Bioactive Ingredients Market Size

The global bioactive ingredients market reached USD 173.3 billion in 2022 and is projected to witness lucrative growth by reaching up to USD 302.3 billion by 2030. The market is expected to exhibit a CAGR of 7.20% during the forecast period (2024-2031). Bioactive substances are auxiliary biomolecules found in food that can adapt one or more metabolic processes for better health.

Food elements that are bioactive are often present in a variety of forms, including those that are glycosylated, esterified, thiolated, or hydroxylated. Nutrients and non-nutrients found in the food matrix have physiological effects in addition to their traditional nutritional qualities employed in bioactive ingredients.

The main factors propelling the market's expansion are rising customer preference for natural products and growing consumer awareness of the potential negative consequences of food additives made artificially. Growing worries about allergies brought on by added compounds and a shift in consumer behavior towards a healthy lifestyle both contribute to the total bioactive ingredients market demand throughout the forecast period of 2023-2030.

Market Scope

| Metrics | Details |

| CAGR | 7.20% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (USD ) |

| Segments Covered | Ingredient Type, Application, Source of Origin, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | North America |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report – Request for Sample

Bioactive Ingredients Market Dynamics

Growing Consumption of Functional Foods & Beverages is Driving the Bioactive Ingredients Market Growth.

The demand for bioactive constituents is adding to the rising consumption of functional foods & potables worldwide. The consumption of functional foods & potables has increased with the growing mindfulness regarding their health and nutritive benefits. According to the National Center for Biotechnology Information (NCBI) check, around 90% of American grown-ups are apprehensive of functional foods' benefits.

According to New Zealand Trade and Enterprise report, the sales of healthy snack products accelerated by 1% between 2017- 2022 and is anticipated to mount to 3.8% between 2022- 2027. Grain-grounded snacks comprise 36.3% of this classification and protein bars 10.9%. This has redounded in boosting the deals of functional foods & potables across the globe, which is driving the bioactive ingredients market growth.

Changing Consumer Preferences For Better Living And Rising Worries About Allergies Brought On By Additional Ingredients.

The global bioactive ingredients market is expanding as consumers adopt healthier lifestyles and allergy fears develop because of additional compounds. As organic food consumers typically lead healthier lifestyles, the research is not conclusive that eating organic food lowers the risk of allergy illness, overweight, or obesity.

Omega-3 fatty acids are more abundant in organic dairy products than they are in conventional ones, as well as possibly in organic meats. These variations, meanwhile, probably have only tangential nutritional importance. Consequently, the global market for bioactive compounds will witness growth during the forecast period of 2023-2030.

Bioactive Ingredients Market Segment Analysis

The global bioactive ingredients market is segmented based on ingredient type, application, source of origin, and region.

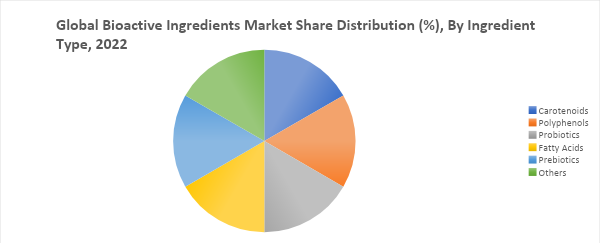

In the Global Market of Bioactive Ingredients, the Fatty Acids Segment Holds the Largest Market Share.

The global bioactive ingredients market has been segmented by ingredient type into carotenoids, polyphenols, probiotics, fatty acids, prebiotics, and others. The fatty acids segment held the largest bioactive ingredients market share of 32.8% in 2022 in the bioactive ingredients market analysis report. The growth of the segment is due to the increased use of foods containing omega-3 fatty acids in the diet to enhance heart and brain function.

According to report by USDA, in 2020, non-communicable chronic diseases like cardiovascular disease, type 2 diabetes, obesity, and cancers accounted for nearly 75% of all fatalities and 60% of all disability-adjusted life years globally, with low and middle income countries bearing the brunt of these increases, which has increased the demand for fatty acids across the globe.

Additionally, it is anticipated that rising consumer spending on healthcare and personal wellbeing will increase demand for the products. As consumers search for alternatives to conventional fish oil, the segment's product offers are continuously diversifying. Since krill oil has better qualities than conventional fish oil, it is one of the most popular sources of omega-3.

Bioactive Ingredients Market Geographical Share

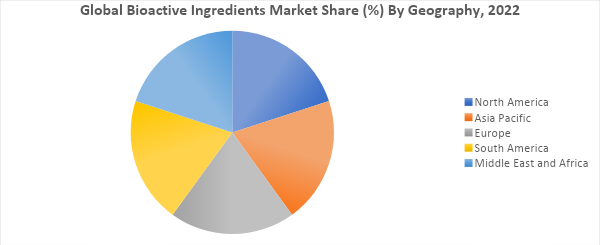

The North America Region Held the Largest Share in Bioactive Ingredients Market.

The global bioactive ingredients market is segmented into North America, South America, Europe, Asia Pacific, the Middle East, and Africa. The North America bioactive ingredients market held the largest market share of 42.6% in 2022 in the bioactive ingredients market analysis.

The demand for functional and fortified food items is developing quickly as a result of rising consumer desire for foods that have vital components like vitamins, proteins, and amino acids added to meet dietary needs.

47% of American consumers choose food with extra nutrients, according to a research study on food and health published by the International Food Information Council Foundation (IFIC). As a result, the bioactive ingredient market, which includes vitamins, minerals, and other nutrients, has grown significantly.

Bioactive Ingredients Companies

The major global players in the market include Archer Daniels Midland Company, Cargill Incorporated, Roquette, Ajinomoto Co., Inc., Mazza Innovation Ltd., E. I. du Pont de Nemours and Company, Koninklijke DSM N.V., BASF SE, Arla Foods, and Sabinsa Corporation.

COVID-19 Impact on Bioactive Ingredients Market

Global Recession/Ukraine-Russia War/COVID-19, and Artificial Intelligence Impact Analysis:

Covid-19 Impact:

The COVID-19 pandemic has had a significant impact on the global market for bioactive ingredients, with research and development efforts for bioactive ingredients for COVID-19 treatment, management, and prevention growing along with the increase in COVID-19 cases around the world.

The potential for COVID-19 infection of the bioactive components produced from plants, animals, and microbes is investigated by numerous organizations, institutes, associations, and businesses. The antiviral effects of bioactive substances against COVID-19 have been demonstrated in numerous investigations. Bioactive substances are proven to have anti-COVID-19 infection medicinal, toxicological, and immune-stimulating effects.

Key Developments

- In August 2022, OZiva, the most prominent plant-based holistic wellness brand in India, just debuted a brand-new line of products for fitness and skin health that are powered by bioactive components that have undergone extensive scientific research.

- In October 2022, California-based biotechnology company Brightseed introduced the first bioactive component found by AI and collaborates with plant-based manufacturer Puris.

- In March 2023, a new line of bioactive ingredients was introduced by Symrise, a German-based manufacturer of flavors and perfumes, for its Beauty from Within product line.

Why Purchase the Report?

- To visualize the global bioactive ingredients market segmentation based on ingredient type, application, source of origin, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities in the market by analyzing trends and co-development.

- Excel data sheet with numerous data points of bioactive ingredients market-level with all segments.

- The PDF report consists of cogently put-together market analysis after exhaustive qualitative interviews and in-depth market study.

- Product mapping is available as Excel consists of key products of all the major market players.

The global Bioactive Ingredients market report would provide approximately 93 tables, 109 figures and 190 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies