Aluminium Market Size

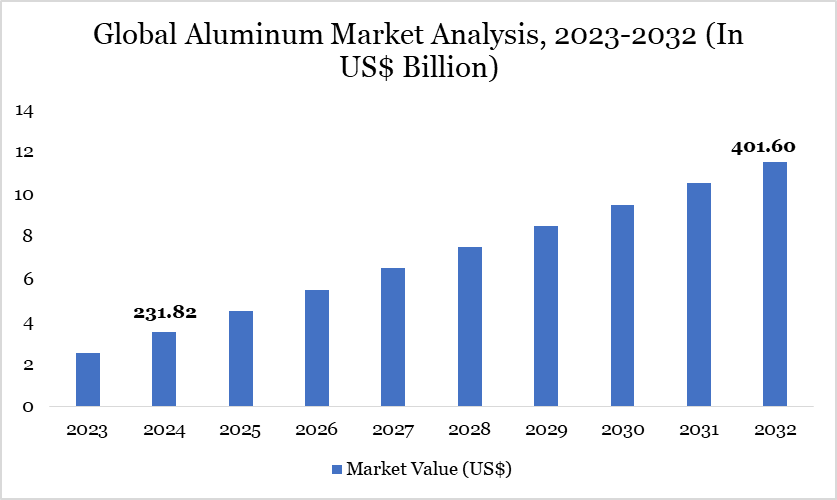

Global Aluminum Market size reached US$ 231.82 billion in 2024 and is expected to reach US$ 401.60 billion by 2032, growing with a CAGR of 7.11% during the forecast period 2025-2032.

Aluminum is the second most abundant metallic element in the Earth's crust and has become integral to various industries due to its lightweight, corrosion-resistant, and durable properties. In 2023, global primary aluminum production was estimated at 70 million tons, with China leading the output at 41 million tons, followed by India, Russia, and Canada. This widespread production underscores aluminum's critical role in sectors such as transportation, packaging, construction, and electrical transmission.

The demand for aluminum has seen a consistent upward trajectory, driven by its extensive application across multiple industries. Notably, the transportation sector utilizes aluminum for manufacturing automobiles, airplanes, and marine vessels, while the construction industry incorporates it into windows, doors, and siding. Additionally, aluminum's recyclability has become a significant component of the industry, with sources including automobiles, appliances, and beverage cans, highlighting its contribution to sustainable practices.

Aluminum Market Trends

A trend in the aluminum market is the increasing emphasis on recycling, which has become a crucial aspect of the industry. Recycling aluminum requires only about 5% of the energy needed to produce primary aluminum, making it both economically and environmentally advantageous. This shift towards recycling is driven by the metal's infinite recyclability without loss of properties, aligning with global sustainability goals and reducing the industry's carbon footprint.

For more details on this report, Request for Sample

Market Scope

| Metrics | Details | |

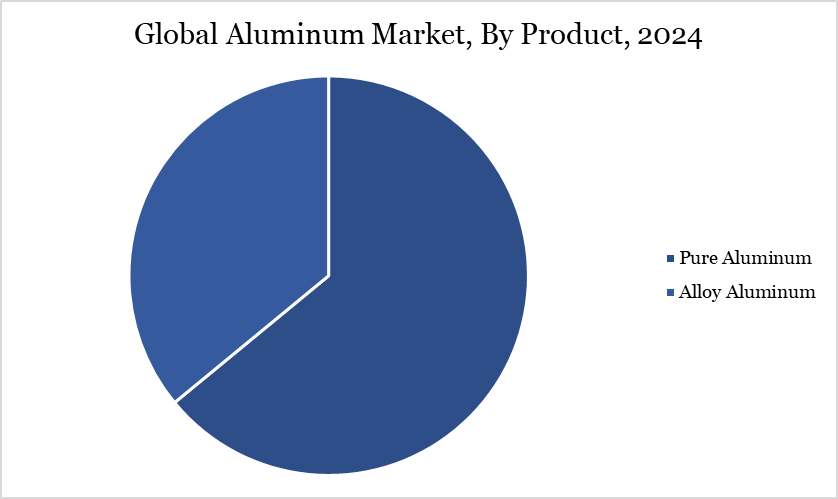

| By Product | Pure Aluminum, Alloy Aluminum | |

| By Form | Powder, Extrusions, Castings, Forgings and Others | |

| By Application | Pigments, Foils, Wires, Sheets and Plates, Rod and Bars and Others | |

| By End-User | Packaging, Automotive & Transportation, Building & Construction, Electrical & Electronics, Consumer Durables and Others | |

| By Region | North America, South America, Europe, Asia-Pacific and Middle East and Africa | |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Government-Led Infrastructure Expansion Accelerating Aluminum Consumption

Government-backed infrastructure investments are driving substantial growth in aluminum demand. In the US, the Bipartisan Infrastructure Law allocates over US$ 1.2 trillion toward transportation, energy, and broadband projects, many of which require large volumes of aluminum for construction and electrical applications. Similarly, India’s National Infrastructure Pipeline involves an estimated investment of US$ 1.4 trillion through 2025, promoting aluminum use in sectors like railways, power transmission, and smart cities. These large-scale initiatives underscore aluminum's critical role in modern infrastructure development.

Energy-Intensive Smelting Process Contributing to High Production Costs and Emissions

The aluminum smelting process is highly energy-intensive, with energy costs comprising approximately one-third of total production expenses. This substantial energy consumption contributes to elevated production costs and significant greenhouse gas emissions. Notably, the industry accounts for about 2% of global greenhouse gas emissions, equating to roughly US$ 1.1 billion tons of CO₂ annually.

Market Segment Analysis

The global aluminum market is segmented based on product, form, application, end-user and region.

Aluminum Alloys Fueling Growth in Automotive and Construction Sectors

Aluminum alloys are playing an increasingly critical role in the automotive industry, particularly in India. According to the Indian Ministry of Mines, the country produced over 4.1 million tons of primary aluminum in 2023, representing around 6% of the global output. A significant portion of this aluminum is used in the production of alloy wheels and lightweight vehicle components, aligned with the government's push for electric mobility and fuel efficiency standards under FAME II and BS-VI regulations.

In the construction sector, aluminum alloys are being widely adopted due to their high strength-to-weight ratio and corrosion resistance. The US Geological Survey reported that domestic primary aluminum production in the US was approximately 880,000 metric tons in 2023, with major use in building facades, window frames, and other structural components. This demand is supported by public infrastructure projects and energy-efficient building mandates at the federal and state levels.

Market Geographical Share

Rising Infrastructure and Industrialization Driving Aluminum Demand in Asia-Pacific

The Asia-Pacific region, particularly China, plays a pivotal role in the global aluminum market. In 2023, China's primary aluminum production reached a record 41.59 million metric tons, marking a 3.7% increase from the previous year. This growth, however, represents the third consecutive year of deceleration, influenced by factors such as power shortages in southwestern regions like Yunnan. These shortages were due to insufficient hydropower supply, leading to production constraints.

In India, government initiatives have significantly impacted aluminum demand, especially in the construction sector. The 2024-25 budget allocated US$ 32 billion for rural development, aiming to enhance infrastructure and housing in rural areas. This substantial investment is expected to boost demand for construction materials, including aluminum, as the country focuses on improving rural infrastructure.

Impact of US Tariffs

The imposition of US tariffs on aluminum imports has significantly influenced the global aluminum market, affecting trade flows, pricing, and production dynamics. In response to the 25% tariff imposed by the US on aluminum imports, key suppliers have redirected their exports to alternative markets. Canada, which accounted for approximately 85% of US aluminum imports in 2024, began channeling more aluminum to Europe to mitigate the impact of US tariffs.

The shift has led to increased aluminum supply in European markets, exerting downward pressure on prices there. Specifically, the Rotterdam P1020A duty-paid premium declined from US$ 370 per ton in early January to US$ 320–330 per ton, reflecting this increased supply. Domestically, the tariffs have contributed to a rise in US aluminum prices.

The Platts US Midwest Transaction premium, a benchmark for aluminum pricing, increased from 18.8 cents per pound at the end of 2024 to 23.8 cents per pound by mid-January 2025. This escalation reflects the market's anticipation of constrained supply due to the tariffs.

Major Global Players

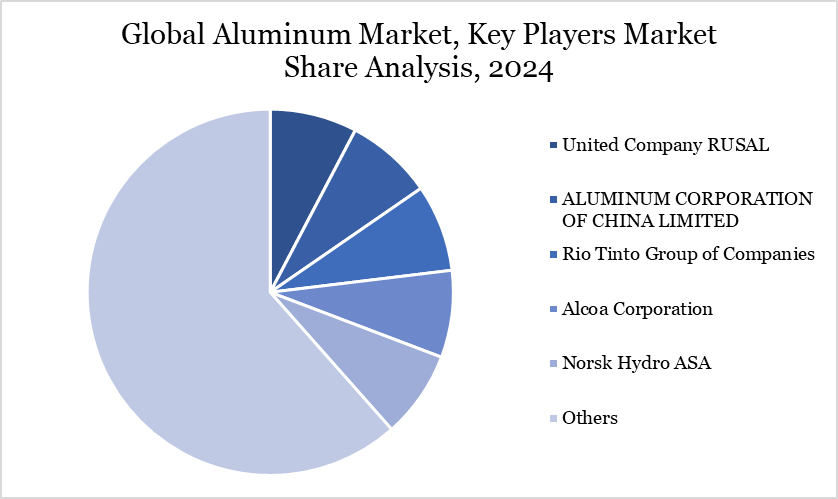

The major global players in the market include United Company RUSAL, ALUMINUM CORPORATION OF CHINA LIMITED, Rio Tinto Group of Companies, Alcoa Corporation, Norsk Hydro ASA, Emirates Global Aluminium PJSC, Vedanta Limited, China Hongqiao Group Limited, Century Aluminum Company, and Kaiser Aluminum Corporation.

Key Developments

- In November 2024, Kobe Steel announces the launch of Kobenable Aluminum, a low-CO2 aluminum product that contributes to reducing CO2 emissions from customers’ products. In aluminum products, it is essential to reduce CO2 emissions in Scope 3, which constitutes a significant portion of the total emissions.

- In March 2024, SiAT, a leading Taiwan manufacturer of advanced nanomaterials for batteries, is excited to announce a strategic partnership with Taiwan C.S. Aluminum Corporation (CSAC). This collaboration marks the introduction of carbon nanotube coated aluminum foil, designed to meet the growing demand for faster charging and extended lifespan in lithium-ion batteries, sodium batteries, and supercapacitors.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies