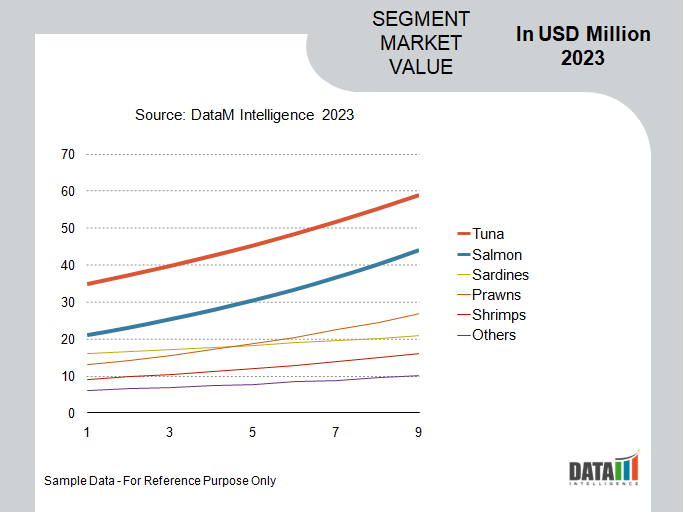

Canned Seafood Market is segmented By Type (Tuna, Salmon, Sardines, Prawns, Shrimps, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Sales, Others), and By Region (North America, Europe, South America, Asia Pacific, Middle East, And Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Canned Seafood Market Size

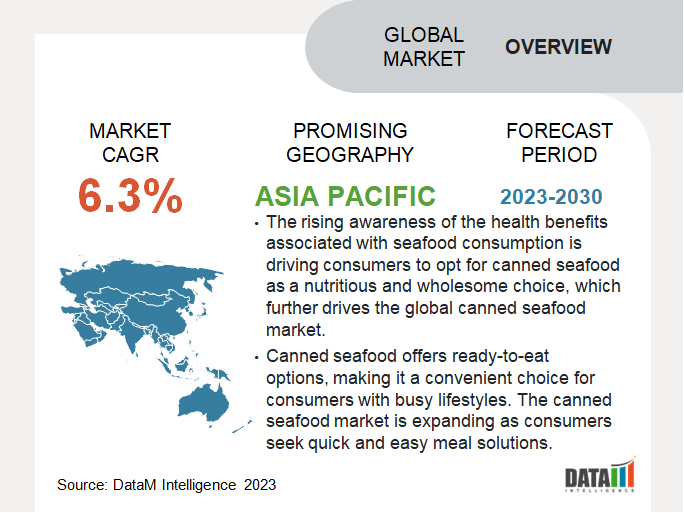

Canned Seafood Market reached USD 25.3 billion in 2022 and is expected to reach USD 35.9 billion by 2030 growing with a CAGR of 4.5% during the forecast period 2024-2031. The convenience factor associated with canned seafood products is a significant driver of the canned seafood market's growth.

Canned seafood offers ready-to-eat options, making it a convenient choice for consumers with busy lifestyles. As consumers seek quick and easy meal solutions, the market for canned seafood expands.

With increasing concerns about overfishing and environmental sustainability, consumers are actively seeking sustainably sourced seafood products. Many canned seafood manufacturers are emphasizing sustainable fishing practices, attracting eco-conscious consumers, and fostering canned seafood market growth.

Market Summary

| Metrics | Details |

| CAGR | 4.5% |

| Size Available for Years | 2021-2030 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

| Largest Region | Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis, and Other key Insights. |

For More Insights Request Free Sample

Market Dynamics

Growing Consumer Awareness About the Health Benefits of Seafood Drives Market Growth

The demand for canned seafood products is on the rise as consumers become more health-conscious and seek nutritious food options. Seafood is enriched with essential nutrients to promote heart health, brain function, and overall well-being. The global health and wellness trend is driving consumers to opt for healthier and more natural food options. Canned seafood aligns with this trend, as it provides a minimally processed and preservative-free source of nutritious protein.

Canning seafood extends its shelf life, allowing consumers to stock up on their favorite products. The longer shelf life makes canned seafood a practical choice for households and contributes to repeat purchases, boosting the market. Manufacturers are continuously innovating and introducing new canned seafood products with different flavors, recipes, and ingredients. This product diversification caters to varying consumer preferences, expanding the market and attracting a broader customer base.

For instance, on March 2, 2023, Thai Union's renowned canned fish brand, John West, introduced a plant-based tuna analog to the market. This innovative product, tailored to meet the surging demand for plant-based seafood and fish-free alternatives, is available for retail in the Netherlands and beyond. By expanding its product portfolio to include a plant-based option, John West addresses the evolving preferences of consumers seeking sustainable and ethical seafood choices.

Rising Demand for Ready-to-Eat Foods Drive Market Growth

Canned seafood offers a time-saving solution for consumers, it requires minimal preparation and can be consumed straight from the can. The busy lives of modern consumers are leading to a growing demand for canned seafood products along with the need for quick meal solutions, which further drives market growth.

Canned seafood is safe to consume for an extended period for consumers looking for long-lasting food items. Canned seafood products are widely available in various retail channels, including supermarkets, grocery stores, and online platforms. This widespread accessibility ensures that consumers can easily purchase canned seafood products, contributing to the expansion of the canned seafood market.

Environmental Concerns Surrounding Canned Seafood Hamper the Market Growth

Consumers are becoming conscious of the environmental impact of fishing practices and their effect on marine ecosystems. Overfishing and unsustainable fishing practices can lead to depleted fish populations, which result in reduced availability and variety of seafood products in the market.

Canned seafood products often come in metal cans, but the secondary cans contribute to plastic waste. The canned seafood market's dependence on plastic packaging is perceived negatively by environmentally conscious consumers, leading them to seek more sustainable alternatives and restraining market growth.

Market Segmentation Analysis

The global canned seafood market is segmented based on type, distribution channel, and region.

Increasing Demand for Nutritional Tuna

Tuna holds the highest share of the global canned seafood market. Tuna is one of the most abundant and widely distributed fish species globally. Its availability in various oceans and seas allows for a steady supply to meet the demand of the canned seafood market. Tuna is a popular choice among consumers due to its mild taste and versatile culinary applications, which contribute to its dominant position in the canned seafood market.

Tuna's enriched nutritional profile aligns with the growing consumer focus on healthier food options, driving demand for canned tuna products. Manufacturers offer a wide range of canned tuna products, including various types and processing methods. This product diversification caters to different consumer preferences and increases its market share.

For instance, on January 10, 2023, Food technology startup Vgarden, Ltd. launched fish-free, canned tuna to its line of private-label meat and dairy alternatives. The tuna, derived from pea protein, was designed to offer a sustainable, vegan alternative that mimics canned versions of the world’s most popular fish.

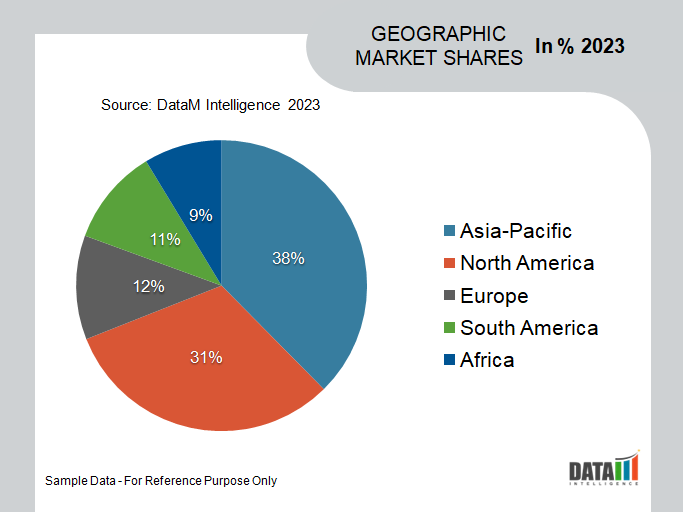

Market Geographical Share

Increasing Exports and Adoption of Canned Seafood in Asia Pacific

In 2022, the Asia Pacific region emerged as the largest contributor to the global canned seafood market. The region's remarkable growth is attributable to the increasing adoption of canned seafood products, driven by a combination of factors. The Asia region benefits from a substantial abundance of raw materials, fostering a thriving aquaculture industry. This abundance of seafood resources provides a solid foundation for the production of canned seafood products, meeting both domestic and international demands.

India, as a prominent player in the region, is playing a vital role in boosting the canned seafood market. According to the Marine Products Export Development Authority (MPEDA), India achieved impressive exports, shipping 12.8 lakh metric tons of seafood worth USD 6.68 billion in 2019. Projections indicate a robust growth rate of 12.6% by the end of 2032, reflecting the country's strong potential in the industry.

Canned Seafood Companies

The global canned seafood market players include Ingredion, StarKist Co., Nippon Suisan Kaisha, Ltd, Maruha Nichiro Corporation, Icicle Seafoods Inc., LDH (La Doria) Ltd, Wild Planet Foods, Thai Union Frozen Products, American Tuna, Inc., Universal Canning, Inc., Tri Marine Group, and Trident Seafoods Corporation.

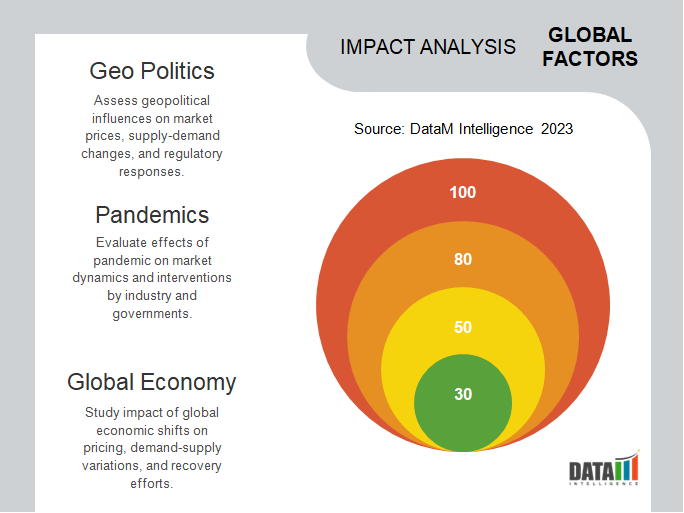

COVID-19 Impact on Market

During the early stages of the pandemic, travel restrictions and lockdown measures disrupted the supply chain for canned seafood. This resulted in transportation delays, labor shortages, and challenges in sourcing raw materials, affecting overall canned seafood market availability.

However, as consumers prioritized essential items and non-perishable food products, there was a shift in preferences toward canned seafood, which offered a longer shelf life and easy storage. This increased demand for shelf-stable products influenced the dynamics of the canned seafood market.

Key Developments

- In May 2021, Nippon Suisan (Europe) B.V., a wholly-owned subsidiary of Nippon Suisan Kaisha Ltd., acquired a significant 75% stake in the esteemed U.K. seafood company, Three Oceans Fish Company Limited. This strategic acquisition aims to bolster Nissui's presence in the U.K.'s coated fish market while fostering collaboration with Caistor Seafoods to maximize business opportunities.

- In May 2021, Thai Union Group completed its acquisition of full ownership of Rügen Fisch, a prominent German manufacturer specializing in shelf-stable seafood products. This acquisition marks a significant milestone for the Thailand-based seafood giant, as it had previously acquired a majority, 51% stake in Rügen Fisch.

- In August 2020, Thai Union Group PCL agreed to acquire the remaining equity stake in Red Lobster Seafood Co. from Golden Gate Capital. With this acquisition, Thai Union Group strengthens its position in the seafood industry and gained full ownership of Red Lobster. Despite the ownership change, Red Lobster will continue to operate from its current headquarters in Orlando, ensuring business continuity and stability.

Why Purchase the Report?

- To visualize the global canned seafood market segmentation based on type, distribution channel, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of the canned seafood market level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global canned seafood market report would provide approximately 53 tables, 51 figures, and 103 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies