Artificial Pancreas System Market Size

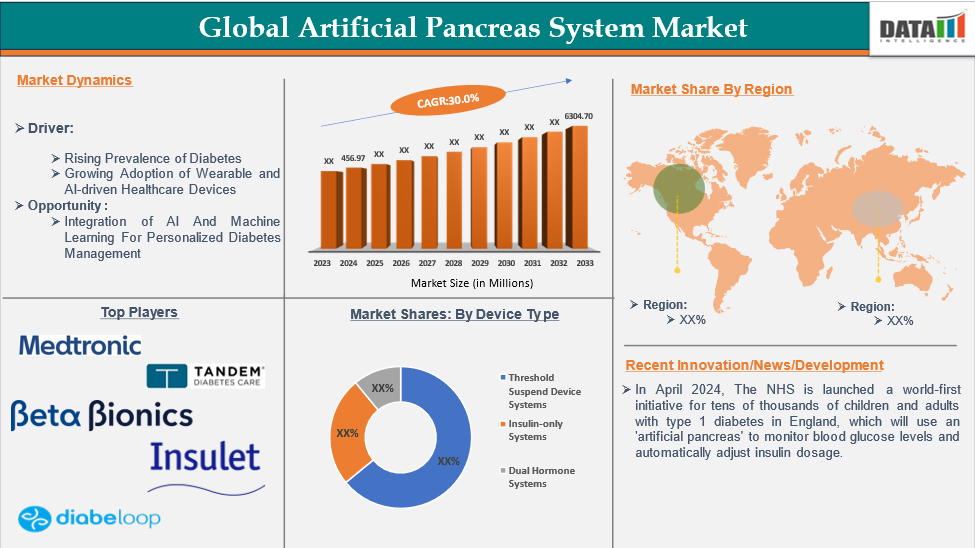

Global artificial pancreas system market reached US$ 456.97 million in 2024 and is expected to reach US$ 6304.70 million by 2033, growing at a CAGR of 30.0% during the forecast period 2025-2033.

Artificial pancreas system is a medical device that automates blood glucose control in type 1 diabetes patients. It includes a continuous glucose monitor, insulin pump, and advanced control algorithm. This system mimics the function of a healthy pancreas, ensuring optimal blood sugar levels and reducing the risk of hyperglycemia and hypoglycemia. It improves diabetes management and patient convenience and minimizes the need for manual insulin administration.

Executive Summary

For more details on this report, Request for Sample

Market Dynamics: Drivers & Restraints

Rising Prevalence of Diabetes

The global diabetes prevalence, particularly type 1, is driving the artificial pancreas system market. Many diabetes patients need continuous blood glucose management, leading to a demand for automated solutions. Advancements in sensor technology improved insulin delivery, and AI-driven algorithms are contributing to market growth by offering efficient, personalized diabetes management solutions.

For instance, according to International Diabetes Foundation by 2045, IDF projections indicate a 46% increase in diabetes prevalence, with over 90% of individuals having type 2 diabetes. Factors contributing to this increase include urbanization, an aging population, decreased physical activity, and an increase in overweight and obesity, which are exacerbated by socio-economic, demographic, environmental, and genetic factors.

Hence, an increase in the prevalence of diabetes will drive demand for artificial pancreas device systems. This demand, coupled with urbanization and lifestyle-related risk factors, necessitates advanced glucose management solutions, leading to market expansion for automated insulin delivery.

High Cost of Artificial Pancreas Systems

Artificial pancreas systems, despite their potential benefits in diabetes management, face significant barriers to market expansion, particularly in low- and middle-income countries. The high cost of advanced components, limited reimbursement policies, and high maintenance costs further restrict adoption, limiting their widespread use. For instance, The Tandem t:slim X2 pump with Control-IQ costs around $4,000, with insurance typically covering 80% of the cost. Additional costs for Dexcom G6 CGM supplies, such as a transmitter and sensors, can be significant.

Market Segment Analysis

The global artificial pancreas system market is segmented based on device type, end-user, and region.

Device Type:

The threshold suspend device systems from the device type segment is expected to dominate the artificial pancreas system market with the highest market share

The threshold suspend and predictive suspend systems are tools that temporarily suspend insulin delivery when blood glucose levels drop below a pre-set level. These systems calculate blood glucose levels and stop delivering insulin before they reach too low. They do not automatically increase insulin doses. Storing insulin at the right moment can help prevent low blood sugar, or hypoglycemia, in individuals with type 1 diabetes. These systems may also assist those who develop hypoglycemia overnight, especially children.

The rise in diabetes, particularly type 1, is driving the adoption of Threshold Suspend Device Systems. This is driven by increased awareness of hypoglycemia risks and the need for automated insulin delivery systems. Technological advancements, regulatory approvals, healthcare expenditure, and expanded reimbursement policies in developed regions contribute to the adoption of these life-saving devices.

Market Geographical Share

North America is expected to hold a significant position in the artificial pancreas system market with the highest market share

North America dominates the threshold suspend device systems market due to advanced healthcare infrastructure, high diabetes management technologies, and key market players. The region's large type 1 diabetes population drives demand for automated insulin delivery solutions. Benefits from reimbursement policies, continuous glucose monitoring awareness, and technological advancements in insulin pumps drive market growth. Government initiatives, increased healthcare expenditure, and personalized medicine focus contribute to the growing adoption of Threshold Suspend Device Systems in North America.

Moreover, FDA approvals are also a significant factor that helps the region to grow during the forecast period. For instance, in May 2024, The U.S. Food and Drug Administration (FDA) approved an artificial pancreas developed by University of Cambridge researchers for use by individuals with type 1 diabetes, including during pregnancy, marking the first time the FDA has authorized the use of this life-changing app during pregnancy.

Moreover, in May 2023, the FDA approved the iLet Insulin-Only Bionic Pancreas System for individuals aged 6 and above with type 1 diabetes, an artificial pancreas system that autonomously determines and delivers insulin doses.

Major Global Players

The major global players in the artificial pancreas system market include Medtronic Plc, Tandem Diabetes Care, Inc., Beta Bionics, Insulet Corporation, Diabeloop, Inreda Diabetic B.V., and Nikkiso Co., Ltd among others.

Key Developments

- In April 2024, the NHS launched a world-first initiative for tens of thousands of children and adults with type 1 diabetes in England, which will use an 'artificial pancreas' to monitor blood glucose levels and automatically adjust insulin dosage.

Scope

| Metrics | Details | |

| CAGR | 30.0% | |

| Market Size Available for Years | 2022-2033 | |

| Estimation Forecast Period | 2025-2033 | |

| Revenue Units | Value (US$ Mn) | |

| Segments Covered | Device Type | Threshold Suspend Device Systems, Insulin-only Systems, Dual Hormone Systems |

| End-User | Hospitals, Clinics, Homecare Settings, Ambulatory Surgical Centers | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

Why Purchase the Report?

- Technological Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global artificial pancreas system market report delivers a detailed analysis with 45key tables, more than 40 visually impactful figures and 165 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Application & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.