Diabetic Macular Edema Market Size

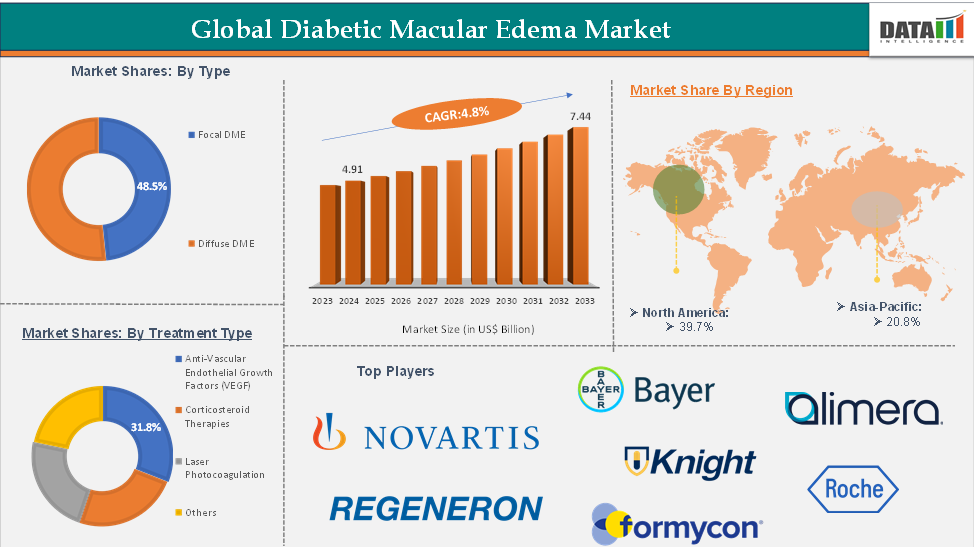

Diabetic Macular Edema Market Size reached US$4.91 Billion in 2024 and is expected to reach USnbsp;7.44 Billion by 2033, growing at a CAGR of 4.8% during the forecast period 2025-2033, according to DataM Intelligence report.

Diabetic Macular Edema Market Overview

Diabetic macular edema (DME) is a serious eye condition that affects individuals with diabetes, whether type 1 or type 2. DME occurs when damaged blood vessels leak fluid, leading to swelling that blurs vision. If diabetic retinopathy progresses, the eye may develop new, abnormal blood vessels over the retina, which can break easily and bleed, resulting in severe vision loss or even blindness.

The growing incidence of diabetes, rising advancements in treatments, and increasing number of drug approvals are expected to be the significant factors driving the market growth. North America holds a significant portion of the market share and is expected to continue throughout the forecast period, owing to the incidence of diabetes among the population, increasing research and development of new treatments, and the rising clinical trials by the market players in the region.

In recent years, intravitreal injections of anti-vascular endothelial growth factor (anti-VEGF) agents have become widely recognized as the most effective treatment for diabetic macular edema (DME). These therapies work by targeting and inhibiting the VEGF protein, which is responsible for abnormal blood vessel growth and leakage in the retina.

Executive Summary

For more details on this report – Request for Sample

Diabetic Macular Edema Market Dynamics: Drivers & Restraints

The rising prevalence of diabetes is significantly driving the diabetic macular edema market growth

The rising global incidence of diabetes is expected to play a pivotal role in driving the growth of the diabetic macular edema (DME) market. As type 2 diabetes becomes increasingly prevalent worldwide, the number of individuals at risk for diabetes-related complications is rising in parallel. DME results from microvascular damage caused by prolonged high blood sugar levels, leading to fluid accumulation and swelling in the macula.

According to a July 2022 NCBI publication, approximately 5.5% of people with diabetes are affected by DME, with prevalence rates slightly higher in low- and middle-income countries compared to high-income nations. As estimated in the IDF Diabetes Atlas 10th edition, there were 537 million adults (20–79 years) with diabetes in 2021. These projections estimate that the global diabetic population will reach 643 million by 2030 and surge to 783 million by 2045, significantly expanding the patient pool at risk for DME.

As screening programs for diabetic eye diseases become more widespread, early diagnosis rates are expected to improve, further fueling the demand for effective DME treatments. This growing burden of diabetes and its complications will be a key driver of sustained market expansion in the years ahead.

The high treatment cost is hampering the growth of the diabetic macular edema market

The high cost of treatment for diabetic macular edema (DME) remains a significant barrier to market growth, especially for advanced pharmacological options such as anti-VEGF injections and corticosteroids. These treatments, while effective, come with substantial financial burdens due to their high costs and the need for repeated administrations, which can be unaffordable for many patients, particularly those without adequate insurance coverage.

For instance, the estimated average cost of DME treatment can be as high as $35,344.96 for faricimab and $26,305.16 for aflibercept 8 mg, making it a significant financial challenge for patients. This high cost not only limits patient access but also restricts market penetration, particularly among populations with low or insufficient insurance coverage, ultimately hindering the broader adoption of these therapies and limiting the growth potential of the DME treatment market.

Diabetic Macular Edema Market Segment Analysis

The global diabetic macular edema market is segmented based on type, treatment type, form, and region.

The anti-vascular endothelial growth factor (anti-VEGF) from the treatment type segment is expected to hold 48.5% of the market share in 2024 in the diabetic macular edema market

The anti-vascular endothelial growth factor (anti-VEGF) segment is projected to dominate the diabetic macular edema (DME) market over the forecast period, driven by its proven efficacy and widespread clinical adoption. Anti-VEGF therapies such as Ranibizumab (Lucentis) and Aflibercept (Eylea) have significantly advanced the standard of care for DME by directly targeting VEGF.

By inhibiting VEGF activity, these therapies effectively reduce retinal swelling, control inflammation, and prevent the development of vision-threatening blood vessels. Owing to their strong clinical outcomes, rapid onset of action, and safety profile, anti-VEGF drugs are widely recognized as the first-line treatment for DME, outperforming other available therapeutic options in both efficacy and patient outcomes.

The growth of the anti-VEGF segment will be further fueled by ongoing product launches, approvals, and strategic partnerships among key market players. For example, in May 2024, Biocon Biologics Ltd (BBL) received U.S. Food and Drug Administration (FDA) approval for Yesafili (aflibercept-jbvf), an interchangeable biosimilar of Aflibercept, marking a significant milestone in the market.

In January 2024, Santen Pharmaceutical Co., Ltd. and Bayer Yakuhin, Ltd. received regulatory approval from the Ministry of Health, Labour, and Welfare (MHLW) for Eylea 8mg Intravitreal Injection 114.3 mg/mL, a treatment for neovascular age-related macular degeneration (nAMD) and diabetic macular edema (DME). These approvals highlight the growing demand and innovation in the anti-VEGF space.

Diabetic Macular Edema Market Geographical Analysis

North America is expected to dominate the global diabetic macular edema market with a 39.7% share in 2024

North America is expected to maintain the largest share of the diabetic macular edema (DME) market throughout the forecast period, driven by the region’s high diabetes prevalence. The market continues to expand due to strong clinical demand, proactive regulatory support, and the presence of industry-leading pharmaceutical companies. For instance, according to the CDC's 2021 report, approximately 38.4 million individuals in the U.S. are living with diabetes. Among adults aged 18 and older, this figure rises to 14.7%.

The North American diabetic macular edema market is further driven by increased research and development efforts, rising awareness, and strategic partnerships among leading industry players. The region has seen a surge in regulatory approvals and product innovation. For instance, in August 2023, Regeneron Pharmaceuticals secured U.S. FDA approval for EYLEA HD (aflibercept) 8 mg, a next-generation therapy indicated for wet age-related macular degeneration (wAMD), diabetic macular edema (DME), and diabetic retinopathy (DR).

Similarly, in April 2024, Eluminex Biosciences announced that the FDA accepted its Investigational New Drug (IND) application for EB-105, a novel tri-specific fusion antibody targeting multiple angiogenic and inflammatory pathways, including VEGF-A/B, PlGF, Ang-2, and IL-6R. This innovative biologic holds promise as a breakthrough therapy for patients with treatment-resistant DME. With a high concentration of market players, a sophisticated healthcare ecosystem, and a surge in innovative treatment options, North America is not only the current leader but also the most strategically attractive region for investment in the DME market.

Asia-Pacific is growing at the fastest pace in the diabetic macular edema market, holding 20.8% of the market share

The Asia-Pacific region is experiencing the fastest growth in the diabetic macular edema (DME) market, driven by a rapid rise in diabetes prevalence, an expanding elderly population, and improved access to healthcare services.

Countries such as China, India, and Southeast Asian nations are witnessing a surge in diabetic complications due to changing lifestyles, urbanization, and limited early-stage diabetes management. In response, governments and healthcare providers are increasing investments in ophthalmic care infrastructure and awareness programs.

Diabetic Macular Edema Market Top Companies

Top companies in the diabetic macular edema market include Novartis AG, Regeneron Pharmaceuticals, Inc., F. Hoffmann-La Roche AG, Formycon AG, Bayer AG, Alimera Sciences, Knight Therapeutics Inc., AbbVie, Samsung Bioepis, among others.

Emerging Players

The emerging players in the diabetic macular edema market include KODIAK SCIENCES INC., Adverum Biotechnologies, Inc., Oculis, and Oxurion NV, among others.

Key Developments

In April 2025, Oculis Holding AG announced the completion of patient enrollment in its Phase 3 DIAMOND-1 and DIAMOND-2 trials for OCS-01 eye drops in diabetic macular edema (DME). The pivotal trials, which will support global regulatory submissions, including an NDA to the U.S. FDA, enrolled over 800 patients across 119 sites in the U.S. and other countries.

In September 2024, Merck and its wholly owned subsidiary EyeBio announced the launch of the Phase 2b/3 BRUNELLO clinical trial. The study will evaluate Restoret (MK-3000, formerly EYE103) for the treatment of diabetic macular edema (DME). The companies are advancing this program as part of their commitment to addressing serious retinal diseases.

Market Scope

Metrics | Details | |

CAGR | 4.8% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Type | Focal DME, Diffuse DME |

Treatment Type | Anti-Vascular Endothelial Growth Factors (VEGF), Corticosteroid Therapies, Laser Photocoagulation, Others | |

Form | Intravitreal Injections, Intravitreal Implants | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global diabetic macular edema market report delivers a detailed analysis with 60+ key tables, more than 55+ visually impactful figures, and 178 pages of expert insights, providing a complete view of the market landscape.