Coated Paper Market Overview

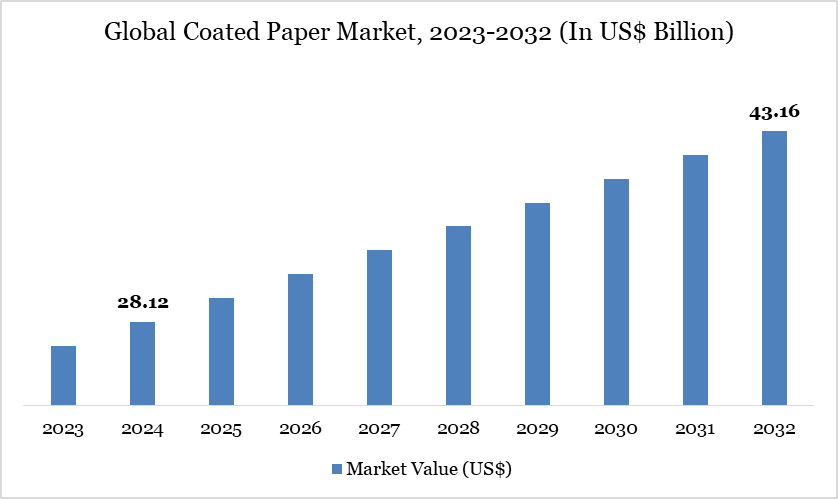

Global Coated Paper Market reached US$ 28.12 billion in 2024 and is expected to reach US$ 43.16 billion by 2032, growing with a CAGR of 5.50% during the forecast period 2025-2032.

The global coated paper market is being driven by growing demand for high-quality printing and sustainable packaging materials. The surge in e-commerce and government-backed recycling targets is increasing the adoption of coated paper in advertising, labeling, and consumer packaging. For example, coated paper is widely used in food-safe, recyclable wraps that align with public procurement and waste reduction policies. Additionally, manufacturers are shifting production lines from traditional grades to recyclable and fiber-based materials to support climate commitments.

Coated Paper Market Trend

A unique trend is the transformation of coated paper production to meet circular economy goals. The European Union’s Circular Economy Action Plan mandates that all packaging be recyclable or reusable by 2030, directly encouraging innovation in coated paper formulations. Companies like Stora Enso are converting older coated paper machines into packaging board facilities to align with sustainability targets.

In the US, the Environmental Protection Agency promotes increased recycling infrastructure, enabling better processing of coated paper waste. This shift reflects how regulatory pressure and environmental accountability are reshaping the global coated paper industry.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Coating Type | Gloss-Coated Paper, Matte-Coated Paper, Satin-Coated Paper, Silk-Coated Paper, Dull-Coated Paper, and Others |

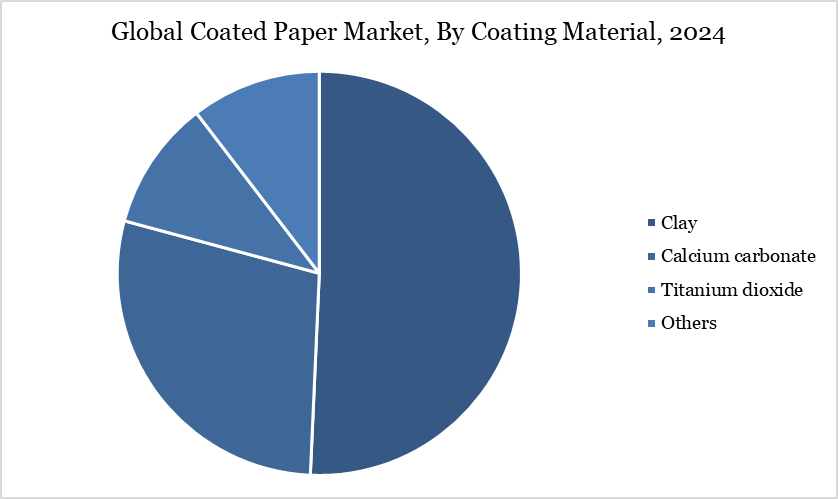

| By Coating Material | Clay, Calcium carbonate, Titanium dioxide, Others |

| By Application | Printing, Packaging, Advertising Materials, Security & Labeling, Stationery, Others |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Coated Paper Market Dynamics

Growth in Sustainable Packaging Demand from Government-Led Circular Economy Initiatives

Government-driven circular economy strategies are accelerating demand for coated paper in sustainable packaging. The EU’s Circular Economy Action Plan mandates that all packaging be recyclable by 2030 and sets a 70% recycling target for packaging waste, boosting demand for coated paper that supports recyclability. In the US, packaging recycling rates reached approximately 39% in 2018, with the EPA estimating that improved infrastructure could increase processing of 38–45 million additional tons highlighting the critical role of coated paper in achieving these recycling goals.

Rising Restrictions on Chemical Coating Agents Due to Environmental Compliance Regulations

Rising restrictions on chemical coating agents are increasingly restraining the global coated paper market, as policymakers enforce stricter regulations on volatile organic compounds (VOCs) and hazardous substances. The US EPA’s updated standards are projected to reduce VOC emissions from paper coatings by approximately 10,600 metric tons about a 16% cut mandating costly low-VOC alternatives. Simultaneously, the EU’s REACH framework now identifies 241 substances of very high concern (SVHC), requiring pre-market authorization or substitution for compliant coatings.

Coated Paper Market Segment Analysis

The global coated paper market is segmented based on coating type, coating material, application and region.

Clay Segment Driving Coated Paper Market

The clay coating segment is emerging as a key growth driver in the global coated paper market, underpinned by widespread industrial demand. As reported by the US Geological Survey, kaolin clay essential for clay coating holds a dominant role in paper applications alongside ceramics and coatings. Its superior properties significantly enhance paper brightness, smoothness, and print clarity. Meanwhile, UPM's expanding portfolio of clay-coated kraft (CCK) papers reflects a strategic focus on high-performance solutions tailored for high-speed converting and precision printing.

Coated Paper Market Geographical Share

North America Drives the Global Coated Paper Market

The North American coated paper market is experiencing steady demand, particularly driven by packaging, labeling, and publishing applications. According to the US Census Bureau, paper and paperboard production in the US exceeded 68 million tons in 2023, with coated papers forming a substantial part of value-added segments.

The US EPA notes that over 43% of paper products are recycled, encouraging sustainability in coated paper usage. Canada reported a 13% increase in paper product exports in 2022, reflecting cross-border trade growth. As e-commerce packaging and shelf-ready displays expand, coated papers offer durability and print clarity critical for branding.

The US Department of Commerce highlights packaging as a top sector in manufacturing output, reinforcing demand for coated substrates. Technological innovations in barrier coatings are gaining ground, especially for food and beverage applications. Sustainability goals are pushing demand for recyclable coated paper as plastic alternatives decline. Companies are also investing in bio-based and water-based coatings, supported by US DOE initiatives to cut petroleum dependence.

Sustainability Analysis

The global coated paper market faces significant sustainability challenges, with the production of one metric ton of coated paper emitting between 1,300 and 1,600 kg of CO₂ equivalent. The pulp and paper industry as a whole account for approximately 4–6% of industrial energy use and about 2% of direct industrial CO₂ emissions. Additionally, paper products represent nearly 35% of municipal solid waste by weight, contributing to landfill volume and methane emissions.

In response, leading manufacturers are taking action to improve sustainability. UPM Company has pledged to reduce CO₂ emissions from its paper products by 65% by 2030, and Stora Enso is repurposing coated paper mills into facilities for renewable board production. Recycling plays a vital role, with one ton of recycled paper saving enough energy to power a home for six months and conserving 7,000 gallons of water. These efforts are shaping a shift toward circularity and low-carbon manufacturing practices. Overall, the coated paper sector is steadily evolving under growing environmental and regulatory pressures.

Coated Paper Market Major Players

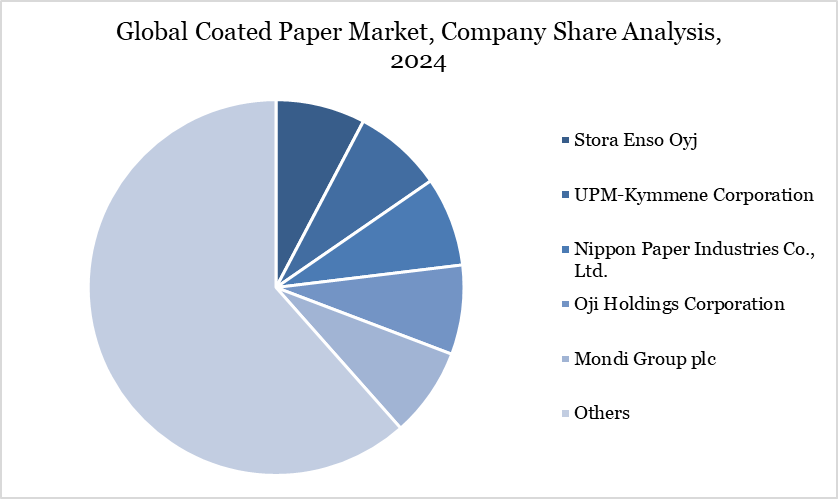

The major global players in the market include Stora Enso Oyj, UPM-Kymmene Corporation, Nippon Paper Industries Co., Ltd., Oji Holdings Corporation, Mondi Group plc, Sappi Limited, International Paper Company, Asia Pulp & Paper Group (APP), Burgo Group S.p.A., and Verso Corporation.

Key Developments

In October 2024, UPM Specialty Papers and Eastman have co-created a novel biopolymer coated paper packaging solution, designed for food applications requiring grease and oxygen barriers. The solution integrates Eastman’s biobased and compostable Solus performance additives with BioPBS polymer to form a thin coating onto UPM’s compostable and recyclable barrier base papers. Thanks to the thinness of the coating layer, the solution is designed for recycling within existing fiber recycling streams, empowering brands to adopt sustainable packaging.

In January 2025, Mitsubishi HiTec Paper launched a new generation of premium matt coated inkjet papers, designed for high-quality photo books and building on its long-standing reputation as a market standard in matt inkjet papers.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies