Antibacterial Drugs Market Size

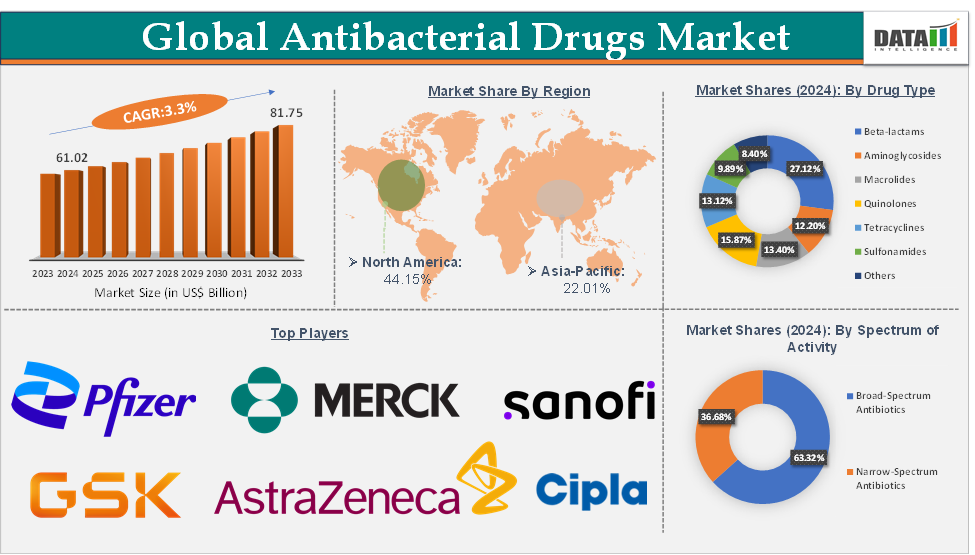

The global antibacterial drugs market size reached US$ 61.02 Billion in 2024 and is expected to reach US$ 81.75 Billion by 2033, growing at a CAGR of 3.3% during the forecast period 2025-2033.

Antibacterial Drugs Market Overview

The global antibacterial drugs market is a critical segment within the pharmaceutical industry, driven by the ever-growing need to combat bacterial infections, the rising prevalence of antibiotic-resistant pathogens, and continuous advancements in drug development. The market encompasses a wide range of antibacterial agents used to treat various infections across diverse patient populations.

The market is characterized by a mix of established pharmaceutical giants and innovative biotech firms focusing on next-generation antibiotics. Key players include Pfizer, Novartis, GlaxoSmithKline, Bayer, and emerging startups specializing in novel antibacterial compounds. Generic manufacturers also play a vital role, especially in developing markets, providing affordable alternatives.

Antibacterial Drugs Market Executive Summary

Antibacterial Drugs Market Dynamics

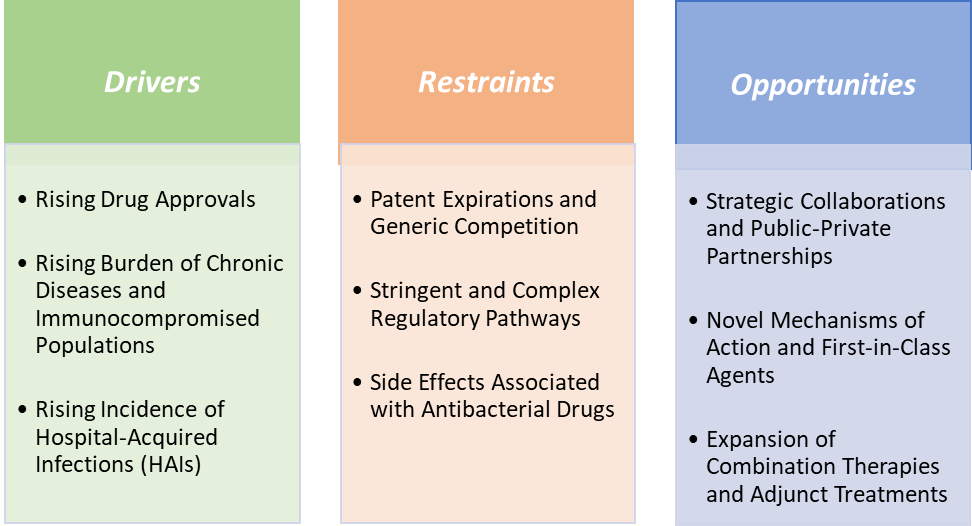

Drivers:

Rising drug approvals are significantly driving the antibacterial drugs market growth

The increasing number of antibacterial drug approvals by regulatory authorities like the U.S. FDA, EMA, and others is a key growth driver for the antibacterial drugs market. These approvals introduce new, innovative treatments that address unmet medical needs, especially against resistant bacterial strains, thereby expanding the market size and improving patient outcomes. Novel antibacterial agents launched by major and emerging market players with improved safety, efficacy, and targeted action gain faster clinical acceptance, increasing market penetration.

For instance, in May 2025, Avenacy launched a suite of antibiotic products for injection, including Ampicillin for Injection, USP, Ampicillin and Sulbactam for Injection, USP, Nafcillin for Injection, USP, Penicillin G Potassium for Injection, USP, and Piperacillin and Tazobactam for Injection, USP. Combined, these products generated U.S. sales of approximately $175M for the twelve months ended September 30, 2024, representing a meaningful opportunity in the antibacterial drugs market.

Similarly, in May 2025, Innoviva Specialty Therapeutics announced its antibiotic, ceftobiprole (Zevtera), is available for prescribing in the US. The antibiotic was approved in April 2024, and now marks the first cephalosporin indicated to treat SAB. In addition to being indicated for treating adults with Staphylococcus aureus bloodstream infections, including those with right-sided infective endocarditis, it can be prescribed for adults with acute bacterial skin and skin structure infections (ABSSSI), and adult and pediatric patients 3 months to less than 18 years old with community-acquired bacterial pneumonia (CABP).

Rising drug approvals refresh the antibacterial drug pipeline, introduce advanced therapies to combat resistant infections, and enable broader clinical adoption. This dynamic pipeline stimulates competition, fosters innovation, and ultimately drives market expansion, meeting the urgent global demand for effective antibacterial treatments.

Rising burden of chronic diseases and immunocompromised populations is also driving the antibacterial drugs market growth

The increasing prevalence of chronic diseases such as diabetes, cancer, and chronic kidney disease, along with a growing population of immunocompromised patients (e.g., HIV/AIDS, organ transplant recipients, chemotherapy patients), significantly boosts the demand for antibacterial drugs. These patient groups are highly susceptible to bacterial infections, often requiring prolonged or repeated antibiotic treatments, which expands the market size.

For instance, the International Diabetes Federation estimated that 537 million adults worldwide had diabetes in 2021, projected to rise to 643 million by 2030. Diabetics are prone to skin and soft tissue infections, fueling antibacterial demand. The global cancer population is expanding, with the World Health Organization projecting new cases to reach 28.4 million by 2040, many requiring immunosuppressive therapies that heighten infection susceptibility.

The growing populations of chronic disease sufferers and immunocompromised patients create a sustained, high-demand segment for antibacterial drugs. This drives market growth by increasing the volume, complexity, and frequency of antibiotic use, encouraging innovation and expanded product offerings in the antibacterial drugs market.

Restraints:

Patent expirations and generic competition is hampering the growth of the antibacterial drugs market

Patent expirations of key antibacterial drugs open the door for generic manufacturers to enter the market, leading to price erosion and significant market share loss for the original branded drugs. This dynamic reduces revenue potential, discourages investment in new antibacterial drug development and ultimately hampers overall market growth.

Generics are priced significantly lower than branded drugs, limiting profit margins and making it difficult for innovator companies to recoup R&D costs. Wide availability of inexpensive generics reduces the incentive for healthcare providers to prescribe newer, often more costly antibiotics. Many new antibacterial drugs face competition from well-established generics that are trusted and widely used, especially in price-sensitive markets. Lower profitability discourages pharmaceutical companies from investing in antibacterial R&D, contributing to a thin pipeline of novel antibiotics.

Opportunities:

Strategic collaborations and public-private partnerships create a market opportunity for the antibacterial drugs market

Strategic collaborations between pharmaceutical companies, biotech firms, governments, and global health organizations are accelerating research, development, and commercialization of new antibacterial drugs. These partnerships help share risks and costs, pool expertise, and fast-track innovation, opening new market opportunities in a traditionally challenging sector.

Strategic collaborations and public-private partnerships mitigate key challenges in antibacterial drug development, enabling more innovative therapies to reach the market faster. They provide vital financial and scientific support, opening new commercial opportunities and fostering a more sustainable antibacterial drug market ecosystem. With the major market players focusing on the strategic collaborations and partnerships, the market is boosting with novel product launches.

For instance, in November 2024, Zai Lab and Pfizer announced a strategic collaboration for the novel antibacterial drug XACDURO (sulbactam-durlobactam) in mainland China. Through this collaboration, Zai Lab will leverage the industry-leading commercialization infrastructure of Pfizer’s affiliated companies in the anti-infective therapeutic area to help accelerate access to this important therapy for patients in need in mainland China. The period of collaboration is for the imported product through November 2028, subject to early termination or extension.

For more details on this report – Request for Sample

Antibacterial Drugs Market, Segment Analysis

The global antibacterial drugs market is segmented based on drug type, spectrum of activity, route of administration, indication, distribution channel, and region.

Beta-lactams from the drug type segment are expected to hold 27.12% of the market share in 2024 in the antibacterial drugs market

The Beta-lactams class, which includes penicillins, cephalosporins, carbapenems, and monobactams, remains the most widely used and dominant segment in the antibacterial drugs market due to its broad spectrum of activity, proven efficacy, and established clinical use against a variety of bacterial infections. Effective against many Gram-positive and Gram-negative bacteria, beta-lactams are often the first-line treatment for common infections like respiratory, skin, urinary tract, and intra-abdominal infections.

Penicillins and cephalosporins represent the bulk of prescriptions worldwide. For example, amoxicillin remains one of the top-selling antibiotics globally. Newer combinations like ceftazidime/avibactam (Zavicefta) and meropenem/vaborbactam (Vabomere) have been approved recently to treat resistant Gram-negative infections, expanding the beta-lactams market in hospital settings. Beta-lactams dominate the antibacterial drugs market due to their broad efficacy, safety, extensive clinical use, and continuous innovation to combat resistance. Their large market share and strong sales across regions underscore their pivotal role in antibacterial therapy worldwide.

Antibacterial Drugs Market, Geographical Analysis

North America is expected to dominate the global antibacterial drugs market with a 44.15% share in 2024

North America, led primarily by the United States, holds a dominant position in the antibacterial drugs market due to its advanced healthcare infrastructure, strong pharmaceutical industry, high healthcare spending, and robust regulatory environment supporting antibacterial innovation and usage. Many leading pharmaceutical and biotech companies developing new antibacterial agents are based in North America, fueling innovation and early market access.

For instance, in October 2024, GSK plc announced that the US Food and Drug Administration (FDA) accepted the New Drug Application (NDA) for gepotidacin, an investigational, first-in-class oral antibiotic with a novel mechanism of action for the treatment of female adults (≥40 kg) and adolescents (≥12 years, ≥40 kg) with uncomplicated urinary tract infections (uUTIs). Gepotidacin, discovered by GSK scientists, is an investigational bactericidal, first-in-class triazaacenaphthylene antibiotic that inhibits bacterial DNA replication by a distinct binding site, a novel mechanism of action, and for most pathogens, provides well-balanced inhibition of two different Type II topoisomerase enzymes.

Asia-Pacific is growing at the fastest pace in the antibacterial drugs market, holding 22.01% of the market share

The Asia Pacific region is experiencing rapid growth in the antibacterial drugs market due to rising infectious disease burden, increasing healthcare infrastructure investments, expanding middle-class population, and growing awareness about antibiotic resistance. These factors are collectively driving higher demand for both existing and novel antibacterial therapies.

Countries like India, China, and Southeast Asian nations have high rates of bacterial infections and antibiotic resistance, necessitating increased antibacterial drug use. Expanding hospital networks, diagnostic capabilities, and healthcare access are enabling better diagnosis and treatment. APAC is becoming a hub for generic and innovative antibiotic production, lowering costs and improving availability.

For instance, in November 2024, the antibiotic Nafithromycin was developed with the support of the Biotechnology Industry Research Assistance Council (BIRAC), a unit of the Department of Biotechnology, and has been brought to market under the trade name Miqnaf by pharma company Wockardt. It is the India’s first indigenously developed antibiotic aimed at tackling Antimicrobial Resistance (AMR).

Antibacterial Drugs Market Competitive Landscape

Top companies in the antibacterial drugs market include Pfizer Inc., Merck & Co., Inc., Sanofi, GSK plc, AstraZeneca, Teva Pharmaceuticals USA, Inc., Bristol-Myers Squibb Company, Paratek Pharmaceuticals, Inc., Cipla Therapeutics, and Innoviva Specialty Therapeutics, among others.

Antibacterial Drugs Market Scope

Metrics | Details | |

CAGR | 3.3% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Drug Type | Beta-lactams, Aminoglycosides, Macrolides, Quinolones, Tetracyclines, Sulfonamides, and Others |

Spectrum of Activity | Broad-Spectrum Antibiotics and Narrow-Spectrum Antibiotics | |

Route of Administration | Oral, Parenteral, and Topical | |

Indication | Respiratory Tract Infections, Urinary Tract Infections, Skin and Soft Tissue Infections, Gastrointestinal Infections, Sexually Transmitted Infections, Sepsis and Bloodstream Infections, Ear, Nose & Throat Infections, Hospital-acquired Infections (HAIs), and Others | |

Distribution Channel | Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and the Middle East & Africa | |

The global antibacterial drugs market report delivers a detailed analysis with 78 key tables, more than 81 visually impactful figures, and 146 pages of expert insights, providing a complete view of the market landscape.

Suggestions for Related Report

For more pharmaceutical-related reports, please click here