Overview

Attention-Deficit/Hyperactivity Disorder (ADHD) is a neurodevelopmental condition that affects how the brain functions, particularly in controlling attention and behavior. Despite its name, ADHD doesn't mean a lack of attention but rather difficulty in regulating and directing attention to specific tasks. Common symptoms include trouble focusing, difficulty sitting still, and impulsive behaviors. These symptoms typically emerge in childhood, often between the ages of 3 and 6, and can persist into adulthood, though some individuals may not be diagnosed until later in life.

While there is no cure for ADHD, various treatments, including medications such as stimulants and non-stimulants, along with behavioral therapies, can significantly help manage the symptoms. These treatments aim to improve focus, reduce impulsivity, and enhance the individual’s ability to function in daily life, making ADHD manageable for most people.

Executive Summary

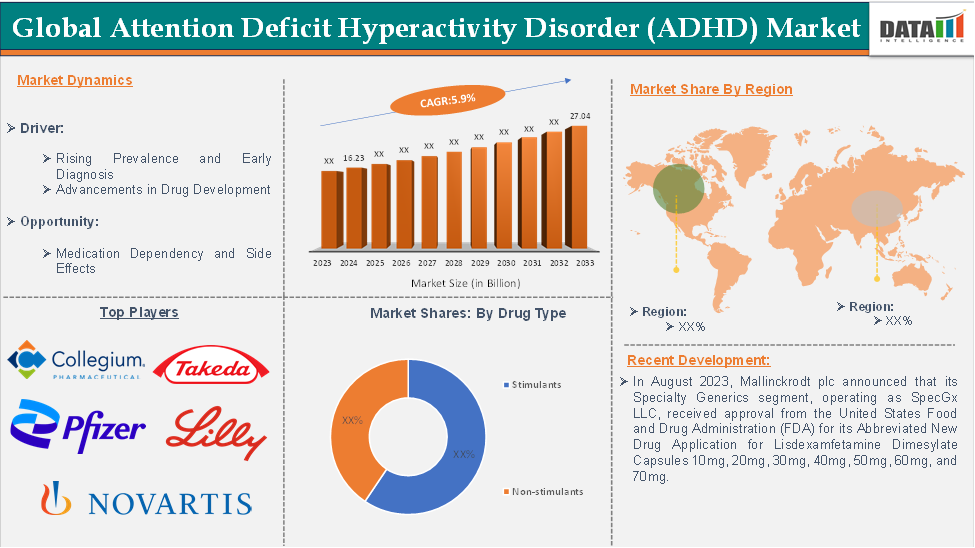

Market Dynamics: Drivers & Restraints

Advancements in Drug Development

Advancements in drug development are expected to be a key driver of growth in the ADHD market, as they lead to more effective, safer, and convenient treatment options for patients. Traditional ADHD medications, particularly stimulants like methylphenidate and amphetamines, have long been effective but are often associated with side effects such as sleep disturbances, decreased appetite, and mood swings. Newer drugs are being designed to maintain efficacy while minimizing these unwanted effects, which is improving patient compliance and satisfaction. For instance, Camber Pharmaceuticals announced the addition of the Amphetamine IR Tablets to their current portfolio. Amphetamine IR Tablets from Camber are available in 5, 7.5, 10, 12.5, 15, 20, and 30 mg strengths.

In addition to improved formulations, the development of extended-release and once-daily medications has significantly enhanced treatment convenience, especially for children and working adults. These formulations reduce the need for multiple doses throughout the day, offering better symptom control with fewer disruptions. For instance, in August 2023, Mallinckrodt plc announced that its Specialty Generics division, operating under SpecGx LLC, has received FDA approval for its Abbreviated New Drug Application (ANDA) for Lisdexamfetamine Dimesylate Capsules in 10mg, 20mg, 30mg, 40mg, 50mg, 60mg, and 70mg strengths. The U.S. Food and Drug Administration confirmed that SpecGx’s product is bioequivalent and therapeutically equivalent to the reference listed drug (RLD), Vyvanse Capsules, developed by Takeda Pharmaceuticals U.S.A., Inc., across all seven approved dosage strengths. This approval allows SpecGx to offer a generic alternative to Vyvanse for the treatment of ADHD.

Moreover, the rise of non-stimulant medications and orally disintegrating tablets is broadening the range of treatment choices, making it easier to personalize care based on individual patient needs. As pharmaceutical companies continue to innovate in this space, the availability of advanced therapies is expected to increase, supporting sustained market growth and expanding access to treatment for a wider patient population.

Medication Dependency and Side Effects

Medication dependency and side effects are significant factors expected to hinder the growth of the ADHD treatment market. Many of the most commonly prescribed ADHD medications—particularly stimulant drugs like amphetamines and methylphenidate—carry a risk of dependency or misuse, especially in adolescents and young adults. Concerns over the potential for abuse can make both patients and healthcare providers hesitant to initiate or continue pharmacological treatment, especially for long-term use.

In addition to dependency risks, side effects such as insomnia, appetite suppression, anxiety, mood changes, and cardiovascular concerns can negatively impact a patient's quality of life. These adverse effects often lead to poor adherence to treatment or complete discontinuation, reducing the overall effectiveness of therapy.

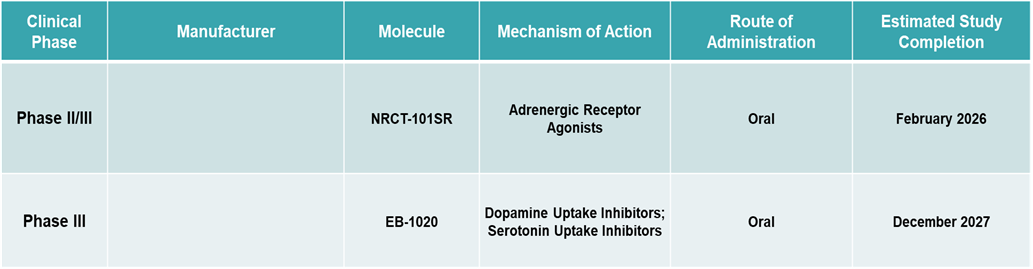

Pipeline Analysis

Segment Analysis

The global attention deficit hyperactivity disorder (ADHD) market is segmented based on type, drug type, age group, and region.

Drug Type:

The stimulants segment is expected to dominate the attention deficit hyperactivity disorder (ADHD) market with the highest market share

The stimulants segment, which includes methylphenidate and amphetamines, is projected to witness substantial growth and continue holding the largest share of the ADHD treatment market. This is primarily driven by their widespread use and proven effectiveness in managing key ADHD symptoms such as short attention span, impulsivity, and hyperactivity. These medications have demonstrated success in reducing disruptive behavior and hyperactive tendencies in approximately 70% of adults and 70–80% of children with ADHD.

Stimulants work by increasing the levels of critical neurotransmitters in the brain, which helps improve attention, focus, and impulse control. Methylphenidate is one of the most commonly prescribed stimulants and is available in multiple formulations, including immediate-release and extended-release versions, providing flexibility in symptom management throughout the day. Focalin, for instance, is a refined form of dexmethylphenidate available in both immediate- and extended-release forms. Concerta, for instance, is an extended-release formulation of methylphenidate that offers the convenience of once-daily dosing.

Amphetamine-based medications are also widely prescribed across age groups. For instance, Adderall, Ritalin, and dextroamphetamine are routinely used in children, adolescents, and adults. For instance, in June 2023, Xelstrym, a transdermal formulation of dextroamphetamine, received FDA approval as the only amphetamine patch available for ADHD treatment in individuals aged 6 years and older.

These medications aim to improve overall executive functioning, making daily tasks more manageable for individuals with ADHD. The choice between methylphenidate and amphetamine-based treatments often depends on how an individual responds to the medication. Considering their clinical effectiveness, diverse delivery formats, and growing adoption, stimulant medications are expected to remain the leading segment in the ADHD treatment market.

Geographical Analysis

North America is expected to hold a significant position in the global attention deficit hyperactivity disorder (ADHD) market with the highest market share

North America is anticipated to hold a dominant share in the ADHD treatment market during the forecast period, driven by several key factors. The region's high diagnostic rates, growing prevalence of ADHD, and strong focus on mental health awareness contribute significantly to market expansion. A well-established pharmaceutical industry and widespread access to specialized care further strengthen its market position. The availability and routine use of both stimulant medications (such as those containing methylphenidate and amphetamines) and non-stimulant options (like atomoxetine) highlight the region’s comprehensive treatment landscape.

The popularity of extended-release formulations, which offer the benefit of once-daily dosing, supports improved patient adherence and long-term management of symptoms. Ongoing research and development activities in North America also play a critical role in driving innovation, including the introduction of new medications, advanced delivery systems, and non-pharmacological interventions for ADHD.

For instance, a 2022 article by the National Library of Medicine titled “ADHD Diagnostic Trends: Increased Recognition or Overdiagnosis” reported that ADHD affects approximately 8.7% (or 5.3 million) children in the United States, indicating a high prevalence. Additionally, a study published in the Journal of Medical Economics estimated the annual societal costs related to ADHD to be approximately $19.4 billion for children and $13.8 billion for adolescents, highlighting the significant economic burden associated with the condition.

Moreover, in July 2023, Mentavi Health, in partnership with ADHD Online, announced a major strategic shift, including the formation of a new corporate entity and the successful acquisition of Series AA investment funding, aimed at expanding operations and enhancing service delivery.

These factors, ranging from high prevalence and advanced treatment availability to strong industry support and innovation, position North America as a key driver in the global ADHD treatment market.

Competitive Landscape

Top companies in the attention deficit hyperactivity disorder (ADHD) market include Pfizer Inc., Takeda Pharmaceutical Company Limited, Novartis AG, Eli Lilly and Company, Lupin, Mallinckrodt, Hisamitsu Pharmaceutical Co., Inc., Camber Pharmaceuticals, Inc., Collegium Pharmaceutical, Inc., and Supernus Pharmaceuticals, Inc., among others.

Scope

| Metrics | Details | |

| CAGR | 5.9% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Bn) | |

| Segments Covered | Type | Predominantly Inattentive Presentation, Predominantly Hyperactive/Impulsive Presentation, Combined Presentation |

| Drug Type | Stimulants, Non-stimulants | |

| Age Group | Pediatric, Adults | |

| Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyze product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global attention deficit hyperactivity disorder (ADHD) market report delivers a detailed analysis with 68 key tables, more than 61 visually impactful figures, and 198 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.