Market Size

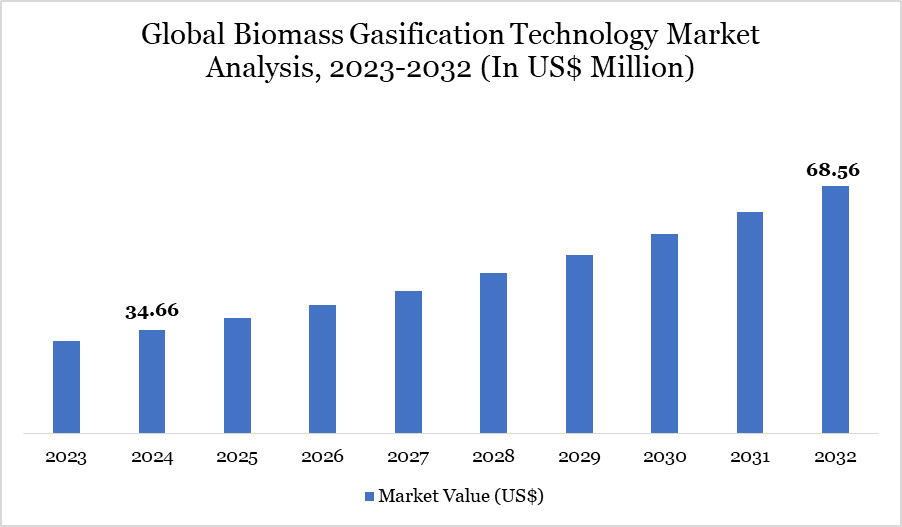

Global Biomass Gasification Technology Market size reached US$ 34.66 million in 2024 and is expected to reach US$ 68.56 million by 2032, growing with a CAGR of 8.90% during the forecast period 2025-2032.

The market for biomass gasification is expanding rapidly globally due to rising demand for sustainable energy sources. Government initiatives, the growing use of renewable energy sources, and the plentiful supply of biomass feedstock are all factors contributing to this expansion. In line with international initiatives to lower greenhouse gas emissions, biomass gasification a process that turns organic materials into syngas offers a cleaner substitute for conventional fossil fuels.

The technology's ability to use a variety of biomass sources, such as municipal solid waste and agricultural wastes, adds to its allure. Biomass gasification stands out as a practical and scalable technology that promises both environmental advantages and energy security as countries work to reach their renewable energy targets.

Biomass Gasification Technology Market Trend

The efficiency and scalability of gasification systems are being improved by technological developments, increasing their economic viability. Plant operations are being optimized, operating expenses are being decreased, and syngas quality is being improved through the integration of automation and artificial intelligence technology. Another important factor is policy support; for example, the US Renewable Fuels Standards Program and the European Union's Renewable Energy Directive both provide incentives for the use of renewable energy technology, such as biomass gasification.

The use of waste biomass for energy production is being promoted by the increased focus on the concepts of the circular economy. Together, these developments support the market's growth and establish biomass gasification as a major force in the world's shift to sustainable energy systems.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

| By Source | Agricultural Waste, Forest Waste, Animal Waste, Municipal Waste, Others | |

| By Gasifier | Fixed Bed Gasifier, Fluidized Bed Gasifier, Entrained Flow Gasifier, Others | |

