Market Size

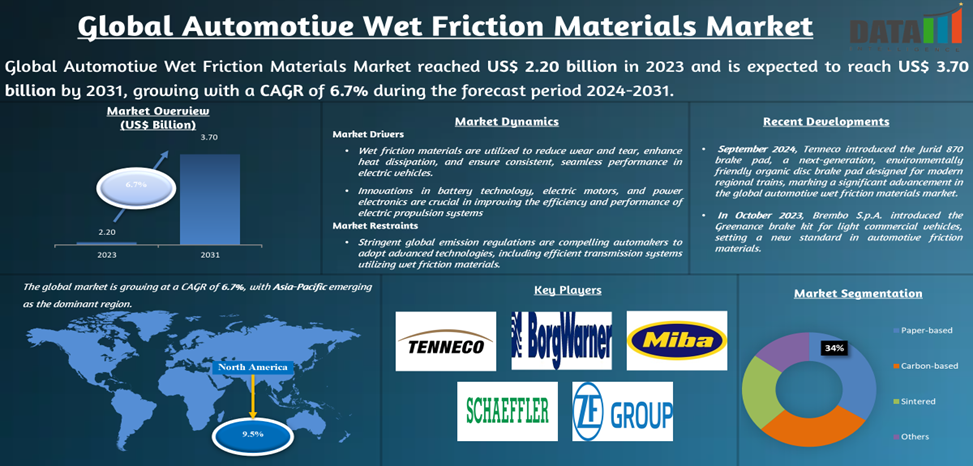

Global Automotive Wet Friction Materials Market reached US$ 2.25 billion in 2023 and is expected to reach US$ 3.70 billion by 2031, growing with a CAGR of 6.7% during the forecast period 2024-2031.

The automotive industry's global market for wet friction materials is anticipated to expand swiftly, primarily as a result of the increased demand for improved transmission systems and vehicle performance. Automatic transmissions, wet brakes and clutches are the primary applications of wet friction materials, which result in both improved durability and cleaner operation. With the increasing production of electric vehicles (EVs) and the increasing demand for their energy-efficient automotive components, its utilization has also been on the rise.

As many governments across the world make improvements to minimize greenhouse gas emissions by shifting to electric automobiles and hybrid vehicle applications, the rate of adoption of new electric and hybrid vehicles has increased. For example, the International Energy Agency (IEA) reports that new electric car registrations for the year 2023 in US increased with over 40% compared to 2022, bringing the total count to 1.4 million. All of these underscore the critical responsibilities that high-performance materials play in this sector.

Asia-Pacific is emerging as the fastest-growing market for automotive wet friction materials, driven by robust automotive manufacturing bases in China, India and Japan. According to the Japan Automobile Manufacturers Association, Japan produced over 7.8 million vehicles in 2023, while China remains the largest automotive producer globally. Increasing EV production and rising investments in automotive innovation in India further propel regional market growth. Additionally, supportive government policies, such as India’s Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) initiative, are catalyzing demand for advanced automotive materials.

Executive Summary

For more Insights - Request Free Sample

Market Scope

| Metrics | Details |

| CAGR | 6.7% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (US$) |

| Segments Covered | Product Type, Vehicle, Application, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | North America |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

Market Dynamics

Rise in Electric Vehicle Production

The demand for automotive wet friction materials is being substantially increased by the increase in electric vehicle (EV) production. In electric vehicles, high-performance transmission systems facilitate the transfer of torque and energy efficiency. Wet friction materials are utilized to reduce wear and tear, enhance heat dissipation and ensure consistent, seamless performance.

Various governments have implemented favorable regulations to encourage the adoption of electric vehicles. For instance, the European Union aims to reduce carbon emissions from new cars by 55% by 2030 compared to 2021 levels, as outlined in the European Green Deal. This has led to a significant increase in the sale of electric vehicles (EVs). According to the European Environment Agency, an estimated 2.4 million new electric cars were registered in 2023, a significant increase from the 2 million registered in 2022.

Stringent Emission Regulations for Automakers

Stringent global emission regulations are compelling automakers to adopt advanced technologies, including efficient transmission systems utilizing wet friction materials. These materials help reduce energy losses and enhance fuel efficiency, aligning with regulatory mandates. The U.S. Environmental Protection Agency (EPA) has implemented the Safer Affordable Fuel-Efficient (SAFE) Vehicles Rule, which mandates a 1.5% annual increase in fuel efficiency for passenger cars and light trucks through 2026.

Similarly, China’s "China VI" emission standards, one of the most stringent globally, require automakers to develop innovative solutions to meet low-emission targets. Wet friction materials are critical in achieving these goals by enabling optimized transmission performance and reduced CO2 emissions. For instance, high-friction performance allows smoother gear shifts and minimizes power loss, directly contributing to fuel savings and compliance with emission standards.

High Development and Manufacturing Costs

The high development and manufacturing costs of automotive wet friction materials present a significant challenge to market growth. Developing these materials requires advanced technologies, extensive R&D and high-grade raw materials, all of which increase production costs. For example, integrating carbon-based composites or advanced ceramic materials into friction components enhances performance but also significantly raises costs.

According to the U.S. Department of Commerce, manufacturing costs in the automotive sector have risen by 8% annually due to the adoption of advanced materials and technologies. Additionally, the need for specialized equipment and processes further inflates production expenses. This cost barrier is particularly challenging for small and medium-sized enterprises (SMEs) looking to enter the market. The high costs also translate into higher prices for End-User, potentially limiting adoption rates in price-sensitive markets.

Market Segment Analysis

The global automotive wet friction materials market is segmented based on product type , vehicle, application, end-user and region.

Critical Applications in Commercial Vehicles and Wet Brake

The automotive wet friction materials market is segmented based on application, including automatic transmissions, wet brakes and clutches. Automatic transmissions represent the largest segment due to their widespread adoption in passenger and commercial vehicles. These systems rely heavily on wet friction materials for efficient operation, especially in EVs and hybrid vehicles.

Wet brakes are another critical segment, predominantly used in heavy-duty vehicles and machinery. The need for reliable braking systems in construction and agricultural equipment drives demand for advanced friction materials. According to the IEA, in 2022, nearly 66,000 electric buses and 60,000 medium- and heavy-duty trucks were sold worldwide, representing about 4.5% of all bus sales and 1.2% of truck sales.

Market Geographical Penetration

Advanced Space Infrastructure and Robust Government Support in North America

North America holds the largest market share in the automotive wet friction materials industry, attributed to a strong automotive manufacturing base and high demand for advanced vehicle technologies. The region’s focus on sustainability and emission reduction also drives the adoption of wet friction materials. The U.S., the largest contributor, benefits from robust R&D activities and government support for automotive innovation.

The National Highway Traffic Safety Administration (NHTSA) reports that over 17 million vehicles were sold in the U.S. in 2023, showcasing sustained demand. Additionally, Canadian government initiatives, such as the "Net-Zero Emissions by 2050" strategy, encourage the adoption of energy-efficient automotive components, further boosting the market.

Major Global Players

The major global players in the market include BorgWarner Inc., ZF Friedrichshafen AG, Aisin Seiki Co., Ltd., Valeo S.A., Brembo S.p.A., Tenneco Inc., Schaeffler AG, Exedy Corporation and Miba AG, F.C.C. Co., Ltd.

Sustainability Analysis

Sustainability is increasingly becoming a focal point in the automotive wet friction materials market, with manufacturers actively developing eco-friendly friction materials that utilize recyclable and biodegradable components to mitigate environmental impact. For instance, the incorporation of natural fibers and bio-based resins in friction materials reduces reliance on synthetic materials, aligning with global sustainability objectives.

Additionally, telematics and remote monitoring systems integrated into vehicles play a significant role in promoting sustainability by optimizing vehicle performance and minimizing unnecessary fuel consumption. The World Economic Forum emphasizes that the adoption of such technologies within the automotive sector can lead to a significant reduction in CO2 emissions by significantly. This shift towards sustainable practices is not only beneficial for the environment but also reflects a growing consumer demand for greener automotive solutions.

Recent Development

- In September 2024, Tenneco introduced the Jurid 870 brake pad, a next-generation, environmentally friendly organic disc brake pad designed for modern regional trains, marking a significant advancement in the global automotive wet friction materials market. Featuring innovative “Green Pad” technology, the Jurid 870 delivers exceptional temperature resistance and mechanical strength, allowing it to replace sintered friction materials in demanding applications.

- In October 2023, Brembo S.p.A. introduced the Greenance brake kit for light commercial vehicles, setting a new standard in automotive friction materials. This innovative kit delivers over 80% reduction in particulate emissions, including a remarkable 83% drop in PM10 and 80% in PM2.5, while boasting a lifespan more than three times that of current aftermarket products.

Why Purchase the Report?

- To visualize the global automotive wet friction materials market segmentation based on product type, vehicle, application, end-user and region.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points at the automotive wet friction materials market level for all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global automotive wet friction materials market report would provide approximately 70 tables, 62 figures and 201 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies