Overview

The global Cold Pain Therapy market reached US$ 22.3 billion in 2024 and is expected to reach US$ 34.58 billion by 2032, growing at a CAGR of 5.6% during the forecast period 2025-2032.

Cold therapy helps in treating several chronic problems, including fibromyalgia and back pain. It can assist in managing pain symptoms and offer momentary relief. Cold therapy is usually used in the acute stage of a soft tissue injury. It involves the use of ice or a cryocuff to cool down a damaged area of soft tissue following an injury.

Executive Summary

Market Dynamics: Drivers & Restraints

The Increasing Incidence of Sports Injuries

The increasing number of sports injuries is expected to increase the demand for cold pain therapy market. As the frequency of sports injuries rises, the demand for pain management treatments increases. Cold treatment is a well-established, effective method for reducing inflammation, swelling, and discomfort caused by sprains, strains, and muscular stiffness, which are all frequent sports injuries. This treatment is frequently used by athletes to speed up their recovery and allow them to return to training or competition earlier. This creates a demand for easily available cold therapy products. Professional athletes' increasing use of cold therapy promotes awareness and inspires beginners to follow similarly.

Cold treatment can also be utilized to aid with post-workout muscle rehabilitation and avoid long-term injury. There is an increasing number of injuries which are increasing the demand for cold pain therapy. For instance, according to the report published by the Australian Institute of Health and Welfare in 2021–22, around 18,700 injury hospitalisations among children and adolescents that involved sport, exercise or recreational activities (21%). Over 1 in 3 injury hospitalisations for children aged 10–12 and 13–15 involved sports

Lack of awareness

Lack of awareness of cold pain therapy is a major impediment to market growth. Many people are unaware of cold therapy as a legitimate pain management option, so they rely on standard treatments such as over-the-counter pain relievers or simply ignore the pain. This limits market penetration and keeps individuals from receiving the potential benefits of cold treatment.

Segment Analysis

The global cold pain therapy market is segmented based on product, application, distribution channel, and region.

Type:

Over-the-counter products segment is expected to dominate the global cold pain therapy market share

Over-the-counter products are widely available in pharmacies, supermarket stores, and online sellers. Because of their ease of access, they are the preferred choice for persons who are experiencing minimal pain.

Consumers can acquire OTC products without a doctor's visit or prescription, saving them time and effort. OTC drugs enable the self-treatment of minor pain, empowering people to manage their discomfort without having to rely on healthcare specialists every time. A large number of patches, cooling gels are being getting traction due to the increasing number of sports injuries and the due to the increased costs of prescribed therapies.

Top of Form

Geographical Analysis

North America is expected to hold a significant position in the global cold pain therapy market share

North America is expected to hold a dominant position in the market share this is due to the region holding a significant number of leading POCT device manufacturers and diagnostics companies.

North America has a well-developed healthcare infrastructure and comprehensive insurance coverage. This increases access to advanced pain management choices, such as cold therapy treatments. Furthermore, coverage for cold therapy-based rehabilitation therapies has the potential to increase demand for cold therapy devices.

The region’s culture values physical activity and engagement in sports. This increases the occurrence of sports injuries such as sprains, strains, and muscle soreness, resulting in a strong demand for cold treatment products for pain relief and recovery. The companies are increasingly entering into strategic collaborations and partnerships that increases the market growth in the region. For instance, in March 2023, Aspen Medical Products (Aspen)and NICE Recovery Systems (NICE) announced a strategic partnership that aims to bring more precise recovery and pain management solutions to patients and medical professionals alike. The partnership leverages NICE's advanced cold compression technology with Aspen's effective bracing solutions to deliver pain management and post-operative care to patients recovering from surgery or injury.

Competitive Landscape

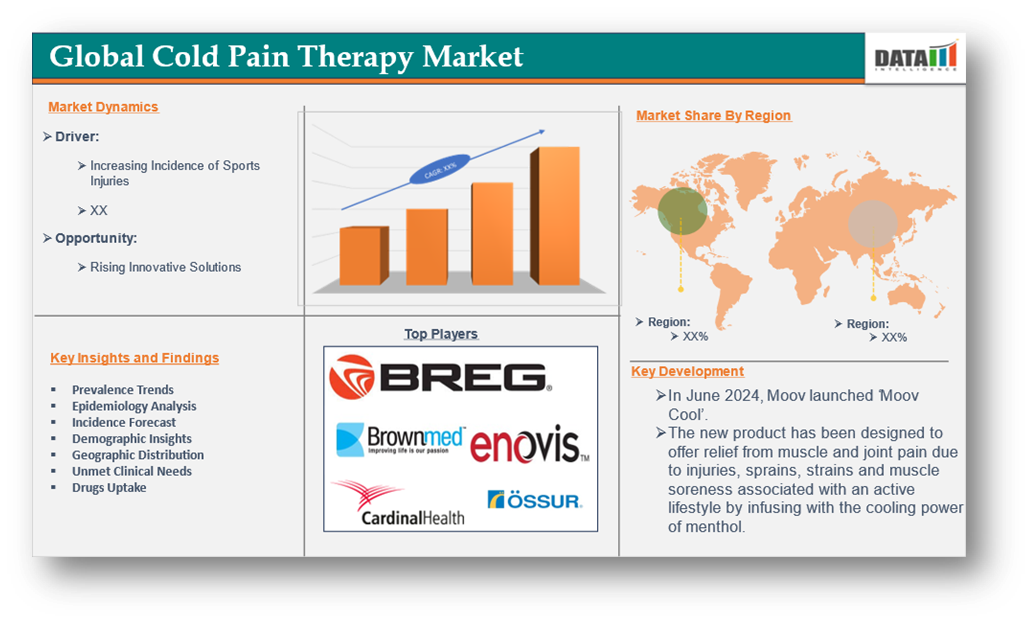

The major global players in the cold pain therapy market include Breg, Inc., Brownmed, Inc., Cardinal Health, Enovis Corporation, Össur hf., Performance Health Supply, Inc., Medline Industries, LP, Compass Health Brands Corp, Romsons Scientific & Surgical Pvt. Ltd and Bird & Cronin, LLC. among others.

| Metrics | Details | |

| CAGR | 5.6% | |

| Market Size Available for Years | 2022-2032 | |

| Estimation Forecast Period | 2025-2032 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Product | OTC Products, Prescription Products |

| Application | Sports Medicine, Post-operative Therapies, Trauma and Orthopedic, Other | |

| Distribution Channel | Retail Pharmacies, Hospital Pharmacies, E-commerce | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |

Key Developments

- In June 2024, Moov launched ‘Moov Cool’. The new product has been designed to offer relief from muscle and joint pain due to injuries, sprains, strains and muscle soreness associated with an active lifestyle by infusing with the cooling power of menthol.

- In March 2023, HealthMe announced a new partnership with Breg to launch a patient direct-pay solution for orthopedic cold therapy Products. HealthMe and Breg, Inc. launched a direct-pay eCommerce engine that will enable orthopedic providers to easily capture patient payments for the company’s line of cold therapy devices. Breg selected HealthMe to power the eCommerce engine.

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, and product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The Global Cold Pain Therapy Market report delivers a detailed analysis with 60+ key tables, more than 50 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2023

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.