Bike Sharing Market is segmented By Bike (Traditional Bike, E-bike), By Sharing System (Docked, Dockless), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Report Overview

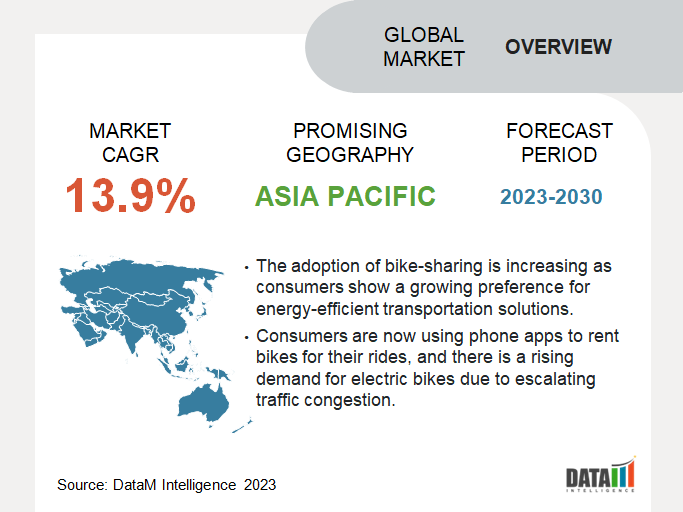

Bike Sharing Market is expected to grow at a CAGR 13.9% during the forecast period (2024-2031).

Bike-sharing is referred to bike pooling or sharing the bike for traveling to reach destinations.

Bike Sharing Market Summary

|

Metrics |

Details |

|

Market CAGR |

13.9% |

|

Segments Covered |

By Bike, By Sharing System and By Region |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, and Other key insights. |

|

Fastest Growing Region |

Asia Pacific |

|

Largest Market Share |

North America |

To Get a Free Sample Click here

The bike-sharing includes sharing the bike ride with the rider going to the desired destination or availability of the bikes for the shared use to individuals on a short-term basis. It is easy to book bikes online through mobile apps and the web.

