Overview

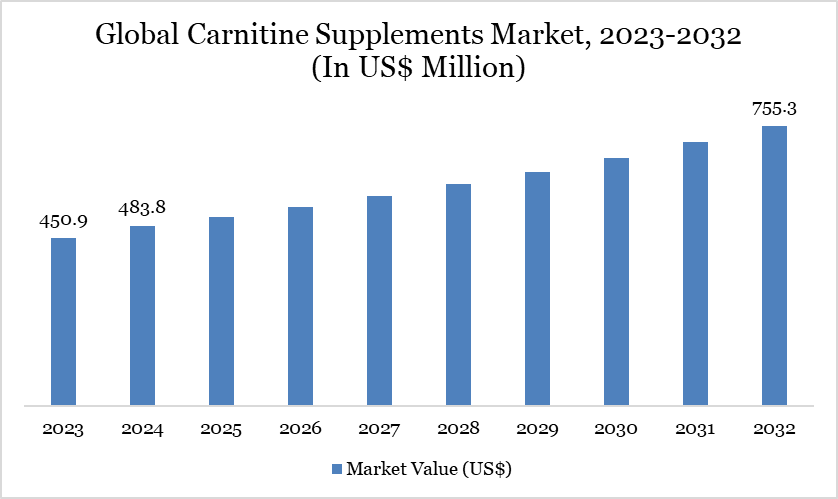

The global market for carnitine supplements reached US$ 483.8 million in 2024 and is expected to reach US$ 755.3 million by 2032, growing at a CAGR of 5.8% during the forecast period 2025-2032.

The global carnitine supplements market is experiencing robust growth, driven by multiple converging factors. Rising health consciousness and the pursuit of wellness have led consumers to seek supplements that enhance energy metabolism and support weight management. L-carnitine, known for its role in fatty acid oxidation, has gained popularity among athletes and fitness enthusiasts aiming to improve endurance and reduce muscle fatigue. The aging population also contributes to market expansion, as older individuals turn to carnitine supplements to maintain muscle function and cognitive health.

Companies respond to demand through innovation, strategic product launches, and consumer-centric formulations. Many brands are integrating carnitine into convenient formats to align with modern lifestyles. For instance, in January 2025, Java Burn launched a new natural health supplement designed to enhance wellness by blending seamlessly with daily coffee routines. The product features a science-backed formula including L-Carnitine, green tea extract, and other ingredients that boost metabolism and energy.

Carnitine Supplements Market Trend

The rising consumer demand for personalized nutrition solutions is a key trend for the carnitine supplement market. Today’s health-conscious consumers are increasingly looking for products tailored to their unique lifestyle, health conditions, and fitness goals. Carnitine supplementation, recognized for its role in energy production and fatty acid metabolism, is well-positioned to align with this trend by offering personalized benefits, from enhanced physical performance to improved metabolic health.

This growing demand for personalization resonates across different consumer groups in North America. Older adults may be looking for products that aid recovery, combat age-related muscle weakness, or help manage health conditions, while millennials and Generation Z consumers are more interested in optimizing their fitness routines and energy levels. Personalized carnitine products, formulated in convenient delivery formats and tailored to individual needs, allow companies to appeal directly to these segments.

Advances in technology, from DNA testing and microbiome analysis to health apps and wearable devices, are helping companies gather data on consumers’ unique physiology and lifestyle. By integrating these data points into their product development, companies can create tailored carnitine supplement formulas. This approach adds significant value by addressing specific health goals — whether it’s weight management, enhanced physical performance, or recovery — strengthening loyalty and satisfaction.

Market Scope

Metrics | Details |

By Type | L-Carnitine L-Tartrate, Acetyl-L-Carnitine (ALCAR), Propionyl-L-Carnitine and Others |

By Product Grade | Food-Grade, Feed-Grade and Others |

By Source | Animal-Based and Plant-Based |

By Flavors | Berry, Lemon/Citrus, Cherry, Mango, Pineapple and Others |

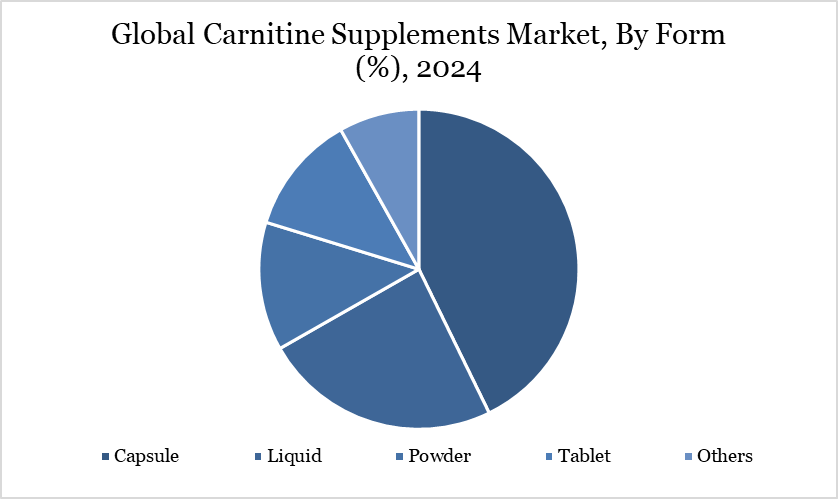

By Form | Capsule, Liquid, Powder , Tablet and Others |

By Application | Sports Nutrition, Weight Management, Cardiac Health, Cognitive Function and Others |

By Distribution Channel | Supermarkets & Hypermarkets, Specialty Stores & Pharmacies, E-Commerce and Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Nutrition Growing Trend of Preventive Healthcare

The growing trend of preventive healthcare is significantly driving the growth of the Carnitine Supplements market as more consumers increasingly focus on maintaining their health proactively rather than treating illnesses after they occur. People are becoming more aware of the importance of a healthy lifestyle, including proper nutrition, regular exercise, and supplementation to support long-term well-being. Carnitine supplements, known for their role in energy metabolism, fat oxidation, and cardiovascular support, fit well into this preventive approach. With rising cases of chronic diseases such as obesity, diabetes, and heart conditions, many individuals are turning to carnitine to help manage risk factors and improve metabolic health.

According to the FAO, chronic diseases are a major global health challenge, responsible for 75% of all deaths worldwide and claiming 41 million lives annually. This staggering impact has heightened the focus on preventive healthcare as a vital strategy to reduce the burden of these conditions. Carnitine supplements play a significant role in this preventive approach by supporting metabolic function, improving energy production, enhancing cardiovascular health, and aiding in weight management—factors critical in managing chronic disease risk.

In response to the growing trend of preventive healthcare, companies are launching specialized carnitine supplements that support energy production and fat metabolism to enhance physical fitness and overall health. For instance, in September 2022, Modicare launched Well Sports L-Carnitine, designed to meet pre-workout energy needs by converting stored fat into energy. This product caters to fitness enthusiasts looking for effective workout supplements.

Healthcare professionals and wellness experts increasingly endorse carnitine in preventive health plans, boosting consumer trust and usage. The rise of personalized health approaches and data-driven supplementation further supports targeted carnitine use for its proven benefits.

Regulatory Challenges

The carnitine supplements market faces significant regulatory challenges due to varying global standards governing formulation, labeling, and marketing. In the US, carnitine is classified under dietary supplements and regulated by the FDA through DSHEA, while the EU imposes stricter controls under its Food Supplements Directive, requiring scientific substantiation for health claims. This lack of harmonization complicates cross-border operations, delays product approvals for novel applications, and increases compliance costs for manufacturers seeking to expand internationally.

Additionally, the sector is under growing scrutiny for product quality, safety, and truthful marketing. Regulators in key markets are tightening oversight on Good Manufacturing Practices (GMP), raw material purity, and contamination risks, while imposing restrictions on unsubstantiated health claims. These regulatory hurdles demand that companies invest in rigorous quality control systems and transparent labeling strategies to safeguard brand reputation and ensure sustained market access.

Segment Analysis

The global carnitine supplements market is segmented based on type, product grade, source, flavors, form, application, distribution channel and region.

Liquid L-Carnitine Demand Accelerates Amid Rising Wellness and Fitness Trends

The demand for liquid-form carnitine supplements in the global market is growing steadily, driven by increasing consumer preference for faster absorption, ease of consumption, and convenience. Unlike tablets or capsules, liquid L-carnitine is often favored by athletes, fitness enthusiasts, and individuals with digestive issues due to its rapid bioavailability and customizable dosage. According to data from the US National Institutes of Health (NIH), L-carnitine plays a critical role in transporting long-chain fatty acids into the mitochondria for energy production. This function has made it a popular supplement in the sports nutrition and weight management categories. The US Food and Drug Administration (FDA) classifies L-carnitine as a dietary supplement, and its liquid forms are commonly available in dosages ranging from 500 mg to 3,000 mg per serving.

In countries like the US, Canada, Germany, and Japan, liquid formulations are experiencing rising sales due to increased participation in fitness and wellness activities. For example, US Census Bureau data (2024) shows that health and fitness club memberships have grown to over 66 million Americans, a trend that aligns with increasing demand for fast-acting, pre-workout liquid supplements like L-carnitine.In Asia-Pacific, especially in Japan and South Korea, the liquid format is popular among older adults and women, as it is perceived as easier to consume and digest. Government nutrition promotion programs in these countries often encourage bioavailable formats for elderly supplementation.

In 2022, Applied Nutrition, a UK-based sports nutrition company has announced the launch of its new L-Carnitine sports drink. Carni-Tone is the company’s first flavored spring water and adds to the company’s portfolio of ready-to-drink (RTD) products.

Geographical Penetration

North American Carnitine Supplement Demand Surges on Health, Fitness, and Aging Trends

The demand for carnitine supplements in North America has seen a significant increase in recent years, driven by rising health awareness, the popularity of fitness lifestyles, and the growing aging population. In the US and Canada, carnitine supplements, particularly in L-carnitine form, are widely used for weight management, athletic performance, and cardiovascular support.

According to the US National Institutes of Health (NIH), L-carnitine is essential for energy production and fat metabolism, making it a popular ingredient in sports nutrition products. A growing number of consumers are incorporating L-carnitine into pre-workout regimens to enhance endurance and fat oxidation. This is supported by data from the US Department of Health and Human Services, which reported that over 50% of US adults engage in moderate-to-vigorous physical activity weekly, a behavior closely linked to supplement use.

The Centers for Disease Control and Prevention (CDC) also notes that obesity remains a major public health concern, affecting over 41.9% of US adults as of 2023. This has further boosted interest in fat-burning supplements like carnitine, especially in liquid and capsule formats, which are often marketed for weight loss and metabolism enhancement. In Canada, data from Statistics Canada shows that approximately 27% of Canadian adults are obese, and nearly 60% use natural health products, including dietary supplements like L-carnitine.

Furthermore, carnitine is commonly recommended in North America by health practitioners for specific populations, such as vegans, vegetarians, and the elderly, due to its role in muscle function and mitochondrial health. This has helped expand the user base beyond athletes to include wellness-focused individuals and older adults.

Consumer Analysis

Consumer analysis for the carnitine supplements market focuses on understanding the preferences, behaviors, and demographic factors driving demand—particularly for health, fitness, and therapeutic use. Carnitine, a naturally occurring compound synthesized in the liver and kidneys, plays a crucial role in energy metabolism by transporting fatty acids into mitochondria. Supplements are widely used for weight management, sports performance, cardiovascular support, and even neurological health.

A key demographic is young adults (18–35 years) who are fitness-focused. According to the US Department of Health and Human Services (HHS), as of 2023, around 25% of US adults engage in high levels of leisure-time physical activity, and this group is more likely to use performance-enhancing supplements like carnitine. Among older adults (50+), interest in carnitine is linked to its potential role in age-related fatigue and heart health, supported by NIH’s Office of Dietary Supplements (ODS), which notes carnitine may benefit individuals with cardiovascular conditions.

The 2020–2025 Dietary Guidelines for Americans emphasize personalized nutrition and increased awareness of nutrient adequacy, fueling consumer interest in supplementation. Though not officially recommended for general population use, carnitine supplements are often used off-label to support energy in individuals with dietary restrictions (e.g., vegans), as carnitine is mostly found in animal products.

In Europe, the European Food Safety Authority (EFSA) has authorized certain health claims related to L-carnitine, particularly in energy metabolism, though still under tight regulatory oversight to prevent misleading advertising. In the US, the FDA classifies L-carnitine as a dietary ingredient and monitors labeling through the Dietary Supplement Health and Education Act (DSHEA) of 1994, requiring companies to avoid unsubstantiated health claims.

Competitive Landscape

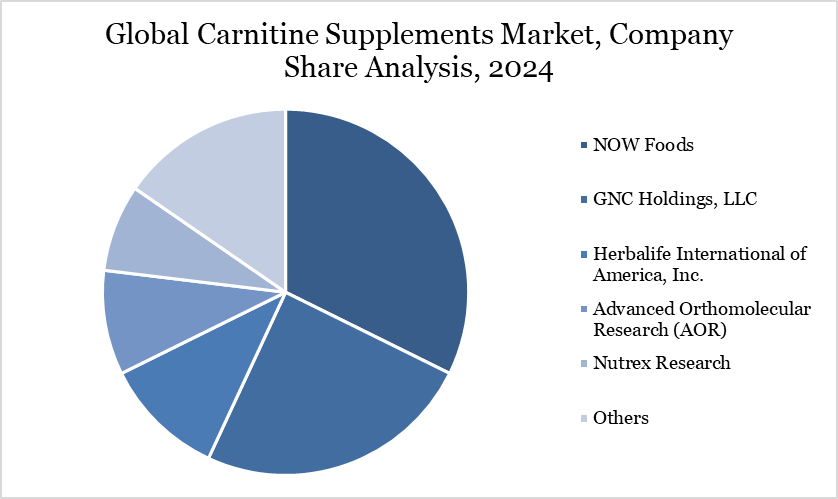

The major global players in the market include NOW Foods, GNC Holdings, LLC, Herbalife International of America, Inc., Advanced Orthomolecular Research (AOR), Nutrex Research, Scorpion Supplements, Allmax Nutrition, Designs for Health, Inc., Ceva Animal Health Pty Ltd and Abbott Laboratories Limited.

Key Developments

In January 2025, Java Burn launched a new natural health supplement designed to enhance wellness by blending seamlessly with daily coffee routines. The product features a science-backed formula including L-Carnitine, green tea extract, and other ingredients that boost metabolism and energy.

In September 2022, Modicare launched Well Sports L-Carnitine, designed to meet pre-workout energy needs by converting stored fat into energy. This product caters to fitness enthusiasts looking for effective workout supplements.