Bauxite Market Size

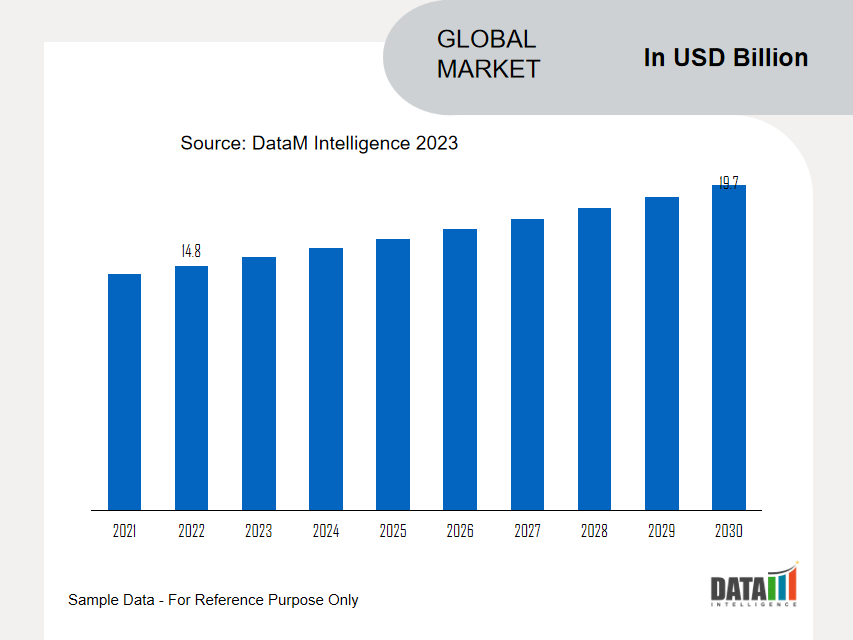

Global Bauxite Market reached US$ 14.8 billion in 2022 and is expected to reach US$ 19.7 billion by 2030, growing with a CAGR of 3.7% during the forecast period 2024-2031

The global bauxite market is a core component of the aluminum industry, directing the essential supply chain for this multipurpose metal. The significance of it comes from its use in many different industries and from being the main component of alumina, which is the precursor to aluminum. The complex dynamics of the market are a result of a combination of factors such as quality variations, sustainability concerns, geographic abundance and shifts in the world economy.

With their large reserves of bauxite in various grades, Australia and Guinea dominate the market. Guinea's rise is largely attributable to its high-grade reserves, which have drawn significant investments and established the area as a key participant.

For instance, as per U.S. Geological Survey (USGS), the world's biggest reserves of bauxite are found in Guinea. Guinea has around 7 billion Tons of basic bauxite deposits or 24% of global reserves. Australia ranks second with 5.84 billion Tons of reserves or 20% of the world's total. Therefore, the both market place accounts for the majority of the global bauxite reserves.

Market Summary

| Metrics | Details |

| CAGR | 3.7% |

| Size Available for Years | 2021-2030 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Product, Application, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | Asia-Pacific |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report – Request for Sample

Market Dynamics

Growing Production in the Emerging Economies

Guinea has large, high-quality bauxite resources that generate interest and significant investments from major participants in the global aluminum market. The reserves are highly sought after for the manufacturing of aluminum because to their purity. In recent years, Guinea has increased its production capacity steadily. The country intends to greatly increase its bauxite output in order to fulfil the growing demand for aluminum in the world by continuing investments in mining and infrastructural projects.

The rise of Guinea as a significant producer of bauxite expands the global supply chain. By increasing its output, it offers a substitute for established nations that produce bauxite, lessening reliance on certain areas for bauxite supplies.

The global bauxite market is significantly influenced by the increasing production capacity and the growth of bauxite mining in developing nations such as Guinea. The factors contribute to the market by increasing supply, offering high-quality deposits and shaping global trends in aluminum manufacturing. Guinea's rise to significance emphasizes its significant impact on the constantly changing dynamics of the world bauxite market. Thus, 21.7% of the global bauxite production or 85 million Tons of bauxite in volume, is produced in Guinea.

Growing Partnerships for Large Scale Supplies

A consistent and dependable flow of raw materials is ensured via partnerships between bauxite producers and purchasers, particularly long-term supply agreements. The supply continuity helps the processes involved in producing aluminum by lowering uncertainty associated with availability changes. Working collaboratively makes it easier to ensure the supply of bauxite in terms of both quality and quantity. Customers can rely on reliable deliveries that adhere to strict quality requirements, ensuring efficient production procedures.

By partnering with several consumers or end-users, bauxite producers can expand their market reach and lessen their reliance on any particular market or buyer. The diversification approach helps to maximize income and optimize sales channels. For instance, in October 2023, the Odisha Mining Corporation and Hindalco Industries Ltd. have announced a long-term supply agreement for bauxite ore. For its projected 2-million-ton alumina refinery and 150-MW captive power plant in Kansariguda, Rayagada district, Odisha, the company intends to source bauxite ore.

Increasing Number of Bauxite Operations

An increase in the number of bauxite operations indicates an increase in supply capacity. The increasing demand for aluminum is being addressed by this increase in production capacity, which offers plenty of chances to meet the growing demand for this adaptable metal globally.

Moreover, risk factors are greatly reduced by the variety of bauxite supplies. Numerous operational sites spread throughout various geographies reduce reliance on particular mines or nations, reducing susceptibility to supply chain disruptions caused by logistical challenges or political instability. Increased supply stability, which is necessary for steady and continuous aluminum production, is a result of this diversity.

For instance, in December 2023, a new 12.4MW solar farm and 8.8MVa/2.1MWh of battery storage have been approved by Rio Tinto to supply renewable energy to the Amrun bauxite plant in the Queensland region of Weipa. Rio Tinto's global decarbonization strategy and continuous efforts to lower emissions at its Pacific bauxite, alumina and aluminum operations include the 12.4 MW solar farm and battery storage.

Fluctuating Raw Material Prices

Operations involved in the mining and processing of bauxite depend on a number of raw resources, including energy sources, chemicals and equipment, all of which have fluctuating prices. A sudden increase in the cost of these inputs might drive up production costs and lower bauxite companies' profit margins. The cost structure of bauxite operations is impacted by volatility in raw material costs, which makes it difficult for businesses to accurately predict and control production expenses.

Uncertain and volatile raw material prices may cause companies or investors considering expansions to hold back. Due to this cost uncertainty, investments in new projects or the expansion of current bauxite operations may be discouraged, which would restrict market growth.

Market Segmentation

The global bauxite market is segmented based on product, application, end-user and region.

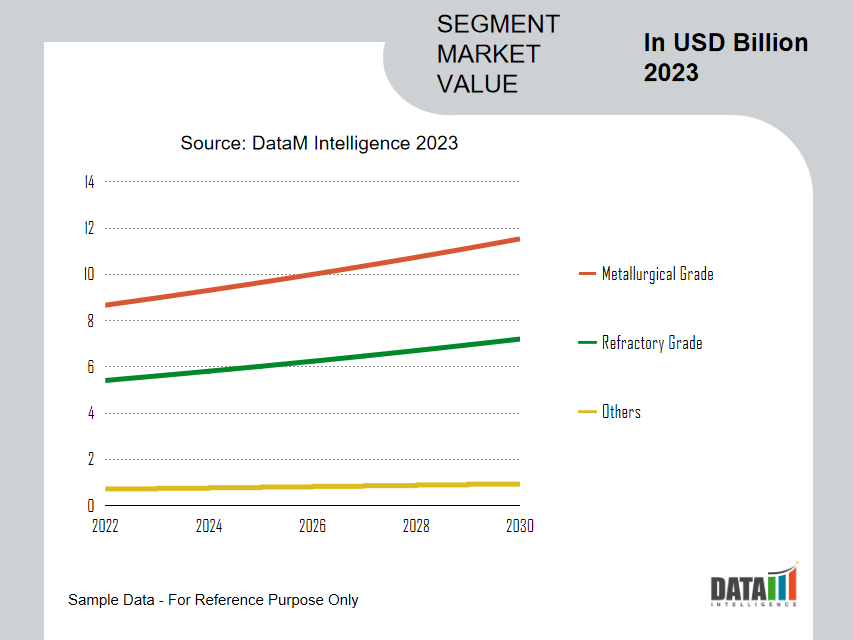

Essential Characteristics and Rising Demand Fueling Aluminium Production

The primary source of aluminum is metallurgical-grade bauxite because of its high aluminum oxide content. By refining it into alumina, which is then processed into aluminum metal, the Bayer process extracts aluminum from bauxite. Because of this feature, alumina is effectively extracted during the refining process, increasing aluminum output rates while lowering production costs.

The global bauxite market may be impacted by changes in the supply of metallurgical-grade bauxite caused by variables such as mining regulations, geopolitical instability, environmental concerns or natural disasters. The market's sensitivity to supply disruptions is emphasized by the potential of price increases. Therefore, the metallurgical grade product segment captures the majority of the total segmental shares.

Market Geographical Share

Large Scale Reserves and Higher Production Leads to the Regional Growth

Large bauxite reserves are present in Africa, especially in nations like Guinea, Ghana and Sierra Leone. Particularly Guinea has some of the biggest and best-quality bauxite reserves across the world. Africa is a major hub for the mining and production of bauxite due to these enormous reserves.

In response to the rising demand for aluminum globally, a number of African nations have been increasing their bauxite production. Because of its abundant deposits, Guinea has experienced a significant increase in bauxite production, attracting investments and increasing output. Therefore, the Middle East and Africa is growing at a highest CAGR during the forecasted period.

COVID-19 Impact Analysis

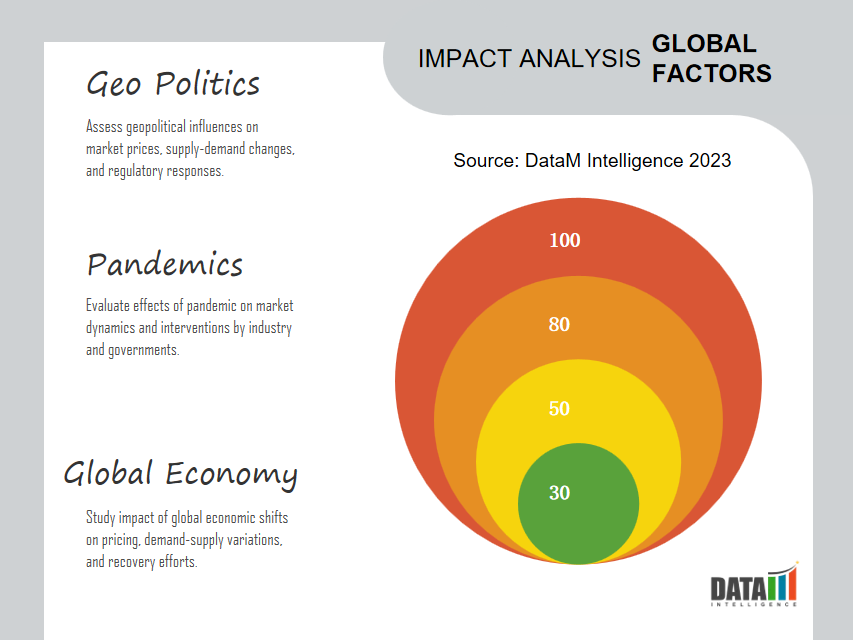

The epidemic caused supply chain disruptions that had an impact on bauxite mining and transportation globally. Lockdowns, limitations on mobility and a lack of workers hampered mining operations, delaying output and affecting supply levels throughout the world, particularly in Asia and Africa.

The pandemic's effects on the economy led to a decline in demand for aluminum and its derivatives. Production of aluminum fell as a result of downturns in key aluminum-consuming industries like building, aerospace and automotive. The reduced the need for bauxite as a raw material as a result.

Price fluctuations for bauxite were caused by changes in supply chains and a decline in the demand for aluminum. Price volatility was brought on by uncertain economic conditions and supply chain interruptions, which had an effect on the profitability of bauxite importers and producers in Asia and Africa.

Bauxite mining companies had additional operating challenges during the epidemic as a result of adhering to health and safety requirements. It became imperative to protect worker safety while preserving operational effectiveness, which resulted in extra expenses and possible production delays.

Russia-Ukraine War Impact Analysis

Trade routes may be disrupted by geopolitical conflicts, especially if export or import restrictions, embargoes or sanctions are put in place. The supply and distribution of bauxite on the global market could be impacted by any disruptions in trade agreements or shipping channels involving major bauxite-supplying nations.

Increased geopolitical tensions are frequently accompanied by market uncertainty. Price changes in commodities, such as those of bauxite, caused by this uncertainty. Changes in demand patterns, disruptions in the supply chain or speculative activity can all cause prices to become volatile.

Key Developments

- In October 2023, The Odisha Mining Corporation and Hindalco Industries Ltd. have announced a long-term supply agreement for bauxite ore. For its projected 2-million-ton alumina refinery and 150-MW captive power plant in Kansariguda, Rayagada district, Odisha, the business intends to source bauxite ore.

- In September 2023, Adbri has awarded ABx Group a contract to provide 90,000–120,000t of bauxite to its cement factory in Birkenhead, South Australia, starting in early 2024 and continuing five years. A "conservative" estimates of US$ 5.4 million has been published by Business News regarding the contract's value. Bauxite from ABx Group's DL130 mining operation will be supplied. Three resources totaling 13.7 million Tons of bauxite reserves are under the project's control.

- In March 2023, India's top producer and exporter of aluminum and alumina, National Aluminium Company Limited (NALCO), which is governed by the Ministry of Mines, successfully developed a Bauxite Certified Reference Material (CRM) known as BARC B1201 in association with the Bhabha Atomic Research Centre (BARC).

Competitive Landscape

The major global players in the market include Rio Tinto, Alcoa Corporation, Guinea Alumina Corporation (GAC), Norsk Hydro, Australian Bauxite Limited, Rusal, Hindalco Industries Limited, BHP, Glencore International and Emirates Global Aluminium PJSC.

Why Purchase the Report?

- To visualize the global bauxite market segmentation based on product, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of bauxite market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global bauxite market report would provide approximately 61 tables, 62 figures and 183 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies