Overview

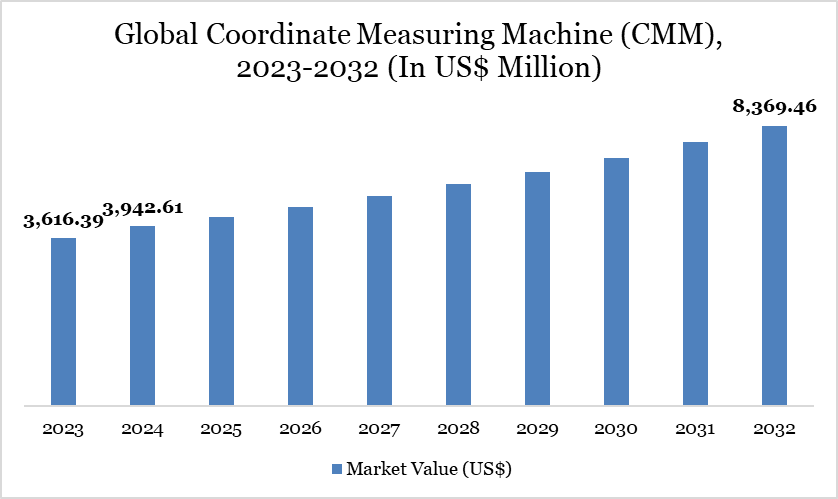

The global market for coordinate measuring machine (CMM) reached US$ 3,942.61 million in 2024 and is expected to reach US$ 8,369.46 million by 2032, growing at a CAGR of 9.96% during the forecast period 2025-2032.

The global coordinate measuring machine (CMM) market is witnessing strong growth, driven by increasing demand for high-precision measurement solutions in industries such as automotive, aerospace, electronics, and medical devices. Historical data shows the market was valued at US$ 3,616.39 million in 2023 and rose to US$ 3,942.61 million in 2024, indicating consistent expansion. The market is projected to maintain this upward trajectory with values expected to reach around US$ 8,369.46 million by 2032. As manufacturing processes evolve with Industry 4.0 integration, the adoption of automated metrology systems is expanding, enabling real-time quality control and efficiency improvements.

For instance, the rapid expansion of the electric vehicle (EV) market is accelerating demand for high-precision metrology solutions, particularly in the coordinate measuring machine (CMM) market. According to the International Energy Agency (IEA), 14 million electric cars were sold globally in 2023, a 35% year-on-year increase, bringing the total number of EVs on the road to 40 million. EVs accounted for 18% of all cars sold in 2023, up from 14% in 2022 and just 2% in 2018, highlighting the strong momentum in electrification and advanced vehicle manufacturing.

Coordinate Measuring Machine (CMM) Market Trend

Technological advancements are further driving the adoption of portable and non-contact CMMs. For instance, in June 2024, Keyence launched Portable Wide Area CMM. This system integrates laser scanning capabilities, allowing users to measure large targets—up to 25 meters—accurately and with minimal setup. The launch highlights the growing demand for portable and non-contact measurement solutions, which are poised to further enhance productivity and measurement accuracy across various industries.

Market Scope

Metrics | Details |

By Type | Fixed CMM, Portable CMM |

By Component | Contact, Non-contact, Multi-sensors |

By Application | Quality Control and Inspection, Reverse Engineering, Virtual Simulation, Others |

By End-User | Automotive, Aerospace & Defense, Energy & Power, Electronics, Medical, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Need for Quality and Efficacy in Automotive Industry

The automotive industry's growth is a pivotal driver for the CMM market. CMMs are essential in ensuring the precision and quality of automotive components, which is critical for vehicle safety and performance. Modern vehicles incorporate complex designs and advanced materials, necessitating precise measurement tools.

According to the European Automobile Manufacturers Association, In 2023, global car manufacturing reached nearly 76 million units, a substantial 10.2% increase from the previous year, indicating a robust demand for automotive components and, consequently, for precision measurement tools like CMMs. CMMs provide the accuracy required to measure intricate geometries of engine parts, transmission systems, and body components. CMMs facilitate thorough inspection processes, ensuring components meet specified tolerances and reducing the risk of defects.

High Costs for Setting up CMM Facilities

The high initial investment required to set up a CMM facility remains a significant restraint in the market. High-end CMM systems, particularly those equipped with advanced capabilities like multi-axis scanning or non-contact technology, can cost from US$250,000 to US$1 million, depending on their specifications. Even basic CMM systems, while less expensive, typically start at US$30,000 and can reach hundreds of thousands when additional equipment, software, and maintenance are factored in. For example, in automotive manufacturing, the setup cost for a typical 3D CMM system can range from US$250,000 to US$500,000, excluding costs for facilities upgrades and peripheral equipment.

Operational expenses also contribute to the overall financial burden. Maintenance costs for CMMs are estimated at around 5% to 10% of the initial equipment price annually. This can amount to tens of thousands of dollars each year, not including the costs of regular calibration, software updates, and ensuring compliance with industry standards.

Segment Analysis

The global coordinate measuring machine (CMM) market is segmented based on type, component, application, end-user and region.

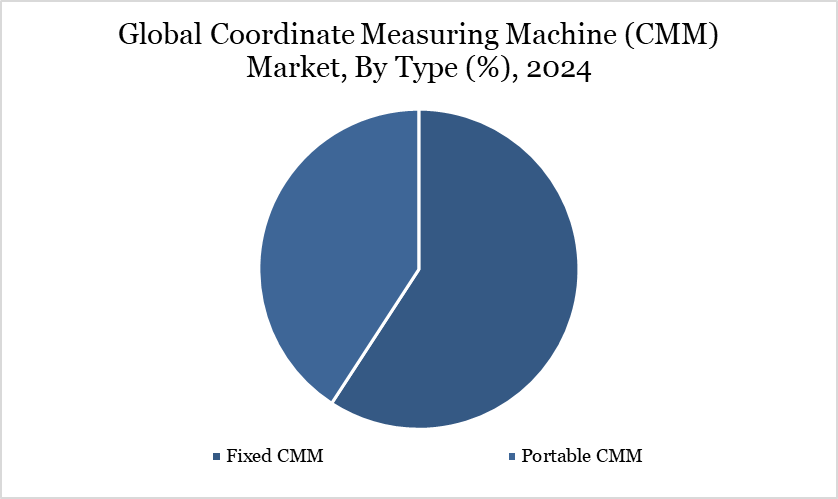

Fixed CMM Holds Significant Share in the Global CMM Market Due to High Precision and Repeatability

The global coordinate measuring machine (CMM) market for fixed CMM was US$ 2,422.73 million in 2024 and is expected to reach US$ 4,817.74 million by 2032, growing with a CAGR of 9.06% between 2025 and 2032.

The fixed Coordinate Measuring Machines (CMMs) market is experiencing significant demand, driven by the need for precision in manufacturing processes across key industries, including automotive, aerospace, and medical devices. Fixed CMMs, particularly bridge, gantry, and cantilever configurations, remain essential tools for high-accuracy measurement applications such as quality control, inspection, reverse engineering, and virtual simulation.

Similarly, a prominent trend is the growing need for cost-effective solutions that deliver high performance. For instance, in June 2023, LK Metrology introduced the ALTO 6.5.5, an affordable entry-level CMM designed for manufacturers transitioning from manual to CNC metrology. Featuring aluminum guideways to reduce costs, a half-gantry design for improved accuracy, and micro-machined aluminum parts for minimal distortion, the ALTO 6.5.5 offers high precision and fast throughput. Its cost-effective construction and durability, enhanced by hard anodizing, make it an appealing option for manufacturers seeking a high-performance, budget-friendly solution.

Geographical Penetration

North America Holds a Significant Share in the Global CMM Market due to Strong Industrial Automation and Quality Standards

North America’s Coordinate Measuring Machine (CMM) market was valued at US$ 1,486.95 million in 2024 and is estimated to reach US$ 3,064.87 million by 2032, growing at a CAGR of 9.54% during the forecast period from 2025-2032.

The Coordinate Measuring Machine (CMM) market in North America has exhibited significant growth, driven by advancements in manufacturing technologies and an increasing demand for precision in quality control. CMMs are essential tools in sectors such as automotive, aerospace, electronics, and medical devices, where accurate dimensional measurements are critical.

The automotive sector significantly contributes to the CMM market due to stringent quality control requirements for complex components such as engines and transmissions. In US, the average light-duty vehicle greenhouse gas (GHG) emission rate is reduced from the MY 2016 level of 250 gCO2e/mile to 163 gCO2e/mile for MY 2025, a 35% reduction. The combined fuel economy for passenger cars, light-duty trucks, and SUVs is estimated to increase from an average MY 2016 level of 34.1 mpg to 49.6 mpg in 2025, an increase of 45%. This results in an annual reduction of 4.6% per model year in the average GHG emissions, and a 4.25% increase per model year in miles-per-gallon fuel economy. This increasing demand for lightweight and fuel-efficient vehicles further amplifies the need for precise dimensional control.

Regulatory Analysis

The coordinate measuring machine (CMM) market operates within a tightly regulated landscape that safeguards precision, quality, and safety across critical industries like automotive, aerospace, and healthcare. Internationally, ISO 10360 stands as the backbone, setting the benchmark for acceptance and reverification tests that unify CMM performance worldwide. In the US, ASME B89.4.10360 aligns closely with ISO standards, while NIST ensures calibration traceability for unmatched measurement integrity. Europe’s compliance hinges on CE marking for safety and environmental assurance, with Germany’s VDI/VDE 2617 adding stringent accuracy checks, and the UK maintaining BS EN ISO 10360 post-Brexit to stay in sync with global norms.

Asia-Pacific countries reinforce this alignment through national standards like Japan’s JIS B7440-2 and India’s BIS IS 15530, which fuel the region’s booming manufacturing, especially in electronics and automotive sectors. China’s GB/T 16857.2-2006 and South Korea’s KS B ISO 10360 similarly anchor regional quality. Meanwhile, Brazil’s ABNT NBR ISO 10360 echoes ISO principles, tightening control as South America’s industrial base expands. The Middle East, driven by aerospace and defense, increasingly embraces international metrology guidelines to uphold competitiveness. Together, these diverse yet harmonized regulations ensure that CMMs deliver consistent, reliable measurements that global industries trust.

Competitive Landscape

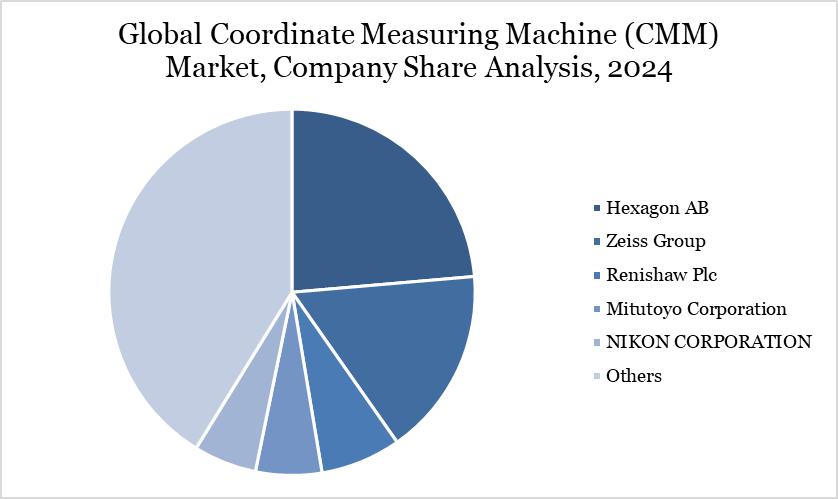

The major global players in the market include Hexagon AB, Zeiss Group, FARO, Siemens, Renishaw plc, LK Metrology, Mitutoyo Corporation, Keyence Corporation, Tokyo Seimitsu, Nikon Corporation and others.

The Coordinate Measuring Machine (CMM) market is dominated by Hexagon AB (23.62%), driven by advanced metrology solutions and automation. Zeiss Group (16.65%) follows, excelling in optical and industrial metrology, especially in aerospace and automotive sectors.

Renishaw Plc (7.10%) leverages expertise in probing technologies, while Mitutoyo Corporation (5.84%) focuses on cost-effective solutions for SMEs. NIKON CORPORATION (5.57%) leads in non-contact measurement innovations. The others 41.22% of the market is fragmented among various regional and niche players, indicating strong competition and opportunities for new entrants.

Key Developments

In September 2024, Hexagon Manufacturing Intelligence India introduced ENSPEC, a multidimensional coordinate measuring machine, available for shipment. It offers touch-trigger probes and scanning sensors for various industries.

In December 2024, ZEISS introduced ZEISS SPECTRUM, a new product family for coordinate measuring machines, aiming to improve quality control processes in automotive, electronics, and general machinery sectors.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies

Suggestions for Related Report