Circular Battery Economy Market Size

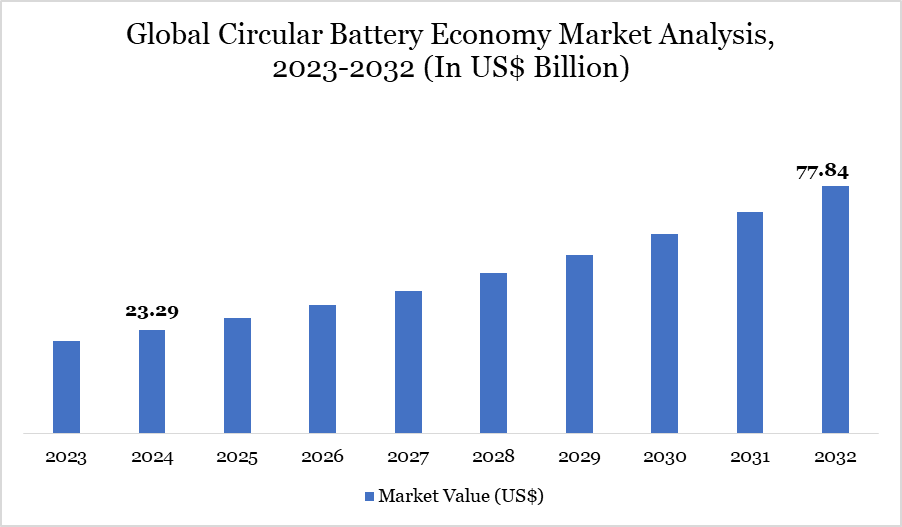

Circular Battery Economy Market size reached US$ 23.29 billion in 2024 and is expected to reach US$ 77.84 billion by 2032, growing with a CAGR of 16.28% during the forecast period 2025-2032.

The significance of lithium-ion (Li-ion) batteries has become increasingly crucial, with the global need for renewable energy and electric vehicles (EVs) escalating, projections currently indicate that the market will attain 4.7 TWh and a valuation above US$400 billion by 2030, expanding at an annual rate surpassing 30% from 2022.

Conventional battery lifecycles, defined by linear models of extraction, utilization, and disposal, present significant environmental and economic issues. The circular battery economy is a revolutionary approach, prioritizing reuse, recycling, and repurposing. This concept minimizes landfill waste and environmental deterioration while promoting sustainable resource utilization.

Key areas include mobility, consumer electronics, and energy storage are progressively embracing circular principles. Global enterprises such as Tesla and Northvolt, coupled with strong governmental measures in nations like the Netherlands and Australia, are spearheading this transition. The circular battery economy signifies a transformative change towards enduring sustainability, resource efficiency, and industrial innovation.

Circular Battery Economy Market Trend

The circular battery economy is advancing due to swift electrification, regulatory measures, and corporate ingenuity. The demand for Li-ion batteries is projected to increase from 700 GWh in 2022 to around 4,700 GWh by 2030, with electric vehicles accounting for nearly 4,300 GWh of this demand.

Trends suggest an increasing focus on digital technologies to improve transparency in battery tracking and end-of-life management. Governments and prominent OEMs have declared lofty objectives, such as the EU's 2035 ban on internal combustion engine vehicles and the US Inflation Reduction Act. Moreover, 13 of the leading 15 OEMs intend to discontinue internal combustion engine vehicles, indicating a fundamental transformation within the sector.

Corporate initiatives such as Tesla's battery recycling program and Northvolt's Revolt project highlight an increasing focus on internal material recovery. National initiatives, such as Australia's Battery Stewardship Scheme, are establishing infrastructure for collection and recycling, whereas Extended Producer Responsibility (EPR) programs, exemplified by the Netherlands, advocate for comprehensive lifecycle accountability. The amalgamation of legislation, digitalization, and industry dedication delineates contemporary market developments.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

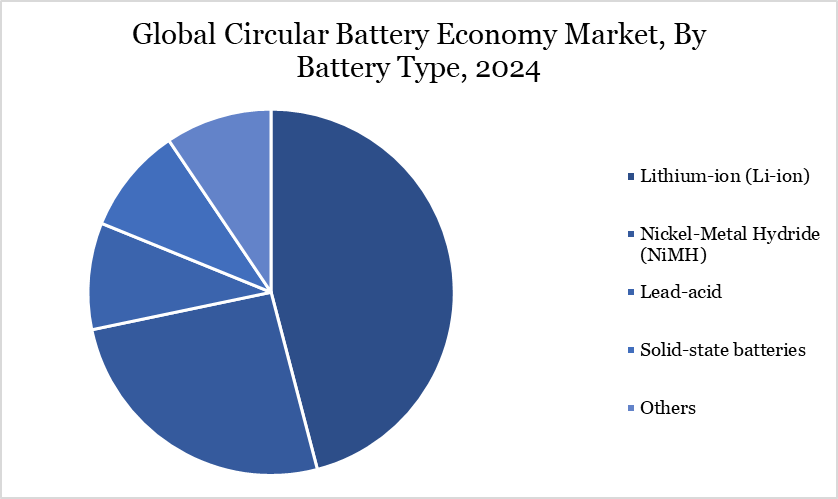

| By Battery Type | Lithium-ion (Li-ion), Nickel-Metal Hydride (NiMH), Lead-acid, Solid-state batteries, Others | |

| By Source | Electric Vehicles (EVs), Consumer Electronics, Energy Storage Systems (ESS), Others | |

| By Technology | Collection & Sorting, Mechanical Separation, Chemical Leaching, Direct Recycling, Others | |

| By End-user | Automotive, Electronics & Electricals, Industrial Equipment, Utilities & Grid Infrastructure, Others | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Circular Battery Economy Market Dynamics

Decarbonization and Electric Vehicle Adoption

As climate change mitigation efforts escalate, electrification has become imperative. Regulatory frameworks like as Europe’s “Fit for 55,” the US Inflation Reduction Act, and India's FAME project are expediting the transition to sustainable mobility. By 2030, certain countries are projected to have up to 90% of new passenger car sales as electric vehicles.

The rapid expansion of electric vehicles is propelling battery consumption and, therefore, necessitating effective battery lifecycle management. Concurrently, the impetus to diminish reliance on raw material imports, along with escalating raw material expenses, further promotes circular models.

Corporations are acknowledging the economic advantages of material recovery via recycling, which diminishes manufacturing expenses and fosters the emergence of new industry sectors. The circular economy provides twin advantages: ecological benefits and improved economic resilience. As the urgency of climate change intensifies—with slightly more than six years remaining before surpassing the 1.5°C limit—embracing circular approaches is imperative.

Disjointed Systems and Infrastructure Deficiencies

Notwithstanding its potential, the circular battery economy encounters considerable limitations, especially in execution. The shift from a linear to a circular value chain necessitates extensive cooperation among industries, supply chains, and governmental entities. Recycling rates are presently inadequate owing to insufficient infrastructure, particularly in developing areas.

The elevated expenses associated with advanced recycling technologies and the lack of standardized protocols for battery design, collecting, and end-of-life processing hinder advancement. Furthermore, regulatory frameworks differ markedly among regions, leading to fragmented policy implementation and inconsistent recycling obligations.

The absence of traceability in battery materials, attributable to insufficient digital infrastructure, further impedes material recovery initiatives. Although digital technologies present a viable answer, their general adoption remains nascent. The circular battery economy may fail to realize its transformative promise without unified global standards, collaborative investments, and regulatory alignment. Confronting these systemic constraints will be essential for realizing the complete advantages of a circular battery lifespan.

Circular Battery Economy Market Segment Analysis

The global circular battery economy market is segmented based on battery type, source, technology, end-user and region.

Surging EV Demand and Gigafactory Investments Driving Lithium-Ion Battery Growth in the Circular Economy

The lithium-ion battery sector has a preeminent role in the Circular Battery Economy Market, principally propelled by the escalating demand for electric vehicles (EVs) and the increasing emphasis on renewable energy integration. As countries pursue carbon neutrality, lithium-ion batteries have emerged as the favored energy storage option due to its superior energy density, efficiency, and extended lifespan.

The rising trend is further bolstered by significant long-term investments in gigafactory infrastructure by leading global entities. Companies such CATL, Tesla, LG Energy Solution, and Panasonic are at the forefront of this transition. Tesla revealed intentions in 2024 to create seven new gigafactories in Europe, the US, and Asia-Pacific, whilst Reliance Industries is developing five gigafactories in India. These programs seek to address the increasing battery demand while promoting circularity through the enhancement of battery recycling and reuse infrastructure, thereby establishing a more sustainable and closed-loop battery economy.

Circular Battery Economy Market Geographical Share

Asia-Pacific: Propelling Circular Battery Initiatives via Policy and Industry

The Asia-Pacific region is a pivotal area for the circular battery economy, propelled by the rise of electric vehicle markets, rising smartphone adoption, and progressive ecological initiatives. Countries such as China, Japan, South Korea, and India are making substantial investments in battery production and end-of-life management.

The FAME plan in India and China's rigorous recycling requirements illustrate significant governmental engagement. With the rapid increase in electric vehicle use, especially in China the largest EV market globally the area is set to produce substantial quantities of spent batteries, rendering circular management a strategic imperative.

The region's industrial capabilities enable it to excel in battery recycling innovation and scalability. Nonetheless, policy coherence and infrastructure are inconsistent among nations. Australia distinguishes itself with its national Battery Stewardship Scheme, promoting cooperation among producers, merchants, and recyclers. Through sustained investments in collection infrastructure, digital traceability, and public awareness, the Asia-Pacific region is anticipated to make substantial contributions to global circular battery capacity, fostering both environmental advancement and economic development.

Sustainability Analysis

The circular battery economy is fundamentally sustainable, providing substantial environmental and economic benefits. Prioritizing reuse, reusing, and recycling diminishes reliance on virgin raw materials, so alleviating environmental harm from extraction and processing. This also reduces greenhouse gas emissions during the battery lifecycle and lowers hazardous waste in landfills, so protecting ecosystems and water resources.

Economically, extracting valuable components from spent batteries diminishes production expenses and mitigates supply chain risks. It additionally fosters industry diversification and employment generation in the recycling and reprocessing industries. Initiatives such as those by Tesla and Northvolt exemplify corporate responsibility in establishing circular systems, whilst national programs in Australia and the Netherlands promote collaboration and accountability.

Furthermore, digital innovation improves transparency, facilitating verifiable end-of-life management and effective resource rotation. With global emissions attaining unprecedented levels, the circular economy model is essential for achieving the 1.5°C climate objective. The circular battery economy harmonizes environmental stewardship with enduring economic resilience through sustainable resource utilization and systemic innovation.

Circular Battery Economy Market Major Players

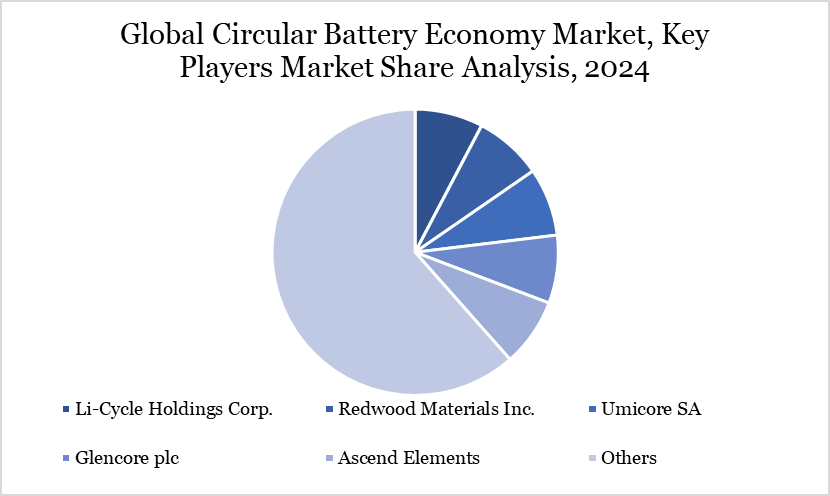

The major global players in the market include Li-Cycle Holdings Corp., Redwood Materials Inc., Umicore SA, Glencore plc, Ascend Elements, Retriev Technologies Inc., American Battery Technology Company (ABTC), TES, Battery Resourcers, Ecobat Technologies Ltd.

Key Developments

- In October 2024, Amprius Technologies secured a contract with a Fortune 500 company to create a custom high-energy SiMaxx pouch cell using its silicon anode technology. The company aims to reduce battery weight and size by approximately 50% and produce over one million cells annually for EVs soon.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies