Autotransfusion System Market Size

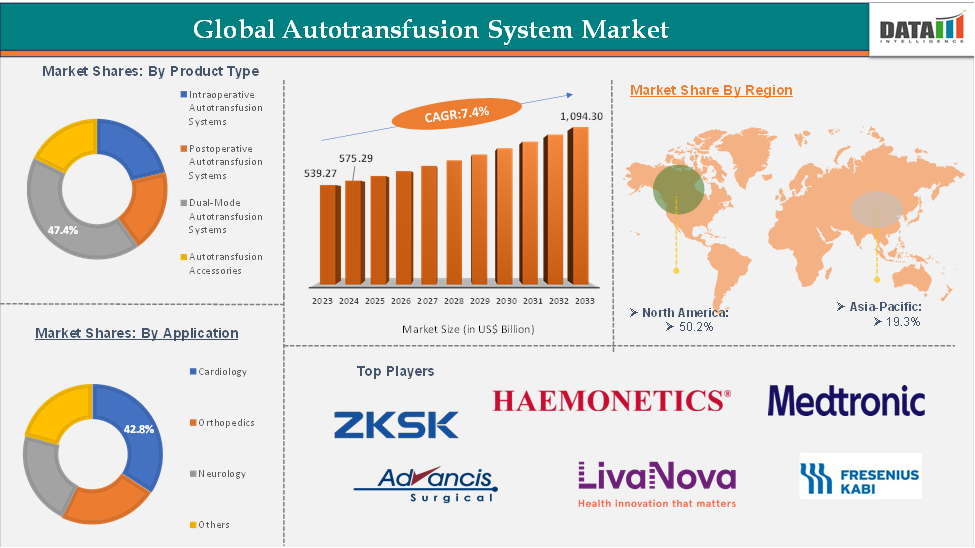

In 2023, the global autotransfusion system market was valued at US$ 539.27 Million. The global Autotransfusion System market size reached US$ 575.29 Million in 2024 and is expected to reach US$ 1,094.30 Million by 2033, growing at a CAGR of 7.4% during the forecast period 2025-2033.

Autotransfusion System Market Overview

The global autotransfusion system market is poised for substantial growth from 2022 to 2032, driven by the increasing incidence of surgeries with maximum blood loss and the rising innovative product launches. Medtronic, LivaNova, Becton, Dickinson and Company, Haemoetics, Fresenius Kabi, and Zimmer Biomet are considered to be the active players of the market within the autotransfusion market their presence across the globe.

These companies are mostly involved in the development of advanced autotransfusion systems and the development of strategic collaborations. The current market growth is expected to be driven by the rising number of surgical procedures.

Autotransfusion System Market Executive Summary

Autotransfusion System Market Dynamics: Drivers & Restraints

Drivers:

Rising number of surgeries with maximum blood loss is significantly driving the autotransfusion system market growth

The rising number of surgeries associated with significant blood loss is expected to drive the autotransfusion system market as healthcare providers increasingly seek effective solutions for managing intraoperative blood loss. Surgeries such as total hip arthroplasty (THA) and total knee arthroplasty (TKA), coronary artery bypass grafting (CABG), and valve replacements, along with other surgeries with maximum blood loss, are demanding patient blood management systems and equipment.

As the volume of these surgeries rises, coupled with the growing emphasis on patient blood management strategies, the adoption of autotransfusion systems is likely to increase, providing a safer alternative to allogeneic transfusions and enhancing overall patient outcomes.

With the rising number of cardiac surgeries, such as coronary artery bypass grafting (CABG) and valve replacements, the demand for autotransfusion systems is expected to rise due to the high volume of blood loss associated with these procedures. For instance, the National Institute of Health in 2023 stated that almost 400,000 CABG surgeries are performed each year making it the most commonly performed major surgical procedure.

The rising surgical volumes of orthopedic surgeries, the need for advanced patient blood management devices is rising to reduce blood loss. For instance, the National Institute of Health in 2023 stated that based on 2019 total volume counts, their model forecasts an increase in THA procedures of 176% by 2040 and 659% by 2060. The estimated increase for TKA is projected to be 139% by 2040 and 469% by 2060.

Surgeries like THA can result in blood loss averaging between 1,000 to 2,000 mL, while TKA may also lead to similar levels of blood loss. With up to 37% of patients undergoing THA and 25% undergoing TKA requiring blood transfusions due to postoperative anemia, there is a clear need for systems that can efficiently recover and reinfuse the patient’s blood during surgery.

With hospitals accounting for a significant portion of surgical procedures, the demand for autotransfusion systems is poised to grow simultaneously with the increasing volume of surgeries performed globally.

Rising innovative product launches are significantly driving the autotransfusion system market growth

The global autotransfusion system market is anticipated to experience significant growth driven by a surge in innovative product launches that enhance the functionality and efficiency of these devices.

Companies are increasingly investing in the development of advanced autotransfusion systems that feature state-of-the-art technologies, such as improved filtration and processing capabilities, which facilitate the seamless collection and reinfusion of a patient's own blood during surgical procedures.

Recent advancements have led to the introduction of systems with intelligent software controls that simplify operations, thereby improving user experience and operational efficiency. The companies are gaining approvals for their latest innovations. For instance, in March 2023, Haemonetics Corporation received 510(k) clearance from the U.S. Food and Drug Administration (FDA) on the next-generation software for the Cell Saver Elite+ Autotransfusion System, with full market release available now.

As surgical volumes continue to rise, particularly for high-blood-loss procedures like Total Hip Arthroplasties (THA) and cardiac surgeries, the demand for safer blood management solutions becomes more critical. Furthermore, the growing emphasis on patient safety and the reduction of transfusion-related complications are driving healthcare providers to adopt these innovative autotransfusion systems.

Moreover, the introduction of smaller, portable devices is expanding the scope of autotransfusion systems beyond traditional operating rooms, allowing their use in emergency care, trauma settings, and even remote areas. These advancements are crucial for addressing challenges like blood shortage, improving patient safety, and ensuring cost-effective solutions in healthcare.

As these innovative products hit the market, they will fuel greater adoption of autotransfusion systems, contributing to their widespread integration into medical practices worldwide and accelerating market growth.

Restraint:

High costs of autotransfusion systems are hampering the growth of the autotransfusion system market

The high costs associated with autotransfusion systems present a significant restraint in the global autotransfusion system market, affecting both healthcare providers and patients.

The high costs associated with autotransfusion systems, particularly highlighted by the Haemonetics Corporation Cell Saver Elite PlusBlood Recovery System, which is priced at around USD 5,032.68, pose a significant restraint in the global autotransfusion system market. This financial barrier impacts healthcare providers' ability to adopt the technologies, especially in smaller facilities or those operating on limited budgets.

The initial investment required for autotransfusion systems can be considerable. The financial strain associated with such investment often leads to reluctance to purchase advanced medical equipment that could enhance patient care and safety during surgical procedures and thus hampers device adoption.

In addition to the purchase price, ongoing maintenance and operational expenses further complicate the financial landscape. Autotransfusion systems require regular servicing and calibration to ensure they operate effectively and safely.

Opportunity:

Integration of AI and big data analytics is expected to create a lucrative opportunity for the growth of the autotransfusion system market

Technological advancements in product development are expected to create significant opportunities for autotransfusion systems, enhancing their effectiveness and usability in clinical settings.

The development of more efficient autotransfusion devices that can quickly and effectively recover blood lost during surgery created a lucrative growth opportunity for the market growth. For instance, advancements like the HemoSep technology allow for the rapid concentration of blood cells, which reduces the need for donor blood and minimizes transfusion reactions. This efficiency not only improves patient outcomes but also streamlines surgical procedures.

As technology advances, the costs associated with manufacturing autotransfusion systems may decrease over time. More efficient production processes and improved designs can lead to lower prices for hospitals and clinics. This cost reduction can make autotransfusion systems more accessible to a wider range of healthcare facilities.

With the growing emphasis on patient blood management strategies, technological innovations in autotransfusion systems align well with efforts to minimize reliance on allogeneic blood transfusions. By enhancing the ability to recover and reinfuse a patient's own blood effectively, these systems support safer surgical practices and better patient outcomes.

For more details on this report – Request for Sample

Autotransfusion System Market, Segment Analysis

The global autotransfusion system market is segmented based on product type, technique, application, end user, and region.

The dual-mode autotransfusion systems segment in the autotransfusion system market was valued at US$ 269.57 million in 2024

Dual-mode autotransfusion systems are sophisticated medical instruments that serve to improve blood recovery during surgical interventions in both intraoperative and postoperative modes. This mode enables the collection and reinfusion of the blood lost by a patient during surgery and minimizes the use of allogeneic blood transfusions. An intraoperative mode is used during the procedure where the blood is collected, processed, and immediately infused back. It is especially useful in surgeries when considerable blood loss is anticipated, such as orthopedic or cardiac procedures.

Recent innovations in dual-mode autotransfusion are, improved filtration and washing techniques regarding quality recovery of blood and interfaces that allow easy operation for health care providers. Innovations like combined data management systems also improve transfusion data and outcomes tracking, propelling patient blood management as a whole.

Moreover, numerous key players are involved in dual-mode autotransfusion systems which include, autoLog IQ Autotransfusion System by Medtronic, Disposable Blood Autotransfusion System by Beijing ZKSK, Hemoclear by HemoClear B.V., and others.

Thus, dual-mode autotransfusion systems are considered a great leap in surgical care that improves patient outcomes through frugality in blood management.

Autotransfusion System Market, Geographical Analysis

The North America autotransfusion system market was valued at US$ 286.52 million in 2024 and is estimated to reach US$ 517.17 million by 2033.

The North American autotransfusion systems market is experiencing significant growth, driven by the various surgeries and supportive government policies aimed at improving healthcare outcomes. The combination of factors, such as the increasing number of surgical procedures, supportive healthcare policies, and a shift towards safer blood management practices, positions autotransfusion systems as a critical component of modern surgical care in the region.

In the United States, an estimated 36,000 units of red blood cells, 5,000 units of platelets, and 6,500 units of plasma are required daily, in addition to a transfusion of nearly 21 million blood components annually. This signifies the higher demand for blood and blood-related products in the country. Autologous transfusion is a safer and more effective alternative to tackle this higher demand.

According to the American College of Surgeons, the US alone conducts over 15 million significant surgeries annually, with the majority of these procedures associated with orthopedic and cardiovascular procedures. This poses a significant risk of blood loss during procedures. Additionally, the scarcity of blood and the risks associated with transfusion-related infections contributed to the rise in demand for autotransfusion systems in the country.

According to the Canadian Medical Protective Association, approximately 1 million surgeries are performed annually in Canada. Health Canada established a $3 million budget for the MSM Research Grant Program, which is jointly administered by Canadian Blood Services and Héma-Québec, due to the critical nature of blood loss in patient care. These initiatives emphasize that the implementation of the autotransfusion technique of blood management and safety measures will significantly enhance the quality of patient care during surgical procedures.

Asia-Pacific is growing at the fastest pace in the autotransfusion system market, holding 19.3% of the market share

The Asia-Pacific autotransfusion system market is witnessing robust growth, driven by the increasing demand for advanced blood management systems during surgeries. The region's large population and the significant burden of surgical procedures have created a pressing need for innovative solutions to address blood scarcity and reduce dependency on donor blood.

The Asia-Pacific region experiences a high volume of surgical procedures, particularly cardiovascular surgeries, which are a primary driver for the adoption of autotransfusion systems. In India alone, approximately 30 million surgical procedures are conducted annually, with studies indicating a demand for nearly 50 million surgeries. Such extensive surgical activity necessitates reliable blood management systems to reduce risks associated with donor blood shortages and potential infections.

Similarly, 738 heart transplants were performed in China in 2021 according to the China Heart Transplant Registry, showcasing the growing reliance on surgical interventions requiring advanced blood conservation methods. Japan also reports 50–70 heart transplants annually, including pediatric cases, underlining the consistent demand for autotransfusion systems in specialized surgeries.

Australia's healthcare sector also contributes significantly to this market, with 112 heart transplants conducted in 2021. These statistics highlight the increasing surgical volume and the necessity for autotransfusion technologies to address perioperative blood management. The WHO reports that Southeast Asia faces one of the highest global burdens of road accidents and trauma cases, often requiring immediate surgical interventions. In such scenarios, autotransfusion systems emerge as life-saving tools, ensuring the timely availability of blood for critical surgeries.

Global Medical Scrubs Market Competitive Landscape

Top companies in the autotransfusion system market include Medtronic, LivaNova PLC, Haemonetics Corporation, Beijing ZKSK Technology Co., Ltd., Hemoclear, BD, Fresenius Kabi, Zimmer Biomet Holdings, Inc., and Advancis Surgical, among others.

Autotransfusion System Market Key Developments

In March 2023, Haemonetics Corporation received 510(k) clearance from the U.S. Food and Drug Administration (FDA) on the next-generation software for the Cell Saver Elite+ Autotransfusion System, with full market release available.

In August 2023, the National Blood Service Commission (NBSC) of Nigeria and Netherlands-based HemoClear B.V. entered into a strategic partnership. This alliance is set to introduce autologous (patient-own) blood transfusion services, addressing the critical issue of blood shortages leading to unnecessary suffering and death.

Autotransfusion System Market Scope

Metrics | Details | |

CAGR | 7.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Product Type | Intraoperative Autotransfusion Systems, Postoperative Autotransfusion Systems, Dual-Mode Autotransfusion Systems, Autotransfusion Accessories |

Technique | Predeposit autologous donation (PAD), Acute Normovolaemic Haemodilution (ANH), Perioperative cell salvage (PCS) | |

Application | Orthopedic, Neurology, Cardiology, Others | |

End-User | Hospitals, Specialty Clinics, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

DMI Insights on Autotransfusion Market

Our research indicates that the global autotransfusion system market is set to experience strong growth over the forecast period, driven by the rising volume of surgical procedures involving substantial blood loss and an increase in innovative product developments. Leading companies such as Medtronic, LivaNova, Becton, Dickinson and Company, Haemonetics, Fresenius Kabi, and Zimmer Biomet are actively contributing to market expansion through the development of advanced systems and strategic collaborations. This growth reflects a broader shift toward safer and more efficient blood management practices in surgical care globally.

The global autotransfusion system market report delivers a detailed analysis with 70+ key tables, more than 60+ visually impactful figures, and 178 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more medical device-related reports, please click here