Global Baby Finger Food Market is Segmented By Product Type (Prepared, Dried, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Sales, Others), and By Region (North America, Europe, South America, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2024-2031

Baby Finger Food Market Size

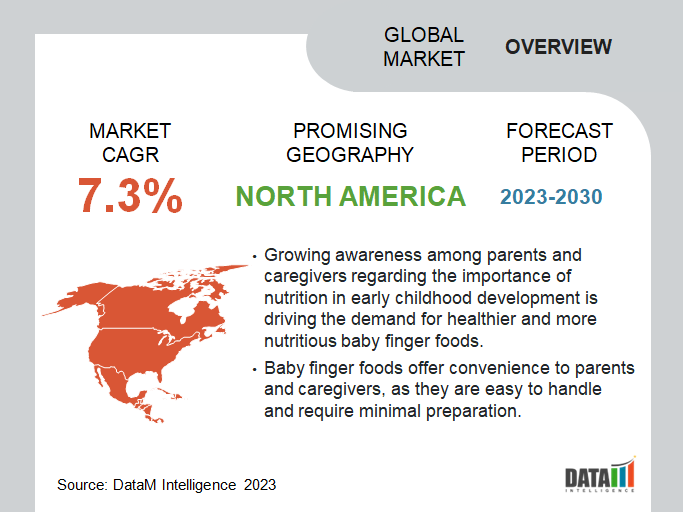

Global Baby Finger Food Market reached USD 19.2 billion in 2022 and is expected to reach USD 33.2 billion by 2030 growing with a CAGR of 7.1% during the forecast period 2024-2031. Growing awareness among parents and caregivers regarding the importance of nutrition in early childhood development is driving the demand for healthier and more nutritious baby finger foods.

Baby finger foods offer convenience to parents and caregivers, as they are easy to handle and require minimal preparation. This factor is boosting their popularity in the baby finger food market.

The increasing adoption of baby-led weaning practices, which involve introducing babies to solid foods through finger foods, is driving the demand for suitable products in the baby fingers food market. The emphasis on the safety and quality of baby finger foods is leading to more stringent regulations and standards, increasing consumer confidence in the baby finger food market.

Market Scope

|

Metrics |

Details |

|

CAGR |

7.1% |

|

Size Available for Years |

2022-2031 |

|

Forecast Period |

2024-2031 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Product Type, Distribution Channel, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, and Middle East & Africa |

|

Fastest Growing Region |

Asia Pacific |

|

Largest Region |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis, and Other key Insights. |

To Know More Insights - Download Sample

Market Dynamics

Growing Awareness among Parents about the Importance of Providing Nutritious Food Drives Market Growth

As parents become more conscious of the nutritional needs of their babies, they seek baby finger food products that offer high-quality, wholesome, and nutritious ingredients. This demand drives manufacturers to develop and offer a wider variety of healthy and nutrient-rich baby finger food options in the baby finger food market. Parents' preference for nutritious food options leads to an increased demand for premium and organic baby finger foods.

Manufacturers respond to this market trend by introducing organic and natural products free from artificial additives and preservatives, catering to health-conscious parents, which further drives the baby finger food market growth. For instance, on December 26, 2022, Mother Nurture launched its delightful range of baby foods, parent-tasted and baby-approved. Packed with nutrition and free from preservatives, the baby foods feature base ingredients sourced from premium farms and factories worldwide. Drawing inspiration from traditional Indian flavors, the recipes are crafted with all-natural ingredients, ensuring a wholesome culinary experience for little ones.

Increasing Rapid Urbanization and Busy Lifestyles Drive Market Growth

Urbanization and busy lifestyles often result in time constraints for parents. As a result, there is a growing demand for convenient and easy-to-prepare baby finger food options. Ready-to-eat and portable baby finger foods cater to the busy routines of urban parents, making them a sought-after choice in the baby finger food market.

With busy schedules, parents look for baby finger foods that can be easily consumed on the go, whether during outings, travel, and other activities. This need for convenience fuels the demand for portable and mess-free baby finger food products, propelling the baby finger food market's growth.

Stringent Regulations and Safety Standards Regarding Baby Food Production Hamper the Market Growth

Compliance with stringent regulations requires manufacturers to implement advanced safety measures, conduct extensive testing, and maintain quality control throughout the production process. These additional requirements often lead to higher production costs, which impacts the pricing of baby finger food products in the market.

Meeting safety standards restrict the use of certain ingredients or additives, limiting the variability of baby finger food products. Manufacturers face challenges in introducing innovative flavors and functional ingredients that could otherwise appeal to a broader consumer base. The rigorous safety testing and approval processes can delay product development and introduction to the market. This slow pace hinders companies from responding quickly to changing consumer demands and preferences.

Market Segment Analysis

The global baby finger food market is segmented based on product type, distribution channel, and region.

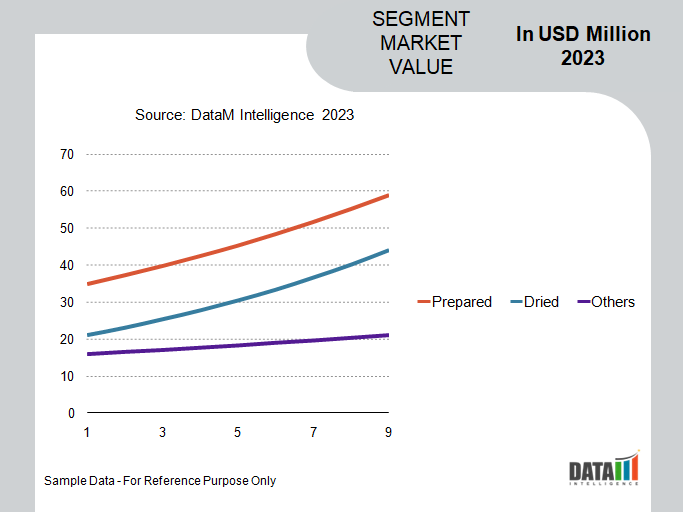

Increasing Demand for Nutritional and On-The-Go Consumption of Prepared Food

The prepared segment is holding the largest share of the global baby finger food market due to its convenience and ease of use for busy parents and caregivers. The prepared baby finger foods come in ready-to-eat forms, requiring minimal preparation, making them an attractive option for on-the-go consumption. The time-saving aspect of prepared baby finger foods aligns with the demands of modern urban lifestyles, where parents often face time constraints.

The prepared segment offers a diverse range of flavors and textures, catering to various taste preferences and nutritional needs of infants. As a result, the market is witnessing a significant preference for prepared baby finger foods, leading to its dominant share in the global market. Manufacturers are continuing to invest in product development and innovation to meet the growing demand in this segment and maintain their competitive position in the baby finger food market.

For instance, on July 13, 2022, Organix, the UK-based organic baby and toddler food brand introduced 29 new products, accompanied by two new ranges: Baby Meals and Organix Kids. These delightful additions will be available at Asda and the Organix Online Shop, offering parents and caregivers a wide array of wholesome and nutritious options for their little ones.

Market Geographical Share

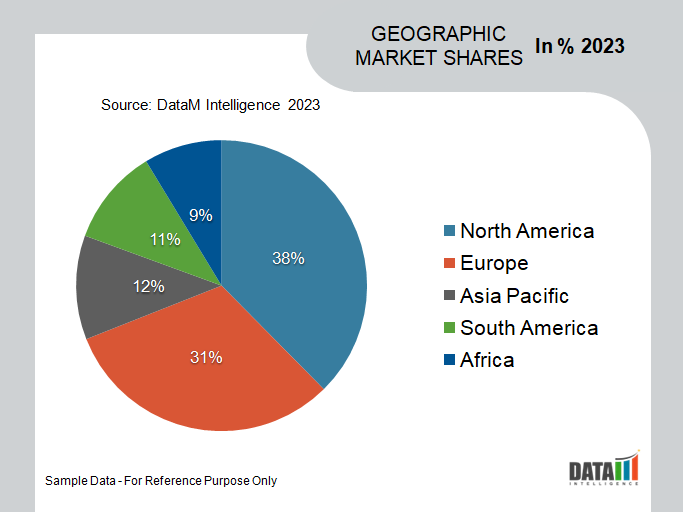

Increasing Demand for Nutritious and Wholesome Baby Finger Food in North America

The North America region is dominating the global baby finger food market. Parents in the region are increasingly health-conscious and seek nutritious and wholesome food options for their babies. Baby finger foods that offer natural and organic ingredients, free from artificial additives, are in high demand, and manufacturers in North America cater to these preferences, driving the market's growth.

The presence of established and innovative baby food companies in North America is contributing to its dominance. These companies have strong distribution networks, extensive product portfolios, and a deep understanding of consumer preferences, enabling them to effectively reach and cater to a wide consumer base. The ability of these companies to launch new and innovative baby finger food products that align with current trends and demands in the market reinforces North America's position as a market leader.

Market Companies

The global baby finger food market players include Kraft-Heinz, Inc., The Hain Celestial Group, Inc., HiPP GmbH & Co. Vertrieb KG, Lotus Bakeries Corporate, Hero Group, Little Dish, Nestlé SA, Annabel Karmel Group Holdings Limited, Piccolo, and Dana Dairy Group.

COVID-19 Impact on Market

The pandemic caused disruptions in the supply chain, affecting the availability of raw materials and production processes. This led to fluctuations in the supply of baby finger food products in the market. The uncertainty and economic challenges during the pandemic influenced consumer spending patterns. Demand for baby finger food products experienced fluctuations, with some parents stockpiling essentials while others cut back on non-essential purchases.

However, with the pandemic prompting lockdowns and restrictions, consumer behavior shifted towards online shopping. The increased reliance on e-commerce channels impacted the distribution and sales of baby finger food products in the baby finger food market.

By Product Type

- Prepared

- Dried

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Sales

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On February 15, 2022, Tiny Organics, a pioneer in early childhood nutrition, introduced an exciting range of plant-based finger foods specially crafted to nurture adventurous eating habits in children. Breaking new ground with their Tiny Beginnings line, they proudly present the very first non-puree baby food designed explicitly for baby-led weaning (BLW), a method that encourages young ones to explore self-feeding at their own comfortable pace.

- On February 16, 2023, Little Spoon, the renowned direct-to-consumer baby, and kids nutrition brand, launched its latest innovation: Biteables – a groundbreaking feeding solution tailored to cater to babies between 9 to 16 months old, whether they're following baby-led weaning or enjoying puree-fed meals.

- In July 2022, Tiny Organics, the U.S.-based baby food brand, introduced "Tiny Beginnings," a groundbreaking line of non-pureed baby food thoughtfully crafted for eaters as young as four months. This innovative collection features six plant-based dishes carefully designed to introduce babies to a variety of enticing tastes and textures, promoting a journey of culinary exploration from the very start.

Why Purchase the Report?

- To visualize the global baby finger food market segmentation based on product type, distribution channel, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of the baby finger food market level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global baby finger food market report would provide approximately 53 tables, 48 figures, and 119 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies