Bispecific T-cell Engagers (BiTEs) Market Size & Industry Outlook

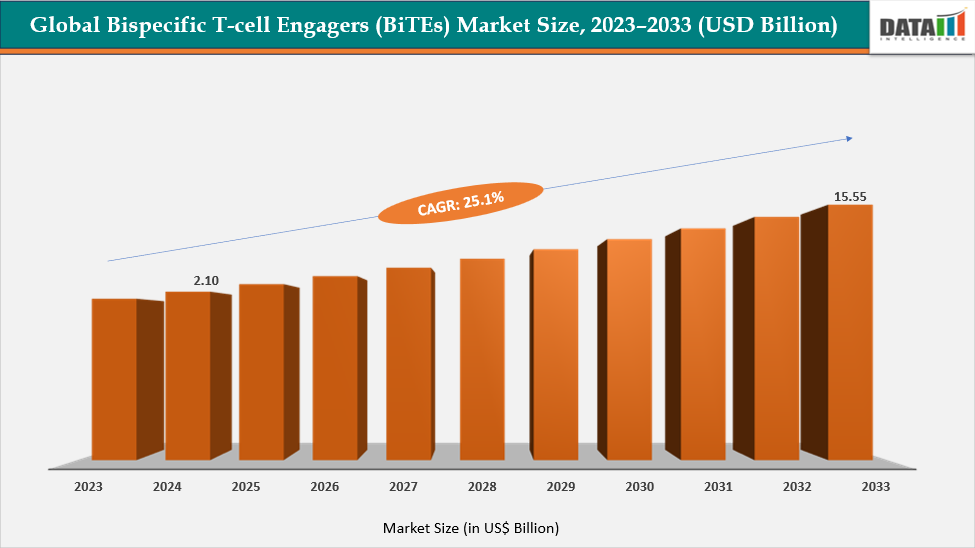

The global Bispecific T-cell Engagers (BiTEs) market size reached US$ 2.10 Billion in 2024 from US$ 1.68 Billion in 2023 and is expected to reach US$ 15.55 Billion by 2033, growing at a CAGR of 25.1% during the forecast period 2025-2033. The market is expanding rapidly, driven by the rising prevalence of hematologic and solid tumors, coupled with the increasing adoption of next-generation immuno-oncology therapies. BiTEs represent a major advancement in cancer treatment by directly engaging cytotoxic T cells to target tumor-associated antigens, resulting in high efficacy and lower off-target toxicity compared to traditional therapies.

Several factors are fueling this growth trajectory. The strong clinical success of approved products such as Blincyto® (Amgen) and the launch of next-generation BiTEs like tarlatamab (Imdelltra) have validated the therapeutic potential of this class, encouraging further R&D investments. Expanding clinical pipelines targeting novel antigens (e.g., DLL3, PSMA, HER2) and the development of half-life–extended BiTE formats are widening the applicability of the technology beyond hematologic cancers into solid tumors. Moreover, favorable regulatory support, increasing strategic collaborations between biotech firms and large pharmaceutical companies, and advancements in antibody engineering are accelerating product commercialization and manufacturing scalability.

Additionally, the growing focus on personalized medicine, rising cancer incidence worldwide, and improved reimbursement frameworks in major markets such as the U.S. and Europe are contributing to market momentum. As key players expand their pipelines and new entrants bring innovative BiTE constructs, the global market is expected to experience sustained double-digit growth, transforming the oncology therapeutics landscape over the forecast period.

Key Market Highlights

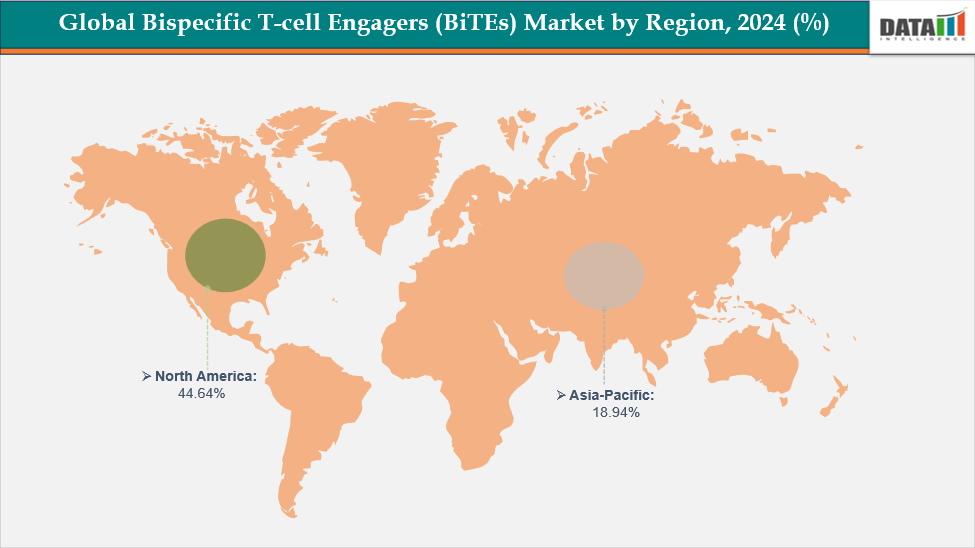

- North America dominates the Bispecific T-cell Engagers (BiTEs) market with the largest revenue share of 44.64% in 2024.

- The Asia Pacific is the fastest-growing region and is expected to grow at the fastest CAGR of 27.83% over the forecast period.

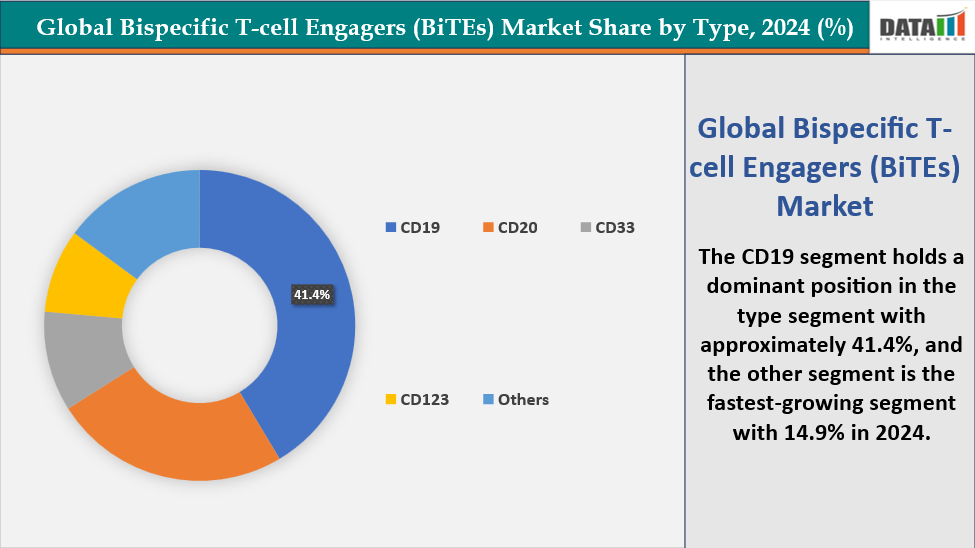

- Based on the type, the CD19 segment led the market with the largest revenue share of 41.4% in 2024.

- The major market players in the Bispecific T-cell Engagers (BiTEs) market are Amgen Inc., F. Hoffmann‑La Roche Ltd., Regeneron Pharmaceuticals, Inc., Genmab, MacroGenics, Inc., Xencor, Inc., Pfizer Inc., Johnson & Johnson, AbbVie Inc., Takeda Pharmaceutical Company Ltd., among others

Market Dynamics

Drivers: The Rising Prevalence of Cancer Worldwide is significantly driving the Bispecific T-cell Engagers (BiTEs) market growth

The global burden of cancer is increasing at a marked pace, driven largely by population ageing, growth, and shifting exposure to risk factors. According to recent estimates from the International Agency for Research on Cancer (IARC) via the World Health Organization (WHO), there were approximately 20 million new cancer cases worldwide in 2022, with nearly 9.7 million deaths. The numbers exclude non-melanoma skin cancers and reflect only the best available data. Projections indicate that by 2050, the annual new cancer cases could reach 35 million or more, representing an increase of roughly 75 % to 80 % from 2022 levels. In addition to sheer case volume growth, the distribution is shifting: lower- and middle-income countries are expected to see the sharpest proportional increases, due to demographic transition and rising prevalence of traditional and lifestyle-related risk factors.

This escalation in cancer incidence presents a strong structural growth driver for therapies such as bispecific T-cell engagers (BiTEs). As more patients become eligible for cancer immunotherapies and as healthcare systems worldwide adapt to the rising volume and complexity of oncology cases, demand for innovative, effective treatments is set to grow significantly.

Restraints: High Development Costs and Complex Manufacturing are hampering the growth of the market

The development of bispecific T-cell engagers (BiTEs) is hindered by exceptionally high research, clinical, and manufacturing expenses. Structurally, these molecules are far more complex than conventional monoclonal antibodies: they often require dual-antigen binding domains, non-natural linkers, engineered heavy- and light-chain pairings, and rigorous analytical controls to ensure correct assembly and functional stability.

The manufacturing process thus becomes cost-intensive: mammalian cell culture systems, high-end bioreactors, multi-step purification (often chromatography and filtration), extensive purification of mispaired and aggregated species, and stringent regulatory chemistry/manufacturing/controls (CMC) frameworks. As one market analysis put it, bispecific antibody production often requires substantial investment and results in a substantially higher cost of goods compared to standard antibodies.

A concrete example is the first-in-class BiTE, Blinatumomab (brand name Blincyto), developed by Amgen. At launch, Amgen set the annual treatment list price at approximately US $178,000. The company explicitly cited “the complexity of developing, manufacturing, and reliably supplying innovative biologic medicines” as part of the justification for this pricing.

The high financial and operational burden associated with engineering, manufacturing, and commercializing BiTE therapies significantly restrains the growth of the market by increasing cost-risk, limiting scalability, and reducing the affordability of these advanced therapeutics.

For more details on this report – Request for Sample

Bispecific T-cell Engagers (BiTEs) Market, Segmentation Analysis

The global Bispecific T-cell Engagers (BiTEs) market is segmented based on type, by target indication, by mechanism of action, by end user, and by region.

Type: The CD19 segment is dominating the Bispecific T-cell Engagers (BiTEs) market with a 41.4% share in 2024

The CD19 segment holds the largest share of 41.4% in the Bispecific T-cell Engagers (BiTEs) market in 2024, driven by its proven clinical efficacy and widespread adoption in treating B-cell malignancies, including acute lymphoblastic leukemia (ALL) and non-Hodgkin lymphoma (NHL). CD19 is a well-validated and consistently expressed antigen on B-cells, making it an ideal and reliable therapeutic target for T-cell redirecting therapies. The success of Amgen’s Blinatumomab (Blincyto®), the first FDA-approved BiTE targeting CD19 and CD3, has set a strong benchmark in this category, demonstrating high remission rates and durable responses in relapsed or refractory ALL patients. Furthermore, several pharmaceutical and biotech companies, including Regeneron, Genmab, and Johnson & Johnson, are actively developing next-generation CD19-directed bispecifics to enhance safety profiles and extend indications to broader hematologic malignancies. The extensive clinical pipeline, combined with robust efficacy data and established commercial infrastructure, reinforces CD19’s position as the dominant target in the global BiTEs market.

The Others segment is the fastest-growing in the Bispecific T-cell Engagers (BiTEs) market, with a 14.9% share in 2024

The Others segment, accounting for a 14.9% share in 2024, represents the fastest-growing category in the global Bispecific T-cell Engagers (BiTEs) market. This segment includes emerging targets such as BCMA, DLL3, PSMA, HER2, and EGFRvIII, which are expanding the therapeutic reach of BiTEs beyond hematologic malignancies into solid tumors and rare cancer types. The growing focus on these novel antigens stems from the unmet clinical need in treating aggressive and treatment-resistant cancers. Major pharmaceutical and biotech players, including Amgen, Regeneron, Roche, and Janssen Biotech, are investing heavily in R&D pipelines to develop BiTEs targeting these diverse antigens, aiming to improve tumor selectivity and minimize off-target toxicity. Additionally, advancements in next-generation BiTE engineering, such as half-life extension technologies and dual-targeting mechanisms, are enhancing therapeutic efficacy and expanding potential indications. As a result, the other segment is witnessing rapid clinical trial activity and strategic collaborations, positioning it as the most dynamic and promising growth area within the BiTEs market.

Bispecific T-cell Engagers (BiTEs) Market, Geographical Analysis

North America is expected to dominate the global Bispecific T-cell Engagers (BiTEs) market with a 44.64% in 2024

North America stands as the dominant region in the Bispecific T-cell Engagers (BiTEs) market, supported by its advanced biotechnology ecosystem, strong clinical infrastructure, and early adoption of innovative cancer immunotherapies. The region’s leadership is largely driven by the presence of major pharmaceutical and biotech companies such as Amgen, Regeneron Pharmaceuticals, Johnson & Johnson, and Pfizer, which are actively engaged in developing and commercializing BiTE-based therapies. The United States serves as the epicenter of BiTE research, with a high concentration of clinical trials, FDA approvals, and academic collaborations focused on next-generation bispecific antibody platforms. Moreover, favorable regulatory pathways, substantial healthcare expenditure, and robust reimbursement systems further facilitate rapid product development and commercialization. The rising incidence of hematologic cancers and growing patient awareness of advanced immunotherapies continue to sustain demand across the region. Collectively, these factors position North America as the leading and most mature market for Bispecific T-cell Engagers worldwide.

US Bispecific T-cell Engagers (BiTEs) Market Trends

The United States represents the largest and most advanced market for Bispecific T-cell Engagers (BiTEs), driven by rapid innovation in immuno-oncology, strong funding for cancer research, and early regulatory approvals. The U.S. Food and Drug Administration (FDA) has played a pivotal role in accelerating BiTE development through breakthrough therapy and orphan drug designations, enabling faster clinical translation of novel molecules. The success of Amgen’s Blinatumomab (Blincyto®), the first FDA-approved BiTE for relapsed or refractory acute lymphoblastic leukemia, established a strong commercial foundation for subsequent pipeline candidates targeting CD19, BCMA, and CD20 antigens.

Furthermore, an increasing number of clinical trials led by U.S.-based biotech firms and academic institutions are expanding BiTE applications to solid tumors, reflecting a shift toward broader oncology indications. The market also benefits from robust venture capital investment, strong intellectual property protection, and collaborations between pharmaceutical giants and emerging biotech startups. With a combination of scientific leadership, advanced healthcare infrastructure, and growing demand for targeted immunotherapies, the U.S. continues to set the global benchmark for BiTE innovation and commercialization.

The Europe region is the fastest-growing region in the global Bispecific T-cell Engagers (BiTEs) market, with a CAGR of 27.83% in 2024

Europe is emerging as the fastest-growing region in the global Bispecific T-cell Engagers (BiTEs) market, driven by expanding oncology research, strong government support for biologics development, and increasing participation in clinical trials. Countries such as Germany, the United Kingdom, France, and Switzerland are at the forefront of BiTE innovation, supported by world-class research institutions and a rapidly evolving biotech ecosystem. The European Medicines Agency (EMA) has shown growing openness to novel immunotherapy approvals, providing conditional marketing authorizations and accelerated assessment pathways for promising bispecific candidates.

Additionally, rising cancer prevalence across Europe, combined with growing adoption of targeted and personalized cancer therapies, is fueling market demand. Strategic collaborations between regional biotech firms and global pharmaceutical companies, such as partnerships involving Amgen, Roche, Genmab, and Novartis, are further stimulating product development and commercialization. As a result, Europe is witnessing a significant surge in R&D activity, regulatory approvals, and patient access to advanced immunotherapies, positioning it as the fastest-expanding BiTEs market worldwide.

Asia Pacific Bispecific T-cell Engagers (BiTEs) Market Trends

The Asia Pacific region is witnessing rapid growth in the Bispecific T-cell Engagers (BiTEs) market, driven by rising cancer incidence, expanding biotechnology capabilities, and increasing investment in immuno-oncology research. Countries such as China, Japan, South Korea, and India are strengthening their clinical and manufacturing infrastructure to support advanced biologic therapies. China, in particular, has emerged as a major innovation hub, with several domestic companies such as Innovent Biologics, Zai Lab, and Akeso Biopharma actively developing and commercializing BiTE-like bispecific antibodies for hematologic and solid tumor indications.

In Japan and South Korea, strong government initiatives supporting precision medicine and biotechnology R&D are further accelerating market adoption. Moreover, growing collaborations between global pharma leaders and regional biotech firms are facilitating technology transfer, clinical trial expansion, and faster regulatory approvals. Increasing healthcare expenditure, patient awareness, and demand for targeted therapies are reinforcing the region’s momentum. As a result, the Asia Pacific is becoming one of the most promising and strategically important markets for the future expansion of Bispecific T-cell Engager therapies.

Bispecific T-cell Engagers (BiTEs) Market Competitive Landscape

Top companies in the Bispecific T-cell Engagers (BiTEs) market include Amgen Inc., F. Hoffmann‑La Roche Ltd., Regeneron Pharmaceuticals, Inc., Genmab, MacroGenics, Inc., Xencor, Inc., Pfizer Inc., Johnson & Johnson, AbbVie Inc., Takeda Pharmaceutical Company Ltd., among others.

Market Scope

| Metrics | Details | |

| CAGR | 25.1% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | CD19, CD20, CD33, CD123, Others |

| Target Indication | Hematologic Malignancies, Solid Tumors | |

| Mechanism of Action | Dual Antibody-Based BiTEs, Single-Chain Variable Fragment (scFv)-Based BiTE, Next-Generation BiTEs (Half-life extended, trispecific, or modular BiTEs) | |

| End User | Hospitals, Specialty Cancer Clinics, Research and Academic Institutes, Biotechnology & Pharmaceutical Companies | |

| Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global Bispecific T-cell Engagers (BiTEs) market report delivers a detailed analysis with 70 key tables, more than 63 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals-related reports, please click here