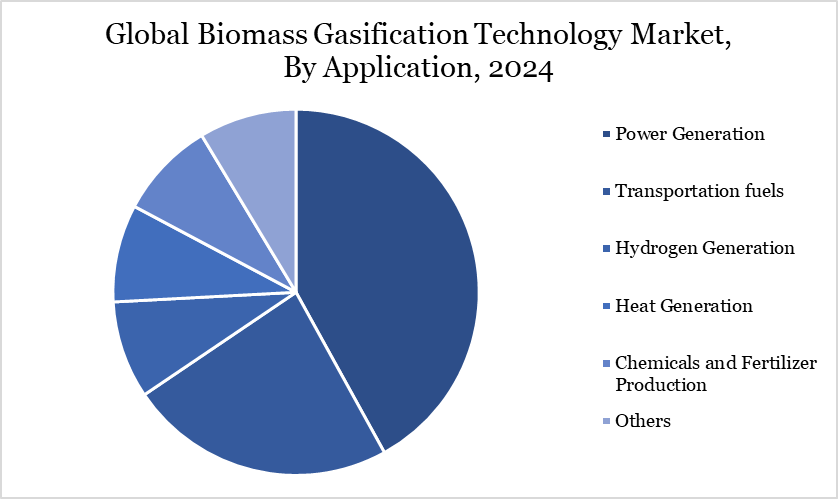

| By Application | Power Generation, Transportation fuels, Hydrogen Generation, Heat Generation, Chemicals and Fertilizer Production, Others | |

| By End-user | Industrial, Utilities, Residential and Commercial Buildings, Agriculture, Others | |

| By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Biomass Feedstock's Wide Availability

The production of organic waste, such as agricultural wastes, forest byproducts, and municipal solid trash, has increased as a result of urbanization and industrialization. The International Renewable Energy Agency (IRENA) projects that by 2050, there would be between 5,700 and 7,000 million tons of oil equivalent per year (Mtoe/year) available globally, up from 2,500 Mtoe/year in 2020.

In addition to helping with waste management issues, this plentiful and renewable resource base offers a steady supply of feedstock for gasification processes, enabling the production of electricity. By decreasing dependency on fossil fuels and lowering greenhouse gas emissions, the prudent use of this biomass promotes environmental sustainability in addition to energy diversification.

Tar Formation-Related Technical Difficulties

Biomass gasification has many technical drawbacks, most notably the production of tar throughout the process. Tar, which is made up of complex chemical molecules, can condense and clog machinery, resulting in inefficient operations and higher maintenance needs. Tar concentrations vary depending on the kind of gasifier; for example, updraft gasifiers can create up to 100 g/Nm³ of tar, but downdraft gasifiers produce much lower amounts, about 1 g/Nm³.

Since too much tar can deteriorate syngas quality and impede downstream applications, controlling tar formation is essential. Thermal cracking and catalytic reforming are two of the many tar removal methods used, but they complicate and increase the expense of the gasification process. Research and development efforts continue to focus on addressing tar-related difficulties to improve the dependability and effectiveness of biomass gasification technology.

Segment Analysis

The global biomass gasification technology market is segmented based on source, gasifier, application, end-user and region.

Advancements in Biomass Gasification Technology for Sustainable Power Generation

The power generation segment of the global biomass gasification technology market represents a substantial application area, due to the pressing need to switch from coal-based energy sources to more environmentally friendly and sustainable alternatives. Biomass is becoming more and more popular as a renewable energy source, because it can lower carbon emissions while supplying the world's growing energy needs.

Roughly 4.8 quadrillion Btu, or over 5% of the nation's total primary energy consumption, came from biomass energy in the US in 2021, with the power sector using roughly 9% of this amount. Syngas, which may be used to generate energy, is produced more easily from organic materials thanks to biomass gasification technology. The method also produces useful byproducts that can be processed into liquid fuels for the aviation and transportation industries. Government and business investments are speeding up the use of biomass gasification in the electricity sector as addressing climate change becomes a global concern.

Market Geographical Share

The Biomass Gasification Market is Leading in Asia-Pacific

Due to its high energy needs, wealth of biomass resources, and pro-biomass gasification laws, the Asia-Pacific region leads the biomass gasification industry. In 2019, the region produced 2,853.1 million tons of oil equivalent, which accounted for almost 73% of the world's total coal output. Biomass gasification is being invested in by nations like China and India to diversify their energy sources and lower pollution levels.

For example, to promote the use of biomass-based power generation equipment, India provides tax incentives and exemptions from customs duties. Additionally, the efficiency and environmental performance of biomass gasification are being improved by technological developments, such as the creation of circulating fluidized bed (CFB) gasification systems in Gansu province, China.

Sustainability Analysis

A potential pathway to sustainability in the face of growing energy demands, environmental deterioration, and the depletion of fossil fuels is provided by worldwide biomass gasification technology. Clean, low-emission energy solutions are desperately needed, as world leaders push for carbon neutrality by 2050 and the negative consequences of climate change become more apparent. Unlike combustion or pyrolysis, biomass gasification is a thermochemical conversion process that converts plentiful, renewable biomass into useful fuels and high-quality syngas with a higher energy recovery efficiency.

In addition to lowering greenhouse gas emissions, this carbon-neutral technology improves energy security, especially in rural and underdeveloped areas where biomass may supply up to 90% of energy needs. It is a crucial component in the shift away from fossil fuels because of its scalability, adaptability, and low environmental impact. The widespread use of biomass gasification has the potential to greatly aid in the creation of a sustainable and just energy future as population increase and industrialization continue.

Major Global Players

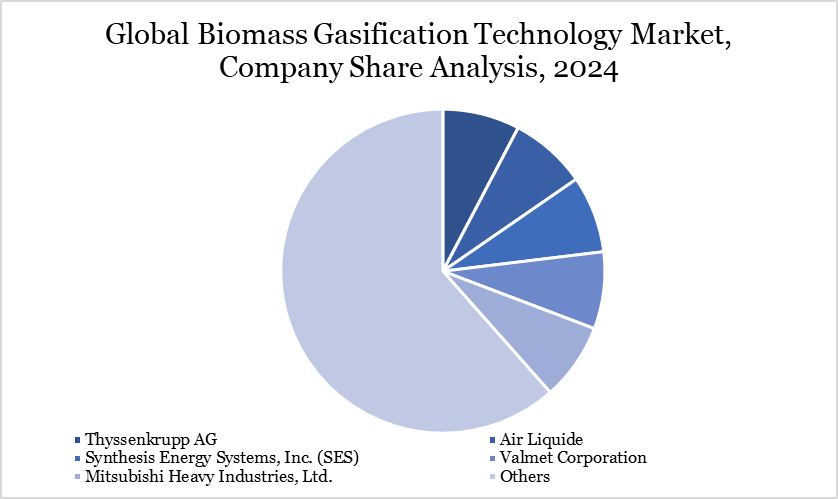

The major global players in the market include Thyssenkrupp AG, Air Liquide, Synthesis Energy Systems, Inc. (SES), Valmet Corporation, Mitsubishi Heavy Industries, Ltd., Ankur Scientific Energy Technologies Pvt. Ltd., Eqtec PLC, SPG Dry Cooling, Nexterra Systems Corp., Babcock & Wilcox Enterprises, Inc.

Key Developments

- In December 2023, Air Liquide announced that it will use its exclusive CryocapTM technology to construct, own, and run a global carbon capture facility in the industrial district of Rotterdam, the Netherlands. To drastically cut CO₂ emissions in this big industrial region, the new unit will be deployed at the group's hydrogen production plant in the port of Rotterdam and connected to Porthos, one of Europe's largest carbon capture and storage infrastructures.

- In October 2023, with an expenditure of about 140 million euros, Air Liquide announced that it would build a new platform in Bécancour, Québec, Canada, to transport low-carbon industrial gases like argon, nitrogen, oxygen, and hydrogen. The infrastructure built by Air Liquide will feature a new air separation unit that produces renewable oxygen and nitrogen, as well as liquid storage capacity that will be connected to the local pipeline network, in addition to the group's existing 20 MW PEM electrolyser.

- In May 2022, Valmet's new Biotrac pre-treatment pilot plant at the fiber technology center in Sundsvall, Sweden, opened its doors. In addition to meeting the market need for bioenergy, biofuels, and biochemicals, the investment in the pilot facility would assist Valmet in improving its research and development capabilities in the area of biomass pre-treatment.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies