Introduction

Consumer preferences for convenient and palatable alternatives to traditional pill-based supplements are the primary drivers of the global chewable supplements market, which is currently experiencing substantial growth. This growth is being driven by the increasing demand for supplement forms that are both convenient and palatable among consumers.

The sector is further boosted by an increasing focus on preventive healthcare and the integration of functional ingredients targeting specific health concerns like immunity and digestion. Advancements in manufacturing, including vegan and sugar-free options, are enhancing the market's appeal globally. The transition to plant-based gummy vitamins is noteworthy.

The Good Food Institute (GFI) reports that 62% of households in US acquired plant-based foods in 2023. Manufacturers are substituting gelatin with alternatives such as pectin to satisfy the need for cruelty-free and allergen-free products. Moreover, health-conscious consumers are increasingly pursuing clean-label and organic certifications. Increasing environmental concerns have heightened the focus on sustainable production and packaging, which corresponds with customer desires, providing a competitive advantage to market innovators.

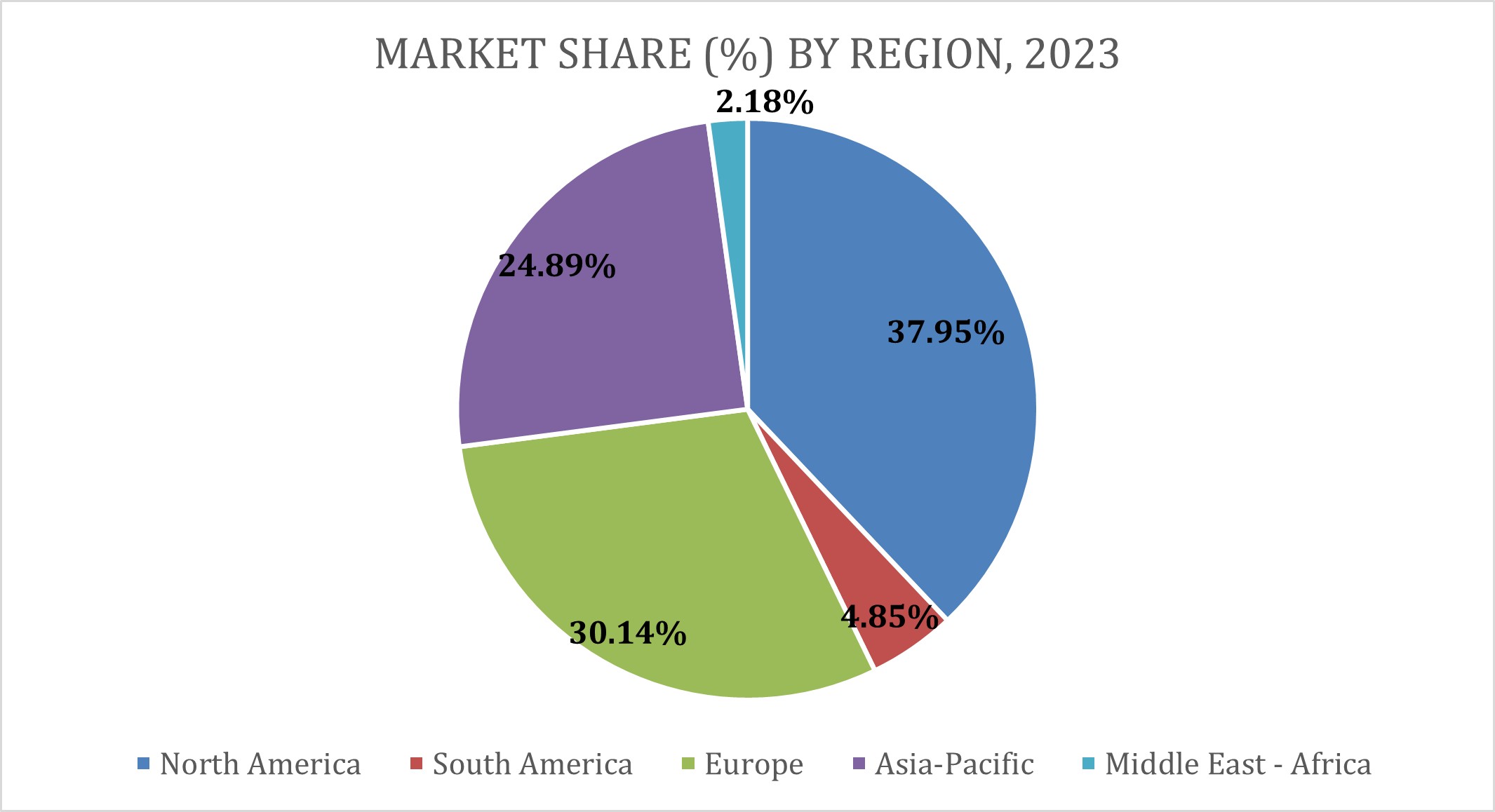

Asia-Pacific is the fastest-growing region, with a CAGR of 15% from 2024 to 2031. Factors such as rising disposable incomes, urbanization and increased health awareness contribute to market growth. China and India are leading, supported by initiatives like India’s “National Nutrition Mission” and China’s Healthy China 2030 strategy. Japan, with its aging population, is a significant consumer, driving demand for supplements targeting bone health and immunity. E-commerce platforms in Asia-Pacific recorded an increase in gummy supplement sales in 2023, reflecting a shift towards online shopping for health products. Overall, these dynamics underscore the region's potential for continued growth in the gummy supplements market.

Innovation in Product Formulations

The gummy supplement market is experiencing significant innovation and growth, particularly in response to consumer demand for health-focused products. This evolution is characterized by the introduction of functional gummies that target specific health concerns such as skin health, sleep improvement and gut health.

Similarly, Health awareness has surged, with consumers actively seeking products that contribute to their well-being. A survey indicates that 62% of Americans consider healthfulness a key driver for food and beverage purchases, reflecting a significant shift towards health-conscious consumption.

Many brands are offering sugar-free gummies that appeal to those looking to reduce sugar intake without sacrificing taste. For instance, products made with natural sweeteners like allulose and monk fruit are gaining popularity due to their zero-sugar impact and appealing flavors. Similarly, there is a growing trend towards organic ingredients and non-GMO certifications, reflecting consumer preferences for cleaner labels and sustainable sourcing. These formulations often avoid synthetic additives, further enhancing their market appeal.

Similarly, functional gummies addressing areas such as skin health, sleep improvement and gut health have gained popularity. For instance, the collagen gummies segment is expected to grow from US$ 1.04 billion in 2023 to US$ 3.54 billion by 2031, at a CAGR of 16.8%. Technological advancements have led to the development of dual-layer gummies that combine multiple health benefits into a single product, appealing to consumers seeking multifunctional supplements.

Opportunities

Sustainability is becoming a pivotal factor influencing consumer purchasing decisions. According to the Global Sustainability Council, 67% of consumers prioritize biodegradable and recyclable packaging, while 45% are willing to pay a premium for eco-friendly products.

Innovations in sustainable packaging include plant-based polymers and recyclable materials, with brands like Olly Nutrition and SmartyPants introducing 100% recycled plastic bottles. In UK, the percentage of consumers that are demanding sustainable packaging has risen to 81%, which is a significant jump toward eliminating plastic waste.

Additionally, US Environmental Protection Agency (US EPA), highlighted that US government has set a goal to reduce plastic waste by 50% by 2030, further incentivizing companies to adopt sustainable packaging solutions. The shifts not only reduce environmental impact but also strengthen brand loyalty, as 70% of consumers associate sustainable practices with higher product quality. By focusing on emerging markets and eco-friendly solutions, the gummy supplements market unlocks significant growth opportunities while addressing global health and environmental challenges.

Expansion into Emerging Markets

Emerging economies, particularly in Asia, Africa, and South America, represent substantial growth opportunities for the gummy supplements market. The regions are experiencing rising disposable incomes, increasing urbanization, and growing awareness about health and wellness. For example, the Ministry for Primary Industries reports that by 2030, the global middle-class population is expected to reach 5.4 billion with total spending of US$ 63 trillion. , creating significant demand for dietary supplements.

India, under its National Nutrition Mission, aims to reduce malnutrition among children, pregnant women, and lactating mothers by 25% by 2025, according to the Ministry of Health, India, 2023.

Similarly, Brazil's government-backed "More Health for All" initiative promotes preventive healthcare. The factors are fostering an 11.3% CAGR in the gummy supplements market in South America for the forecasted period 2024-2031. In Africa, the African Union’s Agenda 2063 prioritizes improved healthcare access, with nutritional supplements being a key focus area. Middle East & Africa’s sales of kid’s gummy supplements grew by 8.16% in 2023, reflecting rising adoption.

Market Trends

Rise in Personalized Supplements

The rise of personalized supplements is reshaping the gummy supplements market as consumers seek products tailored to their specific health needs. This trend has led to the development of gummy supplements targeting concerns like immunity, digestion, and mental well-being. For example, Care/of offers customized gummy supplements based on an individual’s health goals and preferences, providing a more personalized wellness solution.

This level of customization appeals to health-conscious consumers who are looking for more than just a generic vitamin— they want supplements that are aligned with their specific lifestyle and wellness objectives. The rise of personalized supplements is fueling the expansion of the gummy market, with more companies incorporating customization features into their product lines.

Focus on Convenience and Enjoyability

The trend of focusing on convenience and enjoyability is a driving force in the growth of the gummy supplements market. As more consumers seek easier and more enjoyable ways to incorporate supplements into their daily routines, gummy supplements have become a preferred choice over traditional pills or powders. The chewable, tasty format of gummies appeals to a wide demographic, from children who find them fun to consume, to adults who appreciate the ease of taking their daily vitamins without the discomfort of swallowing tablets.

For instance, SmartyPants Vitamins has successfully tapped into this trend by offering gummy supplements that combine essential nutrients like vitamin C, D, and omega-3 in an enjoyable, flavorful format. These gummies are not only effective but also provide a more pleasant experience compared to traditional pills, which many consumers find difficult to swallow.

This increasing demand for convenient and enjoyable supplements is influencing both product formulations and marketing strategies. Companies are focusing on creating unique and delicious gummy supplements that seamlessly fit into consumers' daily routines. By offering health benefits in a fun and easy-to-consume format, the gummy supplement market is reaching a broader audience, including those who may have previously avoided traditional, less palatable supplements.

Competitive Landscape

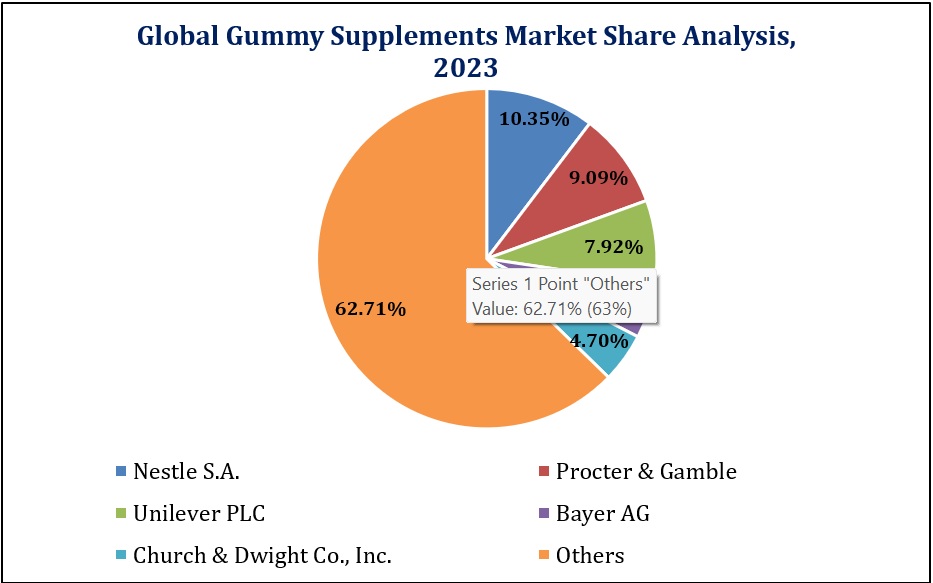

The global gummy supplements market is fragmented with several prominent companies competing to maintain and expand their market share.

The major five global gummy supplement companies hold 37.29% of the total market in 2023. In 2023, Nestle S.A. held the majority of the market share at 10.35% of the global gummy supplements market, followed by Procter & Gamble with 9.09%, Unilever PLC. with 7.92%, Bayer AG with 5.23%, Church & Dwight Co., Inc. with 4.70% and other companies with 9.33% of the total market respectively.

Major market players are expanding their market reach and share through new product developments, partnerships and major investments in growing their market.

For instance, Centrum announced the launch of its new line of high-science supplements in India, offering a variety of benefits in a flavorful gummy format under the name Benefit Blends.

Companies like Nestle, Procter & Gamble, and Unilever are leading the market, while others are making strides through new product launches and strategic partnerships. The ongoing investment in product development and market expansion highlights the growing demand for gummy supplements, especially in emerging markets. As consumer interest in health and wellness continues to rise, the market is expected to see sustained growth and further consolidation among major players.

Regulations

The regulatory environment for gummy supplements is multifaceted, with variations across regions that demand careful attention. The US Food and Drug Administration (FDA), the European Food Safety Authority (EFSA), and other national agencies establish and enforce these standards to safeguard consumer health and maintain product integrity.

In the US, gummy vitamins are categorized as dietary supplements and must comply with the Dietary Supplement Health and Education Act (DSHEA) of 1994. The FDA mandates adherence to Good Manufacturing Practices (GMP) to ensure consistent product quality and safety. This includes testing for contaminants, accurate labeling with ingredient lists and nutritional content, and maintaining comprehensive records of production processes.

Products making health claims must substantiate them with scientific evidence and any misrepresentation can lead to regulatory action, including fines, recalls or suspension of operations. The European Food Safety Authority (EFSA) sets stringent standards for dietary supplements in Europe.

These include regulations on food safety, additives, genetically modified organisms (GMOs), and permissible health claims. The EFSA also mandates that all supplements must be free from harmful contaminants and adhere to specific labeling requirements, including allergen information. Non-compliance can result in market bans or legal penalties.

Countries like India, Japan, and China have their own regulatory bodies such as the Food Safety and Standards Authority of India (FSSAI), the Ministry of Health, Labour and Welfare in Japan, and the National Medical Products Administration in China. These bodies focus on compliance with regional dietary and nutritional standards, often influenced by cultural and dietary habits.

Region Analysis

The North American gummy supplements market is growing rapidly due to rising consumer health awareness and a focus on preventative care, particularly for children. Gummy supplements are popular as a healthier alternative to sugary snacks, with parents using them to boost their children's immunity and overall health. Regional brands are responding with innovative products, such as SmartyPants Vitamins' "Kids Triple Action Immunity" and Nature Made’s "Zero Sugar Gummies."

These products cater to the increasing demand for diverse flavors, sugar-free options, and tailored nutritional benefits, reflecting a shift toward personalized and enjoyable health solutions. In addition, the rise in chronic diseases in Europe has driven increased demand for chewable vitamins, prompting companies to expand in the region. TopGum Industries, for instance, secured investment to boost product availability across Europe.

The UK holds a significant share of the market, with growing interest in health, wellness, and convenience, further fueled by e-commerce. In Germany, demand for natural, organic, and plant-based gummy supplements is rising, with consumers particularly interested in probiotics, vitamins, and immune-boosting options post-COVID-19. The increasing popularity of sports nutrition and weight management gummies, coupled with the availability of established retail and e-commerce channels, has strengthened France's market position and enabled its ongoing growth.

Conclusion

The gummy supplements market is experiencing robust growth, driven by increasing consumer demand for convenient, flavorful, and health-focused products. The rise in chronic health issues, particularly in developed regions like Europe, has led consumers to seek preventative solutions that are easy to incorporate into their daily routines. For instance, in the UK, the combination of a strong health consciousness and the convenience of e-commerce has spurred significant market expansion, while Germany's preference for natural, plant-based, and organic supplements underscores a shift toward more health-conscious choices post-pandemic.

Additionally, companies like TopGum Industries are responding to the growing market needs by expanding their product offerings and manufacturing capacities across Europe. Manufacturers are substituting gelatin with alternatives such as pectin to satisfy the need for cruelty-free and allergen-free products.

Moreover, health-conscious consumers are increasingly pursuing clean-label and organic certifications. Increasing environmental concerns have heightened the focus on sustainable production and packaging, which corresponds with customer desires, providing a competitive advantage to market innovators. As consumer preferences continue to evolve, the market for gummy supplements is expected to thrive, with more tailored formulations and innovative products meeting the demands of health-conscious individuals worldwide.