Continuous innovation, such as the integration of smart monitoring systems and enhanced biocompatible materials, also supports better patient outcomes and safety, making investment in equipment essential for healthcare providers. Several collaborations are taking place to innovate such advanced solutions. For instance, in October 2024, Nephro Care India Limited (NCIL) collaborated with the National Institute of Technology to develop a prototype of a remotely monitored, AI-enabled Smart Hemodialysis Machine. Moreover, as the global prevalence of kidney disease increases, the need for efficient and advanced dialysis devices remains fundamental, securing the equipment segment’s leading position in the market.

Dialysis Market, Geographical Analysis

North America is expected to dominate the global dialysis market with a 39.2% share in 2024

North America is expected to dominate the dialysis market due to several key factors. The high prevalence of end-stage renal disease (ESRD) is driven by chronic conditions like diabetes and hypertension, well-established healthcare infrastructure, widespread availability of advanced dialysis technologies, and strong government support through programs like Medicare’s ESRD coverage.

According to the 2023 Annual Data Report from the United States Renal Data System, over 808,000 individuals in the U.S. are living with end-stage kidney disease (ESKD), also known as end-stage renal disease (ESRD). Of these, 68% are undergoing dialysis treatment, while 32% have received a kidney transplant. Additionally, males are 1.6 times more likely to develop ESKD compared to females.

Additionally, increasing adoption of home dialysis therapies and ongoing innovations in equipment further strengthen North America’s leading position. The rising initiative by the regional centers, government, and the rising awareness programs in the region are also expected to contribute to the region’s growth. For instance, in April 2024, Royal Victoria Regional Health Centre (RVH) launched a Home Hemodialysis Program, offering patients with chronic kidney disease greater flexibility and control over their treatment options.

This initiative marks a major advancement in the delivery of kidney care in the region, enhancing patient independence and improving access to personalized treatment at home. Together, these factors contribute to sustained market growth and dominance in the region.

Asia-Pacific is growing at the fastest pace in the dialysis market holding 20.4% of the market share

Asia-Pacific is emerging as the fastest-growing region in the dialysis market, driven by a sharp rise in chronic kidney disease (CKD) cases, expanding healthcare infrastructure, and increasing government investments in renal care.

For instance, according to the study published by the National Institute of Health in 2024, among Chinese adults with type 2 diabetes, the prevalence of chronic kidney disease (CKD) was significant at 31%, while screening and awareness levels remained low. Countries like India and China are witnessing a surge in end-stage renal disease (ESRD) due to rising diabetes and hypertension prevalence.

This population requires dialysis treatment as the CKD is getting worse. Thus, the above factors are expected to drive the region’s market growth at the fastest pace.

Key Developments

In September 2024, Fresenius Medical Care reached a milestone with over 14,000 U.S. patients using its NxStage systems for home hemodialysis (HHD). Alongside this growth, the company launched the latest version of its home dialysis machine, NxStage and Versi HD, with GuideMe Software designed to simplify treatment, enhance learning, and improve the overall user experience.

Dialysis Market Competitive Landscape

Top companies in the dialysis market include Baxter, B. Braun Medical Inc., Fresenius Medical Care AG, Medtronic, DaVita Inc., Dialife Group, BD, Asahi Kasei Medical Co., Ltd., Nipro Corporation, and Nikkiso Co., Ltd., among others.

Dialysis Market Scope

Metrics | Details | |

CAGR | 7.0% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Hemodialysis, Peritoneal Dialysis |

Product Type | Equipment, Consumables, Services | |

End-User | Hospitals, Dialysis Centers, Homecare, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global dialysis market report delivers a detailed analysis with 60+ key tables, more than 55+ visually impactful figures, and 178 pages of expert insights, providing a complete view of the market landscape.