Biopolymers Market Size

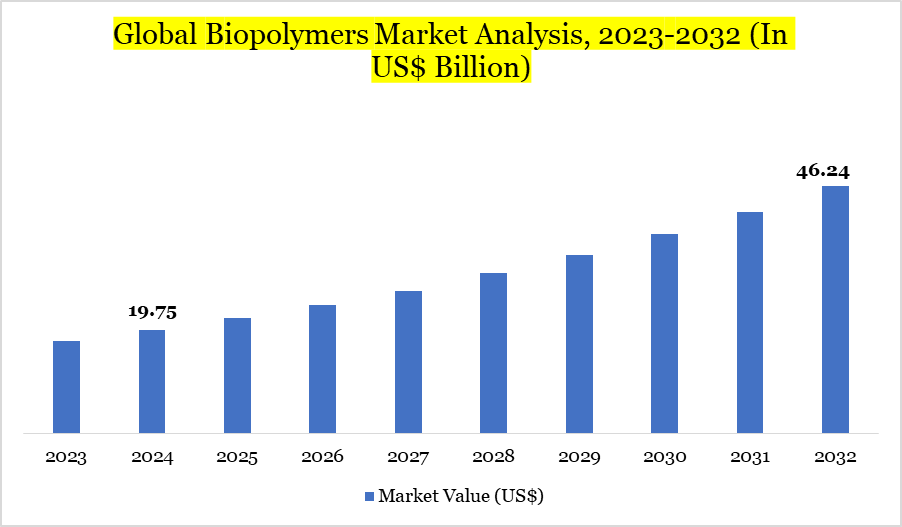

Biopolymers Market size reached US$ 19.75 billion in 2024 and is expected to reach US$ 46.24 billion by 2032, growing with a CAGR of 11.22% during the forecast period 2025-2032.

The biopolymer industry is experiencing significant expansion due to increasing global sustainability demands. Biopolymers, sourced from renewable materials including corn, sugarcane, residual wood, and agricultural biomass, provide an environmentally sustainable alternative to petrochemical plastics.

These biodegradable materials mitigate critical environmental challenges such as plastic pollution and global warming, facilitating their use across various sectors, including biomedical, food, and pharmaceuticals. The increasing demand for polyhydroxyalkanoates (PHA)-based biopolymers, which facilitate wound healing and exhibit superior recovery properties, substantially drives market expansion.

Moreover, with 78 million tons of single-use plastic packaging produced each year and with 2% being successfully recycled, environmental issues have reached a crucial juncture. This has prompted manufacturers, regulators, and major brands to invest in recyclable and biodegradable packaging alternatives. The increasing consumer demand for sustainable options, together with advancing governmental frameworks, is poised to bolster the growth trajectory of the biopolymer market

Biopolymers Market Trend

A significant trend transforming the biopolymer market is the increasing need for sustainable packaging across many industries. As environmental consciousness rises, manufacturers are shifting from conventional plastics to biodegradable substitutes. This transition is particularly apparent in packaging applications, where biopolymers offer end-of-life adaptability and substantially diminish environmental impacts.

Innovations like seaweed-based packaging from Indonesia's Evoware exemplify regional progress in accordance with global sustainability goals. Biopolymers are increasingly being utilized in biomedical applications owing to their inherent healing qualities. The strategic partnership between Mitsubishi Chemical Holding Corporation and Lenovo Group to manufacture bioplastic smartphone components exemplifies the growing incorporation of bio-based solutions into conventional industries.

Moreover, governmental initiatives prohibiting single-use plastics and promoting natural packaging alternatives are enhancing market preparedness. These advancements jointly establish biopolymers as essential facilitators of a circular economy, bolstered by consumers' increasing dedication to minimizing carbon footprints.

For more details on this report – Request for Sample

Market Scope

| Metrics | Details |

| By Product | Bio-PE, Bio-PET, PLA, PHA, Biodegradable Plastics, Other |

| By Application | Films, Bottle, Fibers, Seed Coating, Vehicle Components, Medical Implants, Other |

| By End-user | Food & Beverage, Pharmaceutical & Medical, Cosmetics, Agriculture, Industrial, Other |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Biopolymers Market Dynamics

Regulatory Influence and Consumer Cognizance Surge in Power Demand

The increasing environmental awareness among consumers and the escalating government regulations are serving as dual catalysts for the expansion of the biopolymer industry. The growing knowledge of the ecological impacts of petrochemical plastics, especially their role in pollution and global warming, is driving a transition towards sustainable alternatives.

Governments around are enacting prohibitions on single-use plastics and advocating for compostable, bio-based substitutes. These initiatives are bolstered by policy-level endorsement for packaging solutions that are recyclable or biodegradable in diverse end-of-life contexts. Regional policies in the Asia-Pacific area designed to eradicate plastic bags and mitigate climate change are driving the market for biopolymers.

Simultaneously, enterprises are acknowledging the reputational and regulatory hazards associated with the continued use of non-biodegradable plastics. As a result, biopolymers—especially those derived from PLA and PHA are increasingly recognized as essential elements in sustainable development efforts across several sectors, offering not only compliance but also enduring ecological benefits.

High Cost Impedes Commercial Feasibility

Biopolymers have substantial economic obstacles that impede their extensive utilization. The production cost of biodegradable plastics is generally 20–80% greater than that of conventional polymers, mainly due to elevated polymerization expenses and the absence of extensive manufacturing facilities.

Materials such as PHA, although beneficial for applications like food packaging and medical devices, persistently experience low yields and elevated processing costs. Despite being more inexpensively made than PHA, PLA is still more expensive than petroleum-based PE and PP. The increased expenses stem from restricted commercialization and insufficiently developed industrial economies of scale.

As a result, numerous industries continue to depend on less expensive petrochemical substitutes. The substantial expenditure in research and development, coupled with limited raw material processing skills, remains a significant obstacle to gaining mass-market penetration. The shift to biopolymers will be gradual and sector-specific until cost parity with conventional plastics is achieved.

Biopolymers Market Segment Analysis

The global biopolymers market is segmented based on product, application, end-user and region.

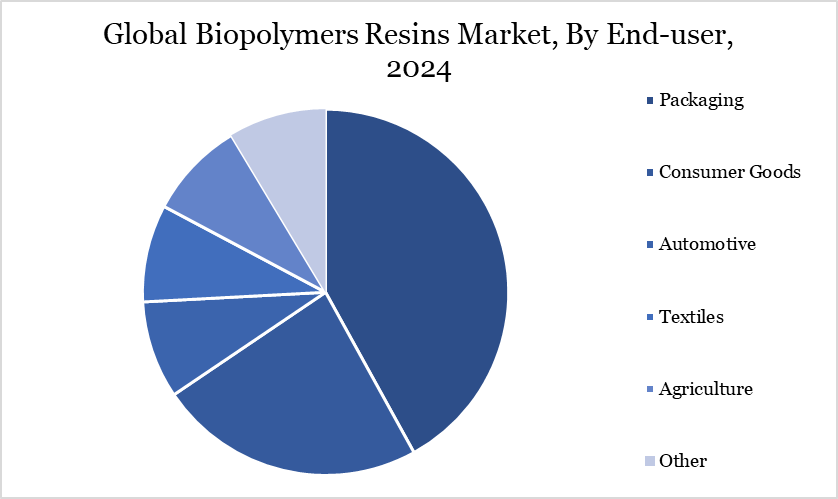

Biopolymer Packaging Fuels the Shift Toward Sustainability

Packaging constitutes the predominant end-use sector for biopolymers, with the consumer goods market serving as a crucial catalyst for demand. Increasing environmental concerns and legal requirements are driving prominent consumer brands to incorporate biodegradable packaging into their product plans. Food and beverage packaging constitutes a significant share of biopolymer usage, since the industry encounters increasing criticism about its role in plastic waste generation.

The functionality of biopolymers, including moisture resistance, rigidity, and compostability, renders them suitable for use in wrapping, containers, and trays. Pharmaceuticals and personal care represent additional significant end-users, leveraging the sustainable allure to environmentally aware consumers.

As large-scale packaging manufacturers use bio-based solutions to achieve corporate sustainability objectives, the end-user scenario is continually transforming. Retailer pressure and changing customer expectations are further solidifying biopolymer usage in packaging formats, establishing this segment as the foundation for future market growth.

Biopolymers Market Geographical Share

Europe Advocates Sustainable Packaging through Regulatory Endorsement

Europe leads the worldwide biopolymer industry, propelled by rigorous regulatory standards and an environmentally aware consumer demographic. The region's sophisticated waste management systems and robust sustainability standards, exemplified by the EU's Single-Use Plastics Directive, promote the swift implementation of biodegradable packaging solutions.

European manufacturers are incorporating biopolymers into supply chains to conform to circular economy objectives, bolstered by governmental incentives and consumer demand. Europe's leadership is seen in its emphasis on research and development and sustainable industrial practices, facilitating the discovery and commercialization of bio-based products.

Public-private collaborations in the region are expediting investment in compostable and recyclable alternatives, particularly within the consumer goods and food packaging industries. While other regions grapple with inadequate waste management systems, Europe’s holistic strategy towards sustainability positions it as a pivotal participant and exemplary market in the global biopolymer shift.

Sustainability Analysis

Biopolymers provide a concrete solution for mitigating environmental degradation, closely harmonizing with global sustainability initiatives. Originating from renewable feedstocks like corn, sugarcane, and residual biomass, they exemplify a circular economy model that diminishes reliance on fossil resources. Their biodegradability guarantees a limited environmental impact, especially in contrast to conventional plastics that endure in ecosystems for decades.

The Ellen MacArthur Foundation's statistics on plastic pollution indicates that 32% of plastic packaging evades garbage collection systems, highlighting the necessity for scalable biodegradable solutions. Biopolymers fulfill this requirement by decomposing spontaneously and assimilating into organic waste cycles.

Biopolymer technologies such as seaweed packaging illustrate how local resources might facilitate sustainable alternatives. Policy interventions and increasing environmental awareness among consumers and businesses are fostering an environment favorable to biopolymer uptake. As industries progressively conform to carbon reduction and circular economy objectives, biopolymers will remain pivotal in transforming sustainable material environments.

Biopolymers Market Major Players

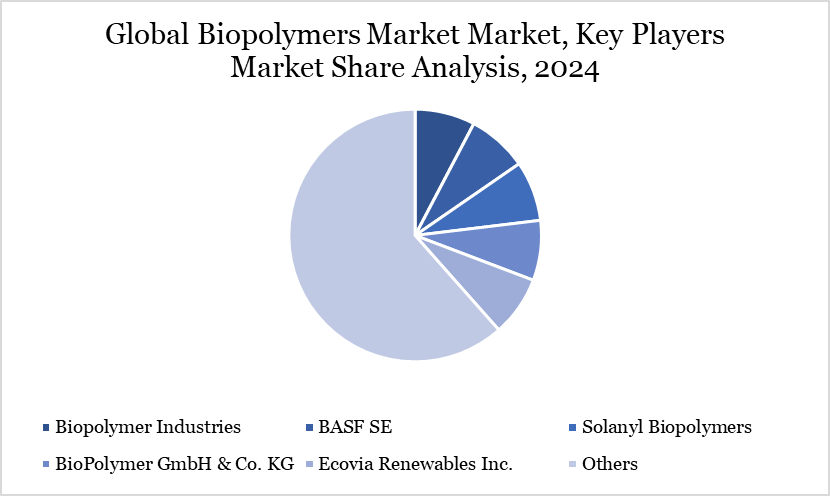

The major global players in the market include BASF SE, Solanyl Biopolymers, BioPolymer GmbH & Co. KG, Ecovia Renewables Inc., BiologiQ, Inc., ADM, DuPont, Novamont, BIOTEC.

Key Developments

In April 2023, NatureWorks launched the newest 'Ingeo' biopolymer solution, enhancing strength and softness in biobased nonwovens for hygiene applications.

In November 2022, Total Energies Corbion announced a long-term partnership with BGF, concentrating on application development and the provision of Luminy PLA.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies