Global Antibiotics Market Size & Industry Outlook

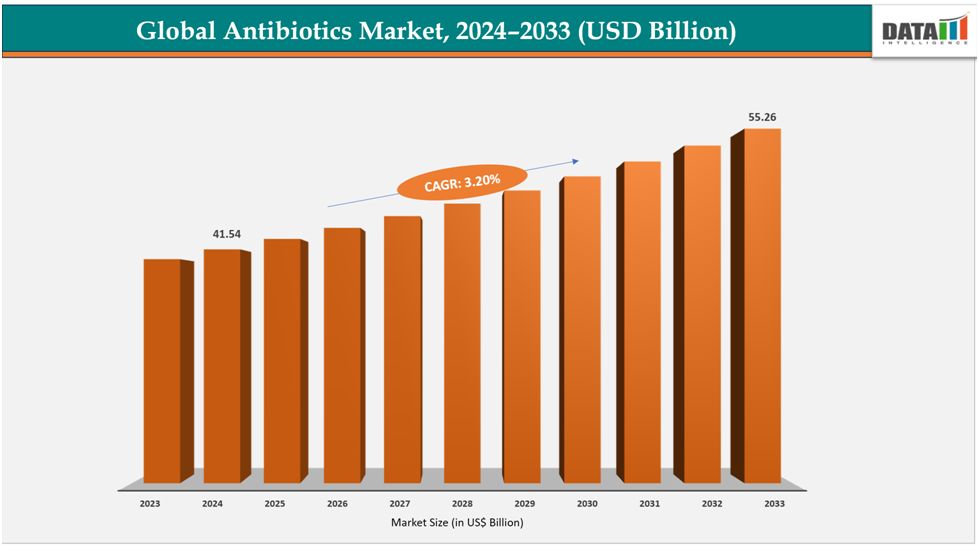

The global antibiotics market size reached US$ 41.54Billion in 2024 and is expected to reach US$ 55.26Billion by 2033, growing at a CAGR of 3.20%during the forecast period 2025-2033.

The prevalence of infectious diseases, increased antimicrobial resistance (AMR), and improved access to healthcare globally are all contributing to the fast growth of the global antibiotics industry. AMR is a serious issue since resistant microorganisms are making older medications less effective and increasing the need for new therapies. This is driving up demand for both new and generic antibiotics, along with an increasing prevalence of sepsis, pneumonia, urinary tract infections, and hospital-acquired illnesses. New product development is also accelerating because to developments in biotechnology, quick diagnostics, and medication discovery, while antibiotic R&D and market entrance are being supported by government programs and regulatory incentives.

Key Highlights

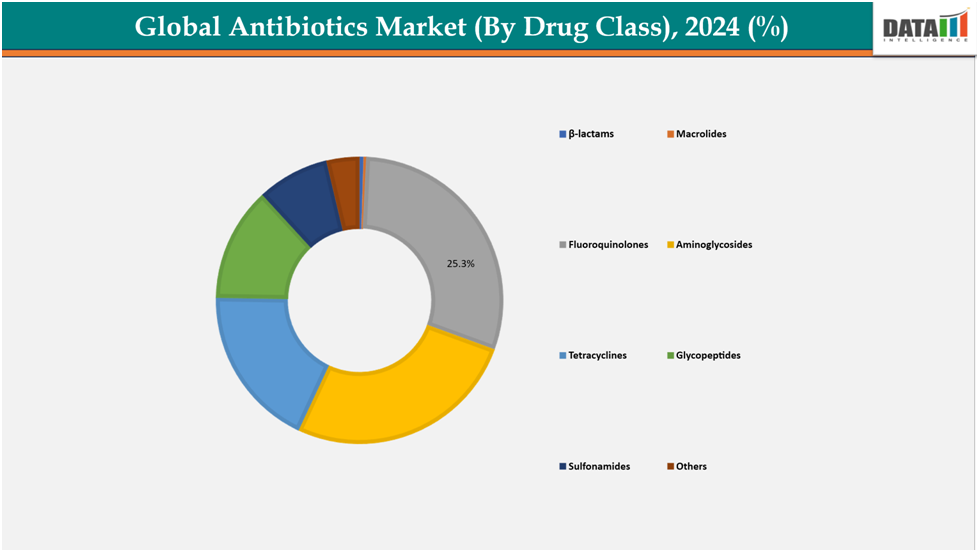

Based on drug class-β-lactams is leading the market with strong growth potential with a 25.3% share in 2024

Based on the spectrum broad-spectrum antibiotics segment is dominating the antibiotic market with a 45.5% share in 2024

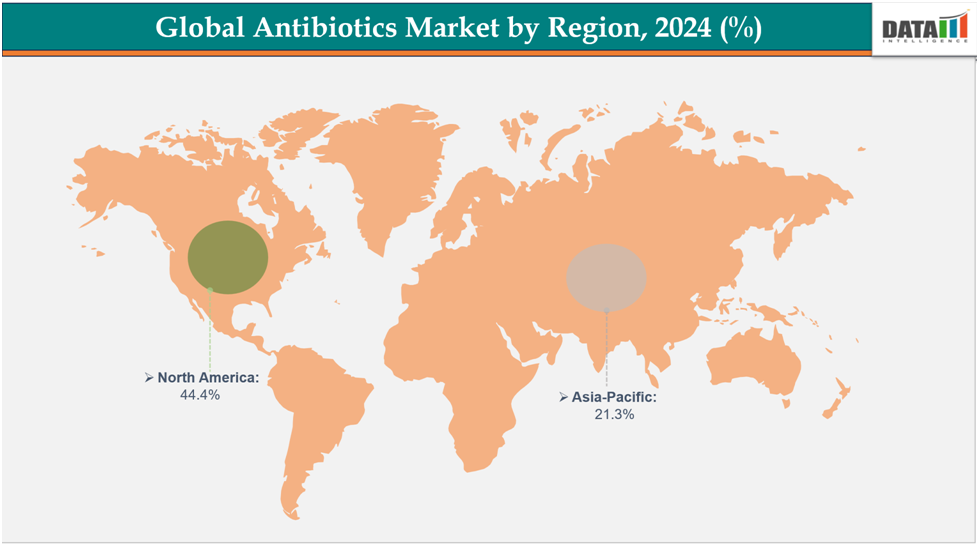

North America is dominating the antibiotics market with the largest revenue share of 44.4% in 2024.

The Asia Pacific is the fastest-growing region and is expected to grow over the forecast period with a market share of 21.3% in 2024

- Top market players in the antibiotics market are Pfizer Inc., GSK plc., Merck & Co., Inc., Johnson & Johnson, Cipla, Lupin, Aurobindo Pharma Limited, Basilea Pharmaceutical Ltd., Wockhardt, Iterum Therapeutics plc., AbbVie Inc. among others.

Market Dynamics

Drivers: The rising prevalence of infectious diseases is significantly driving the global antibiotics market growth

The growing incidence of infectious disorders like sepsis, pneumonia, TB, and UTIs is a major factor propelling the worldwide antibiotics market. There is a great need for efficient therapies since hospital-acquired infections, international travel, and growing urbanization have all sped up the spread of bacterial illnesses. Furthermore, the elderly population's compromised immunity makes them more prone to infections, which encourages the usage of antibiotics. The ongoing need for medicines has also been brought to light by secondary bacterial infections during viral epidemics such as COVID-19. The market is expanding steadily because to the persistent research and development of new treatments, as infectious illnesses continue to pose a significant global health burden.

Owing to factors like the rising prevalence of infectious diseases, According to Global tuberculosis report 2024, the frequency of tuberculosis is still rising. Compared to 10.7 million in 2022 and 10.4 million in 2021, 10.8 million additional cases were reported in 2023. The majority of the increase in incident cases worldwide is due to population expansion. The incidence rate indicates that there was a 0.2% increase from 2023 to 2022.

Restraints: Adverse side effects & safety concerns are hampering the growth of the antibiotics market

Concerns about safety and adverse side effects are the main things holding back the market expansion for antibiotics. Numerous severe side effects, including gastrointestinal issues, liver and renal toxicity, and even hearing loss, have been connected to antibiotics. FDA black box warnings for dangers such tendon rupture, nerve damage, and mental health problems restrict the use of some medicine classes, such as fluoroquinolones. Additionally, prolonged or needless antibiotic use can result in Clostridium difficile infections, a dangerous illness that makes medical professionals cautious. Reduced physician confidence, longer product approvals, and more regulatory supervision are the outcomes of these hazards. The market's growth is further hampered by adverse effects, which frequently lead patients to stop therapy too soon, decreasing its efficacy and raising resistance.

Owing to this fluoroquinolones adverse effect, Australian Government (TGA) in March 2025, systemic fluoroquinolones like ciprofloxacin, norfloxacin, and moxifloxacin have been subject to enhanced safety warnings. To increase awareness and ensure cautious prescribing, these antibiotics, which were previously reserved for patients without other options, now come with new product and consumer information outlining the risks of tendinitis, tendon ruptures, psychiatric reactions, central nervous system effects, and uncommon seizures.

For more details on this report - Request for Sample

Segmentation Analysis

The global antibiotics market is segmented based on spectrum, drug class, route of administration, distribution channel and region

By Drug Class:

By Drug Class-β-lactamsisleading the market with strong growth potentialwith a25.3% share in 2024:

β-lactams, including penicillin, cephalosporins, carbapenems, and monobactams, lead the antibiotics market due to their broad-spectrum activity, established safety, and widespread clinical use. They remain first-line treatments for common infections such as pneumonia, urinary tract infections, skin infections, and hospital-acquired sepsis, ensuring steady global demand. The availability of low-cost generics, particularly penicillin and cephalosporins, boosts accessibility in developing regions, while innovation in β-lactam/β-lactamase inhibitor combinations strengthen their role against resistant pathogens. Carbapenems, in particular, are vital for managing severe multidrug-resistant infections in hospitals and intensive care units. With a strong presence in both generic and novel drug pipelines, β-lactams continue to dominate the antibiotics market, offering significant growth potential despite rising antimicrobial resistance challenges.

For instance, in February 2024,The FDA has approved and in March 2024 EU approved, EXBLIFEP, a Cipla product, is a combination of the beta-lactamase inhibitor enmetazobactam and the cephalosporin antibacterial cefepime. It is prescribed for the treatment of patients aged 18 and up who have complicated UTIs, including pyelonephritis, brought on by specific susceptible microorganisms.

The broad-spectrum antibiotics segment is dominating the antibiotic market with a 45.5% share in 2024

The broad-spectrum antibiotics segment dominates the global antibiotics market due to its ability to target a wide range of Gram-positive and Gram-negative bacteria, making it the first choice in empirical therapy where the exact pathogen is unknown. Physicians rely heavily on these drugs in urgent or severe cases, particularly in hospitals and ICUs, where quick action is critical. Rising incidences of complicated infections, hospital-acquired infections, and multidrug-resistant pathogens further strengthen demand. Broad-spectrum agents such as cephalosporins, carbapenems, and β-lactam/β-lactamase inhibitor combinations remain frontline treatments. Recent approvals, including Cefepime–Enmetazobactam and Aztreonam–Avibactam, expand therapeutic options and reinforce growth. Their versatility, accessibility, and strong innovation pipeline ensure that broad-spectrum antibiotics maintain a leading position in the market.

For instance, in April 2024, The U.S. FDA approved Zevtera, a broad-spectrum cephalosporin effective against methicillin-susceptible and methicillin-resistant Staphylococcus aureus (MSSA & MRSA). Indications include Staph aureus bloodstream infections (SAB), acute bacterial skin and skin-structure infections (ABSSSI), and community-acquired bacterial pneumonia (CABP).

Geographical Analysis

North America is dominating the global antibiotics market share with 44.4% in 2024.

North America's robust healthcare system, high rate of hospital-acquired illnesses, and extensive usage of antibiotics have made it the market leader for antibiotics worldwide. Prominent pharmaceutical firms from the area, including Pfizer, Merck, and AbbVie, are actively involved in the study and development of antibiotics. Strong government funding and regulatory incentives, especially in the fight against antibiotic resistance, are made available by organizations like CDC, NIH, and BARDA. In order to increase market availability, the U.S. FDA also makes sure that new antibiotics have quicker approval processes. Increased knowledge of AMR, sophisticated hospital systems, and high healthcare spending all contribute to uptake. Together, these elements make North America the world's biggest and most active antibiotic market, guaranteeing the region's sustained growth leadership.

Owing to the factors like the U.S. FDA faster approval for novel antibiotics, in March 2025, GSK’s Blujepa (gepotidacin) was approved by U.S. FDA for treating uncomplicated urinary tract infections (uUTIs) in females aged 12 and older. It’s the first new class of oral antibiotic for this indication in about 30 years, targeting common bacteria including E. coli and against some resistant strains.

Europe is the second region to dominate the global antibiotics market share with 34.2% in 2024

Europe is projected to dominate the global antibiotics market, driven by a rising burden of antimicrobial resistance (AMR) and growing demand for advanced therapies. The region benefits from a strong healthcare infrastructure and significant government support, including initiatives like the EU4Health program and the Innovative Medicines Initiative (IMI), which fund antibiotic R&D and AMR surveillance. The European Medicines Agency (EMA) provides accelerated pathways for critical antibiotics, further encouraging innovation. Moreover, leading pharmaceutical companies such as Novartis, Sanofi, Bayer, Basilea, and GSK are actively launching new antibiotics in the region. Combined with robust awareness and stewardship programs, these factors position Europe as a key hub for antibiotic innovation, access, and future market leadership.

Owing to the initiatives like EU4Health program and the Innovative Medicines Initiative2021–2027, more than €5.3 billion was allotted by the EU, with some of the money going toward developing antibiotics, forming AMR action plans, and enhancing international collaboration on infection control. To finance antibiotic research and development collaborations with pharmaceutical and biotech companies.

The Asia Pacific region is the fastest-growing region in the global antibiotic market,with a market share of21.3% in 2024.

The Asia Pacific region is the fastest-growing antibiotics market, fueled by its large population and high burden of infectious diseases such as tuberculosis, pneumonia, and hospital-acquired infections. Rising antimicrobial resistance (AMR), particularly in India and China, is creating strong demand for advanced therapies and combination antibiotics. Rapid improvements in healthcare infrastructure, wider insurance coverage, and growing urbanization have expanded access to treatments. Additionally, Asia Pacific is a global hub for antibiotic manufacturing, with India and China supplying both domestic and international markets. These factors collectively make Asia Pacific the most dynamic and rapidly expanding region in the global antibiotics market.

Owing to the factors like antimicrobial resistance, In May 2024, 30 Asia-Pacific countries (including India, Japan, Australia, Malaysia, Thailand) endorsed a Joint Position Paper on antimicrobial resistance (AMR) in the human health sector. The paper, initiated by Japan, outlines a five-year plan to accelerate actions against AMR across the region.

For instance, in January 2025, The Indian drug regulator, Central Drugs Standard Control Organization (CDSCO) has approved Wockhardt’s Miqnaf (nafithromycin) as a new treatment for the Community Acquired Bacterial Pneumonia (CABP) in adults.

Competitive Landscape

Top companies in the antibiotics market are Pfizer Inc., GSK plc., Merck & Co., Inc., Johnson & Johnson, Cipla, Lupin, Aurobindo Pharma Limited, Basile Pharmaceutical Ltd., Wockhardt, Iterum Therapeutics plc., AbbVie Inc. among others.

Pfizer Inc.: Pfizer Inc. is a leading U.S.-based multinational biopharmaceutical company headquartered in New York, specializing in the discovery, development, and commercialization of innovative medicines and vaccines. Its diverse portfolio spans oncology, vaccines, cardiovascular, immunology, and anti-infectives, including cutting-edge antibiotics. With a strong global presence, Pfizer invests heavily in R&D and strategic collaborations to combat emerging health challenges like antimicrobial resistance.

Market Scope

Metrics | Details | |

CAGR | 3.20% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | By Spectrum | Broad-spectrum antibiotics, Narrow-spectrum antibiotics |

By Drug Class | β-lactams, Macrolides, Fluoroquinolones, Aminoglycosides, Tetracyclines, Glycopeptides, Sulphonamides and Others | |

By Route of Administration | Oral, Injectable, Others | |

| By Distribution Channel | Hospital Pharmacies, Retail pharmacies, Online pharmacies |

Regions Covered | North America, Europe, Asia-Pacific, South America and the Middle East & Africa | |

The global antibiotics market report delivers a detailed analysis with 56 key tables, more than 52 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceuticals related reports, please click here