Global Commercial Vehicle Telematics Market is Segmented By Type(Solution, Service), By Distribution Channel(OEM, Aftermarket), By End-user(Transportation & Logistics, Media and Entertainment, Government and Utilities, Travel and Tourism, Construction, Healthcare, Education), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Commercial Vehicle Telematics Market Size

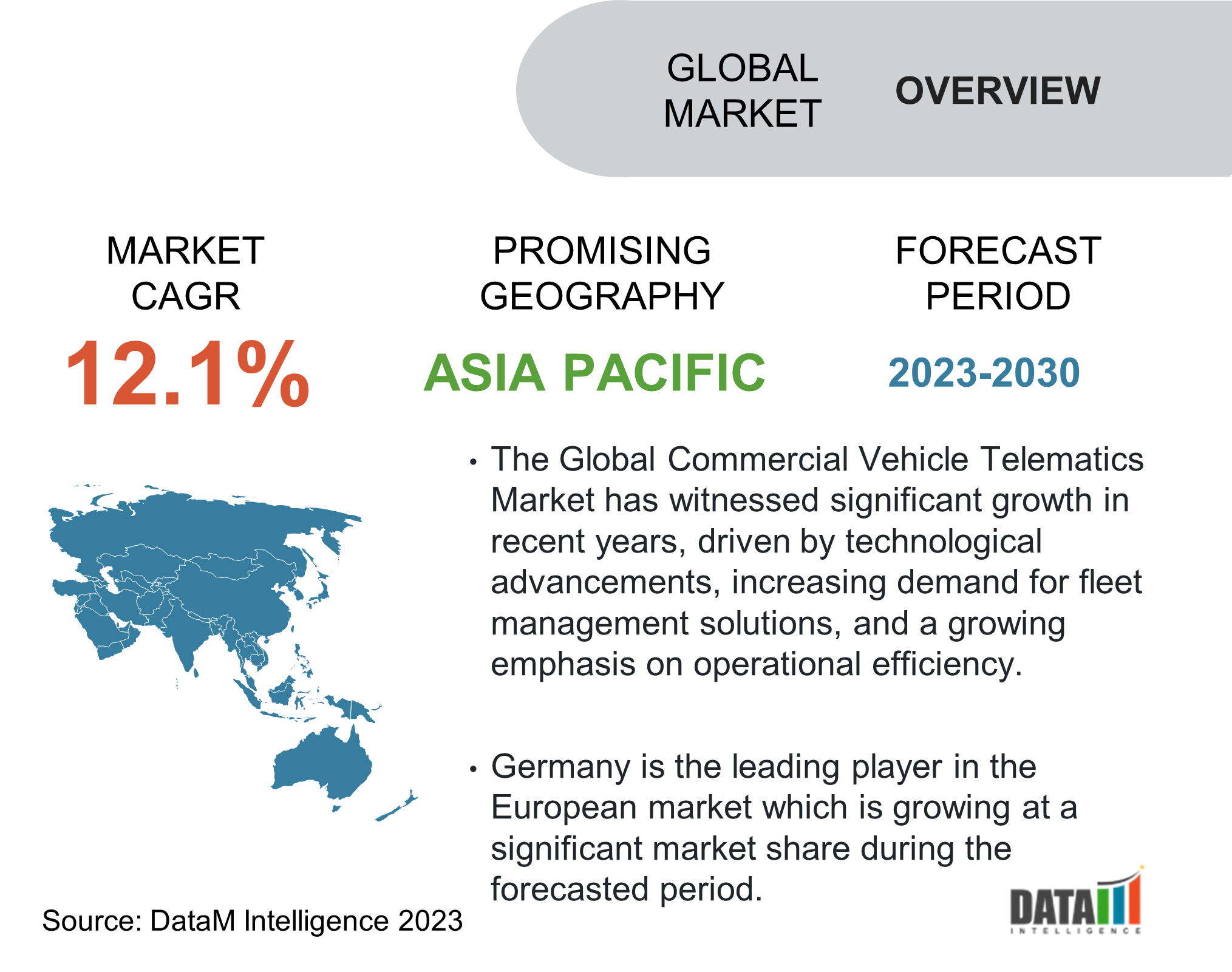

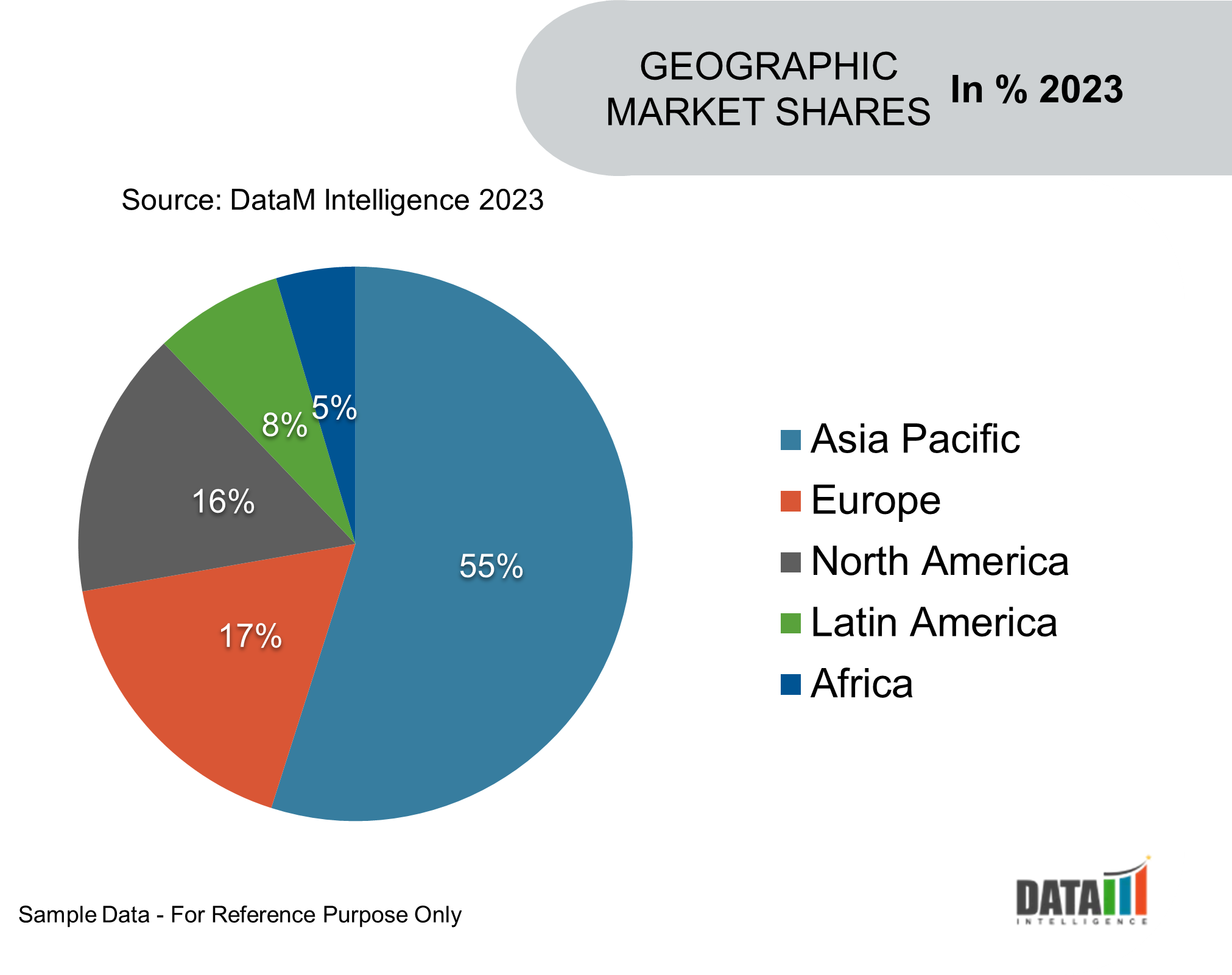

The Global Commercial Vehicle Telematics Market is growing at a CAGR of 12.1% during the forecast period 2024-2031. size reached USD 18,851.3 million in 2022 and is projected to witness lucrative growth by reaching up to USD 61,721 million by 2030. Telematics, a combination of telecommunications and informatics, refers to the use of technology to transmit data from commercial vehicles for monitoring and control purposes. The OEM sales channel segment is expected to hold more than 75% of the market share during the forecasted period and in Asia-Pacific, China is accounting for over 50% of the regional market share.

Commercial Vehicle Telematics Market Scope

|

Metrics |

Details |

|

CAGR |

12.1% |

|

Size Available for Years |

2022-2031 |

|

Forecast Period |

2024-2031 |

|

Data Availability |

Value (USD ) |

|

Segments Covered |

Type, Distribution Channel, End-User and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

Asia-Pacific |

|

Largest Region |

Asia-Pacific |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

To know more insights Download Sample

Commercial Vehicle Telematics Market Dynamics

Fleet Management Efficiency Drives the Market Growth

Fleet management efficiency plays a significant role in driving the growth of the global commercial vehicle telematics market. Telematics refers to the integration of telecommunications and informatics, enabling the transmission of data over long distances. In the context of commercial vehicles, telematics involves the use of advanced technologies to gather and transmit real-time data related to vehicle performance, driver behavior and other relevant information.

Limited Awareness and Understanding

Limited awareness and understanding of telematics technology can restrain the growth of the global commercial vehicle telematics market. Fleet operators who are unfamiliar with telematics may be resistant to adopting new technologies due to a lack of understanding or skepticism about the benefits. They may perceive it as an unnecessary expense or fear disruptions to their existing operations. This resistance can hinder the widespread adoption of telematics solutions.

Commercial Vehicle Telematics Market Segmentation Analysis

The global commercial vehicle telematics market is segmented based on type, distribution channel, end-user and region.

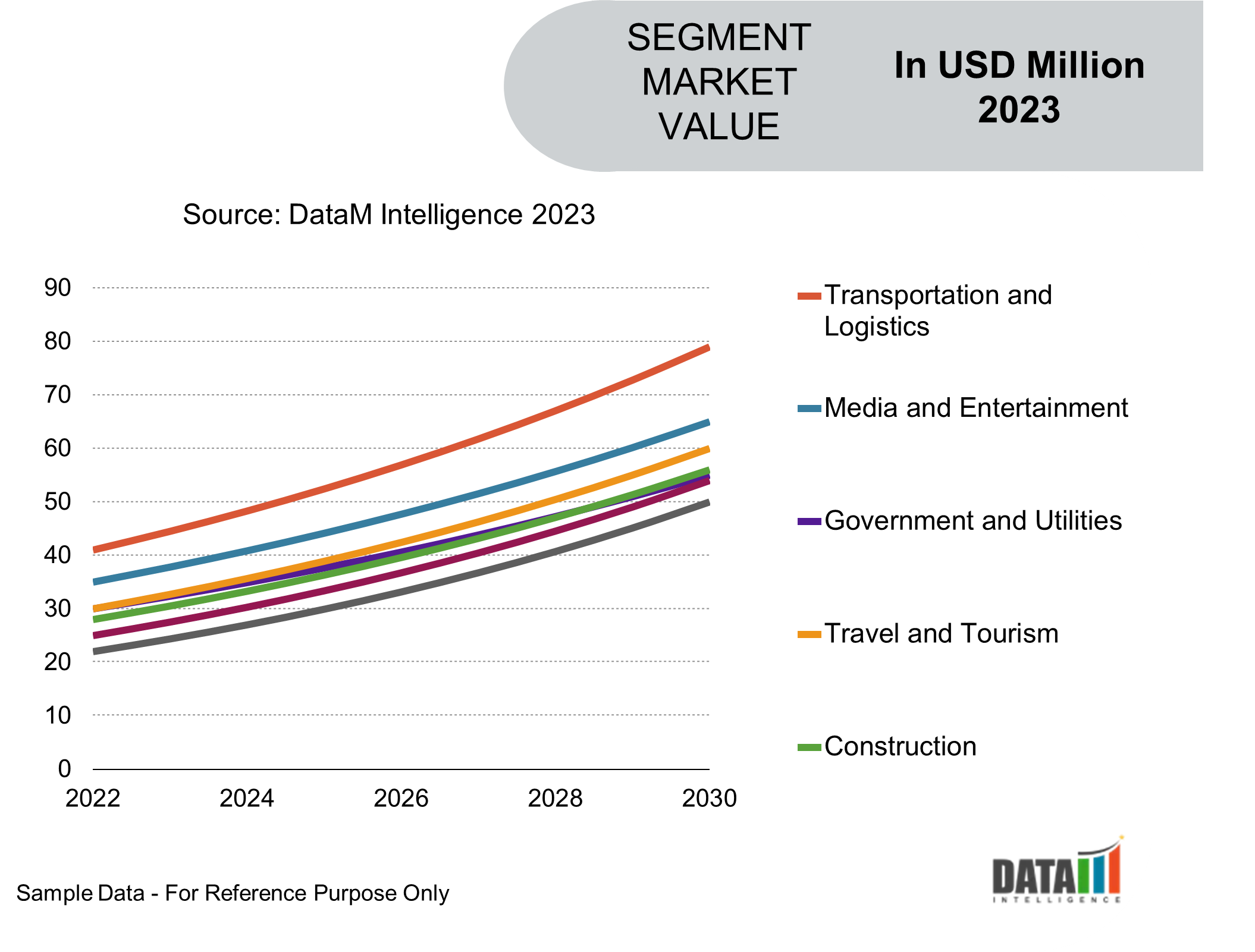

The Rapidly Growing Manufacturing Process Drives the Transportation and Logistics Sector

During the projection period, transportation and logistics will have the most significant market share. The global economy is expanding, government rules are changing and other reasons result in more opportunities in the freight industry. Trends in the national or regional economy are shifting, affecting the manufacturing and distribution processes and hence the demand for transportation.

Carriers must be efficient in light of technological advancements, today's market and government-assisted rules. The world's middle-class population is growing faster and several small and large-scale businesses are eager to expand their market presence Transporation and logistics end-user segment is expected to hold the majority of the market share more than 40% of the global market.

Commercial Vehicle Telematics Market Geographical Share

Increased Awareness About Drivers’ Safety in Asia-Pacific

The Asia-Pacific region has seen a significant rise in road traffic accidents and fatalities in recent years. This has prompted governments, organizations and fleet operators to place greater emphasis on improving road safety. Telematics solutions play a crucial role in this endeavor by providing real-time monitoring and analysis of driver behavior, such as speeding, harsh braking and fatigue.

Asian countries such as China and India are expected to hold more than 65% of the Asia-Pacific commercial vehicle telematics market and China is the market, which is growing at the highest CAGR in the region. China is at the epicenter of this growing New Asia, as low-cost manufacturing leaves the country and relocates to Vietnam, Cambodia, Laos and frontier markets.

Furthermore, new markets are expected to provide market participants with significant growth potential. Furthermore, beneficial government policies and regulations are expected to drive the region’s growth.

Commercial Vehicle Telematics Companies

The major global players include PTC Inc., Trimble Inc., TomTom Telematics Bv, Verizon Telematics, Inc., Mix Telematics International (PTY) Ltd., Zonar Systems, Inc., OCTO Telematics Ltd., Omnitracs, LLC, Masternaut Limited and Microlise Group Ltd.

Key Developments

- On March 11, 2023, An industry leader in fleet management software from CHARLOTTE, North Carolina, announced the official launch of its newest product, a fuel tracking tool that will assist fleet managers in measuring fuel usage and enhancing their bottom line.

- On November 14, 2022, Ashok Leyland introduced the 'Partner Super' line of trucks, which include reverse park assistance, OTA-flashing and telematics. The 914, 1014, and 1114 models in the 9.15T, 10.25T, and 11.28T categories, respectively, will be part of Ashok Leyland's new lineup of ICV trucks under the 'Partner Super' name.

- In 2020, Zonar, a Seattle-based leader in smart fleet technology, announced a strategic agreement with Navistar, a manufacturer of International brand commercial trucks, proprietary diesel engines and IC Bus brand school and commercial buses. The collaboration enables Navistar customers to use its OnCommand Connection platform to access rich and comprehensive fault and diagnostic data from Zonar Telematics Control Units (TCUs) across an entire fleet with a single portal, regardless of vehicle make or model, to streamline operations.

Why Purchase the Report?

- To visualize the global commercial vehicle telematics market segmentation based on type, distribution channel, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of commercial vehicle telematics market level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Distribution Channel mapping available as Excel consisting of key products of all the major players.

The Global Commercial Vehicle Telematics Market Report Would Provide Approximately 61 Tables, 59 Figures and 170 Pages.

Target Audience 2024

- Manufacturers / Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies