Ampoules Packaging Market is Segmented By Material(Glass, Plastic), By Packaging(Pre-scored or Snapped Ampoules, One-Point Cut Ampoules and Ampoules with Break Points), By End-User(Pharmaceuticals, Chemicals, Personal Care and Cosmetics and Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) – Share, Size, Outlook, and Opportunity Analysis, 2023-2030.

Ampoules Packaging Market Overview

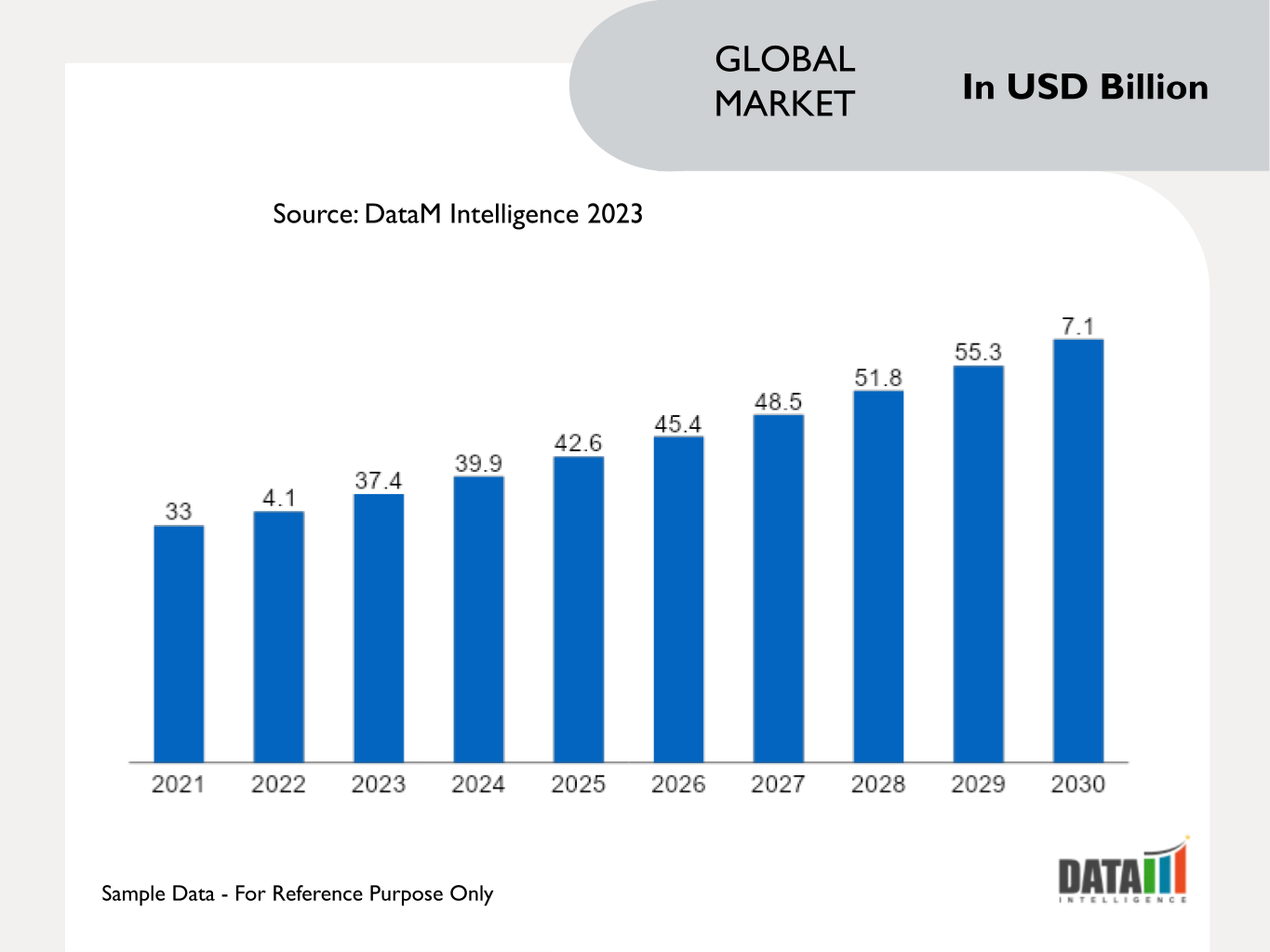

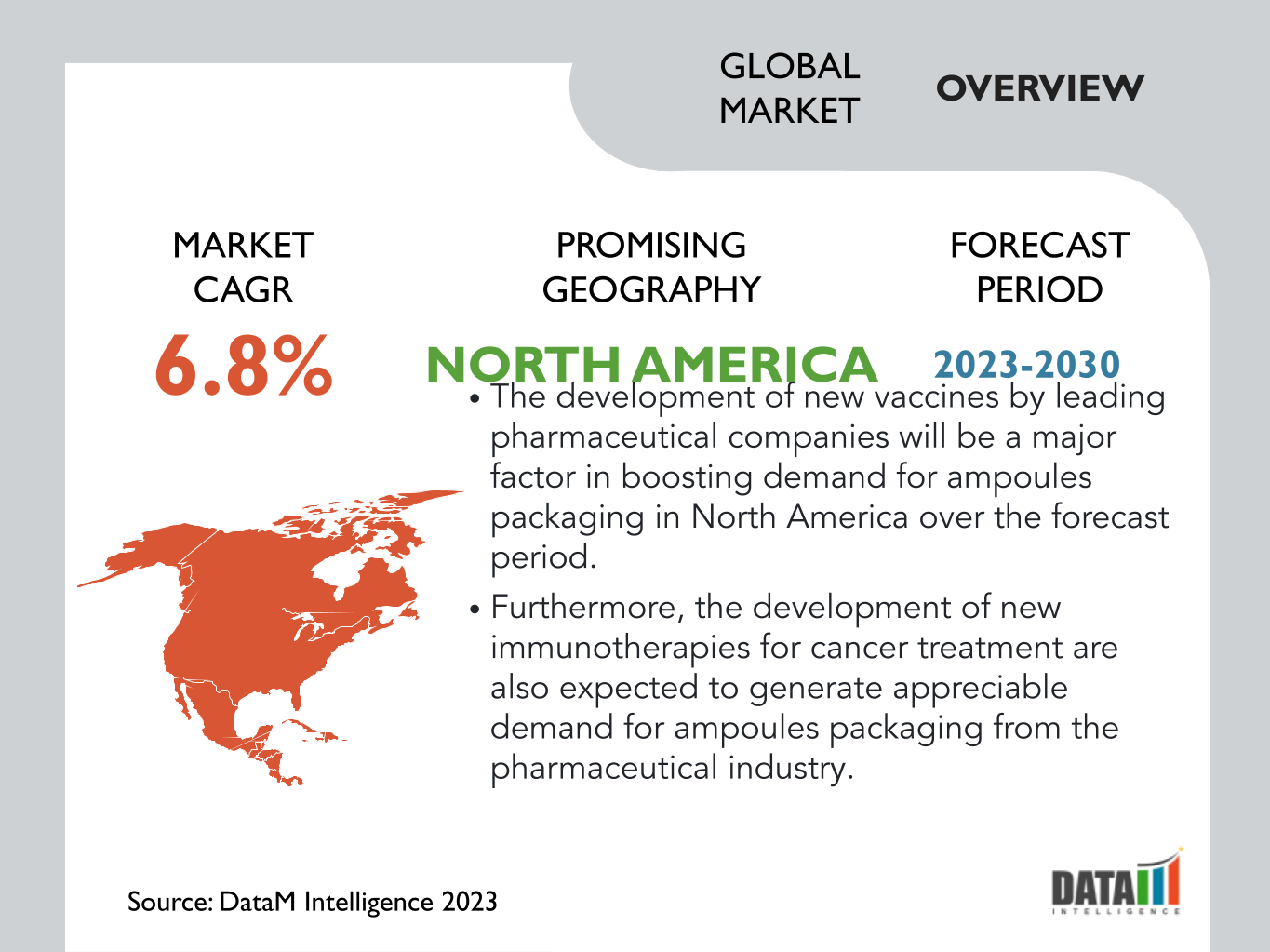

The Global Ampoules Packaging Market reached US$ 4.1 billion in 2022 and is expected to reach US$ 7.1 billion by 2030, growing with a CAGR of 7.2% during the forecast period 2023-2030.

The ampoule packaging is expected to be driven with the growing demand for glass material-based packaging for pharma products. According to SCHOTT PHARMA article, glass ampoules continue to be a preferred choice for storing injectable solutions, with 42% of commercial injectable solutions globally using glass ampoules as primary packaging in 2021. The dominance in the market highlights the trust and reliance placed on ampoules for preserving the integrity of pharmaceutical products.

Glass ampoules gained favor as a packaging solution due to their non-porous and impermeable nature, making them ideal for storing liquids without the risk of contamination or chemical interaction. The properties, along with their hermetically sealed design, ensure the integrity of the stored pharmaceutical solutions. The market's growth is also underscored by the versatility of ampoules in storing a diverse range of pharmaceutical solutions, addressing pain relief, heart conditions, vitamins and emergency treatments.

North America's ampoule packaging market is witnessing notable growth, driven by the increasing adoption of plastic ampoules, especially in emerging economies where cost-effective packaging solutions are in high demand. While glass has traditionally been the material of choice for ampoules, the rising popularity of plastic is reshaping the market dynamics.

According to FDA, in U.S., unit dose plastic ampoules for pharmaceutical packaging account for nearly 24% of the market, driven by factors like ease of administration and compliance. Plastic ampoules eliminate the need for tearing or cutting to dispense the dose, enhancing user experience and medication control.

Ampoules Packaging Market Scope and Summary

|

Metrics |

Details |

|

CAGR |

7.2% |

|

Size Available for Years |

2021-2030 |

|

Forecast Period |

2023-2030 |

|

Data Availability |

Value (US$) |

|

Segments Covered |

Material, Packaging, End-User and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America and Middle East & Africa |

|

Fastest Growing Region |

North America |

|

Largest Region |

North America |

|

Report Insights Covered |

Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

For more details on this report - Request for Sample

Ampoules Packaging Market Dynamics and Trends

Eco-Friendly Glass Ampoules Transforming Pharma Packaging Sustainability

The growing focus on sustainability is driving increased demand for ampoule packaging within the pharmaceutical industry. As pharmaceutical packaging companies strive for more durable and eco-friendly solutions, glass ampoules have emerged as a prominent choice. The trend is particularly evident in the efforts to minimize errors and ensure the delivery of defect-free medicines to consumers.

The importance of sustainability is underscored by a survey by Edelman, revealing that 88% of investors view companies prioritizing Environment, Social and Government (ESG) initiatives as offering superior long-term returns. Within this context, green packaging emerges as a pivotal trend poised to reshape the pharmaceutical packaging landscape. Green or sustainable packaging involves adopting manufacturing techniques and materials that mitigate the adverse ecological and economic impacts of packaging.

Ongoing Expansion of the Pharmaceutical Industry

The ampoules packaging industry is expected to driven with the growing pharmaceutical industry. According to world pharma today analysis burgeoning pharmaceutical industry's rapid expansion, projected to reach US$ 1.5 trillion by 2023, is significantly driving the demand for ampoules packaging. As pharmaceutical products become pivotal in these cost-sensitive markets, ampoules, composed of inert and tamper-proof glass, assure the integrity and safety of the contained medications.

Collaboration between ampoule manufacturers and pharmaceutical companies further refines packaging solutions. As regulations and safety concerns dominate the industry landscape, ampoules' inherent tamper-proof nature and glass material align seamlessly with regulatory requirements. The convergence of historical reliability, customization and regulatory compliance positions ampoules as the go-to choice to meet the surging demand fueled by the pharmaceutical sector's rapid growth.

Concerns About Contamination of Glass Ampoules

The ampoule packaging industry is impacted with contamination concerns, significantly impacting their utilization in the pharmaceutical industry. Glass ampoules have been found to be a common source of contamination, posing risks to healthcare workers and patients alike. Glass particles that contaminate ampoules during the breaking process can be inadvertently transferred to patients upon injection, leading to potentially harmful effects such as pulmonary thrombi, micro-emboli, infusion phlebitis and end-organ granuloma formation.

Glass particle contamination has been observed in opened glass ampoules, indicating a substantial safety issue. Studies involving nursing practice standards reveal that various manual breaking methods used to open ampoules can influence the number of glass particles released. Factors like breaking method, ampoule size and clinical experience have been found to significantly impact the level of glass particle contamination.

Ampoules Packaging Market Segmentataion Analysis

The global ampoule packaging market is segmented based on material, packaging, end-user and region.

Dominance of Glass in Ampoule Packaging

Glass material holds the largest segment in ampoule packaging industry with its intrinsic qualities and extensive advantages in pharmaceutical and cosmetic sectors. Ampoules offer a secure housing for sensitive products, with their glass composition maintaining inertness, impermeability and tamper-proof attributes.

The material choice ensures that medications remain uncontaminated throughout storage, bolstering their stability and efficacy. Furthermore, companies are significantly investing in glass material for ampoules packaging manufacturing. In a notable instance, on March 14, 2023, SCHOTT initiated the production of amber pharma glass in India to cater to the escalating demand in Asia.

Over the last three years, an investment of US$ 81 million (approximately INR 660 Cr) was made to expand pharma glass production in the Gujarat-based facility. The expansion is primarily aimed at doubling SCHOTT's pharma tubing capacities in the region and responding to the surging requirement for high-quality materials converted into pharmaceutical containers such as vials, ampoules and syringes.

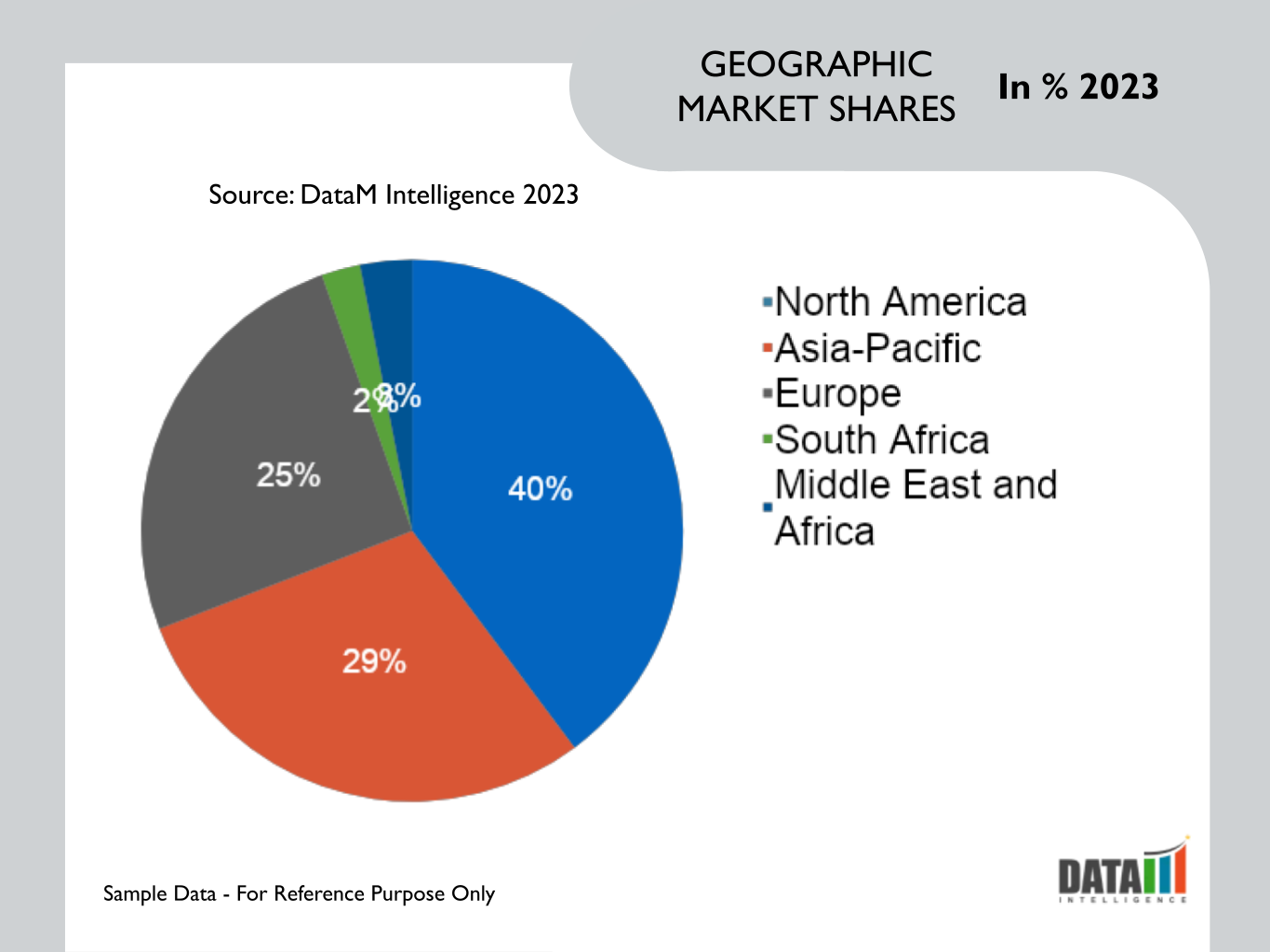

Ampoules Packaging Market Geographical Penetration

North America's Dominance in Ampoule Packaging Amid Pharmaceutical Boom

North America holds the largest share in the ampule packaging market with expansion of the pharmaceutical industry, as well as its significant contributions to the economy, underscores the increasing demand for pharmaceutical packaging, including ampoules in the region. U.S. is described as the biggest market for pharmaceutical industries, ranking high in the list of the highest number of exports in the pharmaceutical industry.

According to a report analysis by "Enterprise Today", the projected market share of 43.72% for U.S. in the global pharma industry by 2023 signifies the country's dominant position and its growing influence on the industry, indicating an expanding need for packaging solutions. The record-breaking sales of US$ 555 billion in pharmaceutical products within U.S. in 2021 showcase the country's thriving pharmaceutical market. As this market continues to expand, the need for reliable and effective packaging solutions will grow as well.

Ampoules Packaging Market Competitive Landscape

The major global players in the market include Gerresheimer AG, SCHOTT AG, SGD Pharma, Nipro Corporation, West Pharmaceutical Services, Inc., Stevanato Group, Bormioli Pharma S.p.A., Schreiner MediPharm, Amposan S.A. and James Alexander Corporation.

COVID-19 Impact on Ampoules Packaging Market

COVID-19 pandemic made a significant impact on the ampoule packaging industry within the pharmaceutical sector, leading to several changes and adaptations. The pandemic caused disruptions in the supply chain, affecting manufacturers and packaging solution suppliers in the ampoule packaging industry. The lack of logistical infrastructure for material dispatch further aggravated the challenges.

Shortages of essential pharmaceuticals during the pandemic led to counterfeit products entering the market. Swift action and technology, such as tamper-proof packaging and blockchain solutions, were employed to combat counterfeit drugs, ensuring product authenticity. The future of the pharma packaging industry is projected to be customer-centric. More companies are expected to incorporate customer-focused design principles into their packaging, aligning with the evolving needs of end-users.

Russia-Ukraine War Impact

Russia-Ukraine war has significantly impacted the pharmaceutical industry, particularly in terms of business operations, supply chain disruptions and the availability of crucial packaging materials. Many global pharma companies, such as AbbVie, Pfizer, Bayer and Sanofi, have suspended operations and deferred investments in Russia due to the conflict. It has led to a disruption in the supply chain, as sanctions imposed on Russia have cut off banks from the SWIFT international payment system, impacting exports and trade.

As many global pharmaceutical companies have suspended operations and investments in the region, it leads to challenges in sourcing materials for packaging, including glass vials for ampoules. These disruptions have potential cascading effects on the production and packaging of pharmaceutical products, including ampoules, which rely on a smooth supply chain.

Key Developments

- In August 2023, Korean skin care brand Vegreen has taken a unique approach by launching its first waterless Vitamin C ampoule, aiming to prioritize product efficacy over consumer resistance. Despite initial hesitations from consumers, Vegreen's focus on education regarding product usage and effectiveness has driven the launch of this innovative product. The ampoule is formulated with an oil-based ethyl ascorbyl (6%) that is highly-absorbent and slows down antioxidant activity, maintaining a Vitamin C concentration of above 80%. The product also includes 14% pure Vitamin C and 6% Vitamin C ethyl ether.

- In May 2023, Corning and SGD Pharma have entered a joint venture to establish a glass tubing facility in Vemula, Telangana, India, with the goal of enhancing the country's pharmaceutical manufacturing capabilities. The facility will manufacture Corning's Velocity Vials technology, leveraging Corning's proprietary glass-coating technology and SGD's vial-converting expertise to improve filling line productivity, vial quality and the delivery of injectable treatments globally. This collaboration aims to address the rising demand for critical medicines on a global scale and enable domestic drug manufacturers to tackle complex quality and capacity issues. Production of Velocity Vials is set to commence next year, followed by pharmaceutical tubing manufacturing in 2025, further localizing the supply chain and fostering the adoption of innovative technology in the Indian pharmaceutical industry.

- In May 2021, Japanese packaging company Nipro PharmaPackaging completed the acquisition of Piramida, a glass pharmaceutical packaging manufacturer based in Croatia. This strategic move has significantly expanded Nipro's capabilities in the Central European market. The company's achievements led it to secure a place among the top five largest ampoule manufacturers in the European pharmaceutical industry.

Why Purchase the Report?

- To visualize the global ampoule packaging market segmentation based on material, packaging, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of ampoule packaging market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global ampoule packaging market report would provide approximately 61 tables, 57 figures and 186 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies