Cogeneration Equipment Market Overview

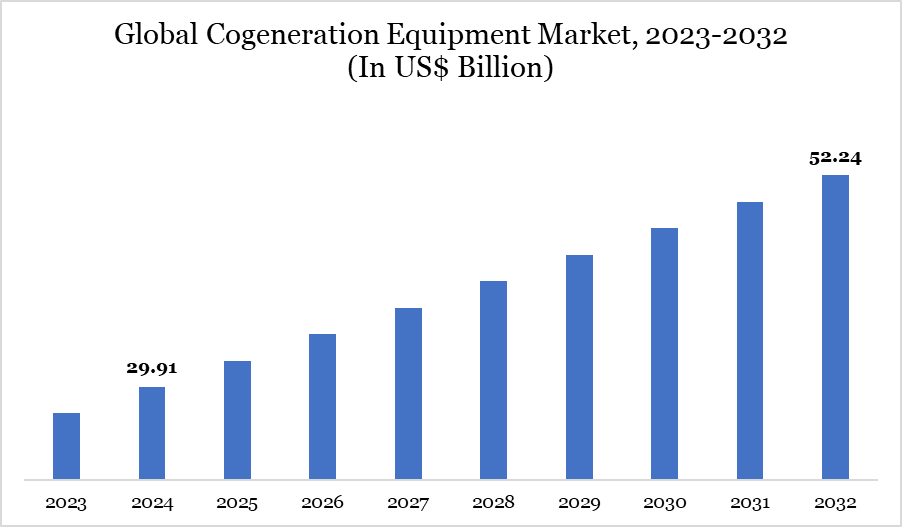

Cogeneration equipment market reached US$29.91 billion in 2024 and is expected to reach US$52.24 billion by 2032, growing with a CAGR of 7.22% during the forecast period 2025-2032.

The global cogeneration equipment market is witnessing steady growth, driven by increasing demand for energy efficiency and sustainable power solutions. Industries such as manufacturing, healthcare, and utilities are investing in cogeneration (CHP) systems to optimize fuel usage, lower operational costs, and reduce carbon emissions. Industries such as manufacturing, healthcare, and utilities are increasingly adopting CHP systems to reduce energy costs and carbon emissions.

Recent innovations are highlighting the industry’s shift toward cleaner energy sources. For instance, in April 2023, Kawasaki introduced the world's first 1.8 MW class, 100% hydrogen-fueled, dry-combustion gas turbine cogeneration system, highlighting the industry's shift towards cleaner energy sources.

Cogeneration Equipment Market Scope

| Metrics | Details |

| By Fuel | Coal, Natural Gas, Biomass, and Others |

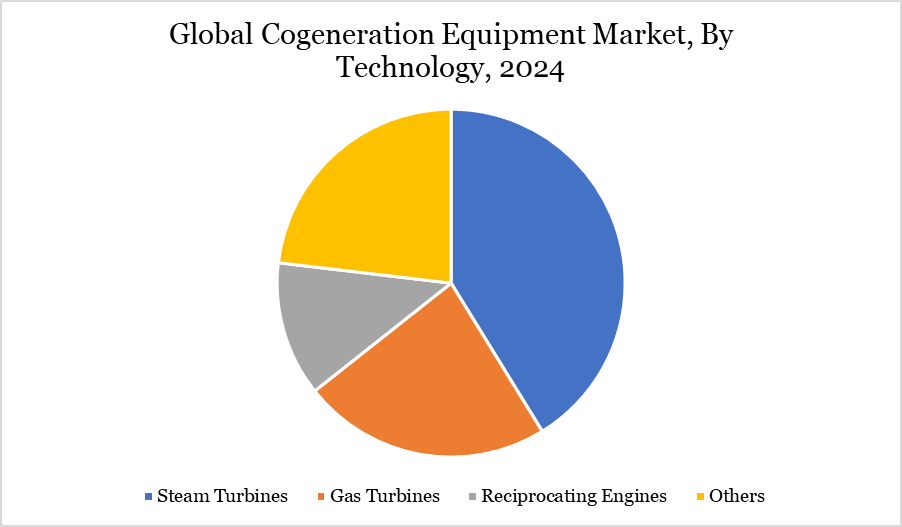

| By Technology | Steam Turbines, Gas Turbines, Reciprocating Engines, Others |

| By Capacity | Up to 30 MW, 31-50 MW, and Above 50 MW |

| By Application | Industrial, Commercial, Residential |

| By Region | North America, South America, Europe, Asia-Pacific, and Middle East Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Cogeneration Equipment Market Dynamics

Growing Demand for Energy Efficiency

As industries prioritize cost-effective energy solutions, the demand for energy efficiency is rising. According to the Environmental Protection Agency, combined heat and power (CHP) or cogeneration systems enhance efficiency by recovering heat from on-site electricity generation, achieving 65–80% efficiency, with advanced systems reaching 90%. This significantly reduces energy waste, fuel costs, and operational expenses. Hence, industries like chemicals, food processing, and healthcare are adopting CHP for its efficiency and sustainability benefits.

Companies are offering sustainable, fuel-flexible CHP systems that enhance efficiency and drive higher adoption rates across various industries. In January 2025, Catalyst Power Holdings LLC expanded its cogeneration (CHP) systems to Connecticut and Massachusetts, enhancing cleaner energy solutions for commercial and industrial clients. Catalyst has successfully installed CHP systems for small and mid-sized businesses in New York and New Jersey through its joint venture with OHA Power. These systems achieve over 90% efficiency by capturing and utilizing wasted thermal energy for on-site heating or cooling.

High Initial Investment Costs

High initial investment costs continue to pose significant challenges to the widespread adoption of cogeneration equipment, particularly among small and medium-sized enterprises (SMEs). The capital-intensive nature of cogeneration systems, including equipment, installation, and engineering, increases financial risks for businesses. Many companies hesitate to invest due to the long payback period, which can range from 5 to 10 years, delaying returns on investment.

Cogeneration Equipment Market Segment Analysis

The global cogeneration equipment market is segmented based on fuel, technology, capacity, application, and region.

Steam Turbines is Leading Cogeneration Equipment with Superior Efficiency and Cost-Effectiveness

The Steam Turbines segment expanded from US$ 8.34 billion in 2022 to US$ 8.43 billion in 2023, owing to rising adoption in the global market.

Steam turbines hold a dominant position in the cogeneration equipment market due to their high efficiency, reliability, and ability to generate both electricity and thermal energy from multiple fuel sources, including biomass, coal, natural gas, and waste heat. Their widespread use in industrial sectors such as chemical plants, refineries, and district heating systems underscores their scalability and long operational life.

Mergers, partnerships, and collaborations play a crucial role in the steam turbine cogeneration market by driving technological advancements, expanding market reach, and enhancing operational efficiency In February 2025, Siemens Energy partnered with Rolls-Royce to supply steam turbines, generators, and auxiliary systems for Rolls-Royce's small modular nuclear reactors (SMRs). This collaboration aims to enhance the efficiency and scalability of SMRs, which are designed to be more cost-effective and quicker to deploy than traditional nuclear plants.

Cogeneration Equipment Market Geographical Penetration

North America's Advanced AI Adoption, Strong Cloud Infrastructure, and Major Tech Companies Driving Innovation.

North America led the Global Cogeneration Equipment Market in 2022 with a market size of US$ 8.95 billion and expanded further to US$ 9.37 billion in 2023.

North America holds a significant share of the global cogeneration equipment market due to its strong focus on energy efficiency and carbon reduction. The region benefits from stringent environmental regulations and government incentives promoting combined heat and power (CHP) systems. The presence of key industry players and their technological innovations, product launches, and expansion further drive market growth.

In April 2023, Orion Engineered Carbons installed cogeneration technology at its Ivanhoe plant in Louisiana, US to enhance efficiency and sustainability. The system features a steam turbine generator that converts waste steam from carbon black production into electricity. This renewable energy can power the facility and be supplied to the local grid. The upgrade improves reliability while reducing environmental impact.

Environmental Impact Analysis

Utilizing waste heat, CHP systems achieve up to 90% efficiency, significantly lowering greenhouse gas emissions compared to conventional power generation. They also contribute to better air quality by reducing NOx and SO₂ emissions. Additionally, cogeneration systems use less water than traditional power plants, minimizing strain on water resources. Companies are also integrating CHP systems to reduce CO₂ emissions and enhance energy efficiency.

For instance, in February 2022, Otsuka Pharmaceutical Factory introduced a cogeneration system at its Naruto Factory in Tokushima, Japan, to enhance energy efficiency and reduce CO₂ emissions. The facility ensures a stable pharmaceutical supply while supporting the company's sustainability goals, aligning with its 2050 Environmental Vision of achieving "Net Zero."

Competitive Landscape of Cogeneration Equipment

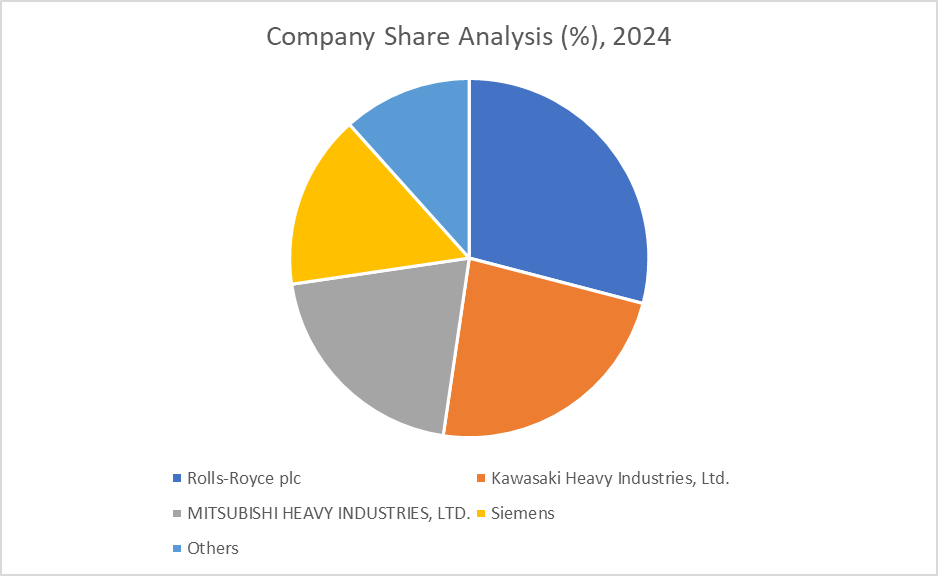

The cogeneration equipment market is highly competitive, driven by increasing demand for energy efficiency, sustainability, and decentralized power generation. Market players compete based on technological innovation, fuel flexibility, system efficiency, and compliance with stringent environmental regulations. The major players in the market include Rolls-Royce plc, Kawasaki Heavy Industries, Ltd., MITSUBISHI HEAVY INDUSTRIES, LTD., Siemens, GE Vernova, Wärtsilä, AB HOLDING SPA, Clarke Energy, YANMAR HOLDINGS CO., LTD., Cummins Inc., and others.

Key Developments in Cogeneration Equipment Market

- In November 2024, Yanmar Energy System Co., Ltd., a subsidiary of Yanmar Holdings, completed its acquisition of TEDOM Group, a leading manufacturer of cogeneration units. This strategic move enhances Yanmar's position in the decentralized energy systems market, leveraging TEDOM's expertise and global presence to offer comprehensive energy solutions and services.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies