Global Cancer Biomarker Testing Market – Industry Trends & Outlook

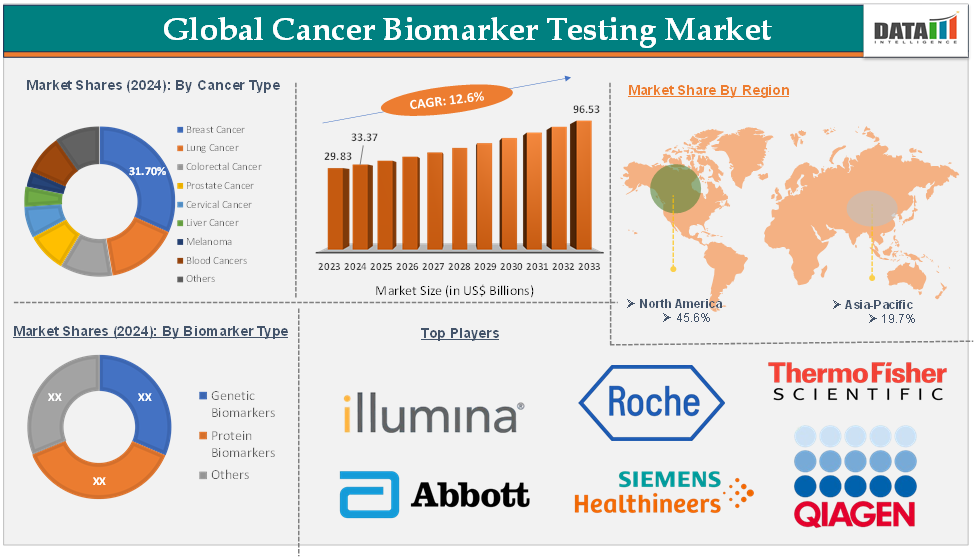

The global cancer biomarker testing market was valued at US$ 29.83 Billion in 2023. The market size reached US$ 33.37 Billion in 2024 and is expected to reach US$ 96.53 Billion by 2033, growing at a CAGR of 12.6% during the forecast period 2025-2033.

The global cancer biomarker testing market is primarily driven by the rising prevalence of cancer worldwide, which increases the need for early detection and personalized treatment. Advancements in diagnostic technologies like next-generation sequencing (NGS), liquid biopsies, and AI-powered analytics have made testing more accurate, accessible, and cost-effective, further fueling adoption.

A major trend is the shift toward personalized medicine, where biomarker testing tailors therapy to individual patient profiles, improving outcomes and reducing unnecessary treatments. Liquid biopsy technology is gaining traction as a non-invasive, real-time monitoring tool, and the integration of multi-omics data (genomics, proteomics, metabolomics) is enhancing diagnostic precision. T

Opportunities abound in the development of novel biomarkers, including non-coding RNAs and multiplex panels, that enable earlier detection and more targeted therapies. Emerging markets in Asia-Pacific, Latin America, the Middle East & and Africa offer significant potential, driven by expanding healthcare infrastructure, increasing patient populations, and greater awareness.

Global Cancer Biomarker Testing Market – Executive Summary

Global Cancer Biomarker Testing Market Dynamics: Drivers

Emergence of multi-omics and AI-driven diagnostics

The emergence of multi-omics and AI-driven diagnostics is a powerful driver for the global cancer biomarker testing market, fundamentally transforming how cancer is detected, diagnosed, and managed. Multi-omics integrates data from genomics, transcriptomics, proteomics, and metabolomics, providing a comprehensive and detailed view of cancer biology that single-omics approaches cannot achieve. This integration significantly improves the sensitivity and specificity of early cancer diagnostics, enabling the identification of new biomarkers, especially for cancers that currently lack effective screening methods.

For instance, in May 2025, BioMark Diagnostics Inc. announced the publication of a groundbreaking study on the use of artificial intelligence (AI) in lung cancer diagnosis. The research, titled “M-GNN: A Graph Neural Network Framework for Lung Cancer Detection Using Metabolomics and Heterogeneous Graph Modeling,” appears in the International Journal of Molecular Sciences’ special issue on Machine Learning in Bioinformatics and Biomedicine.

Similarly, in April 2025, 1Cell.Ai’s launch of OncoIncytes represents a major advancement in cancer diagnostics by leveraging a multi-omics approach, the integration of multiple molecular data types (such as genomics, transcriptomics, proteomics, and metabolomics) to provide a comprehensive, precise, and actionable profile of a patient’s cancer.

Also, in August 2024, io9’s AI-powered cancer biomarker test, specifically the DeepHRD model, demonstrated superior performance compared to traditional next-generation sequencing (NGS) and FDA-approved homologous recombination deficiency (HRD) diagnostics in recent study data. This innovation is likely to accelerate the adoption of AI and multi-omics in cancer biomarker testing, raising the standard for the entire industry.

