Automated Ophthalmic Perimeters Market – Industry Trends & Outlook

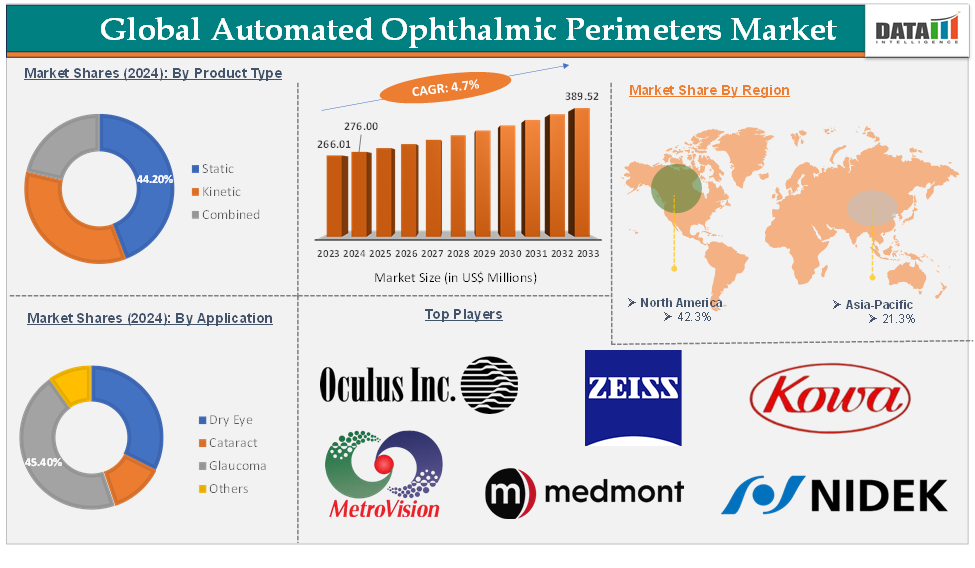

The global automated ophthalmic perimeters market was valued at US$ 266.01 Million in 2023. The market size reached US$ 276.00 Million in 2024 and is expected to reach US$ 389.52 Million by 2033, growing at a CAGR of 4.7% during the forecast period 2025-2033.

The increasing prevalence of ocular conditions such as glaucoma, diabetic retinopathy, and age-related macular degeneration (AMD), the growing aging population, and technological advancements a primary drivers for market growth. Innovations in automated perimetry technology have significantly enhanced the accessibility and effectiveness of these devices, making them essential tools in the early detection and management of visual field defects.

For instance, in May 2024, iCare introduced the faster and Smarter iCare COMPASS perimeter. This perimeter marks a significant improvement in ophthalmic diagnostics by integrating speed, precision, and user-friendly features. Incorporating active retinal tracking and confocal imaging enhances the capability to identify and monitor changes in the visual field, making it an essential tool for ophthalmologists in managing eye health, particularly for conditions such as glaucoma.

Executive Summary

Global Automated Ophthalmic Perimeters Market Dynamics: Drivers

Increasing prevalence of eye disorders

The increasing prevalence of eye disorders is expected to drive the market growth during the forecast period. The rising incidence of eye diseases, particularly glaucoma and age-related macular degeneration (AMD), is a significant driver for the automated ophthalmic perimeters market.

According to a BMJ Ophthalmology publication in April 2024, the estimate of 57.5 million cases of primary open-angle glaucoma (POAG) reflects the growing recognition of the disease's impact on global health. POAG is the most common form of glaucoma, accounting for about 74% of all glaucoma cases. The prevalence of POAG is approximately 2.4% among adults over the age of 40, which increases significantly with age, reaching 9.2% in those over 80 years old.

Age-related macular degeneration (AMD) is a major cause of vision loss, particularly among older adults. As the population ages, the number of individuals at risk for AMD is on the rise. The World Health Organization data in October 2022 projects that by 2050, the population aged 80 years and older will triple, leading to a higher prevalence of age-related eye diseases, including AMD.

As individuals grow older, they become increasingly susceptible to various eye conditions, including glaucoma, age-related macular degeneration (AMD), and cataracts. The World Health Organization estimates that the population aged 65 and older will increase from 700 million to 1.5 billion by 2050. This demographic shift is expected to result in a higher prevalence of visual impairments, as many eye diseases are associated with aging and become more common in older adults.

Global Automated Ophthalmic Perimeters Market Dynamics: Restraints

High cost of devices and treatment

The high cost of automated ophthalmic perimeters and associated treatments is a significant restraint on the global market, particularly impacting smaller clinics and healthcare providers in developing regions. Advanced perimetry devices require substantial initial investment and ongoing maintenance expenses, which can be prohibitive for facilities with limited budgets.

The price range of $2,800.00 to $3,200.00 for hospital automated perimetry machines and computer peripheral vision test equipment represents a comparatively affordable option within the global automated ophthalmic perimeters market. In this market, device prices can be significantly higher depending on the manufacturer, technological sophistication, and included features.

These financial barriers restrict access to the latest diagnostic technologies, especially in areas where healthcare funding is constrained, ultimately limiting the adoption of automated perimeters and reducing the availability of high-quality eye care for patients. Additionally, the lack of comprehensive reimbursement policies for visual field testing further discourages both providers and patients from utilizing these advanced diagnostic tools, thereby slowing market growth and perpetuating disparities in access to effective ophthalmic care.

Global Automated Ophthalmic Perimeters Market Dynamics: Opportunities

Integration of AI and advanced analytics

The integration of artificial intelligence (AI) and advanced analytics presents a major opportunity for the global automated ophthalmic perimeters market, promising to transform how visual field testing and eye disease management are conducted. AI algorithms can analyze the vast amounts of high-resolution imaging data generated by automated perimeters, such as visual field maps and retinal scans, with greater speed and precision than traditional methods.

AI-powered systems can also automate the segmentation and quantification of visual field defects, standardize test interpretations, and reduce inter-observer variability, leading to more consistent and reliable diagnoses. Advanced analytics further enable predictive modeling, allowing clinicians to forecast disease progression, personalize treatment plans, and optimize follow-up intervals based on individual risk profiles.

For instance, in June 2025, Perimeter Medical Imaging AI, Inc. launched the OCT-Tissue Registry, a nationwide database designed to collect thousands of images and clinical data from surgical procedures performed with the company’s advanced Optical Coherence Tomography (OCT) imaging technology. This initiative aims to accelerate the development and refinement of Perimeter’s artificial intelligence (AI) deep-learning models, particularly for its next-generation investigational imaging systems.

Also, in August 2024, OCULUS launched Frequency Doubling Perimetry (FDP) as a new capability within its Easyfield VR Virtual Reality Visual Field Analyzer & Screener, expanding the device’s functionality for eye care professionals. FDP is a visual field testing method that uses flickering black and white bars to detect visual field defects. It is particularly sensitive for the early detection of glaucomatous damage and other optic nerve diseases, often identifying functional loss sooner than standard automated perimetry (SAP).

For more details on this report, Request for Sample

Global Automated Ophthalmic Perimeters Market - Segment Analysis

The global automated ophthalmic perimeters market is segmented based on product type, application, end-user, and region.

Product Type:

The static product type segment in the automated ophthalmic perimeters market was valued at US$ 121.99 Million in 2024

Static perimeters are instruments utilized in ophthalmology to evaluate a patient's visual field by displaying stationary stimuli at specific locations. These devices gauge the sensitivity of the visual field, aiding in the identification of vision loss or irregularities. They are especially useful for diagnosing conditions like glaucoma, where it is crucial to monitor changes in the visual field for prompt intervention.

Recent developments in software algorithms have greatly improved the accuracy and efficiency of static perimeters. These algorithms facilitate quicker testing durations and provide more precise assessments of visual field sensitivity, resulting in enhanced diagnostic results.

Moreover, key players in the industry's innovative product launches and technological advancements help to drive this market growth. For instance, in March 2024, Medmont International Pty Ltd introduced the Medmont M700 Automated Perimeter, an innovative technology designed for assessing visual fields effectively. The M700 is designed to offer greater sensitivity to glaucoma than conventional tests like the 24-2 and 30-2 patterns.

By enhancing the density of test points in central regions, the M700 is capable of identifying subtle variations in visual field sensitivity that could signal early indications of glaucoma, which is essential for prompt diagnosis and intervention. These factors have solidified the segment's position in the global automated ophthalmic perimeters market.

Application:

The glaucoma application segment in the automated ophthalmic perimeters market was valued at US$ 125.31 Million in 2024

The glaucoma application segment within the global automated ophthalmic perimeters market focuses on the use of these devices for the detection, diagnosis, and ongoing monitoring of glaucoma, a leading cause of irreversible blindness worldwide. Automated perimeters are essential tools in glaucoma care, as they systematically measure a patient’s visual field to identify early functional loss and track disease progression over time.

This segment is driven by several key factors, including the rising global prevalence of glaucoma, especially among aging populations, and the critical need for early detection and intervention to prevent vision loss. Technological advancements, such as the integration of artificial intelligence and improved imaging capabilities, have enhanced the accuracy, efficiency, and patient comfort of automated perimetry, further fueling adoption.

Additionally, growing awareness of eye health, supportive clinical guidelines recommending routine visual field testing for glaucoma patients, and the shift toward outpatient and remote care are expanding access to these diagnostic tools. As a result, the glaucoma segment remains a primary driver of growth in the automated ophthalmic perimeters market, underscoring the importance of advanced perimetry in effective glaucoma management and prevention of blindness.

For instance, in May 2024, iCare introduced a faster and smarter version of its COMPASS perimeter, a device used for advanced visual field testing and retinal imaging, particularly in glaucoma management. The new ZEST Fast threshold strategy significantly reduces exam time by 30% in glaucoma patients and 40% in healthy patients, compared to previous methods, without compromising accuracy. This leads to greater patient comfort and improved test reliability. These factors have solidified the segment's position in the global automated ophthalmic perimeters market.

Global Automated Ophthalmic Perimeters Market – Geographical Analysis

North America automated ophthalmic perimeters market was valued at US$ 112.66 Million in 2024

Cataracts are a prevalent eye condition associated with aging, marked by the clouding of the lens, which can result in vision loss and blindness if not treated. As cataracts advance, they can lead to visual field defects that can be identified using automated perimetry devices. Cataracts are a prevalent condition associated with aging and the leading cause of vision loss globally.

As per CDC data in May 2024, over 20.5 million Americans aged 40 and above are currently affected by cataracts. By the age of 65, more than 90% of people in the United States are likely to develop cataracts. In around 3% of individuals with ocular hypertension, the retinal veins may become obstructed, a condition known as retinal vein occlusion, which could potentially result in vision impairment.

Also, according to the Glaucoma Research Foundation data in February 2024, more than 3 million individuals in the United States currently have glaucoma. The National Eye Institute projects that this number will increase to 4.2 million by 2030, representing a 58 percent rise.

The rising geriatric population in North America greatly impacts the need for effective diagnostic tools, like automated perimeters, because older adults are more vulnerable to age-related eye conditions. According to Population Reference Bureau news in January 2024, the number of Americans aged 65 and older is expected to rise from 58 million in 2022 to 82 million by 2050.

Moreover, a major number of key players present, well-advanced healthcare infrastructure, and product launches drive this market growth in this region. According to Optometry Times in January 2024, the introduction of a new virtual reality visual field analyzer and vision screener into the U.S. ophthalmic market marks a significant advancement in eye care technology. This innovative device, such as the OCULUS Easyfield VR, utilizes virtual reality (VR) to conduct visual field tests, providing a more efficient and comfortable experience for both patients and eye care professionals. Thus, the above factors are consolidating the region's position as a dominant force in the global automated ophthalmic perimeters market.

Asia-Pacific automated ophthalmic perimeters market was valued at US$ 56.66 Million in 2024

The Asia-Pacific automated ophthalmic perimeters market is witnessing strong growth, propelled by several important factors. The region is facing a rising prevalence of vision-related disorders such as glaucoma, diabetic retinopathy, and age-related macular degeneration, largely due to an aging population and increasing rates of chronic diseases.

This escalating disease burden is driving the need for early detection and continuous monitoring, making automated perimeters an essential part of clinical eye care. Technological advancements, including the integration of artificial intelligence, enhanced imaging capabilities, and more user-friendly interfaces, are further increasing the accuracy, efficiency, and accessibility of these devices.

Hospitals and eye care clinics across Asia-Pacific are rapidly adopting new and advanced models introduced by leading manufacturers. Additionally, the expansion of healthcare infrastructure and rising healthcare spending in countries like China, India, and Japan are making it easier for providers to invest in sophisticated ophthalmic equipment.

Furthermore, greater awareness of eye health, supportive government initiatives, and the growing number of industry conferences and trade shows in the region are all contributing to market expansion. Together, these drivers are positioning Asia-Pacific as one of the fastest-growing regions in the global automated ophthalmic perimeters market.

For instance, in February 2025, in Japan, Rexxam introduced the FIELDNavigator automated perimeter to its product portfolio, marking a significant advancement in visual field-testing technology. The FIELDNavigator is a head-mounted, eye-tracking perimeter designed to objectively and reliably assess patients' visual fields, offering several improvements over traditional perimetry devices. Thus, the above factors are consolidating the region's position as a dominant force in the global automated ophthalmic perimeters market.

Automated Ophthalmic Perimeters Market Major Players

The major global players in the automated ophthalmic perimeters market include Carl Zeiss, Occulus Inc., Metro Vision, Kowa Company, Ltd., Medmont, Nidek Co., Ltd., Essilor Instruments, Haag Streit, Optopol Technology, Topcon Corporation, OCULUS, FREY, TOMEY GmbH + RODENSTOCK Instruments, and iCare, among others.

Key Developments

In February 2025, Altris AI, recognized for its advanced AI solutions in OCT (Optical Coherence Tomography) scan analysis, launched an advanced glaucoma Optic Disc Analysis module to further enhance early and accurate glaucoma detection. This new module builds on Altris AI’s earlier innovation with Ganglion Cell Complex (GCC) Asymmetry Analysis, which was designed to detect early glaucoma risk.

In November 2024, Konan Medical launched the objectiveFIELD (OFA) visual field analyzer, a next-generation device designed to objectively assess visual field abnormalities by measuring pupillary responses, rather than relying on patients' manual input.

Market Scope

Metrics | Details | |

CAGR | 4.7% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Mn) | |

Segments Covered | Product Type | Static, Kinetic, Combined |

Application | Dry Eye, Cataract, Glaucoma, Others | |

End-User | Hospitals, Ophthalmology Clinics, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

DMI Insights:

According to DMI analysis, the global automated ophthalmic perimeters market was valued at US$ 266.01 Million in 2023. The market size reached US$ 276.00 Million in 2024 and is expected to reach US$ 389.52 Million by 2033, growing at a CAGR of 5.6% during the forecast period 2025-2033.

The growth of the global automated ophthalmic perimeters market is largely fueled by the rising incidence of vision-related conditions such as glaucoma, diabetic retinopathy, and age-related macular degeneration. These diseases, which are becoming more prevalent due to an aging population and increasing rates of chronic illnesses, require frequent and accurate visual field testing, driving up demand for automated perimeters.

Technological advancements are also playing a pivotal role in shaping the market landscape. Innovations such as artificial intelligence integration, enhanced imaging technologies, and more intuitive user interfaces are significantly improving the precision, efficiency, and usability of automated perimetry devices. The growing adoption of telemedicine and remote monitoring solutions is making advanced eye care more accessible, especially in remote and underserved areas.

The future outlook for the market remains highly positive. North America leads the market, with substantial healthcare spending, rapid uptake of new technologies, and a large patient population. The Asia-Pacific region is projected to experience the fastest growth, propelled by expanding healthcare infrastructure, increasing awareness, and a rising elderly demographic. As manufacturers continue to develop faster, smarter, and more AI-enabled devices, the market is set for continued expansion. The ongoing trend toward patient-centered care, along with the growth of outpatient and home-based healthcare services, is expected to sustain robust demand for automated ophthalmic perimeters well into the future.

The global automated ophthalmic perimeters market report delivers a detailed analysis with 74 key tables, more than 57 visually impactful figures, and 173 pages of expert insights, providing a complete view of the market landscape.