Bike Sharing Market Dynamics

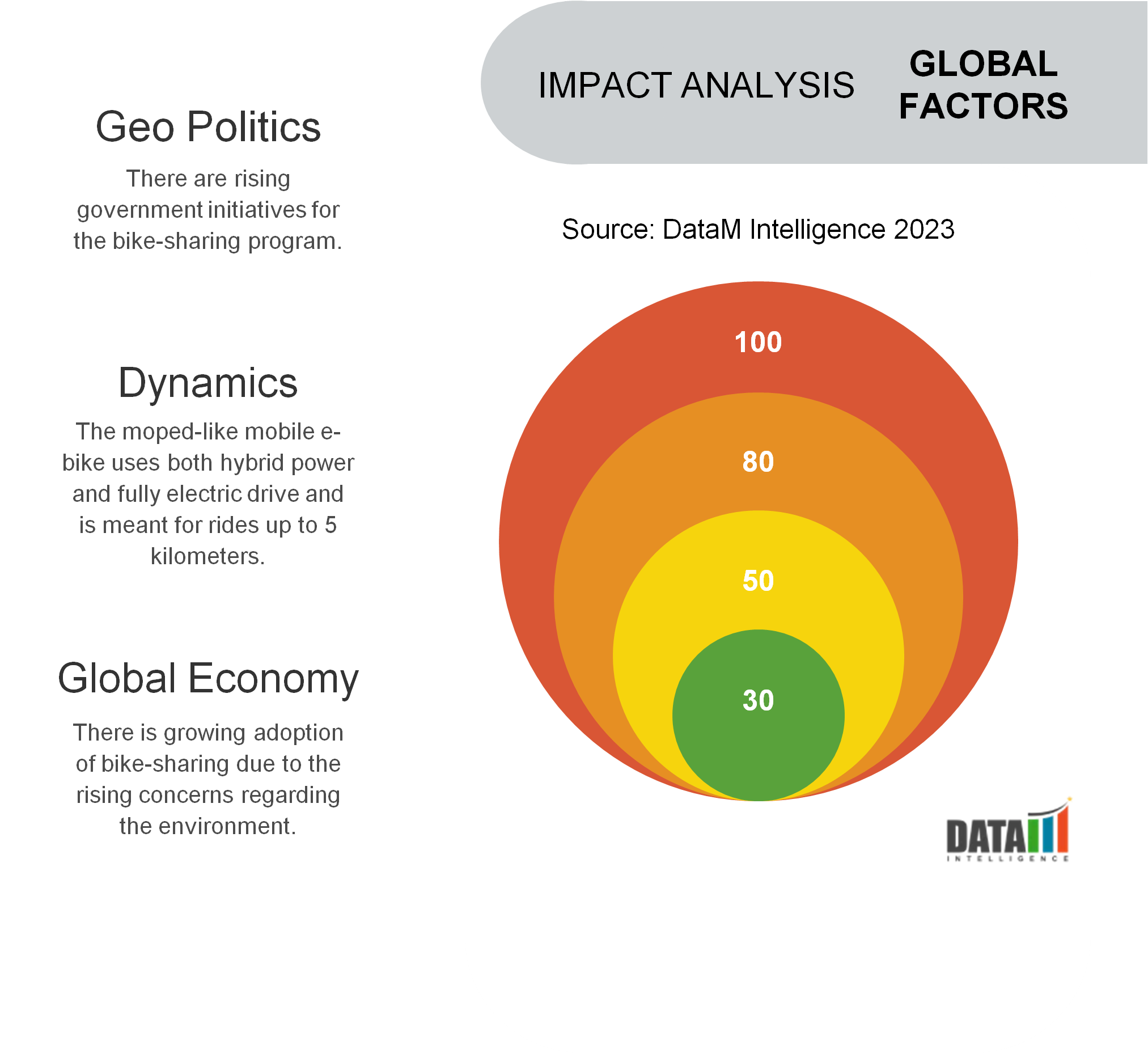

The market is driven by the rising demand for bike-sharing due to its flexibility, accessibility, and affordability. There is growing adoption of bike-sharing due to the rising concerns regarding the environment. The rising need for urban transportation has increased the number of vehicle usage on roads resulted in heavy traffic jams and pollution.

There is an increase in the launch of bike-sharing products. For instance, in August 2018, mobile had launched the electric bike-sharing developed in collaboration with Amsterdam-based design firm springtime. The moped-like mobile e-bike uses both hybrid power and fully electric drive and is meant for rides up to 5 kilometers. This bike can be left anywhere in the street. It allows an easy transition for people with moped experience rather than cycling experience. The bike provides a 70 km range and a top speed of 20 km/h.

In November 2019, Helbiz launches Greta e-bike sharing in Rome. Greta is a pedal-assisted e-bike. Greta would cost far less in comparison to the Rome bike-sharing competitor Uber Jump. Greta bikes guarantee a range of up to 80 km when fully charged, and can reach a maximum speed of 25 km/h. Greta bikes are equipped with GPS and a shopping basket.

The market is witnessing technological advancement including the proliferation of GPS technology, consumer-ready mobile payments, and the Internet of Things, and reducing the investment cost of locking and tracking systems for bikes for the development of bike-sharing products.

However, the rising bike vandalism & theft are hindering the market growth. Several dockless bike-sharing service providers have reported the instance regarding the theft of the dockless bikes. For instance, in September 2018, Mobike had withdrawn its services due to theft & vandalism in Manchester. This has resulted in huge bike losses for the company.

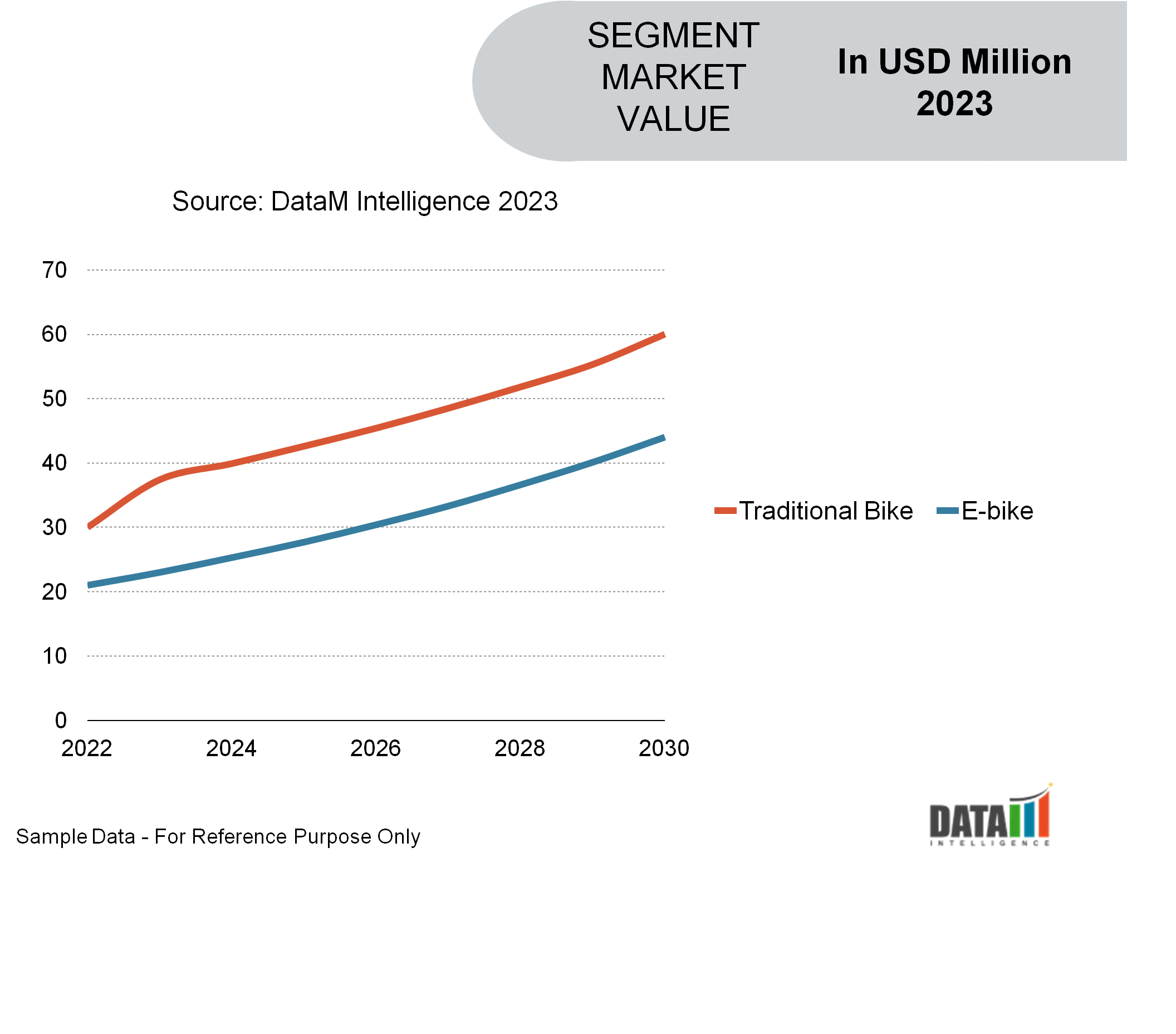

Bike Sharing Market Segment Analysis

The global bike-sharing market is segmented based on the bike as the traditional bike and e-bike. The e-bike segment is expected to have positive market growth over the forecasted period due to the growing usage of the e-bikes because of fast & flexible operations and zero carbon emissions. The e-bikes are the cost-effective, reliable, and eco-friendly transport solution, especially for recreational activities, hill climbing, and carrying heavy loads as these bikes, provide the fun of cycling combined with automobile suitability. It is easy for consumers to navigate on rough terrains through e-bikes.

There is an increase in the number of companies providing e-bike sharing products. For instance, in December 2016, Uber had launched the bike-sharing product uberMOTO in India. The uberMOTO is a quick, easy, and affordable way to get around the city. There is an increase in the investment for the research and development activities for enhancing the performance of batteries and improving the e-bike infrastructures. For instance, in December 2019, Wheels, an electric bike-share startup has redesigned its two-wheeled vehicle to include a special spot to hold a helmet. The helmet is locked to the rear rack of the bike and is free for riders to use. The helmet can only be unlocked via the Wheels app.

Further, the market is also classified based on the sharing system as docked, and dockless. The dockless segment is expected to witness positive market growth over the forecasted period. The technological advancement has led to the introduction of dockless electric bike-sharing products that provide better bike-sharing services, ease of transit access by offering users the sheer flexibility of picking up and dropping off bikes freely at any legal public vehicle parking instead of the operator’s bike stations. There is an increase in the launch of dockless electric bikes.

For instance, in May 2019, Uber had launched its dockless electric bikes in London. The dockless bikes are equipped with baskets and phone mounts, as well as an electric pedal system that provides users assistance of up to 15 miles per hour. In August 2018, Mobike had launched an electric bike for dockless sharing. These dockless bikes can be parked in almost any public space rather than just traditional docking stations.

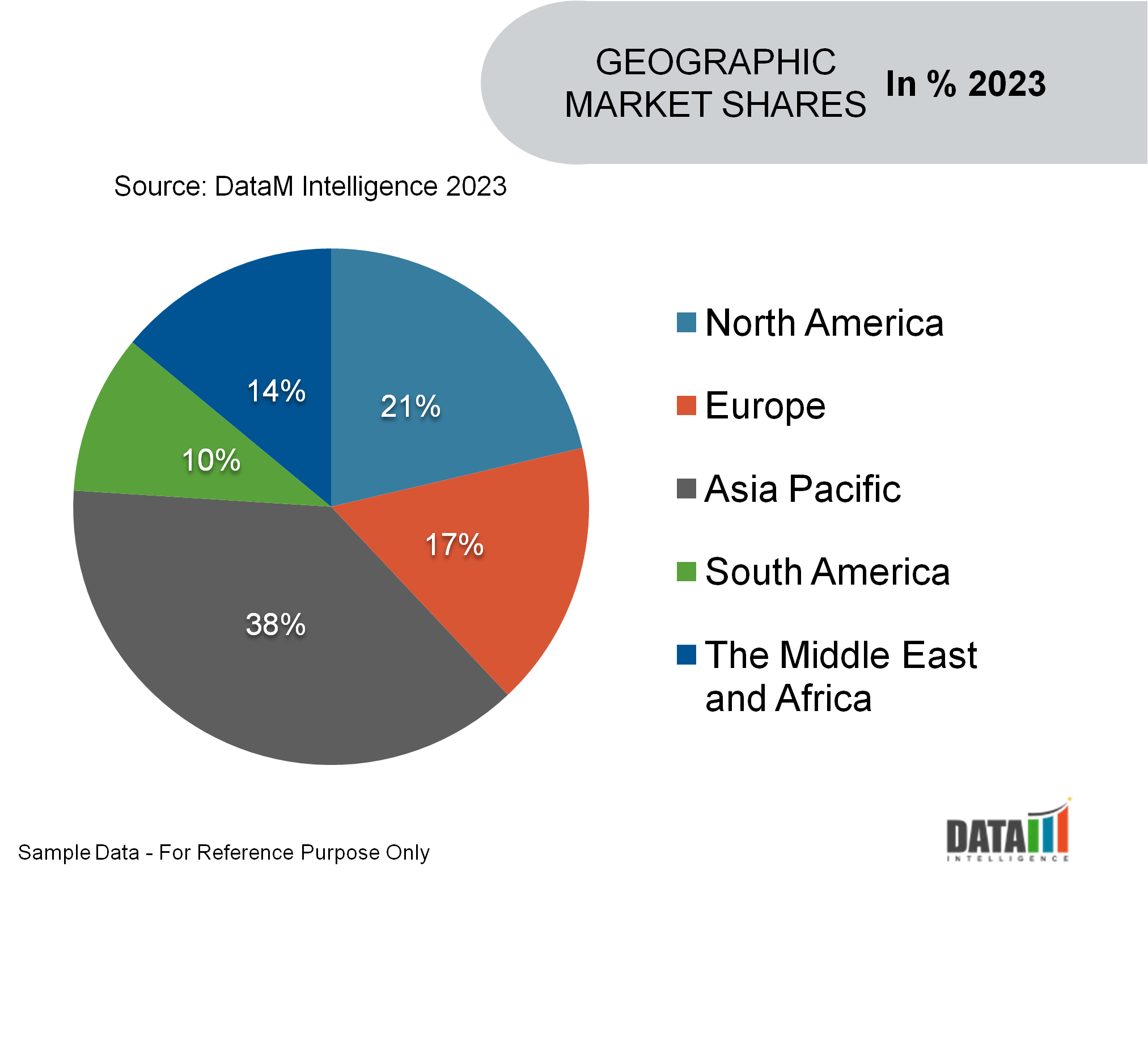

Bike Sharing Market Geographical Share

By region, the global bike-sharing market is segmented into North America, South America, Europe, Asia-Pacific, Middle-East, and Africa. Among all of the regions, Asia-Pacific dominated the global bike-sharing market and is expected to grow at the highest CAGR during the forecasted period due to the rising adoption of bike-sharing with the growing consumer preference toward energy-efficient transport solutions.

Consumers are renting the bike via phone apps for the rides. There is growing usage of electric bikes with the growing traffic jams in the countries. There are rising government initiatives for the bike-sharing program. For instance, in 2018, the Chinese Municipal government has subsidized the Public Bike Sharing Program (PBSP) development for the encouragement of non-motorized transport for providing convenient, flexible, and low-cost mobility options.

China accounts for the highest market share of XX% due to the presence of a large number of companies developing the sharing bike. According to the Ministry of Transportation of China, more than 16 million bikes were sold in 2016. The government has implemented several regulations for bike-sharing maintenance, operation & production in more than 30 Chinese cities including Shanghai and Beijing. These cities have more stringent criteria including the requirement of an annual check-up of the bikes, a minimum amount of maintenance workers, and making operators responsible for cleaning up the bikes.

In May 2017, China’s national-level Ministry of Transportation had drafted the first country-wide framework for regulating dockless bike-sharing. The government has issued a formal regulation regarding this law in August 2017. This new law aims at regulating the bicycle and traffic standards, punishing individuals for illegal behavior, and requiring local governments to ensure an even distribution of bikes and to set up designated parking spaces. India is also witnessing an increase in the demand for bike-sharing due to the rising concerns regarding pollution and noise emission. Several consumers are using bike-sharing due to their low-cost and easy availability.

Bike Sharing Companies and Competitive Landscape

The global bike-sharing market is highly competitive with the presence of several international and local markets. Product diversification, revenue generation, and opportunities intensify the market competition. Mobike, Uber Technologies Inc., Ofo Inc., Neutron Holdings Inc., Lyft Inc., Youon Bike, Beijing Mobike Technology Co. Ltd., and Nextbike GmbH are the leading market players with significant market share.

The major players are using product development, novel product launch, collaborations, acquisitions, mergers, market expansion, capacity utilization, and product diversification strategies for holding their position in the market. For instance, In July 2018, Lyft had acquired Motivate, a bike-sharing company that operates Citi Bike in New York City and Ford’s GoBike program in San Francisco. The company would be renamed Lyft Bikes. Lyft and Motivate would revolutionize urban transportation and put bike-share systems across the country on a path toward growth and innovation.

In April 2018, Uber had acquired the electric bike-share startup Jump Bikes for an undisclosed amount. Under the terms of the agreement, Jump Bikes would become a subsidiary of Uber.

In April 2018, Meituan Dianping had acquired the bike-sharing firm Mobike for USD 2.7 billion. In January 2019, the Meituan Dianping had renamed it Meituan Bike as part of an ongoing integration with its parent.

The major players are raising the funding and investment for the bike-sharing expansion. For instance, in May 2020, Bike-sharing service provider Lime had raised an investment of USD 170 million in an investment round led by Uber Technologies Inc, with Alphabet Inc, Bain Capital Ventures, and GV among other participants. As a part of the investment, Lime would acquire an electric bicycle service JUMP Bikes, which was bought by ride-hailing company Uber in 2018.

Several companies are investing in several bike-sharing companies to enhance their business operations. For instance, in May 2020, Sherpa Capital had acquired a majority stake in Barcelona-based bike-sharing company CityBike from its founder, Moventia Group, which would retain a minority shareholding. In March 2019, Alibaba Group had invested USD 866 million in Ofo Inc