Global Cancer Biomarker Testing Market Dynamics: Restraints

High cost of biomarker tests and drug development

The high cost of biomarker tests and drug development is a significant restraint on the global cancer biomarker testing market. Advanced biomarker tests often rely on cutting-edge technologies like next-generation sequencing (NGS), multiplex assays, and specialized laboratory equipment, all of which require substantial investment in both infrastructure and highly trained personnel.

This makes the tests expensive to perform and limits their accessibility, especially in low- and middle-income countries where healthcare budgets are constrained and traditional pathology remains the primary diagnostic option. Additionally, the costs involved in developing new biomarker tests and companion diagnostics are rising steadily, with research and development requiring significant funding and time.

Pharmaceutical and diagnostic companies face high expenses not only for discovery and validation but also for regulatory approval and market launch. These costs are often passed on to healthcare providers and patients, further limiting widespread adoption.

Global Automated Ophthalmic Perimeters Market Dynamics: Opportunities

Development of novel biomarkers

Development of novel biomarkers represents a major opportunity for the global cancer biomarker testing market by enabling earlier, more accurate, and more personalized cancer management. Novel biomarkers discovered through advances in genomics, proteomics, and metabolomics provide deeper insight into tumor biology, allowing for the identification of specific molecular features unique to different cancer types and even to individual patients. This facilitates early detection, which is critical for improving patient outcomes, as cancers found at an early stage are generally more treatable.

New biomarkers such as tumor mutation burden (TMB), microsatellite instability (MSI), and tumor-infiltrating lymphocytes (TILs) are being actively investigated in clinical studies to refine diagnostics and guide therapy selection. For instance, in April 2025, Artera, a leader in multimodal artificial intelligence (MMAI)-based cancer prognostic and predictive testing, announced an exclusive collaboration with Tempus, a technology company at the forefront of AI-driven precision medicine. Together, they will work to expand access to the ArteraAI Prostate Test, a cutting-edge tool for prostate cancer risk stratification.

The development of novel biomarkers also underpins the personalization of cancer treatment. By identifying which patients are likely to respond to specific therapies, clinicians can tailor treatments, thereby minimizing unnecessary interventions and reducing adverse effects. This personalized approach is increasingly important as new targeted therapies and immunotherapies enter the market.

For more details on this report, Request for Sample

Global Cancer Biomarker Testing Market - Segment Analysis

The global cancer biomarker testing market is segmented based on biomarker type, technology, product type, application, cancer type, end-user, and region.

Cancer Type:

The breast cancer segment in the cancer biomarker testing market was valued at US$ 10.58 Billion in 2024

Cancer biomarkers are defined as biological molecules such as proteins, genes (notably HER2, ER, PR, and Ki-67), or other substances found in blood, tissues, or body fluids that signal the presence or progression of breast cancer.

The growth of this segment is driven by several factors, including the high and rising prevalence of breast cancer globally. Breast cancer is the most frequently diagnosed cancer among women in the U.S., accounting for roughly 32% of all new cancer cases in women each year. In 2025, it is estimated that 316,950 women will be diagnosed with invasive breast cancer, along with an additional 59,080 cases of non-invasive ductal carcinoma in situ (DCIS). Notably, about 16% of women diagnosed with breast cancer are under the age of 50.

Technological advancements are significantly driving the breast cancer segment, with innovations such as next-generation sequencing, digital pathology, liquid biopsy, and multiplexed molecular assays. These technologies allow for earlier, more accurate, and less invasive detection of critical breast cancer biomarkers like HER2, ER, PR, and Ki-67, greatly improving diagnostic precision and patient care.

For instance, in December 2024, PathAI launched the AIM-IHC Breast Panel, a suite of advanced AI-powered algorithms designed to help pathologists accurately and consistently quantify key breast cancer biomarkers: HER2, ER, PR, and Ki-67. These biomarkers are essential for diagnosing breast cancer, determining its subtype, and guiding treatment decisions.

Also, in April 2024, Bio-Rad Laboratories introduced the ddPLEX ESR1 Mutation Detection Kit, its first ultrasensitive, multiplexed digital PCR assay tailored for breast cancer mutation detection in clinical research. This innovative kit enables researchers to simultaneously identify, distinguish, and accurately quantify seven important mutations in the ESR1 gene, a gene associated with resistance to hormone therapies in the breast cancer market.

Global Cancer Biomarker Testing Market – Geographical Analysis

The North America cancer biomarker testing market was valued at US$ 15.22 Billion in 2024

Rising cancer incidence remains the most significant driver, with the US, about 16% of women with breast cancer are younger than 50, which underscores the importance of early and accessible diagnostic tools for a broader age range, not just older women. Additionally, with approximately 66% of breast cancer cases diagnosed at a localized stage before the cancer has spread, biomarker testing plays a crucial role in early detection and precise diagnosis.

The US cancer biomarker testing market was valued at US$ 12.20 Billion in 2024

The integration of biomarkers into clinical trials and the expansion of companion diagnostics are fueling the shift toward precision oncology, enabling clinicians to match patients with the most effective therapies based on their unique biomarker profiles. Technological innovation is another major catalyst. North America leads in the adoption of advanced diagnostic solutions, including next-generation sequencing, digital pathology, liquid biopsy, multiplex molecular assays, and AI-powered imaging systems.

For instance, in August 2024, Illumina, Inc., a global leader in DNA sequencing technologies, received FDA approval for its TruSight Oncology (TSO) Comprehensive test, a major advance in cancer diagnostics. This in vitro diagnostic (IVD) test is the first FDA-approved, distributable comprehensive genomic profiling kit with pan-cancer companion diagnostic claims in the United States.

Also, in September 2024, Roche significantly expanded its digital pathology platform by integrating more than 20 advanced artificial intelligence (AI) algorithms from eight new collaborators into its open environment. This strategic move is designed to bring a wide array of innovative AI-based pathology tools together, allowing pathologists and scientists to analyze digital images of tissue samples with greater speed and accuracy.

Thus, the above factors are consolidating the region's position as a dominant force in the global cancer biomarker testing market.

Asia-Pacific cancer biomarker testing market was valued at US$ 6.57 Billion in 2024

The region is witnessing a significant increase in cancer incidence, especially in populous countries like China, India, and Japan. The growing number of cancer cases directly increases the demand for early detection and precision therapy products, boosting the need for biomarker testing.

The Japan cancer biomarker testing market was valued at US$ 1.16 Billion in 2024

Governments across Asia-Pacific are prioritizing cancer care, investing in healthcare infrastructure, and supporting biotechnology advancements. These efforts include funding for drug discovery, establishing research centers, and launching national precision medicine initiatives, which together accelerate biomarker adoption.

Rapid advances in diagnostic technologies such as next-generation sequencing (NGS), liquid biopsies, and AI-driven data analytics are making cancer biomarker testing more accurate, accessible, and cost-effective. Local diagnostic companies are innovating quickly, and global firms are entering the market through joint ventures and alliances.

There is a rising demand for personalized medicine and companion diagnostics in oncology care. Biomarker testing enables tailored treatment plans, improving patient outcomes and driving market growth. Biomarker testing is expanding beyond traditional uses to include immunotherapy, minimal residual disease monitoring, and multi-cancer early detection. This broadening scope increases the relevance and adoption of biomarker tests.

For instance, in April 2025, A Bengaluru-based laboratory, in partnership with the LuNGS Alliance, launched a program offering free next-generation sequencing (NGS) biomarker testing for lung cancer patients across India. This initiative is led by the Cancer Research and Statistics Foundation (CRSF) and supported by major pharmaceutical companies AstraZeneca, Pfizer, and Roche, with 4baseCare as the laboratory partner. Thus, the above factors are consolidating the region's position as a dominant force in the global cancer biomarker testing market.

Global Cancer Biomarker Testing Market – Competitive Landscape

The major global players in the cancer biomarker testing market include Illumina, Inc., F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific Inc., Abbott, QIAGEN, Siemens Healthineers AG, Bio-Rad Laboratories, Inc., Agilent Technologies, BioMérieux, and Foundation Medicine, Inc., among others.

Global Cancer Biomarker Testing Market – Key Developments

In May 2025, Cizzle Bio, Inc., a biotechnology company specializing in innovative cancer diagnostics, agreed with Doctors Hospital in the Cayman Islands to provide its advanced blood-based tests for early cancer detection. Specifically, the hospital’s clinical laboratory will now offer Cizzle Bio’s CIZ1B lung cancer test and DEX-G2 gastric cancer test.

In February 2025, Imagene, a company specializing in artificial intelligence (AI) solutions for oncology, announced a collaboration with Tempus AI, Inc., a technology leader in AI-driven precision medicine. The goal of this partnership is to advance cancer diagnostics by leveraging the strengths of both companies in AI and clinical data.

Global Cancer Biomarker Testing Market – Scope

Metrics | Details | |

CAGR | 12.6% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Biomarker Type | Genetic Biomarkers, Protein Biomarkers, Others |

Technology | Omics Technologies, Imaging Technologies, Immunoassays Next-Generation Sequencing (NGS), PCR-based Techniques, Others | |

Product Type | Instruments, Consumables, Software | |

Application | Diagnostics, Drug Discovery and Development, Therapy Prediction and Monitoring, Personalized and Precision Medicine, Others | |

Cancer Type | Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, Cervical Cancer, Liver Cancer, Melanoma, Blood Cancers, Others | |

End-User | Hospitals, Diagnostic Laboratories, Biopharmaceutical and Biotechnology Companies, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

DMI Insights:

Our research indicates that the market for cancer biomarker testing is expected to expand at a compound annual growth rate (CAGR) of 12.6% from 2025 to 2033.

The global cancer biomarker testing market is growing quickly due to rising cancer cases and demand for earlier, more precise, and less invasive diagnostics. Technological advances and AI are boosting test accuracy, while emerging markets and companion diagnostics fuel further growth, making biomarker testing vital for the future of personalized cancer care.

The global cancer biomarker testing market report delivers a detailed analysis with 86 key tables, more than 94 visually impactful figures, and 173 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here