AI in Healthcare Market Overview

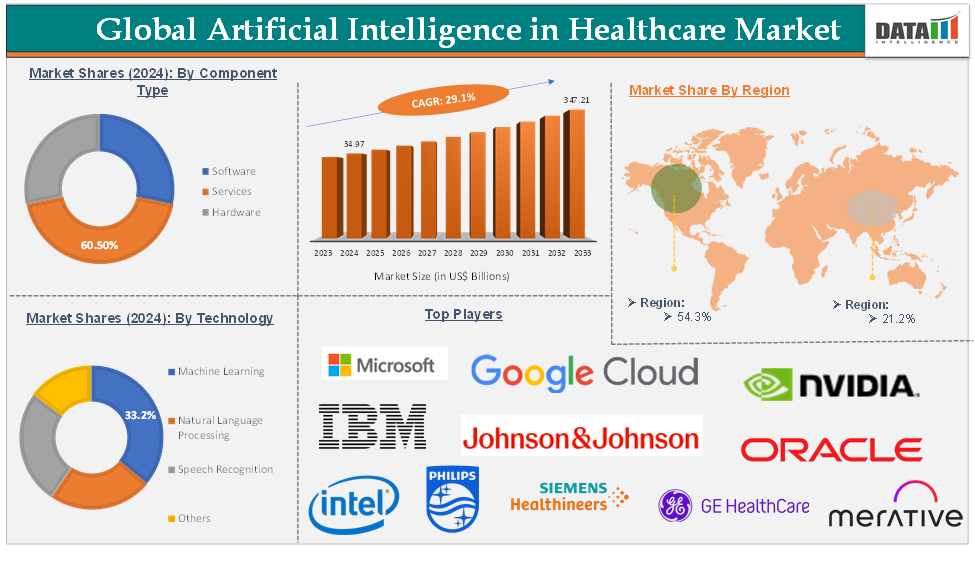

AI in Healthcare Market reached US$ 27.64 Billion in 2024 and is expected to reach US$ 305.96 Billion by 2033, growing at a CAGR of 30.1% during the forecast period 2025-2033.

The Global AI in Healthcare Market showed resilience and upward growth in its early stages, moving from US$ 17.91 billion in 2022 to US$ 22.02 billion in 2023.

Artificial intelligence in healthcare refers to the deployment of technologies like machine learning, natural language processing, computer vision, and predictive analytics to enhance clinical decision-making, diagnostics, treatment planning, patient monitoring, and operational efficiency.

Key drivers fueling this growth include the rising incidence of chronic diseases, an aging global population, the need for early and accurate disease detection, and the exponential increase in healthcare data from sources like electronic health records and wearables.

Opportunities abound in areas such as medical imaging analysis, personalized medicine, drug discovery, virtual assistants, and remote patient monitoring, with AI enabling faster diagnoses, cost reductions, and improved patient outcomes.

Major trends shaping the market include the proliferation of AI-powered diagnostic tools, the integration of AI in clinical trials and drug development, the adoption of AI for administrative automation, and growing investments from both the government and private sectors to accelerate innovation and implementation.

Executive Summary

For more details on this report – Request for Sample

AI in Healthcare Market Dynamics: Drivers

Rising Demand for Enhanced Efficiency and Accuracy

Rising demand for enhanced efficiency and accuracy is a major driver in the global AI in healthcare market. As healthcare systems face increasing patient loads, complex administrative processes, and a surge in medical data, there is a pressing need to streamline operations and reduce human error.

AI technologies address these challenges by automating routine administrative tasks-such as data entry, claims processing, and appointment scheduling-freeing up valuable time for healthcare professionals to focus on patient care. In diagnostics, AI-powered algorithms can analyze medical images and patient data with remarkable speed and precision, often surpassing human capabilities in detecting subtle patterns and anomalies, which leads to earlier and more accurate disease detection.

Furthermore, major players in the industry have key initiatives and product launches that would drive the global AI in healthcare market growth. For instance, in April 2024, the World Health Organization (WHO) announced the launch of S.A.R.A.H., which stands for Smart AI Resource Assistant for Health. This innovative digital health promoter prototype is powered by generative artificial intelligence (AI) and is designed to enhance public health engagement ahead of World Health Day, which focuses on the theme “My Health, My Right.

Also, in October 2024, Amazon One Medical integrated advanced AI technology into its healthcare services, leveraging AWS generative AI services, including Amazon Bedrock and AWS HealthScribe, to help doctors save time and enhance patient care. All these factors drive the global AI in healthcare market.

AI in Healthcare Market Dynamics: Restraints

Data security and privacy concerns

AI in healthcare systems relies heavily on access to large volumes of sensitive patient data, such as electronic health records (EHRs), medical imaging, and personal health information (PHI). This data is highly confidential, and its protection is critical for maintaining patient trust and adhering to legal and regulatory standards.

In the United States, for example, the Health Insurance Portability and Accountability Act (HIPAA) sets stringent guidelines for managing PHI. Healthcare organizations must ensure that any AI technologies they adopt are fully compliant with these regulations, which include implementing robust safeguards to protect the confidentiality, integrity, and availability of patient data. For instance, generative AI tools used in healthcare must undergo comprehensive security assessments and require a signed Business Associate Agreement (BAA) to ensure regulatory compliance.

AI in Healthcare Market Segment Analysis

The global AI in healthcare market is segmented based on component type, technology, application, end-user, and region.

Component Type:

The software segment is expected to hold 60.5% of the global AI in healthcare market

In 2022, the software segment represented one of the fastest-growing segments, reaching US$ 13.71 billion, and further increased to US$ 16.87 billion in 2023.

The software segment is a crucial and rapidly expanding component of the global AI in healthcare market. This segment encompasses a wide range of AI-driven applications and platforms designed to enhance various aspects of healthcare delivery, from clinical decision support and diagnostics to patient management and administrative automation.

AI healthcare software includes solutions for medical imaging analysis, predictive analytics, natural language processing (NLP), virtual health assistants, and electronic health record (EHR) integration. For example, AI-powered diagnostic tools can analyze radiology images such as X-rays, MRIs, and CT scans with high accuracy, assisting clinicians in detecting diseases like cancer, cardiovascular conditions, and neurological disorders at earlier stages. Predictive analytics software leverages machine learning algorithms to forecast patient outcomes, identify at-risk populations, and optimize treatment plans, leading to improved patient care and resource allocation.

Furthermore, major players in the industry product launching products that would drive the global AI in healthcare market growth. For instance, in May 2025, Iodine Software launched AwarePre-Bill, a next-generation AI solution designed to optimize revenue cycle management for hospitals and health systems. This new pre-bill tool specifically targets the post-discharge phase, where hospitals often miss out on revenue due to incomplete or inaccurate documentation and coding after a patient leaves the facility.

AI in Healthcare Market Geographical Analysis

North America is expected to hold 54.3% of the global AI in healthcare market

AI in Healthcare Market in North America witnessed substantial growth, increasing from $12.55 billion in 2023 to an estimated $15.76 billion in 2024.

North America, particularly the U.S., benefits from highly developed healthcare systems and widespread adoption of electronic health records (EHRs), enabling seamless integration of AI solutions. The explosion of healthcare data from diverse sources necessitates advanced analytics and AI to interpret and utilize this information efficiently, leading to better patient outcomes and operational efficiency.

The rapid digitalization of healthcare, including the use of wearable devices, IoT sensors, and real-time patient data, creates a rich environment for AI applications. Machine learning, deep learning, and natural language processing are increasingly used to enhance diagnostics, personalize treatments, and streamline workflows.

Both healthcare professionals and patients are increasingly aware of AI’s potential to improve operational efficiency, diagnostic accuracy, and personalized care, fostering broader acceptance and investment in these technologies. Major technology companies such as Microsoft, NVIDIA, Intel, and Amazon Web Services are actively developing and deploying AI healthcare solutions. Strategic collaborations between tech firms, healthcare providers, and pharmaceutical companies are accelerating innovation and adoption.

For instance, in February 2024, CitiusTech in New Jersey introduced the industry’s first Gen AI Quality & Trust solution, specifically designed to help healthcare organizations meet the critical requirements of reliability, quality, and trust in AI-driven healthcare solutions. This platform enables organizations to design, develop, integrate, and monitor generative AI applications with greater confidence, supporting enterprise-wide adoption and scalability.

Similarly, in June 2024, Cognizant, based in New Jersey, launched its initial suite of healthcare large language model (LLM) solutions as part of an expanded generative AI partnership with Google Cloud. This collaboration is focused on leveraging AI to tackle key challenges in the healthcare sector, such as enhancing operational efficiency, improving patient care, and streamlining administrative tasks.

These significant initiatives by leading technology firms are strengthening North America’s position as a dominant force in the global AI in healthcare market, driving innovation, accelerating adoption, and setting new standards for quality and trust in AI-powered healthcare solutions.

AI in Healthcare Market Major Players

The major global players in the AI in healthcare market include Intel Corporation, Koninklijke Philips N.V., Microsoft, Siemens Healthcare GmbH, NVIDIA Corporation, Merative, GE Healthcare, Medtronic, Google (Alphabet Inc.), Arterys Inc. (Tempus), IBM, Google, Itrex Group, Oracle, Medidata, Merck, IQVIA, Epic System Corporation, and Cognizant, among others.

Key Developments

In February 2025, Innovaccer Inc. announced the launch of “Agents of Care,” a suite of pre-trained AI agents engineered to automate repetitive, low-value tasks in healthcare settings and help manage rising workloads caused by staff shortages.

In February 2025, Salesforce launched a new suite of ready-made AI tools for healthcare, known as Agentforce for Health, aiming to help healthcare organizations automate and streamline time-consuming administrative tasks.

In December 2024, DexCom, Inc. launched a proprietary Generative AI (GenAI) platform, making it the first continuous glucose monitor (CGM) manufacturer to integrate GenAI into glucose biosensing technology. The Dexcom GenAI platform leverages advanced AI to analyze individual health data patterns, uncovering direct links between lifestyle choices and glucose levels, and delivering actionable insights to help users improve their metabolic health.

In November 2024, in Japan, healthcare innovators are developing AI-augmented systems to enhance the capabilities of radiologists and surgeons, providing them with "real-time superpowers" to improve patient care and operational efficiency.

In October 2024, Microsoft announced significant advancements in its Cloud for Healthcare offerings, unveiling several artificial intelligence enhancements aimed at improving healthcare delivery. These enhancements include new healthcare AI models in Azure AI Studio, enhanced data capabilities in Microsoft Fabric, and developer tools within Copilot Studio.

In June 2024, Cognizant unveiled its first suite of healthcare large language model (LLM) solutions developed in collaboration with Google Cloud, leveraging generative AI technologies such as the Vertex AI platform and Gemini models.

In March 2024, NVIDIA Healthcare launched a suite of generative AI microservices aimed at advancing drug discovery, medical technology (MedTech), and digital health. This initiative includes a catalog of 25 new cloud-agnostic microservices that enable healthcare developers to leverage the latest advancements in generative AI across various applications, including biology, chemistry, imaging, and healthcare data management.

In September 2024, Harrison.ai launched a radiology-specific vision language model named Harrison. rad.1, marking a significant advancement in healthcare artificial intelligence. This model is designed to address specific needs in the field of radiology, enhancing the capabilities of AI in medical imaging and diagnostics.

Market Scope

Metrics | Details | |

CAGR | 29.1% | |

Market Size Available for Years | 2022-2033 | |

Estimation Forecast Period | 2025-2033 | |

Revenue Units | Value (US$ Bn) | |

Segments Covered | Component Type | Software, Services, Hardware |

Technology | Machine Learning, Natural Language Processing, Speech Recognition, Others | |

Application | Medical Imaging & Diagnostics, Precision Medicine, Drug Discovery & Development, Virtual Assistants, Lifestyle Management & Monitoring, Healthcare Assistant Robots, Insights & Risk Analytics, Others | |

End-User | Healthcare providers, Healthcare payers, Pharmaceutical & Biotechnological Companies, Others | |

Regions Covered | North America, Europe, Asia-Pacific, South America, and Middle East & Africa | |