Defense Electronics Market Overview

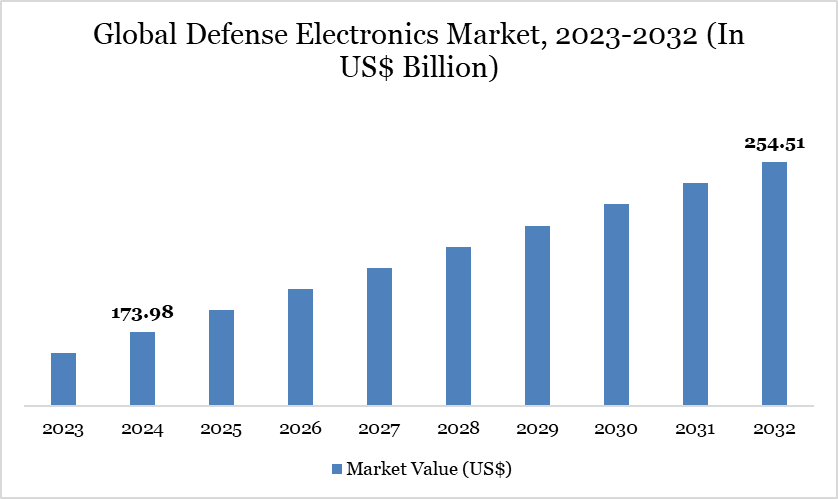

Global Defense Electronics Market reached US$ 173.98 billion in 2024 and is expected to reach US$ 254.51 billion by 2032, growing with a CAGR of 4.87% during the forecast period 2025-2032.

The global defense electronics market is witnessing steady growth driven by rapid technological advancements, increasing defense spending, and rising demand for sophisticated electronic systems across military platforms. Nations worldwide are modernizing their armed forces with advanced electronic warfare systems, secure communication networks, and high-performance radar and surveillance solutions to counter evolving security threats.

Growth is further fueled by the expanding need for intelligence, surveillance, and reconnaissance (ISR) capabilities that enable real-time decision-making and operational superiority in both conventional and asymmetric warfare. The integration of artificial intelligence, cybersecurity measures, and miniaturized electronics into defense applications is enhancing efficiency, accuracy, and interoperability across platforms.

Defense Electronics Market Trend

One of the most prominent trends in the global defense electronics market is the integration of artificial intelligence (AI) and machine learning (ML) into defense systems, enabling faster data analysis, predictive threat detection, and autonomous decision-making across surveillance, targeting, and command-and-control operations.

Another major trend is the miniaturization and modular design of electronic components, which allows for lighter, more power-efficient, and easily upgradeable systems that can be adapted for multiple platforms, from drones to naval vessels. Additionally, the market is witnessing a shift toward multi-function radar and sensor systems, which combine multiple capabilities, such as surveillance, target tracking, and weather monitoring into a single unit, reducing operational costs, saving space, and enhancing versatility for modern defense missions.

For more details on this report - Request for Sample

Market Scope

| Metrics | Details |

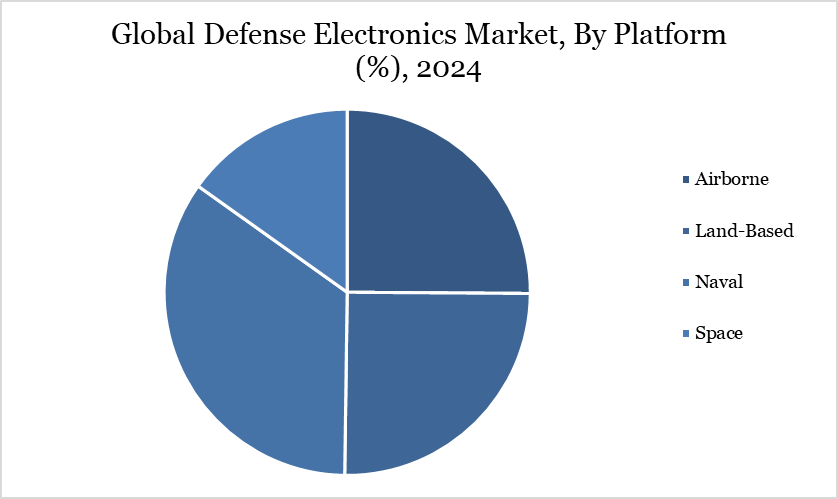

| By Platform | Airborne, Land-Based, Naval, Space |

| By Product Type | Communication Systems, Radar Systems, Electronic Warfare Systems, Optronics & Infrared Systems, Command & Control Systems, Others |

| By Application | Intelligence, Surveillance & Reconnaissance, Command & Control, Navigation, Target Acquisition, Others |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Defense Budgets and Modernization Programs Worldwide

Rising defense budgets and modernization programs worldwide are a major driver of the global defense electronics market, as nations increasingly allocate larger portions of their national expenditure to enhance military capabilities. For instance, Japan’s Cabinet approved a record FY2025 defense budget of 8.7 trillion yen ($55.1 billion), marking the 13th consecutive year of growth and a 9.4% increase from the previous year.

This budget includes significant investments such as 123.8 billion yen for a new communications satellite to replace the Kirameki-2 by 2030, directly boosting demand for advanced defense electronics in secure communication and space-based systems. Similarly, Russia’s military spending surged dramatically, with the 2022 budget estimated at $75 billion and increasing to about $84 billion in 2023 over 40% higher than initial projections. These sustained and rising expenditures create a robust pipeline of procurement programs, driving the continuous adoption of next-generation defense electronics globally.

Vulnerability to Cybersecurity Threats

Vulnerability to cybersecurity threats acts as a significant restraint for the global defense electronics market, as modern military systems increasingly rely on interconnected digital platforms, cloud-based networks, and software-driven operations. The integration of advanced electronics such as communication systems, radar networks, and electronic warfare platforms, creates potential entry points for cyberattacks, data breaches, and system manipulation by hostile actors.

A successful cyber intrusion could compromise classified information, disrupt critical defense operations, or even disable weapon systems, posing severe national security risks. This vulnerability forces defense agencies and manufacturers to invest heavily in cybersecurity measures, encryption, and continuous monitoring, which increases project complexity, delays procurement timelines, and inflates overall costs.

Market Segment Analysis

The global defense electronics market is segmented based on platform, product type, application and region.

Modernization of Ground Forces and Advanced Electronics Integration in Land-Based Defense Systems

The land-based segment drives the global defense electronics market through the continuous modernization of ground forces and the integration of advanced electronic systems into armored vehicles, artillery, missile systems, and command centers. This segment benefits from increasing investments in battlefield communication networks, surveillance radars, electronic warfare systems, and unmanned ground vehicles to enhance operational efficiency and situational awareness.

For instance, the U.S. Army has been upgrading its M1A2 Abrams tanks with advanced sensors, improved targeting systems, and enhanced communications to meet modern combat needs. Similarly, in 2024, India’s Defence Research and Development Organisation (DRDO) successfully tested an advanced Active Electronically Scanned Array (AESA) radar for ground-based applications, enhancing border surveillance and air defense capabilities.

Market Geographical Share

Rising Investments in Advanced Airborne Defense Systems Across Asia-Pacific

Advancements in Airborne Platforms and Combat Systems are significantly driving the Asia-Pacific defense electronics market, as regional powers invest in cutting-edge technologies to enhance operational capabilities and maintain strategic superiority. In 2024, Japan successfully launched a defense satellite aboard its new flagship H3 rocket, aiming to improve communication speed and coordination for military operations, a move that underscores the growing demand for advanced space-based electronics in defense applications.

In 2025, China unveiled a major new combat aircraft designed to act as an airborne cruiser, capable of engaging both air and surface targets, showcasing the integration of sophisticated avionics, targeting systems, and electronic warfare suites. These developments reflect how the Asia-Pacific region’s focus on modernizing airborne platforms with state-of-the-art defense electronics is fueling market growth, as countries seek to strengthen surveillance, command-and-control, and multi-domain operational readiness amid rising regional tensions.

Technological Analysis

The technological landscape of the global defense electronics market is rapidly evolving, driven by advancements in artificial intelligence (AI), machine learning (ML), miniaturization, and open architecture systems that enhance performance, interoperability, and adaptability across platforms. Modern defense electronics integrate multi-function radars, advanced electronic warfare suites, and secure communication networks capable of operating in contested and cyber-threatened environments.

Space-based technologies, such as high-throughput defense satellites, are enabling faster, more secure data transmission and real-time battlefield coordination. The adoption of gallium nitride (GaN)-based components is improving power efficiency and range in radar and electronic warfare applications, while next-generation sensors provide enhanced situational awareness in multi-domain operations.

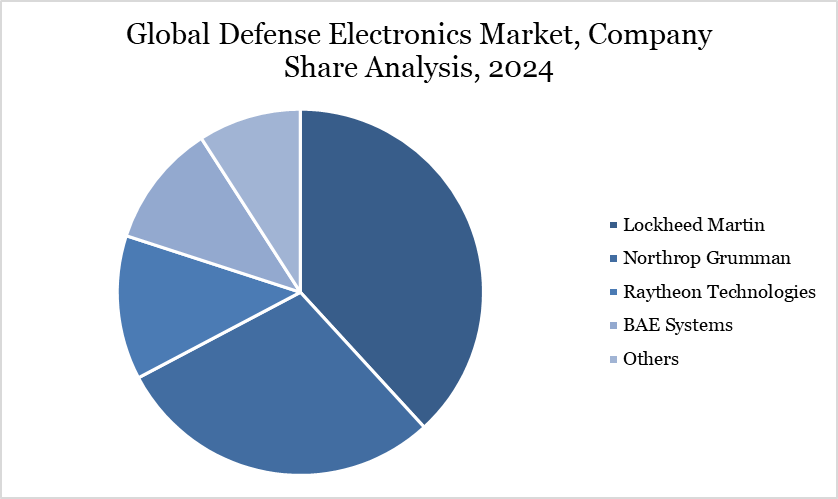

Competitive Landscape

The major global players in the market include Lockheed Martin, Northrop Grumman, Raytheon Technologies, BAE Systems, L3Harris Technologies, Thales Group, Hensoldt, Aselsan, Kratos Defense & Security Solutions, Mercury Systems and among others.

Key Developments

In 2025, Israel Aerospace Industries (IAI) has partnered with DCX Systems Limited to establish a joint venture named ELTX, focused on manufacturing advanced defense electronics in India. This collaboration is set to bolster the production of cutting-edge systems, including airborne radars and ground-based technologies, tailored for the Indian defense sector.

In 2025, Navratna Defence PSU Bharat Electronics Limited (BEL) and Safran Electronics & Defense, France, have announced the signing of a partnership to establish a joint venture in India for the manufacturing, customization, sale, and maintenance of the HAMMER (Highly Agile Modular Munition Extended Range) smart precision-guided air-to-ground weapon.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies