Market Size

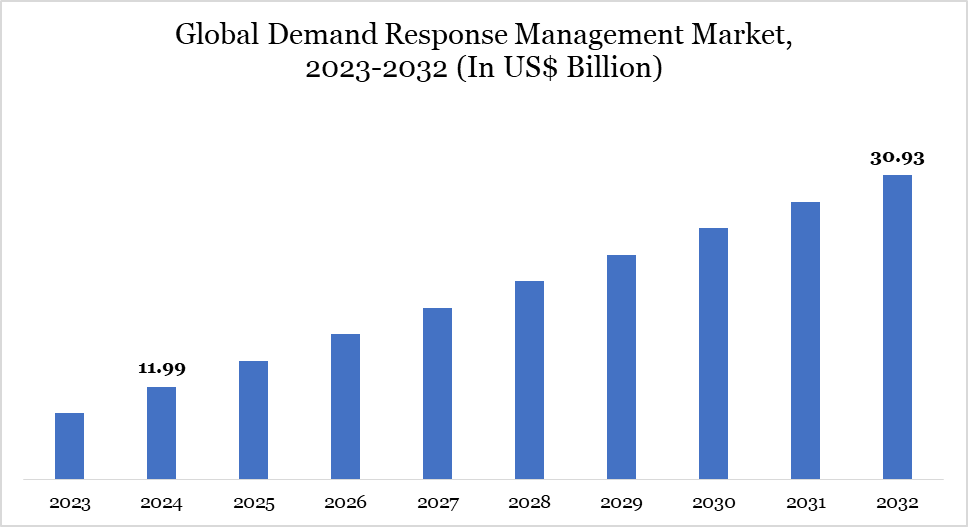

Global Demand Response Management System Market reached US$11.99 billion in 2025 and is expected to reach US$30.93 billion by 2032, growing with a CAGR of 14.50% during the forecast period 2025-2032.

Demand Response Management System Trends

The global demand response management system (DRMS) market is experiencing robust growth, driven by increasing energy consumption and the need for grid stability. According to the International Energy Agency (IEA), global electricity demand is expected to grow by 2.7% annually between 2023 and 2030, putting pressure on existing power infrastructure.

Increasing integration of renewable energy sources, coupled with regulatory mandates for energy efficiency, is driving market expansion. Advancements in smart grid technology, IoT-enabled energy management systems, and AI-based demand forecasting are further enhancing DRMS adoption. North America dominates the market due to supportive policies, while the food and beverage sector is a key end-user segment.

For more details on this report – Request for Sample

| Metrics | Details | |

| CAGR | 14.50% | |

| Size Available for Years | 2023-2032 | |

| Forecast Period | 2025-2032 | |

| Market Value | In US$ Billion |

Market Dynamics

Driver - Rising Adoption of Smart Grid and IoT Technologies

- The increasing adoption of smart grids and IoT-enabled demand response solutions is a major driver of the DRMS market. Smart grids enhance real-time energy monitoring and allow utilities to manage demand more efficiently. IoT-based energy management systems enable automated demand response, reducing energy costs for industries and households.

- Advanced metering infrastructure (AMI) and AI-driven predictive analytics provide precise energy consumption insights, allowing for proactive demand response measures. Governments and utilities are investing heavily in modernizing energy infrastructure, which is expected to further accelerate the adoption of DRMS, helping to optimize grid stability and efficiency.

Restraint - High Initial Investment and Regulatory Challenges

- Deploying demand response programs requires substantial investment in smart meters, communication networks, and automation infrastructure. Many industries and utilities, particularly in developing regions, struggle with the initial capital expenditure required for DRMS adoption.

- Additionally, integrating demand response solutions with existing grid systems poses technical challenges, requiring a skilled workforce and regulatory approvals.

Market Segment Analysis

The global demand response management System market is segmented based on services, technology, application, end-use industry, and region.

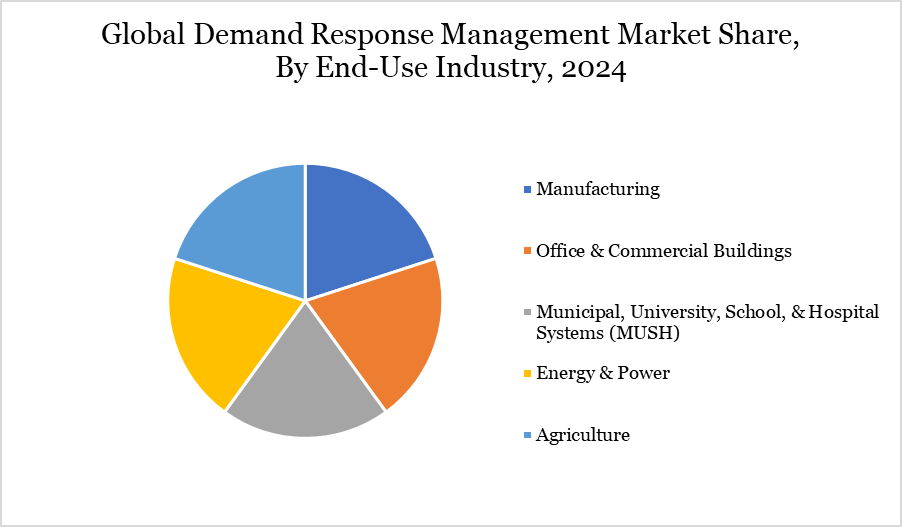

High Energy Consumption and Growing Focus on Cost Optimization Drive the Manufacturing Industry.

The manufacturing sector represents the largest end-use industry for DRMS due to its high energy consumption and growing focus on cost optimization. According to the U.S. Energy Information Administration (EIA), the manufacturing industry accounted for 38% of total industrial energy use in the US in 2023, making it a critical sector for demand response adoption. Energy-intensive processes, including metal production, chemical manufacturing, and automotive assembly, benefit significantly from demand response programs.

Energy-intensive industries such as steel, cement, and petrochemicals are leveraging DRMS to reduce electricity bills and benefit from government incentives. The U.S. Department of Energy (DOE) estimates that demand response programs save manufacturers between 10% and 30% on energy costs annually. Utility providers in North America and Europe offer dynamic pricing programs, rewarding industries for reducing consumption during peak demand. For example, California's Capacity Bidding Program (CBP) provides incentives to manufacturers that voluntarily decrease electricity usage during high-demand periods.

Market Geographical Share

North America holds the Largest Region Due to Energy Efficiency Mandates, and the Rapid Deployment of Smart Grid Infrastructure.

North America leads the global DRMS market, driven by government incentives, energy efficiency mandates, and the rapid deployment of smart grid infrastructure. According to the North American Electric Reliability Corporation (NERC), demand response contributed 54,000 MW of peak load reduction in 2023, helping stabilize the region’s electricity grids. The Federal Energy Regulatory Commission (FERC) Order 2222, which allows distributed energy resources (DERs) to participate in wholesale electricity markets, has further accelerated DRMS adoption in the U.S.

Major utilities such as Duke Energy, Pacific Gas & Electric (PG&E), and Constellation Energy have implemented large-scale demand response programs to manage electricity demand and prevent grid congestion. According to the Edison Electric Institute (EEI), utilities in North America spent over $15 billion on smart grid and demand response programs in 2023, with projected annual growth of 7.5% through 2030. The success of demand response programs in the U.S. and Canada is encouraging further expansion into residential and industrial sectors.

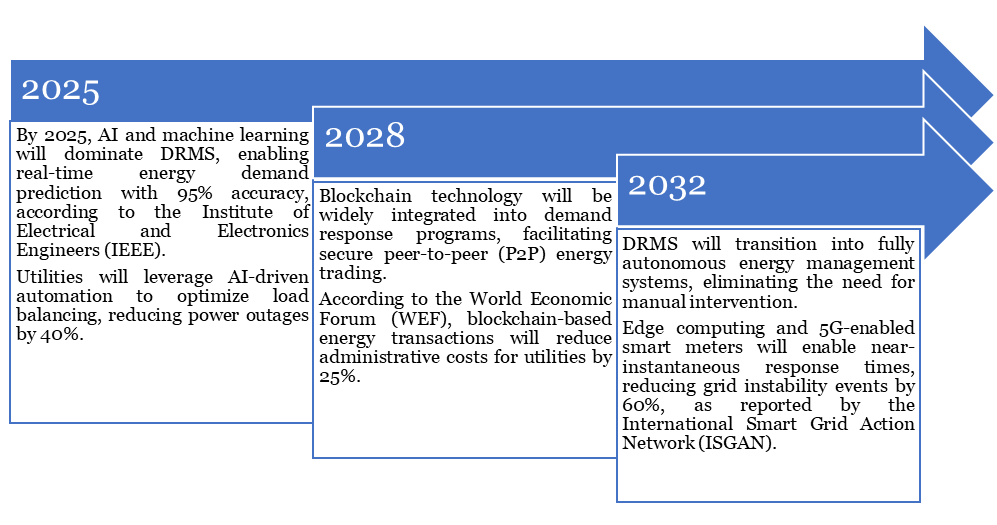

Technology Roadmap

The global demand response management system market is expected to evolve significantly over the coming years, driven by advancements in network infrastructure, the expansion of IoT, and the increasing adoption of artificial intelligence (AI) at the logistics. Government initiatives, regulatory frameworks, and private sector investments are set to accelerate AI adoption in cybersecurity across multiple industries.

Technology Roadmap of Global Demand Response Management System Market

Major Global Players

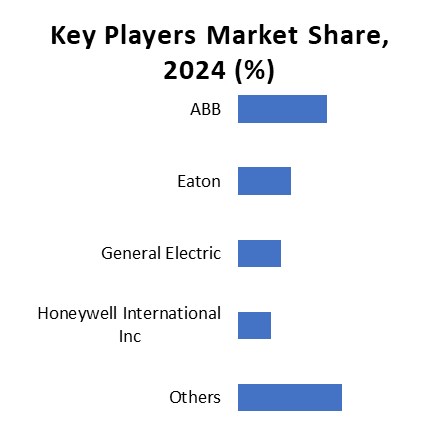

The major Global players in the market include ABB, Eaton, Enel Spa, ALARM.COM HOLDINGS, INC., General Electric, Honeywell International Inc, Itron Inc., Johnson Controls, Inc., Schneider Electric SE, and Siemens.

By Services

- Curtailment Services

- System Integration & Consulting Services

- Managed Services

- Support & Maintenance

By Technology

- Conventional Demand Response

- Automated Demand Response

By Application

- Residential

- Industrial

- Commercial

By End-Use Industry

- Manufacturing

- Office & Commercial Buildings

- Municipal, University, School, & Hospital Systems (MUSH)

- Energy & Power

- Agriculture

By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies