Overview

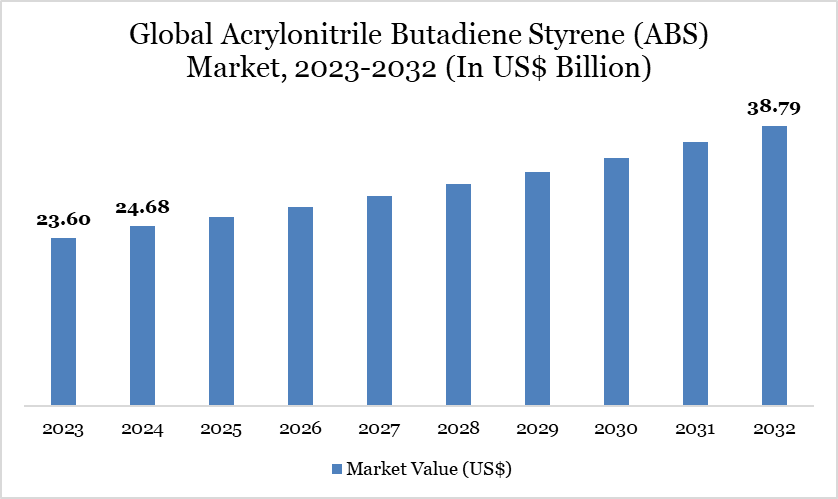

The global acrylonitrile butadiene styrene (ABS) market reached US$24.68 billion in 2024 and is expected to reach US$38.79 billion by 2032, growing at a CAGR of 5.96% during the forecast period 2025-2032.

The Acrylonitrile Butadiene Styrene (ABS) market is witnessing steady growth, driven by the increasing demand from sectors like automotive, electronics, and consumer goods, where lightweight and durable materials are essential. As global sustainability goals tighten, manufacturers are shifting toward recycled alternatives, accelerating the adoption of eco-friendly ABS.

A notable example is MBA Polymers UK's launch of ABS 4125 UL in June 2023—a UL-certified, post-consumer recycled ABS developed at their Worksop facility. This product directly addresses the rising demand for sustainable materials while maintaining performance standards. With supply struggling to keep pace with demand, MBA Polymers is now exporting globally and aims to scale production to 100,000 tonnes annually by 2030. This trend signifies a broader transformation in the ABS industry, where circular economy principles are shaping both product development and market expansion.

Acrylonitrile Butadiene Styrene (ABS) Market Trend

Sustainability is emerging as a crucial trend in the acrylonitrile butadiene styrene (ABS) market as industries push for lower carbon footprints and circular solutions. Growing consumer demand for eco-friendly products has driven companies to innovate beyond traditional virgin ABS. For instance, in October 2022, Ineos Styrolution made headlines by launching the world’s first fully bio-attributed ABS under its Terluran ECO line, marking a significant leap towards sustainable plastics. This new grade complements their existing mechanically recycled Terluran ECO, creating a portfolio that blends bio-attributed and recycled options for diverse applications. By offering such solutions across Styrolution PS, Terluran, and Novodur, the company is empowering manufacturers in automotive, electronics, and household goods to meet stricter sustainability goals.

Market Scope

Metrics | Details |

By Type | Opaque, Transparent, Colored |

By Processing Technology | Injection Blow Molding, Extrusion Blow Molding, Injection Stretch Blow Molding, Others |

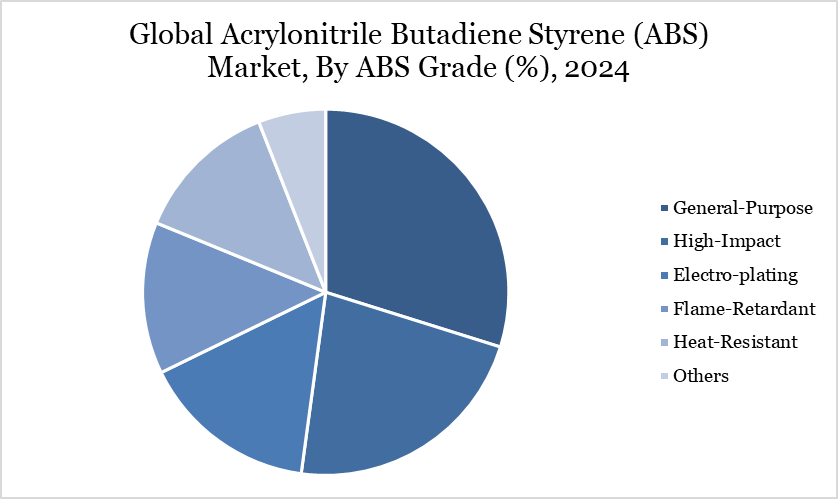

By ABS Grade | General-Purpose, High-Impact, Electro-plating, Flame-Retardant, Heat-Resistant, Others. |

By Manufacturing Process | Emulsion Polymerization, Mass Polymerization, Continuous Polymerization, Others |

By Application | Automotive & Transportation, Electrical & Electronics, Building & Construction, Consumer Goods, Others |

By Region | North America, South America, Europe, Asia-Pacific, Middle East and Africa |

Report Insights Covered | Competitive Landscape Analysis, Company Profile Analysis, Market Size, Share, Growth |

Market Dynamics

Rising Demand from Automotive & Transportation

The rising demand from the automotive and transportation sector is significantly driving the Acrylonitrile Butadiene Styrene (ABS) market, thanks to its lightweight, impact-resistant, and moldable properties ideal for vehicle interiors, trims, and panels. According to Autos Drive America, the US, being the world’s second-largest automotive market, witnessed 11.5 million light vehicle sales in 2022 and produced 4.9 million vehicles in 2023, underscoring the scale of ABS usage. As automakers aim to improve fuel efficiency and reduce emissions, the demand for lighter thermoplastics like ABS continues to grow. This shift is even more apparent in the electric vehicle (EV) segment.

According to the IEA, global EV sales exceeded 17 million in 2024 — a record high — and are projected to reach over 20 million in 2025, accounting for more than a quarter of total car sales. With EVs requiring lightweight, durable, and heat-resistant materials for battery enclosures and interiors, ABS has emerged as a preferred choice. The continued push for EV adoption and increased production volumes in North America and globally ensure robust growth prospects for the ABS market.

Recycling Challenges

Recycling challenges are restraining the Acrylonitrile Butadiene Styrene (ABS) market because ABS is difficult to recycle efficiently due to contamination and quality degradation during the recycling process. Unlike some other plastics, recycled ABS often fails to meet the high-performance standards needed for automotive, electronics, or construction applications. This limits the use of recycled content and increases reliance on virgin raw materials, raising costs and environmental concerns. As sustainability regulations tighten, industries are pressured to adopt materials with better recycling rates. Consequently, buyers may shift to alternative polymers that align more easily with circular economy goals.

Segment Analysis

The global acrylonitrile butadiene styrene (ABS) market is segmented based on type, processing technology, ABS grade, manufacturing process, application and region.

General-Purpose ABS Commands a Significant Share Due to Its Versatility and Cost-Effectiveness

General-purpose ABS continues to hold a significant share in the Acrylonitrile Butadiene Styrene (ABS) market due to its versatile applications across multiple industries. As demand for durable and lightweight plastics rises, especially in consumer electronics, this segment has become indispensable. Notably, China’s electronics manufacturing industry posted a strong performance in the first four months of this year, driven by steady production growth and recovering domestic and global demand.

This surge has fueled the need for high-quality General-Purpose ABS, which is widely used in electronic casings and components. The combined profits of major companies in China’s electronics sector soared 75.8% year-on-year to 144.2 billion yuan (about 20.3 billion US$), underscoring the expanding market for ABS resins. With such robust industry growth, manufacturers increasingly rely on General-Purpose ABS for its ease of processing and cost-effectiveness. This synergy between thriving electronics production and versatile plastic demand keeps General-Purpose ABS firmly at the forefront of the market.

Geographical Penetration

Asia-Pacific Dominates the Acrylonitrile Butadiene Styrene (ABS) Market Due to Robust Manufacturing and Rising Consumer Demand

The Asia-Pacific region holds a significant share in the Acrylonitrile Butadiene Styrene (ABS) market, driven by robust demand from its thriving automotive and electronics industries. In 2024, global electric car production surged to 17.3 million units, up 25% from 2023, with China alone producing a staggering 12.4 million electric cars, cementing its position as the world’s largest manufacturing hub with over 70% of global output. This electric vehicle boom fuels strong demand for high-performance plastics like ABS, used extensively in lightweight auto parts.

Simultaneously, India is making strategic moves to strengthen its presence in the global auto value chain. NITI Aayog’s recent report, “Automotive Industry: Powering India’s Participation in Global Value Chains,” outlines an ambitious plan to expand auto component production to US$ 145 billion by 2030. The initiative aims to boost India’s share in the global value chain from 3% to 8%, signaling a huge growth potential for ABS demand.

Furthermore, rapid urbanization, rising consumer incomes, and government policies supporting manufacturing strengthen Asia-Pacific’s role. The region’s strong electronics production, particularly in China, South Korea, and Taiwan, adds further momentum. Together, these developments make Asia-Pacific a dominant force propelling the ABS market forward.

Sustainability Analysis

Sustainability is becoming a key pillar in the acrylonitrile butadiene styrene (ABS) market as industries worldwide face mounting pressure to reduce their environmental impact. With ABS widely used in automotive parts, consumer electronics, and household goods, its fossil-based nature has long posed sustainability challenges. In response, companies are exploring bio-based alternatives and circular solutions to lower carbon footprints.

For instance, in June 2024, Swedish greentech firm Lignin Industries AB began scaling up its Renol technology, which uses lignin derived from trees to partially replace traditional ABS. This breakthrough allows industries to retain the strength and versatility of ABS while significantly cutting dependence on petroleum-based feedstocks. Such innovations promise to reshape supply chains, offering manufacturers a greener path forward.

Competitive Landscape

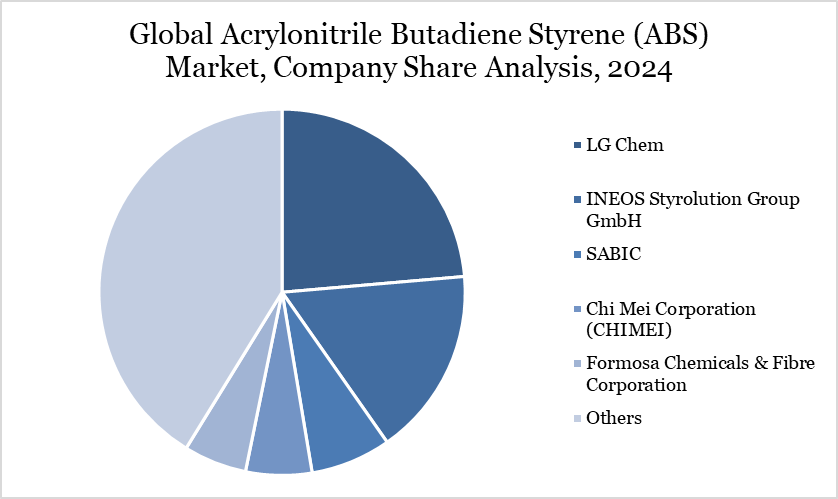

The major global players in the market include LG Chem, INEOS Styrolution Group GmbH, SABIC, Chi Mei Corporation (CHIMEI), Formosa Chemicals & Fibre Corporation, Toray Group, Trinseo PLC, Kumho Petrochemical Co., Ltd., Versalis S.p.A, LOTTE Chemical Corporation and others.

Key Developments

In April 2022, Trinseo unveiled new PFAS-free flame-retardant PC and PC/ABS grades — Emerge PC 8600PV, 8600PR, and PC/ABS 7360E65 — at Chinaplas 2024 in Shanghai, targeting Asia-Pacific markets. These materials, UL94 V0 rated at 1.5 mm, offer high thermal resistance and up to 65% post-consumer recycled content while matching virgin material performance. Applications include EV battery chargers, IT equipment, and electrical products, addressing rising regulatory pressure to eliminate PFAS and halogenated additives.

Why Choose DataM?

Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

Manufacturers/ Buyers

Industry Investors/Investment Bankers

Research Professionals

Emerging Companies