Overview

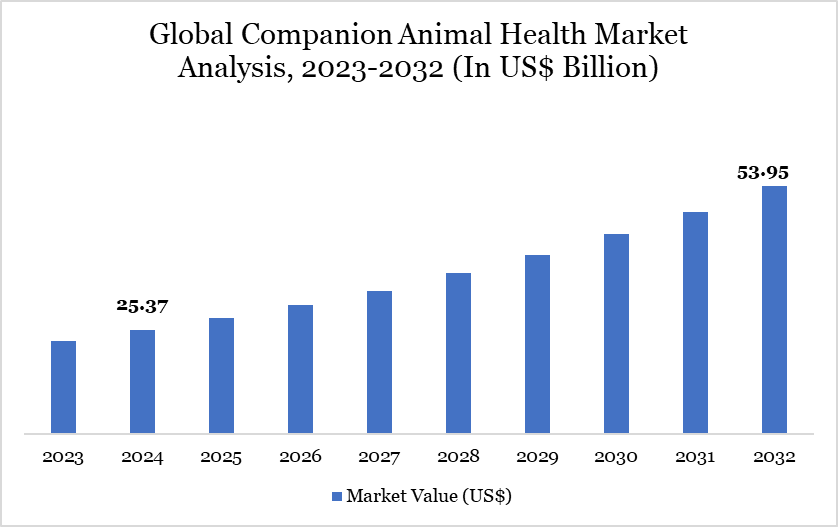

Global companion animal health market size reached US$ 25.37 billion in 2024 and is expected to reach US$ 53.95 billion by 2032, growing with a CAGR of 9.89% during the forecast period 2025-2032.

The global companion animal health market is experiencing substantial expansion, propelled by escalating pet ownership, heightened awareness of pet wellbeing and innovations in veterinary care. According to Health for Animals, as of September 2022, more than 50% of the global population possesses a pet. The increase in pet humanization is driving a heightened desire for individualized treatment, hence propelling market growth.

A significant increase in diseases among companion animals, especially cancer and cardiovascular conditions, is amplifying the demand for novel therapies. In June 2023, the Royal Veterinary College (RVC) disclosed a significant prevalence of osteosarcoma in dogs inside the UK.

Moreover, pet insurance has experienced significant growth, as the North American Pet Health Insurance Association (NAPHIA) reported a 17.1% annual rise in covered pets in 2023. The industry is benefiting from innovations like Next-Generation Sequencing (NGS) for pet DNA testing and the proliferation of innovative medicinal treatments, bolstering its growth trajectory.

Companion Animal Health Market Trend

The companion animal health market is advancing swiftly due to technological innovations and a transition towards individualized pet care. A significant trend is the incorporation of genetics and diagnostics into standard veterinary practices. In October 2023, Zoetis's Basepaws expanded their feline DNA testing to canines utilizing modern NGS technology, providing insights into breed characteristics and health risks.

Simultaneously, there is an increasing need for sophisticated biotherapeutics, exemplified by Ceva Santé Animale’s acquisition of Scout Bio in January 2024 to expedite innovation in pet therapies. The adoption of insurance is on the rise, attributed to the growing humanization of dogs—NAPHIA has reported a steady yearly growth of 22.6% in insured pets since 2020.

Moreover, regulatory endorsement is enabling the introduction of innovative products; for example, in June 2024, Merck Animal Health obtained US$A approval for NOBIVAC NXT Canine Flu H3N2, a state-of-the-art canine influenza vaccine. These trends demonstrate a robust tendency towards precision health and preventative treatment for companion animals.

Market Scope

| Metrics | Details | |

| By Animal | Dogs, Equine, Cats, Others | |

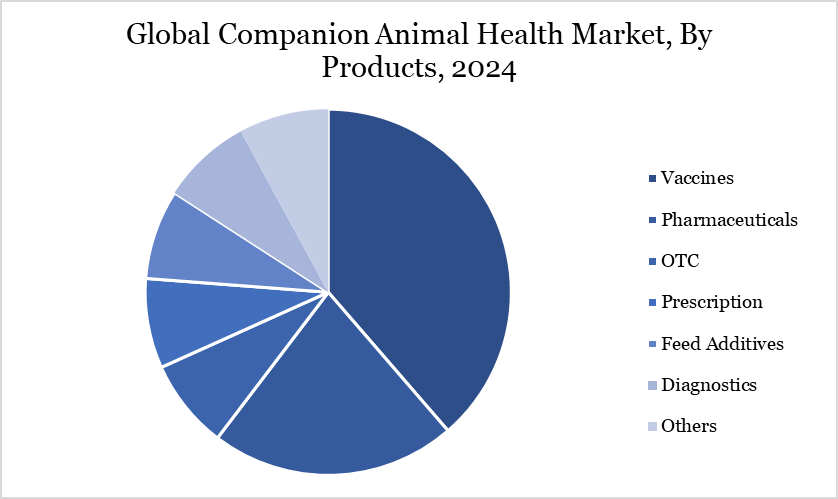

| By Product | Vaccines, Pharmaceuticals, OTC, Prescription, Feed Additives, Diagnostics, Others | |

| By Distribution Channel | Retail, E-commerce, Hospital pharmacies, Others | |

| By End-User | Point-of-care/In-house testing, Hospitals & Clinics, Others | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Global Companion Animal Health Market Dynamics

Increase in Companion Animal Diseases

The increasing incidence of diseases in pets has been a primary market driver, markedly enhancing the demand for veterinary healthcare solutions. Conditions such as cancer, cardiovascular disorders and infectious diseases are being reported with increasing frequency. In May 2024, more than 10% of assessed dogs in Kerala, India, were diagnosed with cardiovascular illness, highlighting the necessity for prompt diagnosis and intervention.

The risk of parvovirus and feline panleukopenia in cats is driving a rise in the uptake of prophylactic vaccines. The Royal Veterinary College's 2023 study on the prevalence of osteosarcoma in UK dog breeds underscores the pressing necessity for specific cancer treatments. These illness patterns are compelling governments and private enterprises to invest in research and development, product innovation and disease management infrastructure. Companies are broadening their diagnostic, vaccination and treatment portfolios to address the increasing demand for specialist care.

Counterfeit Pharmaceuticals and Escalating Veterinary Expenses

Despite positive growth trends, the companion animal health market has significant constraints, chiefly due to the rise of counterfeit veterinary pharmaceuticals and the increasing expenses associated with animal healthcare. The unique characteristics of veterinary therapies and biologics render them vulnerable to copying, potentially jeopardizing animal safety and diminishing trust in branded products.

The escalating expenses associated with clinical testing, diagnostics and veterinary services are establishing access impediments, especially in economically sensitive areas. The obstacles are intensified by rigorous regulatory processes, which, although crucial for safety and efficacy, can postpone product introductions and increase development costs.

Regulatory agencies like as the EMA and US$A enforce stringent safety measures; nevertheless, the substantial investment and compliance demands restrict the involvement of smaller entities. As veterinary care advances, it is imperative to address pricing and supply chain integrity to avert market fragmentation and sustain consumer confidence in animal health solutions.

Segment Analysis

The global companion animal health market is segmented based on animal, products, distribution channel, end-user and region.

Increasing Demand for Vaccines in the Companion Animal Health Sector Fueled by Disease Prevention and Innovation

The vaccines sector is experiencing significant expansion in the companion animal health industry, driven by various converging causes. The escalating incidence of zoonotic and chronic diseases, heightened public awareness about animal health and augmented governmental and institutional investments are substantially propelling market growth.

Vaccines, consisting of altered viruses, bacteria or genetically modified elements, are essential for augmenting immunity in dogs without inducing disease. Global veterinary initiatives, including complementary vaccination campaigns and awareness programs, emphasize the significance of preventive care. In March 2024, Bernalillo County Animal Care Services conducted a drive-thru clinic providing complimentary vaccinations and microchipping for cats and dogs.

Industry stakeholders are allocating resources towards sophisticated research and development, exemplified by the USDA's US$3.7 million award for vaccine research at the University of Wisconsin. Philanthropic initiatives, such as Merck Animal Health's contribution of five million rabies vaccines, enhance the worldwide immunization infrastructure.

Geographical Penetration

Europe is Enhancing Companion Animal Welfare with Innovation

Europe is becoming a center for companion animal health innovation, propelled by significant investments in research and strategic efforts to enhance animal welfare. In 2022, around 46% of European homes own pets, totaling approximately 340 million companion animals (European Pet Food Industry, 2023). The European Partnership on Animal Health and Welfare (EUPAHW), initiated in January 2024 with EUR 360 million in European Commission financing, seeks to address infectious diseases and enhance animal welfare standards.

Nation-specific advancements additionally augment regional outlooks. In April 2024, the UK launched its inaugural animal healthcare start-up incubator at the University of Surrey to foster veterinary innovation. Germany is experiencing swift expansion driven by progress in veterinary diagnostics and biologics. This amalgamation of public-private collaboration, regulatory stringency and research infrastructure establishes Europe as a significant contributor to the advancement of the global companion animal health sector.

Sustainability Analysis

The sustainability of the companion animal health market increasingly focuses on ethical innovation, ecologically responsible techniques and long-term animal welfare. The market's advancement in biotherapeutics, preventive vaccinations and digital health monitoring systems diminishes dependence on invasive therapies and enhances animal welfare. Research efforts such as the EUPAHW integrate with sustainability objectives by advocating for illness prevention and mitigating the environmental consequences of extensive treatment campaigns.

The inclination towards DNA-based diagnostics, exemplified by Zoetis’s NGS dog test launched in October 2023, illustrates a transition towards individualized, non-invasive and resource-efficient healthcare. Organizations are using circular manufacturing models, minimizing medical waste and complying with stringent regulatory criteria that prioritize safety and environmental responsibility. With the increase in pet ownership and the strengthening of human-animal relationships, sustainability in companion animal healthcare is becoming crucial, not only for enhancing animal longevity but also for minimizing the ecological impact of veterinary services.

Competitive Landscape

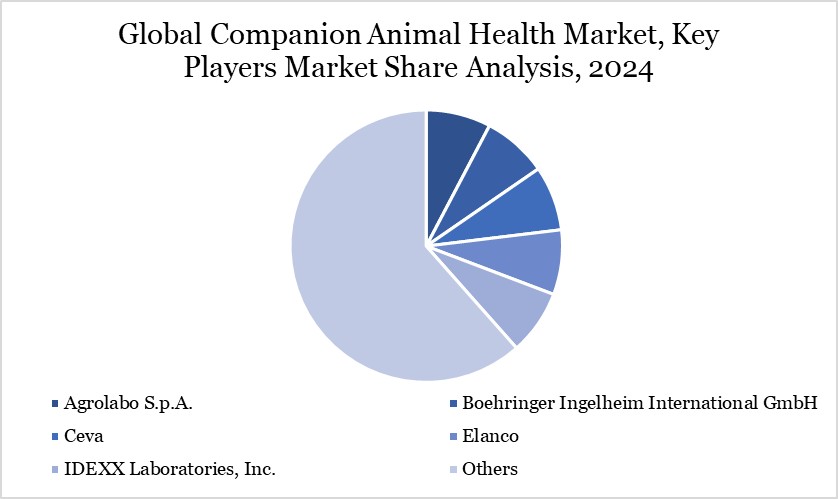

The major global players in the market include Agrolabo S.p.A., Boehringer Ingelheim International GmbH, Ceva, Elanco, IDEXX Laboratories, Inc., Indian Immunologicals Ltd., Merck & Co., Inc., Norbrook, Vetoquinol and Virbac.

Key Developments

- In June 2024, Merck Animal Health, a division of Merck & Co., Inc., launched the NOBIVAC NXT Rabies portfolio in Canada. This novel generation of rabies vaccinations employs advanced RNA-particle technology to protect felines and canines from rabies. The NOBIVAC NXT Rabies portfolio includes NOBIVAC NXT Feline-3 Rabies and NOBIVAC NXT Canine-3 Rabies.

- In January 2024, TheraVet, a business specializing in the management of pet osteoarticular illnesses, introduced BIOCERA-VET products in Germany. This initiative represents TheraVet's development of breakthrough solutions for osteoarticular conditions in pets to a new market, allowing German pet owners access to modern therapies for their animals.

- In January 2024, Zoetis Inc. enhanced its Vetscan Imagyst diagnostics platform by incorporating AI Urine Sediment analysis, enabling veterinarians to efficiently and precisely evaluate samples at their clinics. This breakthrough accelerates treatment decisions and enhances care for canines and felines.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Suggestions for Related Report