Continuous Positive Airway Pressure Devices Market Size & Industry Outlook

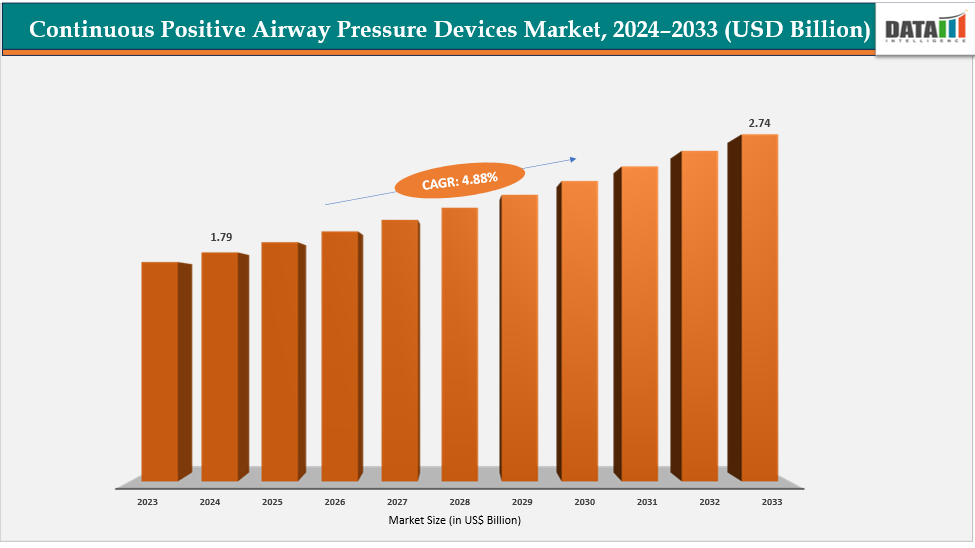

The continuous positive airway pressure devices market size reached US$ 1.71 Billion with a rise of US$ 1.79 Billion in 2024 and is expected to reach US$ 2.74 Billion by 2033, growing at a CAGR of 4.88% during the forecast period 2025-2033.

The market for CPAP equipment is being driven by cost-containment strategies and the move to home healthcare. Patients with obstructive sleep apnea (OSA) can conveniently manage their disease at home using home-based therapy, which eliminates the need for overnight sleep studies and hospital stays. Remote monitoring made possible by cloud-connected CPAP equipment enables medical professionals to efficiently check adherence and modify treatment. This method improves patient outcomes while reducing healthcare expenses. Adoption is also encouraged by the growing support for home therapy provided by insurance coverage. The demand for CPAP devices is being driven by convenience, affordability, and increased compliance; as a result, home-based management is a major factor driving market expansion.

Owing to factors like the shift to home healthcare and cost-containment measures, for instance, in August 2024, SoClean announced that it had received FDA De Novo clearance for the SoClean 3+, a bacterial reduction device for certain compatible CPAP masks and hoses. Designed for single-patient home use after recommended cleaning procedures, the device was intended to continually reduce bacteria buildup by sanitizing masks and tubing with activated oxygen, without using chemicals.

Key Highlights

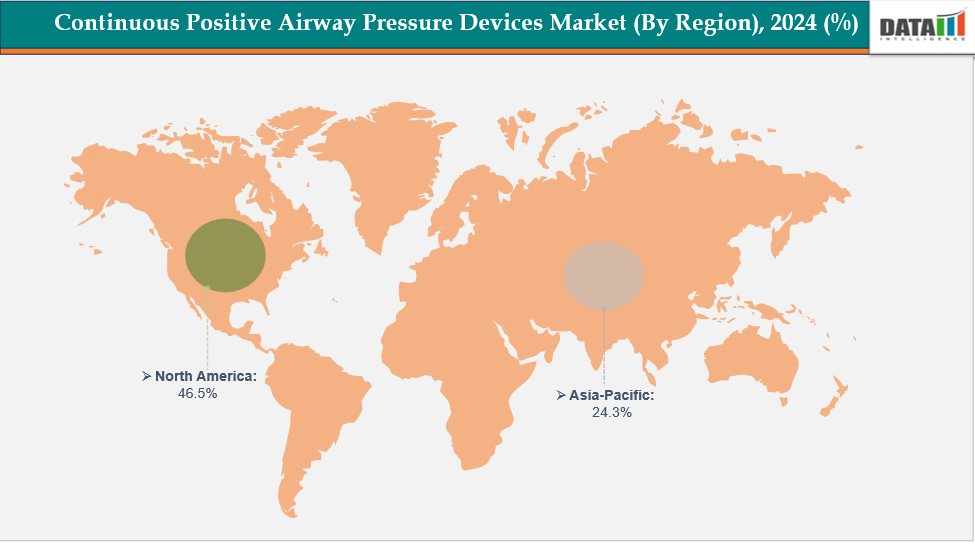

- North America dominates the Continuous Positive Airway Pressure Devices Market with the largest revenue share of 46.5% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 7.37% over the forecast period.

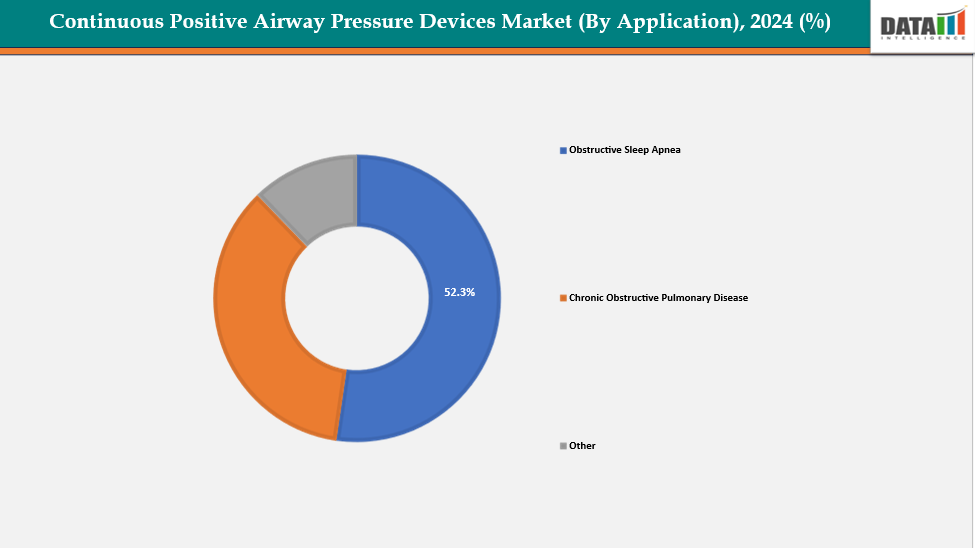

- Based on product, the CPAP devices segment led the market with the largest revenue share of 52s.3% in 2024.

- Top companies in the Continuous Positive Airway Pressure Devices Market include ResMed, Koninklijke Philips N.V., Fisher & Paykel Healthcare Limited, BMC, Wellell Inc., Oxymed India, DeVilbiss Healthcare LLC, Hamilton Medical, Löwenstein Medical SE & Co. KG, and Lincare Holdings Inc., among others.

Market Dynamics

Drivers: Rising prevalence of obstructive sleep apnea (OSA) are significantly driving the continuous positive airway pressure devices market growth

The rising prevalence of obstructive sleep apnea is driving growth in the Continuous Positive Airway Pressure (CPAP) devices market. Adoption is being accelerated by growing knowledge of the health hazards of untreated sleep apnea as well as improvements in technologically advanced and home-based CPAP systems. Patient adherence is being improved by innovations like alternative therapies, quieter and more comfortable designs, and networked gadgets. Increased illness incidence is a result of lifestyle variables like obesity and sedentary behavior. Access is further facilitated by insurance coverage, supportive healthcare legislation, and improved interaction with digital health systems. In general, demand is rising as more people look for efficient sleep apnea treatment.

For instance, in May 2025, according to Oxford Academic, an estimated 80.6 million individuals were living with obstructive sleep apnea (OSA) in the United States in 2024, comprising 47,623,848 (59%) males and 32,967,117 (41%) females. This corresponded to an overall prevalence of 32.2% among adults aged 20 years and older, with 39% in males and 25.8% in females, after adjusting for obesity. The severity of OSA, based on the apnea–hypopnea index (AHI), was distributed as 61% mild, 24% moderate, and 15% severe.

Restraints: High upfront costs of CPAP devices are hampering the growth of the continuous positive airway pressure devices market

The high upfront costs of CPAP devices are restraining the growth of the continuous positive airway pressure market. A major financial obstacle is the cost of expensive equipment, masks, and accessories, especially in areas with little insurance coverage. The financial burden is further increased by additional costs for routine mask, tubing, and filter replacements, which deters long-term use. In poor countries, patient adoption rates are lowered by income limits and partial or nonexistent insurance reimbursement. Despite the growing frequency of obstructive sleep apnea, these cost obstacles hinder the number of new users and postpone the start of therapy, which eventually slows market expansion.

For instance, according to CPAP, the high upfront costs of Continuous Positive Airway Pressure (CPAP) devices had been a significant barrier to market growth, particularly in regions with limited insurance coverage. CPAP machines typically ranged from $700 to $1,300, depending on the type, brand, and features. Additional expenses included masks, which cost between $60 and $170, and ongoing maintenance, such as tubing and filter replacements, which amounted to $220 to $1,600 annually.

For more details on this report, see Request for Sample

Segmentation Analysis

The Continuous Positive Airway Pressure Devices Market is segmented based on product type, application, end user, and region.

Application: The obstructive sleep apnea segment from application is dominating the continuous positive airway pressure devices market with a 52.3% share in 2024

The obstructive sleep apnea (OSA) segment dominates the continuous positive airway pressure (CPAP) devices market due to its large patient base and the clinical effectiveness of CPAP therapy. CPAP devices are the main option for managing OSA because they were created especially to treat the disorder and maintain an open airway while you sleep. The patient pool has grown even more as a result of increased awareness, better screening, and increased diagnostic rates. Furthermore, CPAP therapy is frequently supported by insurance, which promotes uptake. Its standing as the top CPAP application is supported by established advantages such better sleep, fewer apneas, and lower cardiovascular risks.

For instance, in August 2025, Nyxoah announced that the FDA had approved the Genio system for a subset of patients with moderate to severe obstructive sleep apnea (OSA) who had an apnea-hypopnea index (AHI) between 15 and 65. Developed by Nyxoah, Genio therapy provided a new option for patients who had failed, refused, or could not tolerate positive airway pressure therapy such as CPAP and met additional eligibility criteria.

Product type: The CPAP devices segment from product type is dominating the continuous positive airway pressure devices market with a 43.3% share in 2024

The CPAP devices segment dominates the Continuous Positive Airway Pressure market because the machine is the core therapy enabler without it, masks, tubing, or humidifiers cannot function. High prescription rates are caused by the growing frequency of obstructive sleep apnea, and adoption is further encouraged by clinical recommendations and insurance coverage. High-value products, CPAP machines bring considerably more money per unit than accessories. Upgrades and recurrent purchases are encouraged by ongoing technological improvements, such as smart, connected gadgets with remote monitoring. CPAP devices are the largest and most important product class due to regulatory emphasis on devices as the primary therapeutic tool and the ongoing need for better machines.

Geographical Analysis

North America dominates the continuous positive airway pressure devices market with 46.5% in 2024

North America dominates the Continuous Positive Airway Pressure (CPAP) devices market due to a combination of high obstructive sleep apnea (OSA) prevalence and advanced healthcare infrastructure. Strong demand for CPAP therapy is driven by widespread awareness and routine diagnosis, and clinics and hospitals are well-equipped to facilitate treatment. In order to improve patient comfort and compliance, the area quickly embraces cutting-edge technology, such as humidifiers and auto-adjusting equipment with smart connectivity. Furthermore, government payment programs and insurance coverage increase the accessibility of CPAP therapy. Further securing North America's market dominance is the robust presence of major manufacturers like as ResMed and Philips, which guarantee device availability and ongoing innovation.

Owing to factors like the presence of key manufacturers in the USA, in September 2024, ResMed led CPAP (Continuous Positive Airway Pressure) mask innovation with the launch of the AirTouch N30i. Designed to provide a natural and comfortable sleep experience, the AirTouch N30i featured a fabric-wrapped frame with a soft, breathable, and moisture-wicking design, offering optimal comfort in a tube-up configuration.

Europe is the second region after North America, which is expected to dominate the continuous positive airway pressure devices market with 35.5% in 2024

The European Continuous Positive Airway Pressure (CPAP) Devices Market is expected to be the second largest globally, with significant contributions from countries such as Germany, the UK, and France. The primary factors driving growth include the region's sophisticated healthcare system, the increasing incidence of obstructive sleep apnea (OSA), and the quick uptake of cutting-edge CPAP technology including integrated humidifiers, smart connection features, and auto-adjusting devices. An aging population, risk factors linked to lifestyle choices, and heightened awareness of early diagnosis and long-term care are further reasons driving demand. Supportive legislative frameworks and programs from groups like the European Sleep Research Society (ESRS) strengthen Europe's position by improving patient outcomes, facilitating prompt intervention, and encouraging therapy adherence.

Germany leads the European CPAP devices market due to high healthcare spending, advanced medical infrastructure, and an aging population. Rising prevalence of obstructive sleep apnea (OSA) and other respiratory disorders drives demand, while early adoption of innovative technologies such as auto adjusting CPAP machines, smart-connected devices, and integrated humidifiers accelerates growth.

Owing to the factors like initiatives from organizations like the European Sleep Research Society (ESRS), for instance, in March 2025, ESRS introduced Sleep Awareness Month Europe, a new initiative dedicated to raising awareness about sleep health across the continent. The campaign aimed to inform families, educators, and healthcare professionals about the importance of sleep and to promote healthy sleep habits. ESRS developed dedicated resources, providing guidance and practical tools to support these efforts. While initially a pilot project, there are plans for a European-wide launch in 2026.

The Asia Pacific region is the fastest-growing region in the continuous positive airway pressure devices market, with a CAGR of 7.37% in 2024

The Asia Pacific (APAC) region is the fastest-growing market for CPAP devices, driven by rising obstructive sleep apnea (OSA) prevalence, lifestyle changes, and an aging population. More instances are being found as a result of improved diagnosis rates, growing healthcare infrastructure, and more public awareness, while advancements in home-based therapy and portable, smart CPAP machines are enhancing adherence. Access and affordability are increasing in nations like China and India due to economic expansion, urbanization, and government initiatives. APAC is a significant contributor to the growth of CPAP devices worldwide due to regulatory support, insurance expansion, and local manufacture, all of which speed up market acceptance.

Japan’s CPAP devices market is growing steadily, driven by an aging population, rising prevalence of obstructive sleep apnea (OSA), and a strong focus on effective, patient-friendly treatments. High demand for advanced CPAP technologies, such as auto-adjusting devices, smart-connected machines, and integrated humidifiers, and fast approvals for medical devices and government support further support the growth of sleep apnea management solutions in Japan.

Owing to the factors like fast approvals for medical devices and government support, for instance, in May 2025, Japan amended its Pharmaceutical and Medical Device Act (PMD Act), introducing a conditional approval system for innovative medical devices and drugs. This system aims to expedite the commercialization of products addressing serious diseases with unmet medical needs, potentially impacting the approval process for CPAP devices in the future.

Competitive Landscape

Top companies in the Continuous Positive Airway Pressure Devices Market include ResMed, Koninklijke Philips N.V., Fisher & Paykel Healthcare Limited, BMC, Wellell Inc., Oxymed India, DeVilbiss Healthcare LLC, Hamilton Medical, Löwenstein Medical SE & Co. KG, and Lincare Holdings Inc., among others.

ResMed: ResMed, founded in 1989 and headquartered in San Diego, is a global leader in sleep health, specializing in CPAP devices for obstructive sleep apnea. Its AirSense and AirCurve series feature advanced technology, digital health integration, and remote monitoring, driving patient adherence. Strong innovation and market leadership underpin its global prominence.

Key Developments:

- In August 2024, Inspire Medical Systems, Inc. announced the FDA approval of the Inspire V therapy system, which included the next-generation neurostimulator along with the associated Bluetooth patient remote and physician programmer. The company, focused on developing and commercializing innovative, minimally invasive solutions, provided this therapy for patients with obstructive sleep apnea (OSA).

- In November 2023, Vivos Therapeutics received the first-ever FDA 510(k) clearance for its oral device for the treatment of severe obstructive sleep apnea (OSA), becoming the first company to offer an approved alternative to CPAP therapy or surgical neurostimulation implants for patients with severe OSA.

Market Scope

| Metrics | Details | |

| CAGR | 4.88% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product Type | CPAP Devices, CPAP Humidifiers, CPAP Masks and Accessories |

| Application | Obstructive Sleep Apnea, Chronic Obstructive Pulmonary Disease and Other | |

| End User | Hospitals, Clinics, Sleep Centers, Home Care Settings and Other | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The continuous positive airway pressure devices market report delivers a detailed analysis with 62 key tables, more than 54 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here