Global Confectionery Packaging Market is segmented By Material (Plastic, Paper, Metal, Bioplastics, Film, Cardboard), By Packaging (Flexible Packaging, Rigid Packaging, Box Packaging, Smart Packaging, Others), By Confectionery (Chocolate Bars, Gummy Candies, Hard Candies, Lollipops, Chewing Gum), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Confectionery Packaging Market Size

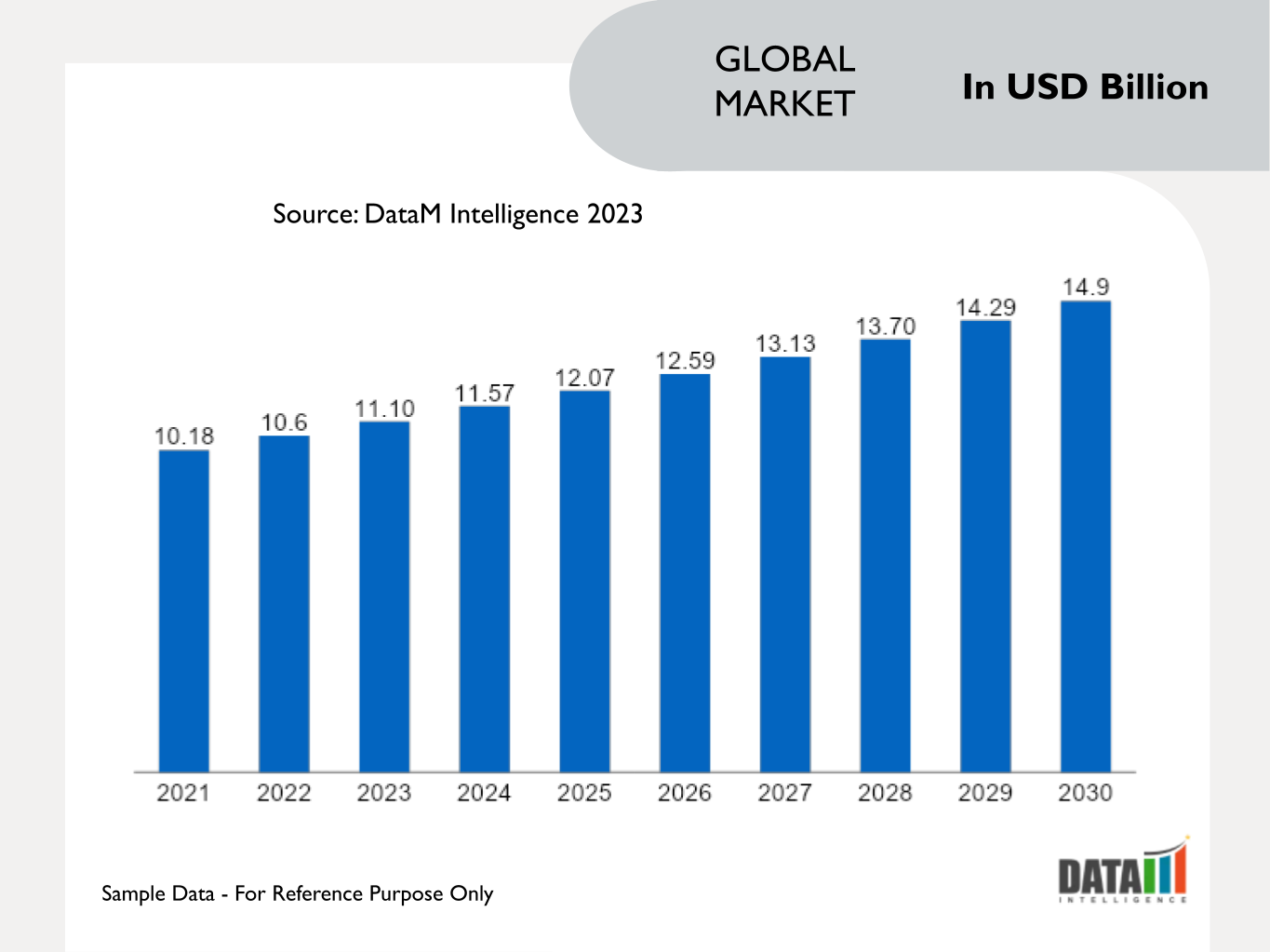

Global Confectionery Packaging Market reached US$ 10.6 billion in 2022 and is expected to reach US$ 14.9 billion by 2030, growing with a CAGR of 4.3% during the forecast period 2024-2031.

The confectionery packaging market will be influenced by the confluence of sustainability and technological advancements. As global confectionery sales witness robust growth, packaging takes on a pivotal role in safeguarding product quality and captivating consumers. Furthermore, packaging innovation extends to consumer convenience, encompassing resealable and portion-controlled designs, catering to the evolving snacking habits of consumers on the move.

Major players and institutions are at the forefront of transformative packaging developments, with Nestle introducing recyclable paper-based packaging for KitKat bars and Mondelez International experimenting with near-field communication (NFC) technology for Lacta chocolate bars, fostering deeper consumer engagement.

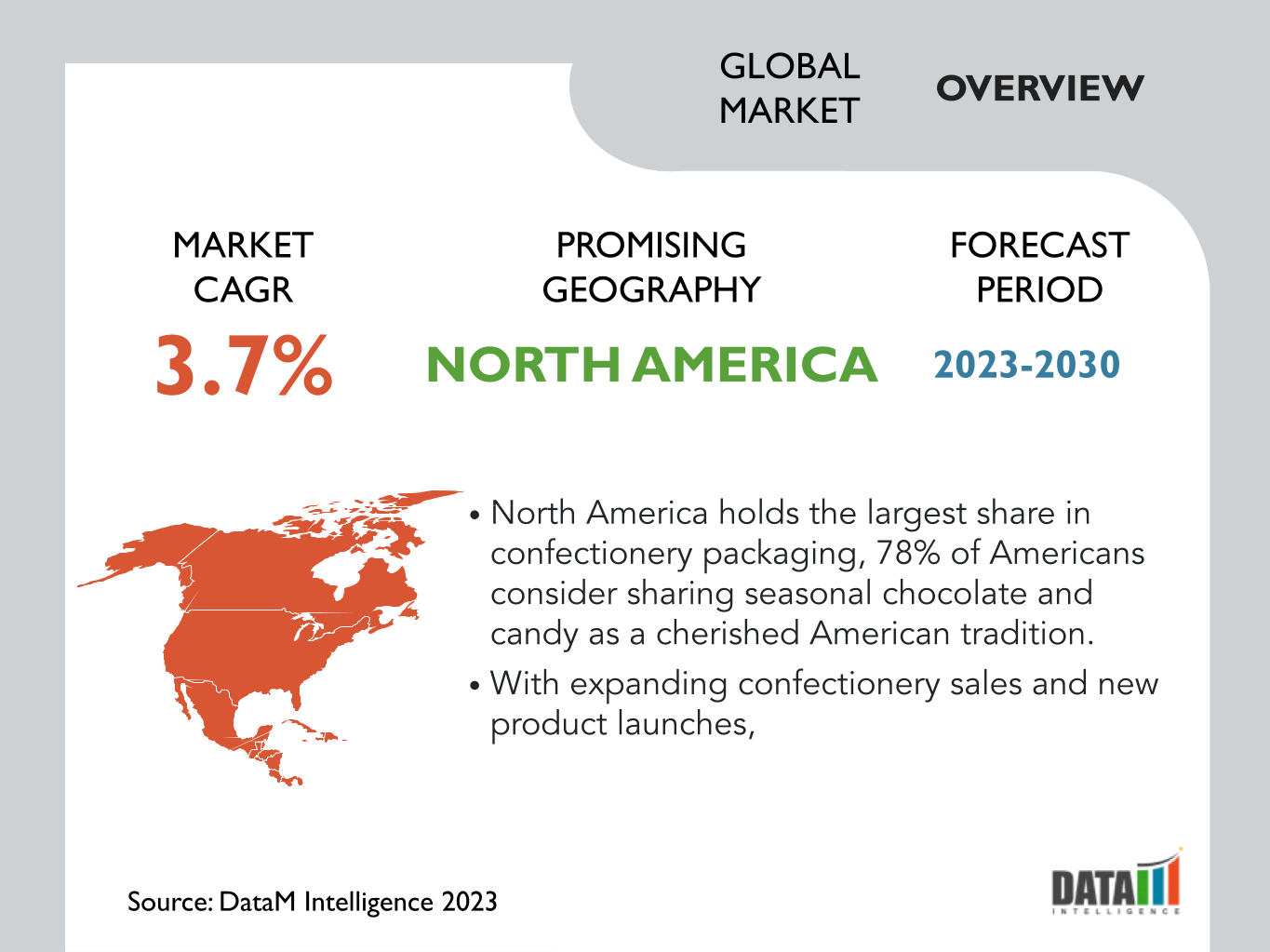

North America holds the largest share in confectionery packaging, the confectionery industry is a vital contributor to the U.S. economy, employing nearly 58,000 individuals directly and supporting approximately 700,000 jobs across related sectors such as agriculture, retail and transportation. With manufacturing facilities present in all fifty states, the industry's impact is widespread.

Market Scope

|

Metrics |

Details |

|

CAGR |

4.3% |

|

Size Available for Years |

2022-2031 |

|

Forecast Period |

2024-2031 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Material, Packaging, Confectionery and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report Request for Sample

Market Dynamics

Advancements in Packaging Technology

New innovations and advancements in packaging technology are expected to drive the demand for improved confectionery packaging during the forecast period. Beyond the traditional considerations of sustainability and digitalization, the industry is responding to changing preferences for healthier and more natural ingredients. The shift is influencing processing technology, as manufacturers adjust recipes to reduce sugar content while maintaining taste and texture.

Furthermore, apart from these trends, packaging automation and machinery are pivotal to the industry's growth. Manufacturers are increasingly automating processes to enhance hygiene, minimize operator-product contact and ensure gentle handling of sensitive items. For instance, Syntegon's linear motor technology facilitates the gentle transportation of delicate items like cookies and crackers at high speeds.

Automation also extends to cleaning and sanitizing processes, safeguarding consumers and product safety. Robots, including collaborative robots, are employed for tasks such as feeding, loading and palletizing, reducing contact between employees and products while enhancing flexibility.

Rising Adoption Of Sustainability Practices in the Confectionery Industry

The confectionery packaging industry is increasingly adopting sustainable packaging trends, grown by a shift towards eco-conscious practices and consumer demand for environmentally friendly options. As the paper production process becomes increasingly fossil-free, with 97% already achieved, a goal is set for all integrated mills to be entirely fossil-free by 2030.

Melodea Ltd., an Israeli-based supplier of sustainable coating products for consumer packaged goods, has introduced its latest innovative packaging solution, VBseal. The advanced coating material offers resistance to water vapor, oils and aromas and features heat-sealing capabilities. Designed to replace single-use plastics in various applications including fresh food, fast food, cereal and confectionery packaging, VBseal addresses the pressing need for sustainable barrier coatings with versatile properties.

Health Challenges in Confectionery Industry Impacting Packaging

The confectionery packaging industry is impacted by significant challenges brought about by health campaigners and government regulators advocating for changes in product formulation and marketing strategies. Among the primary concerns is the excessive use of sugar in confectionery products, prompting calls for companies to decrease sugar content.

The demand arises from mounting worries about the connection between sugar consumption and obesity, alongside the growing preference for healthier dietary choices. Health activists have also called for increased taxation on confectionery products, which might lead to depressed sales and reduced demand for packaging solutions.

The industry faces the challenge of striking a balance between meeting consumer demands for healthier options and addressing the health concerns associated with excessive sugar consumption. As the dialogue continues, the confectionery packaging industry must navigate the evolving landscape of consumer preferences, health considerations and regulatory demands to ensure its long-term sustainability and relevance.

Market Segmentation Analysis

The global confectionery packaging market is segmented based on material, packaging, confectionery and region.

Chocolate Bars Generate the Largest Demand for Confectionery Packaging

Chocolate is a major segment in confectionery packaging due to its high share and popularity. Recognizing the deep connection people have with chocolate, confectionery packaging solutions are optimized to enhance the packaging of chocolates and cater to consumer preferences. It offers a wide range of packaging solutions, including mono PP and polyolefin-based laminates, cold seal and heat seal packaging, flow wraps with high-barrier films, transparent barrier films and more.

Ferrero India has introduced a new pouch packaging for its product line, Ferrero Rocher Moments, aiming to offer a "premium yet affordable gifting" option. The revamped packaging is available in various sizes, including 8-, 16- and 32-piece packs and is designed to cater to consumer needs for self-consumption, sharing and gifting purposes. The original essence and design identity of Ferrero Rocher are retained in the new packs, featuring gold-colored packaging and contemporary design patterns.

Market Geographical Share

Confectionery Packaging to Witness Tremendous Growth due to North America's Tradition-rich Market

North America holds the largest share in confectionery packaging, 78% of Americans consider sharing seasonal chocolate and candy as a cherished American tradition. Leading chocolate and candy manufacturers are also taking steps to address consumer preferences and health concerns. They have committed to offering information, choices and support to consumers, ensuring that at least 50% of individually wrapped products will be available in packs containing 200 calories or fewer and 90% will display calorie information on the front of the packaging by 2022.

Chocolate, candy, gum and mints hold a unique place in American holidays, celebrations and daily life. When enjoyed in moderation as part of a balanced diet, these treats contribute to positive emotional experiences, create connections between people and evoke cherished memories. Despite the challenges posed by external factors, the confectionery packaging industry in U.S. remains resilient, continually adapting to consumer needs and preferences while upholding its position as a significant contributor to the country's economy and cultural fabric.

Market Key Players

The major global players in the market include Mondi Group, Amcor, Sonoco, Berry Global, Huhtamaki, Coveris Holdings, Graphic Packaging International, Smurfit Kappa Group, Constantia Flexibles and AptarGroup, among others.

COVID-19 Impact

COVID-19 made a significant impact on confectionery packaging with demand shifts being a central issue. While some regions experienced increased consumption of confectionery and sweets as people sought comfort foods at home, other regions such as Latin America witnessed a decline due to economic struggles. The pandemic disrupted supply chains, causing logistical difficulties and delaying the movement of both raw materials and finished products.

As the pandemic led to shifts in consumer behavior and work patterns, the confectionery packaging sector anticipates enduring consequences. Despite vaccine rollouts, remote work and online learning are expected to persist, affecting the demand for baked goods and confectionery products. The recovery path for the industry is projected to be gradual, with challenges including adapting to changing conditions and recuperating from the economic impacts of the pandemic.

Russia-Ukraine War Impact

The Russia-Ukraine war made a significant impact on confectionery packaging, "The Association of the German Confectionery Industry" (BDSI) expressed its concern over the conflict, highlighting the close ties that normally exist between Germany, Russia and Ukraine. The ties encompass shared contacts, raw materials and cross-border production, making the ongoing war deeply incomprehensible to the industry. Ukraine, historically a key supplier of confectionery sweets to Russia, has now been affected by the conflict, disrupting supply chains and trade relationships.

The war's impact on the confectionery packaging industry is particularly evident in the disrupted supply chains and shifting trade dynamics. Traditionally, Ukraine was a major confectionery sweet supplier to Russia, but EU member states and Switzerland have taken over a substantial portion of imported products. Germany, for instance, accounts for 30% of chocolate exports to Russia, alongside other countries like Poland and Italy. The conflict has led to a decrease in trade and a shift in import sources, affecting not only confectionery products but also the overall supply chain, including agricultural raw materials and logistics.

Key Developments

- In October 2022, Nestlé Confectionery unveiled significant packaging innovations for two of its renowned brands, Quality Street and KitKat. In a pioneering move within the confectionery category, Quality Street introduced recyclable paper packaging for its twist-wrapped sweets, replacing foil and cellulose with a paper wrap. The transition eliminated over two billion pieces of packaging material from Quality Street's supply chain. Concurrently, KitKat launched wrappers made with 80% recycled plastic, facilitating recycling at supermarkets across the UK and in household recycling in Ireland.

- In May 2023, Jolly Rancher, a popular U.S. sweet and gummies brand manufactured by Hershey, introduced a new line of limited-edition packaging featuring designs from street artists. The collaboration between Jolly Rancher and Beautify Earth, a non-profit visual arts organization, led to the selection of three street artists: Joe Starkweather from Miami, Danielle Mastrion from New York and Evan Farrell from Los Angeles.

- In January 2022, Mondelēz International's Cadbury chocolate brand introduced the Twist Wrap packaging solution for its Duos range, offering consumers a way to enjoy smaller portions of chocolate. The innovative packaging allows consumers to twist and seal the package after consuming half of the chocolate bar, promoting better portion control and mindful snacking. The packaging is designed using memory technology, ensuring that the wrapper remains twisted with a single twist, maintaining the chocolate's freshness, texture and shape.

Why Purchase the Report?

- To visualize the global confectionery packaging market segmentation based on material, packaging, confectionery and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of cement market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global confectionery packaging market report would provide approximately 61 tables, 64 figures and 196 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies