Market Size

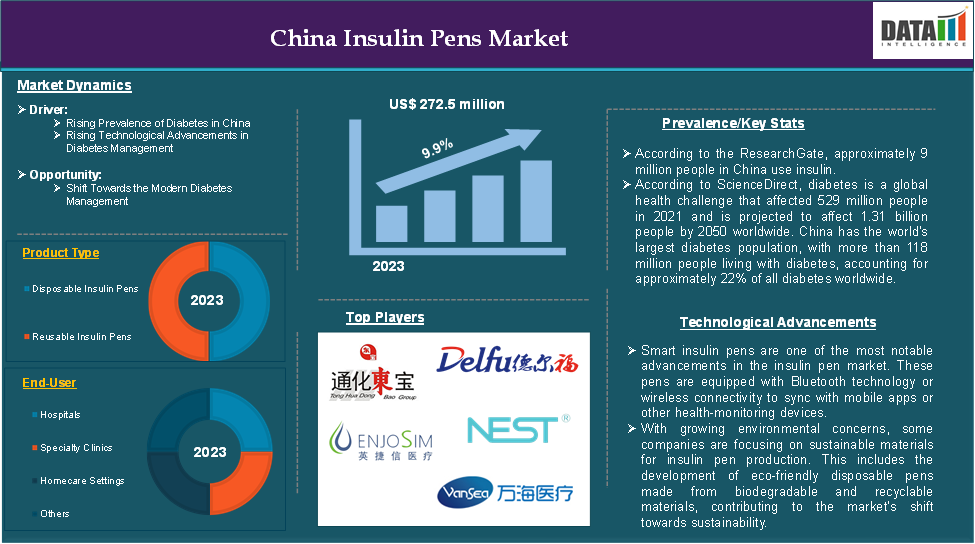

The China Insulin Pens Market reached US$ 272 million in 2023 and is expected to reach US$ 579.2 million by 2031, growing at a CAGR of 9.9% during the forecast period 2024-2031.

Insulin pens are medical devices designed to deliver insulin conveniently and controlled, primarily for individuals with diabetes who require regular insulin therapy. They combine an insulin cartridge (pre-filled or replaceable) with a pen-like design for easier handling and dosing. These devices are a modern alternative to traditional insulin vials and syringes, simplifying the injection process and enhancing patient adherence. Insulin pens have revolutionized diabetes management by improving convenience, accuracy, and patient compliance.

The demand for insulin pens in China is rapidly growing, driven by the increasing prevalence of diabetes, advancements in healthcare and strong government support for diabetes management programs. The rising adoption of insulin for diabetes management in China significantly drives the demand for insulin pens due to their convenience, precision and ease of use. For instance, according to the ResearchGate, approximately 9 million people in China use insulin. As diabetes becomes more prevalent in China, the number of patients requiring insulin therapy rises. Insulin is critical for managing Type 1 diabetes and often necessary for advanced Type 2 diabetes.

Market Summary

| Metrics | Details | |

| CAGR | 9.9% | |

| Market Size Available for Years | 2022-2031 | |

| Estimation Forecast Period | 2024-2031 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Product Type | Disposable Insulin Pens and Reusable Insulin Pens |

| End-User | Hospitals, Specialty Clinics, Homecare Settings, Others | |

For more details on this report - Request for Sample

Market Dynamics: Drivers & Restraints

Rising prevalence of diabetes in China

The rising prevalence of diabetes in China is significantly driving the China insulin pens market and is expected to drive the market over the forecast period. According to ScienceDirect, diabetes is a global health challenge that affected 529 million people in 2021 and is projected to affect 1.31 billion people by 2050 worldwide. China has the world's largest diabetes population, with more than 118 million people living with diabetes, accounting for approximately 22% of all diabetes worldwide. This growing patient base creates a substantial and sustained demand for insulin delivery devices, including insulin pens. As more people are diagnosed with diabetes, the need for insulin pens as an efficient, easy-to-use solution increases.

With the increasing number of diabetes cases, the demand for insulin delivery methods that are easier, more precise and more comfortable grows. Insulin pens are particularly appealing as they provide convenient dosing, accuracy, and portability. For instance, disposable insulin pens are gaining popularity due to their simplicity and the fact that they come pre-filled, making them ideal for patients who prefer not to deal with vials and syringes.

China’s healthcare system is emphasizing self-management for chronic diseases like diabetes. Insulin pens facilitate self-administered insulin therapy, making them a practical choice for patients who wish to manage their diabetes independently at home. This is crucial as more individuals with diabetes in China seek out ways to manage their disease efficiently and independently, contributing to a higher demand for insulin pens

Competition from traditional methods

The competition from traditional methods, particularly vials and syringes, poses significant challenges to the growth of the insulin pens market in China. Despite the advantages that insulin pens offer, traditional methods remain entrenched due to various reasons, hampering the broader adoption of insulin pens.

Insulin pens are expensive than traditional vials and syringes. The cost difference can be substantial, especially in rural areas where disposable income is lower. For instance, while a vial and syringe set may cost less in comparison to an insulin pen, the latter requires continuous refills or purchases of cartridges, making it a more expensive option over time.

Traditional methods such as vials and syringes have been the standard for decades. Many patients and healthcare providers are accustomed to these methods, and there is often resistance to change. This is particularly true for older generations or those with longstanding diabetes who are more familiar with the vial-syringe system and perceive insulin pens as too complex

Market Segment Analysis

The China insulin pens market is segmented based on product type and end-user.

Product Type:

The disposable insulin pens segment is expected to dominate the China insulin pens market share

The disposable insulin pens segment holds a major portion of the China insulin pens market share and is expected to continue to hold a significant portion of the market share over the forecast period. Disposable insulin pens are pre-filled and ready to use, which makes them extremely convenient for patients. There’s no need for patients to load insulin cartridges or manage refills, making them an ideal choice for individuals seeking simplicity in their diabetes management.

For instance, leading brands like Novo Nordisk's FlexPen and Sanofi's SoloStar and other local brands dominate the disposable insulin pen market in China. These brands benefit from strong brand recognition and a well-established presence, making disposable pens the preferred choice for patients.

With an increasing preference for insulin pens over traditional syringes, disposable insulin pens have become the go-to option due to their ease of use and accuracy. This shift, particularly in younger patients or those newly diagnosed with diabetes, further strengthens the dominance of disposable pens. In contrast, reusable pens, while more cost-effective in the long run, are not as easy to use and require cartridge refills, which can be a barrier for many patients, especially those who are new to insulin therapy.

Market Companies

The Major China players in the insulin pens market include Tonghua Dongbao Pharmaceutical Co., Ltd., Jiangsu Delfu medical devices Co., Ltd., Wuxi NEST Biotechnology Co., Ltd, Lepu Medical Technology (Beijing)Co., Ltd., Jiangsu Enjosim Medical Technology Co., Ltd, Shanghai Eastern Medtech Co., Ltd., Wanhai Medical Instruments Co., Ltd., Ypsomed AG, Wanhai Medical Instruments Co., Ltd., Novo Nordisk A/S and among others.

Why Purchase the Report?

- Pipeline & Innovations: Insights into clinical trials, product pipelines, and upcoming advancements.

- Market Positioning: Analysis of product performance and growth potential for optimized strategies.

- Real-World Evidence: Integration of patient feedback for enhanced product outcomes.

- Physician Preferences: Insights into healthcare provider behaviors and adoption strategies.

- Regulatory & Market Updates: Coverage of recent regulations, policies, and emerging technologies.

- Competitive Insights: Analysis of market share, competitor strategies, and new entrants.

- Pricing & Market Access: Review of pricing models, reimbursement trends, and access strategies.

- Market Expansion: Strategies for entering new markets and forming partnerships.

- Regional Opportunities: Identification of high-growth regions and investment prospects.

- Supply Chain Optimization: Assessment of risks and distribution strategies.

- Sustainability & Regulation: Focus on eco-friendly practices and regulatory changes.

- Post-Market Surveillance: Enhanced safety and access through post-market data.

- Value-Based Pricing: Insights into pharmacoeconomics and data-driven R&D decisions.

The China Insulin Pens Market report delivers a detailed analysis with 36 key tables, more than 22 visually impactful figures, and 176 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2023

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.