Agricultural Plastics Market Size

The Global Agricultural Plastics Market reached USD 10.6 billion in 2022 and is expected to reach USD 17.1 billion by 2031 growing with a CAGR of 6.2% during the forecast period 2024-2031. The global agricultural plastics market witnessed increasing demand from Asia-Pacific, as large and small farming operations increasingly adopt sustainable farming techniques. The forecast period will witness a major shift in global demand, with emerging countries accounting for a significant share.

Farmers in emerging countries are moving towards farming exotic vegetables to offset stagnating income from traditional crops. Exotic vegetables are mainly grown in greenhouses with suitable microclimates that require extensive usage of agricultural plastics.

Furthermore, plastic manufacturers are launching new and improved agricultural films to augment market growth. For instance, in November 2022, Agriplast SpA, an Italian, agricultural plastics producer, launched its new ECOAGRI range of sustainable non-woven plastic film during the EIMA fair 2022 in Bologna, Italy.

Market Summary

| Metrics | Details |

| CAGR | 6.2% |

| Size Available for Years | 2022-2031 |

| Forecast Period | 2024-2031 |

| Data Availability | Value (USD ) |

| Segments Covered | Material, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, South America and Middle East & Africa |

| Fastest Growing Region | Asia-Pacific |

| Largest Region | Europe |

| Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth, Demand, Recent Developments, Mergers and Acquisitions, New Product Launches, Growth Strategies, Revenue Analysis, Porter’s Analysis, Pricing Analysis, Regulatory Analysis, Supply-Chain Analysis and Other key Insights. |

Agricultural Plastics Market Dynamics

Global Drive for Improving Crop Yields

Governments and multilateral organizations are constantly striving to improve global crop yields to keep up with global population growth. Forecasts by the Food and Agriculture Organization (FAO) show that the global population will rise to 9.1 billion in 2050, with global food crop demand increasing to 3 billion tons, up from 2.1 billion tons today. Furthermore, crop yield rise is required to offset the projected loss of 120 million hectares of arable land in developed countries.

Plastic films are used in agriculture to reduce moisture loss and regulate soil temperature, thus leading to increased yields. Improvements in water management are crucial for increased crop yields and modern agricultural practices depend upon plastic pipelines and tanks to ensure efficient water usage. The usage of greenhouse covers and high-tunnel films can extend the growing season, thereby leading to a sizeable increase in crop harvest.

Growing Adoption of Vertical Farming

Vertical farming is an innovative method of growing crops in vertically stacked layers or structures, often indoors or in urban environments. It is a modern farming technique that offers optimized space utilization, year-round cultivation, and reduced dependency on traditional agricultural land. Vertical farming can help reduce land and water usage by up to 98%.

Vertical farming often takes place in greenhouses, which make extensive use of plastic films for plant protection. Furthermore, the irrigation of vertical farms occurs through hydroponics, which involves growing plants in plastic trays without soil and using nutrient-rich water solutions. Furthermore, plastic storage tanks are used for large-scale water management in vertical farms.

Growing Concerns about Microplastic Contamination of the Food Chain

Plastics used in agriculture can break down over time into smaller particles known as microplastics. The microplastics contaminate the soil, water and air, which can then be absorbed by plants. As a result, microplastics may end up in the food we consume, including fruits, vegetables, grains, and even animal products.

A 2022 report by the United Nations Environment Programme (UNEP) found that plastics are leaching into food at an alarming rate, causing widespread contamination of agricultural soil and food supply. To curb microplastic contamination, governments are encouraging the adoption of biodegradable alternatives and are exploring plastic usage bans in agriculture.

Agricultural Plastics Market Segment Analysis

The global agricultural plastics market is segmented based on material, application and region.

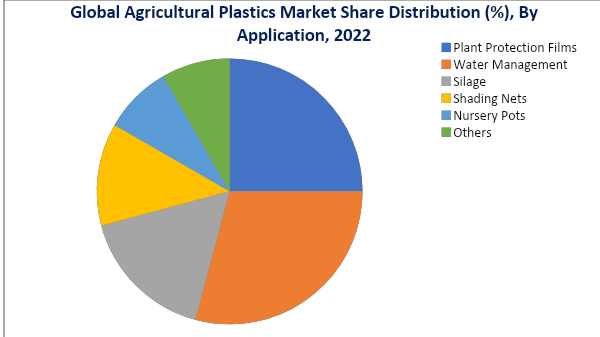

Water Management is a Leading Application of Agricultural Plastics

Water management segment is expected to account for the single largest share of the global agricultural plastics market. Water is a vital resource for crop growth, and proper water management is crucial to ensure efficient irrigation, water conservation, and optimal plant health. With the growing adoption of sustainable agriculture practices, plastic usage for water management has increased considerably in recent years.

Plastic materials, such as polyethylene (PE) pipes and tubing, are commonly used in irrigation systems. Plastic mulch films are widely used for water conservation and weed suppression. Furthermore, agricultural plastics are used to construct water storage tanks and reservoirs on farms. The tanks are made of high-density polyethylene (HDPE) or polyvinyl chloride (PVC) materials that are durable and resistant to chemical and biological degradation.

Agricultural Plastics Market Geographical Share

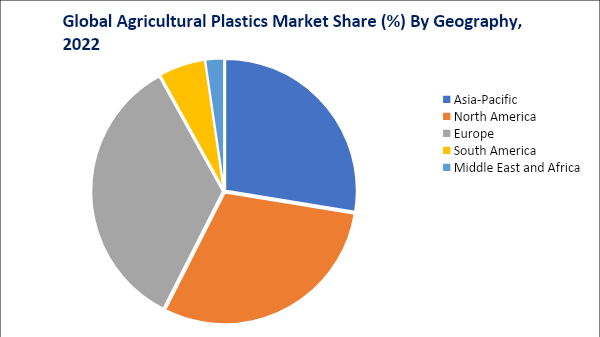

Major Thrust on Organic Farming Propels Growth of the European Market

Europe is expected to account for nearly a third of the global agricultural plastics market. Europe does not have large arable tracts of land like those found in Asia-Pacific or North America. Therefore, innovative farming techniques such as greenhouses and vertical farming are used to increase agricultural yields and efficiency.

Thrust on organic farming has increased the share of organic farming in a total utilized agricultural area (UAA) rising from 5.9% in 2012 to nearly 9.1% in 2020. Under the Green New Deal proposed by the EU, it has targeted to have atleast 25% of EU’s agricultural land under organic farming by 2030. The renewed thrust on organic farming will increase demand for agricultural plastics in Europe in the coming years.

Agricultural Plastic Market Major Players

The major global players include AEP Industries Inc., BASF SE, Dow, ExxonMobil Chemical, Novamont S.p.A., Trioplast Group, Berry Global, Grupo Armando Alvarez, Ab Rani Plast Oy and BioBag International AS.

COVID-19 Impact

The COVID-19 pandemic presented challenges and opportunities for the global agricultural plastics market. The initial period of the pandemic, with tight restrictions, created significant problems for agriculture, as sourcing materials and equipment became difficult. Production of agriculture plastics was also affected, however, many manufacturers stocked up on cheaper feed material, as global oil prices crashed during the initial period of the pandemic.

In the aftermath of the pandemic, a growing movement towards sustainable agricultural practices, especially in developed countries, has augmented demand for various agricultural plastics. Furthermore, the expansion of agricultural production in developing regions such as Asia-Pacific, will also create demand for agricultural plastics in the post-pandemic period.

AI Impact

Artificial intelligence (AI) is expected to refine plastic manufacturing processes. New automation protocols can be devised with AI integration, which could significantly improve production efficiency. It would greatly reduce the cost of agricultural plastics and lead to an increase in their adoption, especially in low-income, underdeveloped countries.

Another more beneficial aspect of AI would be in the research and development of new agricultural plastics. AI-based algorithms could be used to formulate and test new types of plastics. It could hasten the pace and reduce the cost of new research work, especially in creating a new generation of plastics that do not leach into food and create microplastic contamination.

Ukraine-Russia War Impact

The Ukraine-Russia war caused significant erosion of demand for agricultural plastics in Ukraine, as the war disrupted the farming industry. Furthermore, due to economic sanctions imposed by the EU and the U.S., the Russian agriculture industry had to reorient their sourcing of agricultural plastics from European to Asian manufacturers.

The Ukraine-Russia war caused a significant increase in European energy prices due to supply disruptions. High energy costs eroded producer margins and rendered many European plastics manufacturers uncompetitive on the global market. It created a new opportunity for North American and Asia-Pacific-based manufacturers to increase their market share.

Key Developments

- In April 2023, Mill Point Capital LLC, a U.S.-based private equity fund, acquired Nursery Supplies Inc., a U.S.-based manufacturer of agricultural plastic products. The acquisition will allow significant capital injection into the company’s operations, thus allowing it to expand rapidly.

- In April 2023, Plastics Unlimited, a U.S.-based manufacturer of industrial plastic components, announced its expansion into the agricultural plastics industry.

- In June 2022, Rivulis Ltd., an Israeli manufacturer of plastic agricultural irrigation equipment, announced that it was acquiring the international operations of Jain Irrigation Systems Ltd, an Indian irrigation system manufacturer.

Why Purchase the Report?

- To visualize the global agricultural plastics market segmentation based on material, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of agricultural plastics market level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global agricultural plastics market report would provide approximately 50 tables, 53 figures and 195 Pages.

Target Audience 2024

- Plastics Manufacturers

- Petrochemical Companies

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies